Do you know the different performance parameters of equity mutual funds: Alpha and Beta

In our post, Do you know the different performance parameters of equity mutual funds: Part 1, we discussed various risk and risk adjusted performance parameters of mutual funds. Let us do a brief recap of the various concepts discussed in the first part. Standard deviation is a measure of dispersion of a fund’s returns in various periods from its average return. Standard deviation is a measure of volatility or risk of a mutual fund scheme. Higher the standard deviation, higher is the investment risk.

Sharpe Ratio is a measure of risk adjusted returns of a mutual fund scheme. A limitation of Sharpe Ratio is that, it does not distinguish between good volatility (higher than average returns) and downside volatility (lower than average returns). Sortino Ratio, also a measure of risk adjusted returns, addresses the limitation of Sharpe Ratio, by taking into account the downside volatility only. In this post, we will discuss two very important performance parameters of mutual fund schemes – Alpha and Beta. Though Alpha comes before Beta alphabetically, investors should first understand the concept of Beta.

What is Beta?

Beta is the risk of a stock or mutual fund scheme relative to the relevant market benchmark. Beta is, in my opinion, a more relevant risk measure for equity investors, compared to the risk measure we discussed in our post, Do you know the different performance parameters of equity mutual funds: Part 1, Standard Deviation.Why is beta more relevant than standard deviation for equity investors? Equity investors understand (or should understand) the risk / return relationship and are willing to take risks in order to get higher returns.

Different segments or sectors of the market have different risk grades and naturally the standard deviations of riskier segments/ sectors (e.g. midcap, small cap funds etc) will be higher than those of the less risky ones (e.g. large cap funds). Different market segments and sectors have different market benchmarks, e.g. Sensex (for the largest 30 market cap stocks), BSE-100 (for the largest 100 market cap stocks), BSE Midcap Index (for midcap stocks), BSE Small Cap Index (for small cap stocks), Bankex (for bank stocks) etc.

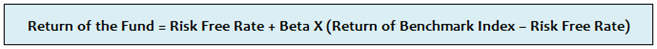

Beta broadly tells us, how much price change (for a stock or fund) we can expect, if the market benchmarkmoves up or down by 1%. Please note that this is only an approximate definition of Beta. The exact definition of Beta, for investors who are more theoretically inclined, is implicit in the classic Capital Asset Pricing Model (CAPM):-

Let us understand this formula with the help of two examples. Assume that you have invested in a large cap fund, whose benchmark is BSE-100. The beta of the fund is 2. Readers should not worry about, how to calculate Beta. You will get the Beta of a mutual fund scheme in the factsheet or in some of the mutual fund research websites like valueresearchonline.com, morningstar.in, advisorkhoj.com etc. For our readers, who are more mathematically inclined, beta is calculated by running a regression analysis of daily excess returns of a fund over the risk free rate versus the daily excess returns of the benchmark index over the risk free rate.

Let us get back to our example now. Let us assume that the risk free rate is 8%. If BSE–100 rises by 15%, then as per CAPM, the return of your fund will be 8% + 2 X (15% - 8%) = 22%. On the other hand, if BSE – 100 falls by 10%, then as per CAPM, the return of your fund will be 8% + 2% X (-10% - 8%) = -28%. Let us now assume that the Beta of your fund is 0.8. If BSE–100 rises by 15%, then the return of your fund will be 8% + 0.8 X (15% - 8%) = 13.6%. If BSE – 100 falls by 10%, then the return of your fund will be 8% + 0.8 X (-10% - 8%) = -6.4%. Clearly, higher the beta more is the risk and vice versa.

Beta is a very important concept in investing. High or low beta does not imply a good or bad fund; it simply indicates the risk profile of the fund. When you are investing in a high beta fund, you should be conscious of the risk you are taking. We have discussed a number of times in our blog that, you should invest based on your investment objectives and risk appetite. If you have an aggressive risk appetite and naturally desirous of high returns then you can invest in high beta funds. If you do not have a high risk appetite, you should choose a low beta fund.

What is Alpha?

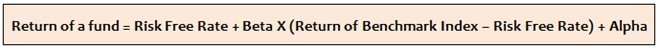

Capital Asset Pricing Model (CAPM) is one of the classic finance theories, but can the performance of a mutual fund scheme be always explained by CAPM? The answer is no. CAPM assumes that a fund can give higher return only by taking more risks. In reality, however, some fund managers are able to givebetter returns than other fund managers, by taking the same amount of risk or even lesser risk. In other words, returns of your mutual schemes are not just dependent on the risk profiles of the schemes, but also on the value added by the fund managers. Alpha is a measure of the value added by your fund manager, for the same amount of risk. In mathematical terms, we have to modify the CAPM formula to accommodate the fund manager’s value – add.

Let us understand this concept by revisiting the example discussed earlier. Let us assume the risk free rate is 8%. Let us further assume that you have invested in a fund whose benchmark index is BSE-100 and beta is 2. If BSE-100 rises by 15%, how much return can you expect from your fund? As per Capital Asset Pricing Model (discussed earlier) you can expect a return of 22% from your fund. Let us assume you get a return of 25%. How did you get 3% extra returns? It was a result of the value created by your fund manager. The 3% is the alpha of the fund. What if BSE-100 falls by 10%? As per CAPM your expected return would be -28%, but if your fund manager is able to generate a 3% alpha, your actual return would be -25%.

From a conceptual standpoint, alpha is the excess return generated by your fund manager versus what is predicted by CAPM. You will get the Alpha of a mutual fund scheme in the factsheet or in some of the mutual fund research websites like valueresearchonline.com, morningstar.in, advisorkhoj.com etc. The top performing funds that have sustained their outperformance over a sufficiently long period of time are undoubtedly funds with high alphas. High alpha speaks of the fund manager’s ability of stock selection and portfolio construction.

How to use Alpha and Beta for Fund Selection?

Now that we understand the concepts of Alpha and Beta, we can put them to use while selecting funds for our mutual fund portfolio. Firstly, you need to determine your investment objectives and risk tolerance level. Based on your risk tolerance level, you need to identify the category or categories of funds that you will invest in and the relative allocations to each category. For example, if you have a high risk tolerance level you may have a higher allocation to small and midcap funds. On the other hand, if you have a lower risk tolerance level, your portfolio should be biased towards large cap funds. Once you have determined your allocation to a particular category, you should select funds based on your investment objectives and risk appetite. If you have an aggressive risk appetite you can select high beta funds in that particular category; on the other hand if you are less aggressive and want more stability in your portfolio you should select a low beta funds in that category. In either case, you should select funds that have given high alphas. It is usually recommended that you select moderate beta and high alpha funds, but if you have a high risk appetite then you can select high beta and high alpha funds.

Conclusion

In this post we have reviewed two important concepts related to mutual fund selection. Instead of simply looking at historical returns, you should look at the Alpha and Beta of the fund. Beta can help you identify funds consistent with your risk appetite, while Alpha will tell you whether a mutual fund scheme can outperform in the future, as long as the fund manager and the investment strategy of the scheme remain unchanged. Pay attention to alphas and you will emerge as a savvier and more successful investor.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY