SBI Savings Fund: Make your idle money work for you

We Indians love a good bargain. Whether it is haggling with the vegetable seller or arguing with the cab or rickshaw driver about the shortest (and most economic) route, to booking air tickets and hotels for leisure or business travel, we are always looking for the best possible deal. Unfortunately, when it comes to our savings, most of us settle for a bad deal. Most families have money lying idle in their savings bank account for long periods of time, before they find some productive use for them. Savings bank accounts usually pay 4% interest per annum, which is less than the CPI inflation rate.

In other words, the real (inflation adjusted) rate of return on your idle funds is negative. Debt mutual funds offer investors the option of making their idle funds productive, while also offering comparable levels of liquidity and convenience.

Money market mutual funds which invest in money market securities like commercial papers, certificate of deposits, treasury bills etc. provide high liquidity, low risk and good yields (compared to savings bank interest rate). These funds are suitable for parking your idle funds for a few days to up to a year. There are different types of money market mutual funds like overnight funds, liquid funds, ultra-short duration funds, money market funds etc. SBI Savings Fund, a money market fund has given 6.6% returns in the last one year, significantly higher than savings bank interest rate. In the last 6 months, the scheme has given 3.7% absolute returns.

Let us assume you had Rs 1 Lakh lying idle in your savings bank account for the last six months. You would have got an interest of Rs 2,000. If you had invested in SBI Savings Fund, you could have got a return of Rs 3,700; Rs 1,700 extra over savings bank account in 6 months. If you are able to generate additional income of Rs 1,700 every six months, then how much can you extra earn over 25 – 30 years of working life? If you do the math, you will see that you can earn several Lakhs extra.

Low Risk

The modified duration of SBI Savings Fund is only 0.19. This means that the scheme has very limited interest rate risk. If you hold this scheme for 6 months and there is a 25 bps increase in interest rates, then effect of interest rate increase on the scheme NAV will only be 5 bps (0.05%). Even if there are two rate increases of 25 bps each in 6 months, the price effect on the scheme NAV will be 10 bps. Further, the price effect of interest rate increase will partially be offset by the higher yields of money market instruments, which may replace maturing lower yield instruments during your investment tenor.

Regular Advisorkhoj readers know that apart from interest rate risk, the other risk factor in debt funds is credit risk. SBI Savings Fund scores high even on the credit risk parameter. The credit rating profile of the instruments in the scheme portfolio is on average AAA. AAA is the highest credit rating of debt instruments and denotes very high degree of safety. Therefore, both from an interest rate risk and credit risk perspective, SBI Savings Fund scores quite high, making this fund suitable for investors, who want low risk and stable returns.

High Liquidity

Money market funds have high liquidity, which means that the funds are able to meet redemption requirements of investors at any point without any significant impact to the NAV of the schemes. SEBI mandates AMCs to carry out liquidity stress test of their money market funds at least once a month or more frequently, if required. The AMCs risk management mechanisms, in compliance with SEBI’s risk management framework, will ensure that the investors of SBI Savings Fund enjoy high liquidity to meet any near term requirements. For redemptions made after 3 days from investment date, no exit load is levied. This means investors can draw their money anytime after 3 days from investment date without any penalty. Redemptions made within 3 days from the date of investment will attract an exit load of 0.1%.

Returns

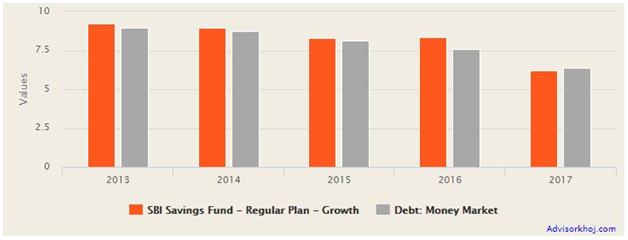

The chart below shows the annual returns of SBI Savings Fund versus the money market debt fund category over the last 5 years. You can see that SBI Savings Fund outperformed the category in most years.

Source: Advisorkhoj Research

The chart below shows the annualized returns of SBI Savings Fund versus the money market debt fund category over various trailing time periods. You can see that SBI Savings Fund outperformed the category across most time-scales.

Source: Advisorkhoj Research

Over the last 1 to 5 years, annualized returns of the scheme ranged from 6.6 to 7.8%. While returns of money market funds will depend on the prevailing yields in money market, historical data shows that money market fund returns are almost always higher than savings bank interest.

Why invest in SBI Saving Fund?

While we have already discussed the benefits of SBI Savings Fund in this post, it may be useful for some of our readers to do a brief recap of the benefits.

- Like any other mutual fund, SBI Savings Fund is subject to market risks (interest rate risk). However as discussed in this post, the interest rate risk is very limited since the scheme invests in very short maturity money market instruments. The scheme invests in instruments with high credit quality and hence, the credit risk is also very low.

- Money market mutual funds offer high liquidity. There is no exit load on withdrawals made after 3 days from the date of investment in SBI Savings Fund.

- While mutual fund returns are not assured, historical data shows that SBI Savings Fund across various time-scales were able to beat savings bank interest rate by a wide margin.

- While money market funds do not offer any tax advantage over savings bank account over shorter investment tenors, over 3 years plus investment tenors debt mutual funds (including money market funds) enjoy considerable tax advantage over savings bank and FDs. Savings bank and FD interest income is taxed as per the income tax rate of the investor, while debt mutual fund long term capital gains (investment held for 3 years or more) are taxed at 20% after allowing for indexation benefits. Indexation benefits reduce the tax obligation of investors in higher tax brackets considerably. For shorter tenor, investors in the 30% tax slab can consider investing in the dividend re-investment option. While dividends or dividends re-invested are tax free for investors, AMCs have to pay dividend distribution tax of 28.8%. For investors in the 30% tax slab, dividend re-investment option offers tax arbitrage for shorter tenors.

- SBI Mutual Fund is one of the oldest, largest and most respected Asset Management Companies in India. Schemes of SBI Mutual Funds are among the best performing funds across multiple mutual fund categories.

Conclusion

While we work very hard to earn money, we must also make our money work, so that our money grows. In this post, we discussed how you can put your idle money to productive use to make more money, without giving up on liquidity and flexibility for your near term needs. We discussed several advantages of investing in SBI Savings Fund vis-a-vis keeping your money parked in your savings bank accounts. Investors should consult with their financial advisors if SBI Savings Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY