SBI Dynamic Bond Fund: A good fixed income investment option in current environment

Interest rates have been falling for the past couple of years. Since the beginning of the COVID-19 outbreak Reserve Bank of India has cut the repo rate by 115 bps, prompting banks to bring down fixed deposit interest rates even lower. General 2 to 5 year FD interest rates of major public and private sector banks are now in the range of 5.1 – 5.5%. Inflation adjusted yield on a post-tax basis is very low, especially for investors in higher tax brackets.

We have stated a number of times in our blog that debt mutual funds offer tax efficient investment alternatives to traditional fixed income investment options. Debt mutual funds provide a range of investment solutions for different risk appetites, investment tenures and interest rate scenarios. In the current interest rate scenario, dynamic bond funds offer good investment options for 3 years or longer investment tenures.

In this post, we will review one of the top performing dynamic bond funds, SBI Dynamic Bond Fund.

SBI Dynamic Bond Fund

SBI Dynamic Bond Fund was launched in 2005 and has Rs 1,500 Crores of assets under management (AUM). The expense ratio of the scheme is 1.66%. Dynamic bond funds follow a flexible approach of investing across durations depending on the fund manager’s outlook on interest rates. These schemes have the potential of delivering good returns in a declining interest rate environment.

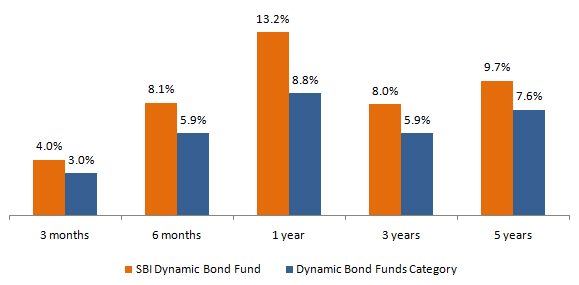

The chart below shows the trailing returns of SBI Dynamic Bond Fund versus the category average over different periods ending 16th June 2020.

Source: Advisorkhoj Research

You can see that the scheme delivered outstanding returns in the last one year and is continuing its fantastic run in the last 3 – 6 months. The scheme also outperformed the category and delivered good long term (3 to 5 year) returns.

Performance Consistency

We have discussed a number of times in our blog that performance consistency is one of the most important evaluation factors as far as mutual funds are concerned. A fund manager may adopt an investment strategy which generates very high returns in specific market (yield) conditions, but may not work in other conditions.

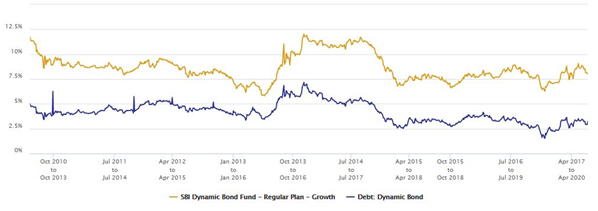

Rolling returns looks at fund performance across different market conditions and provides an unbiased view. The chart below shows the 3 year rolling returns of SBI Dynamic Bond Fund versus the dynamic bond funds category average over the last 10 years which had many periods of rising and falling interest rates. We are showing 3 year rolling returns because dynamic bond funds can be quite volatile over shorter investment tenures.

Source: Advisorkhoj Rolling Returns

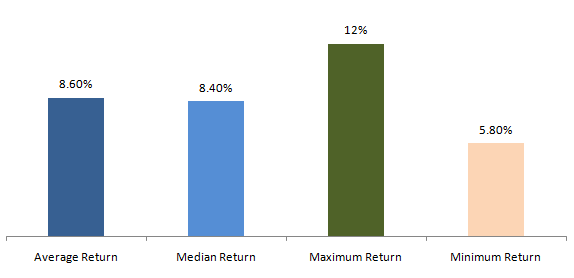

You can see that SBI Dynamic Bond Fund consistently outperformed the Dynamic Bond Funds category across different bond market conditions. Here are some interesting 3 year rolling returns statistics of the scheme over the last 10 years.

Source: Advisorkhoj Rolling Returns

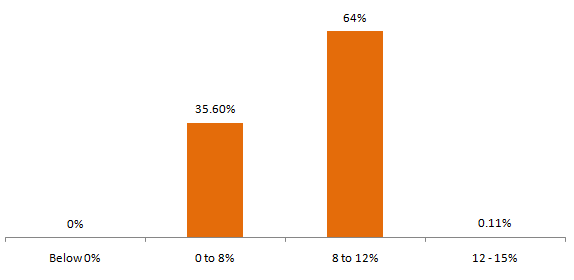

The chart below shows the percentage of instances when SBI Dynamic Bond Fund delivered returns in different ranges. You can see that, the scheme delivered 8%+ annualized returns 64% of the times over 3 year investment tenures in the last 10 years.

Source: Advisorkhoj Rolling Returns

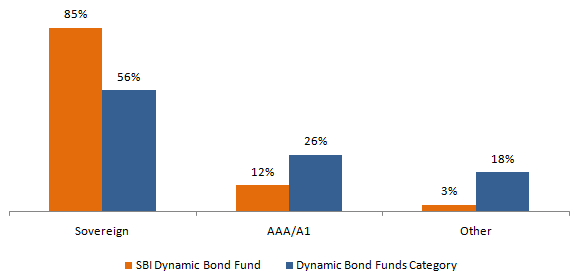

Strong credit quality

Credit risk is a concern which has been rankling debt mutual fund investors for more than a year now. With COVID resulting in huge revenue loss for many companies, credit risk concerns are likely to get heightened. SBI Dynamic Bond Fund with 85% of its assets invested in Government Securities has an excellent credit quality profile. Around 12% of the assets of the scheme are invested in AAA / A1 rated instruments.

Source: Advisorkhoj Research

Summary

The average maturity of the scheme portfolio is 10.63 years which makes this scheme highly sensitive to interest rate changes. Investors must have long investment tenure of at least 3 years in this scheme. Over 3 years or longer investment tenure, investors take get the tax advantage of long term capital gains.

Long term capital gains in debt mutual funds are taxed at 20% after allowing for indexation benefits. Indexation benefits can reduce tax obligations for investors considerably. We think that the current duration profile of this scheme will be beneficial for investors because the RBI is committed to an accommodative interest rate policy to spur economic growth in the difficult circumstances that we are facing now. Lower interest rates will result in higher capital appreciation in this scheme. Investors should consult with their financial advisors, if SBI Dynamic Bond Fund is suitable for their fixed income investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY