Why invest in the highest quality companies through SBI ETF Quality

SBI Mutual Fund has launched its latest fund offering SBI-ETF Quality. The New Fund Offer (NFO) opened yesterday (November 26) and will close on December 3rd 2018. Exchange Traded Funds (ETFs) are increasingly gaining currency with Indian investors, since their expenses are much lower compared to actively managed mutual funds and they offer better visibility to the portfolio of underlying securities. ETFs aim to replicate a market index and are traded on stock exchanges. Unlike actively managed mutual fund schemes, ETFs are passive funds; the fund managers of an ETF do not aim to beat the market, they aim to replicate the index returns by reducing tracking errors.

Smart Beta Index

SBI-ETF Quality will track the Nifty 200 Quality 30 Index. This index is what is known in investment parlance as, Smart Beta Index. What is a Smart Beta Index? Understanding the underlying index of an ETF is crucial to understanding the risk / return characteristics of a fund. Advisorkhoj readers are aware of various market capitalization based indices like Nifty – 50 (index of the 50 largest companies by market cap), Nifty – 100 (index of 100 largest companies by market cap), Nifty – Midcap 100, Nifty – Small Cap 100 etc. Investors are also familiar with various sectoral indices like Bank Nifty, Nifty Auto, Nifty FMCG, Nifty IT, Nifty Pharma etc.; these indices track specific industry sectors.

Smart Beta Indicesare strategy based indices which use quantitative models to assign weights to stocks into the index based on certain factors. Unlike actively managed funds, which involve fair amount of subjectivity on part of the fund managers in selecting stocks, Smart Beta indices stocks are selected on the basis of pre-defined quantitative rules. For example, the Nifty 200 Quality 30 Index is a smart beta index filters out stocks from the Nifty – 200 Index (index of 200 largest companies by market cap) based on some quantitative factors to identify quality stocks and selects 30 highest quality stocks based on the quantitative factors.

We will discuss how stocks are screened in the Nifty 200 Quality 30 Index in the next paragraph.

Nifty 200 Quality 30 Index

If you read or hear transcripts of interviews we had with various fund manager on our portal (please visit our Interview Section) or other portals, you will often come across statements like, “we select high quality stocks with strong visibility on earnings growth”.

Different fund managers use different quantitative and qualitative criteria for selecting high quality stocks. Nifty 200 Quality 30 Index, however, uses a set of pre-defined quantitative rules for selecting highest quality stocks. For quant based stock selection certain quantitative parameters (metrics) must be applied to select stocks. Jeremy Grantham (co-founder and chief investment strategist of Grantham, Mayo & van Otterloo) in his whitepaper (2004) has defined quality companies as those which meet the following criteria:

Low Leverage:

Leverage is the ratio of debt to equity in the capital structure of a company, and is indicative of the risk of the business model. Higher the leverage, higher is the financial risk. Low leverage is a characteristic of a quality stock.High Profitability:

Profitability measure of ability and efficiency of a company to generate earnings. There are various profitability measures, the most common ones being Return on Capital Employed (ROCE), Return on Assets (ROA) and Return on Equity (ROE) etc. Return on Equity is one of the best measures of shareholder value created by the management. If you go through our Interview Section, you will see that many fund managers favor using ROE or ROCE in their active stock selection process.Earning Quality:

Earnings quality implies persistence in earnings growth measured by low variability in Earnings per Share (EPS) growth. Steady EPS growth is a testimony to the stability and robustness of the business model of the company. It is one of the strong characteristics of high quality companies.

Each of these parameters are given equal (one third) weight in the screening process of Nifty 200 Quality 30 Index. The Quality Score for each company in the Nifty – 200 Index is determined based on Return on Equity, Financial Leverage and Earnings. The weights of the stocks are derived from their quality scores and square root of free float M-Cap. The stock weight is capped at 5%.The Nifty 200 Quality 30 Index is rebalanced semi-annually.

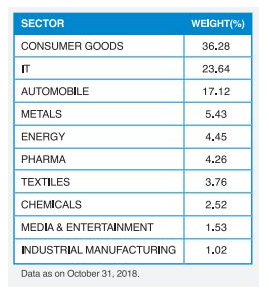

The NIFTY - 200 Quality 30 index includes top 30 companies from its parent NIFTY 200 index, selected based on their quality scores. Over 85% of the index value is constituted by large cap stocks and the balance by midcap stocks. The table below shows the current sector allocation of NIFTY - 200 Quality 30 index.

Source: SBI Mutual Fund

Why Quality Stocks are important in meeting your long term investment goals?

Whether you are investing in large cap, multi-cap, midcap or small cap funds, at the end of the day, you are investing in an underlying portfolio of stocks. The difference between investors who directly invest in the stock markets versus investors who choose the mutual fund route is that in the first case, investors try to identify the right stocks themselves, whereas in the second case, investors rely on the stock picking ability of a fund manager. Whether it is investors or professional fund managers, in equity investments, we often face the dilemma of identifying the right stock that is expected to perform well in most market phases. Some stocks outperform well in bull runs, while others underperform in bear markets. Banking on quality stocks in such a dilemma may turn out to be a more wise investment strategy, especially in the long run.

Investing in the NIFTY - 200 Quality 30 Index through SBI-ETF Quality is a smart way of investing in quality stocks (based on rule based selection criteria) at alow cost.

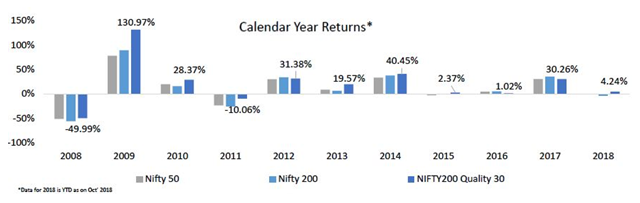

Let us now see how the NIFTY - 200 Quality 30 Index performed against the market, both in the large cap segment (assuming Nifty – 50 is the benchmark) and the large and midcap segment (assuming Nifty – 200 is the benchmark).

Source: SBI Mutual Fund

You can see that NIFTY - 200 Quality 30 Index outperformed both Nifty – 50 and Nifty - 200 across most years. Note the performance of the index versus the two other indices in volatile markets. The chart below shows the trailing returns of NIFTY - 200 Quality 30 Index versus Nifty – 50 and Nifty – 200 over several time periods (ending October 31, 2018). You can see that Nifty – 200 Quality 30 Index outperformed other indices, across most time-scales.

Source: SBI Mutual Fund

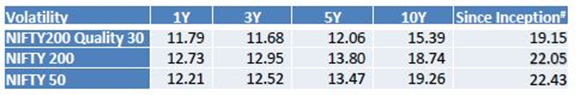

Let us now compare the volatility of returns across different trailing time-scales (period ending October 31, 2018).

Source: SBI Mutual Fund

You can see that the Nifty – 200 Quality 30 Index had lower volatility versus both Nifty – 50 (Large Cap) and Nifty – 200 (Large and Midcap) indices, across different time-scales. Lower volatility and higher returns, imply that Nifty – 200 Quality 30 Index generated superior risk adjusted returns. In our view in Advisorkhoj, superior risk adjusted returns is one of the most important performance attributes of investments in a highly volatile market like India.

Why invest in SBI ETF Quality NFO?

- During the NFO period, you can subscribe to SBI ETF Quality with a minimum application amount of only Rs 5,000.

- Post the NFO period, if you want to buy units of SBI ETF Quality directly from the AMC, the minimum lot size will be 12,000 units. You can always buy units of the fund in the stock exchanges, but you will have to pay for brokerage and other costs.

- By subscribing to this NFO you will be able to invest in the ownership of some of the highest quality companies in India, as represented in the Nifty – 200 Quality 30 Index, with a small capital outlay.

- Since this is an exchange traded fund (ETF), the expenses are likely to be quite low. Expenses come out of fund returns and over a long investment horizon, lower expenses can have a significant contribution to your investment returns.

- Unlike actively managed mutual funds, you will have much greater visibility / transparency into the underlying portfolio of stocks at any point of time. Whereas mutual fund scheme portfolios are disclosed monthly through factsheets, investors have visibility on the underlying portfolio of the ETF at any point of time because they track a market index.

- SBI Mutual Funds is one the largest AMCs in India, with over Rs 3 Trillion of Assets under Management (AUM). It is also one of the most respected AMCs in the country, as many of its funds are among the top performing funds across various mutual fund and ETF categories. SBI Mutual Funds has an Investment team of 48 professionals with strong track record. NavneetMunot and Raviprakash Sharma are the fund managers of this ETF.

Conclusion

In this blog post, we reviewed SBI ETF Quality NFO. Since this is an ETF offering, investors need to have demat accounts to invest in the ETF. You will also need to have a trading account to buy or sell these funds in stock exchanges; units of SBI ETF Quality will be listed on National Stock Exchange (NSE). ETFs, as discussed earlier, are becoming an increasingly popular way of investing in stock markets in India. Smart beta investments like SBI ETF Quality NFO, lies somewhere midway between pure beta based (market returns) investing and alpha oriented / active fund management (mutual funds).

Superior risk adjusted returns along with lower costs associated with ETFs are an advantage in smart beta investments. Investors should consult with their financial advisors if SBI ETF Quality NFO is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY