What is Multi Asset Allocation Funds and how SBI Multi Asset Allocation Fund is placed

Multi Asset Allocation funds are hybrid mutual fund schemes which invest in 3 or more asset classes. According to SEBI regulations multi asset allocation funds must invest minimum 10% each in at least 3 asset classes. Apart from the two most popular asset classes, debt and equity, these schemes invest in asset classes like gold, real estate investment trusts (REIT) etc. The fund manager decides the proportional allocation to each asset class based on the market conditions with the objective of balancing risks and returns.

How does multi-asset allocation work?

Equity and fixed income (debt) are the two most popular asset classes. The objective of equity investment is primarily capital appreciation, while debt investments are made to generate income. Gold and real estate are also popular asset classes in India, but these investments are primarily made in physical form e.g. gold jewellery, residential property etc. Gold however, can be very useful in asset allocation because gold usually show negative correlation with equity. A combination of 3 or more asset classes can balance risk and return more effectively than a combination of just equity and debt classes.

Equity outperforms other asset classes during periods of economic expansion or growth but tends to underperform during periods of economic slowdown or downturns. Gold returns usually have an inverse relationship with equity returns i.e. gold performs well, when equity underperforms and vice versa. Similarly fixed income outperforms or underperforms equity and gold in different parts of investment cycles.

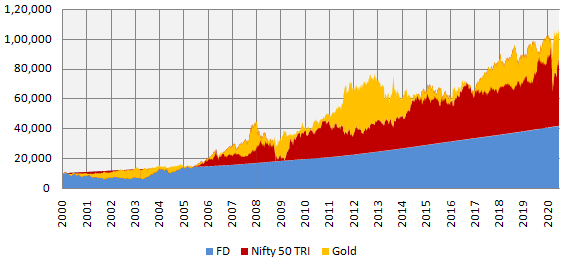

The chart below shows the growth of Rs 10,000 invested in Nifty 50 TRI (equity), bank FD (debt) and gold from 1st January 2000 to 30th June 2020.

Source: Advisorkhoj Research

You can see that equity is the most volatile asset class but can rally sharply in bull markets e.g. 2014 to 2018-19. At the same equity can correct sharply as seen in 2008, 2011 and 2020. Even though gold is less volatile than equity, it can underperform for periods of time e.g. 2013 to 2017.

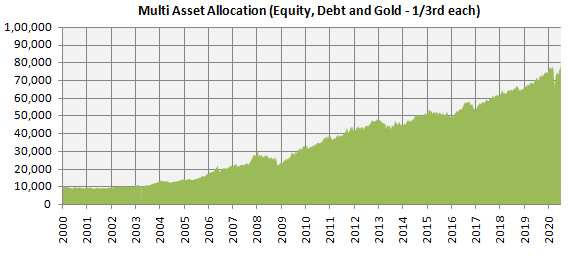

Let us now see how a multi asset allocation portfolio would have performed during the same performance period. The chart below shows the growth of Rs 10,000 investment split equally (one thirds each) in equity (Nifty 50 TRI), debt (bank FD) and gold. You can see that the returns of this portfolio is similar to Nifty 50 TRI, but with much less volatility.

The maximum drawdown of Rs 10,000 investment in Nifty 50 TRI was 59% during the Global Financial Crisis. The maximum drawdown of Rs 10,000 investment in multi asset allocation portfolio was only 17% during the COVID-19 related meltdown in March 2020.

Source: Advisorkhoj Research

Benefits of Multi Asset Allocation Funds

- Diversification across different asset classes will reduce asset class risk in different market scenarios

- Automatic portfolio rebalancing will reduce over-exposure to a particular asset class and provide stability of returns through profit booking at higher levels and re-investing in underperforming assets

- It provides a well-rounded portfolio wrapped in a single scheme. You do not have to worry about managing asset allocation and leave it to experts

- Advantage of equity taxation if average equity allocation during the year is more than 65%. For tax consequences of your investment in these schemes please consult with your financial and tax advisors in order to make informed investment decisions

SBI Multi Asset Allocation Fund

SBI Multi Asset Allocation Fund previously known as SBI Magnum Monthly Income Plan – Floater, this scheme in its multi asset allocation fund avatar came into being in May 2018 after AMCs rationalized and re-classified their older schemes to comply with SEBI’s mutual fund rationalization and re-classification directive. SBI Multi Asset Allocation fund has Rs 193 Crores of assets under management (AUM) as on 30th June 2020. Gaurav Mehta has been managing this scheme since February 2019. Mr Mehta has 12 years of fund management experience.

The current asset allocation of the scheme is 45% equity, 35% debt (fixed income), 18% gold and the balance in cash or cash equivalents.

The equity portion of the scheme portion is biased towards large cap. The debt portion of the portfolio is of very high credit quality, predominantly Government securities.

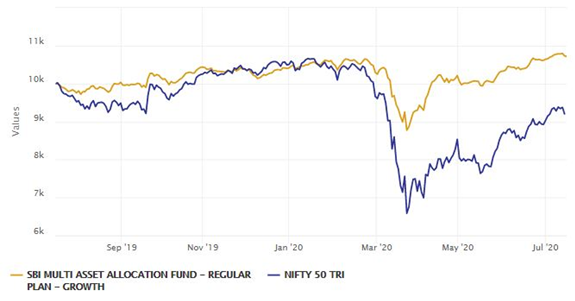

The chart below shows the growth of Rs 10,000 lump sum investment in SBI Multi Asset Allocation Fund over the last one year ending 15th July 2020. You can see that the scheme has outperformed Nifty 50 TRI by a wide margin. Also drawdown of this scheme was significantly lower than Nifty over this period.

Source: Advisorkhoj Research

Summary

Traditionally, asset allocation funds implied balanced funds which invested in equity and debt instruments. Multi asset allocation funds are relatively new and there is less awareness among both investors and financial advisors about these funds.

Our learning objective in this post is to have an understanding of how different asset classes behave relative to one another in different market conditions. We saw in this post that multi asset allocation covering three or more asset classes, particularly equity, debt and gold provides stability to your portfolio and good returns in the long term. SBI Multi Asset Allocation Fund is a promising multi asset allocation hybrid scheme. SBI Mutual Fund has a strong long term track record across different product categories. Investors should consult with their financial advisors if multi asset allocation is suitable for their investments needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY