How investment in ELSS Mutual Fund is a superior choice over PPF

Section 80C of Income Tax Act 1961 allows investors to claim up to Rs 150,000 deduction from their gross taxable incomes by investing in eligible schemes. You can save up to Rs 46,800 in taxes (for investors in the highest tax bracket) by investing in 80C schemes. Some of the most popular tax saving investments under Section 80C are Employee Provident Fund (EPF), Voluntary Provident Fund (VPF), Public Provident Fund (PPF), National Savings Certificates (NSC), 5 year tax saver bank fixed deposits, life insurance plan (traditional and ULIP) and mutual fund Equity Linked Savings Schemes (ELSS).

In this blog post, we will compare and contrast two most popular tax savings investments – PPF and ELSS.

What is PPF?

Public Provident Fund (PPF) is a small savings scheme of the Government of India. It is one of the most popular 80C investment options for Indian investors. You can open a PPF account with just Rs 100 in public or private sector banks or post office. The minimum and maximum deposit amounts in a financial year are Rs 500 and 150,000 respectively. Since PPF is a Government scheme, your investment is risk free. You will get interest on your PPF deposit based on interest rates which can be reset quarterly by the Government. PPF interest rates are linked to Government bond (G-Sec) yields of similar maturities. The current PPF interest rate is 7.1%.

PPF investment matures in 15 years. However, under certain conditions you can take a loan from your PPF balance (between third and sixth year) or make pre-mature partial withdrawals (after 7 years). An account holder can withdraw prematurely, up to a maximum of 50% of the amount that is in the account at the end of the 4th year (preceding the year in which the amount is withdrawn or at the end of the preceding year, whichever is lower). Upon maturity of your PPF (completion of 15 years) you have the option of extending your PPF in blocks of 5 years. The maturity proceeds of PPF are entirely tax exempt.

What is ELSS?

Mutual Fund Equity Linked Savings Scheme (ELSS) has been growing in popularity as tax savings investments among retail investors over the last several years. Investment in ELSS mutual funds like PPF, qualify for tax deduction under Section 80C of Income Tax 1961. However, unlike PPF, ELSS is market linked and subject to market risks. Equity Linked Savings Schemes are essentially diversified equity mutual fund schemes which invest in equity and equity related securities across sectors and market capitalization segments. An investor can invest in ELSS either in lump sum or through Systematic Investment Plans (SIP). Minimum investment amount in ELSS can be as low as Rs 500.

ELSS funds have a lock in period of 3 years. Investors should note that if you are investing in ELSS through SIP, each instalment is locked in for 3 years. After completion of 3 years you can redeem your ELSS units partially or fully without any penalty. Capital gains of up to Rs 100,000 in ELSS are tax free and taxed at 10% thereafter. Dividends (now known as Income Distribution cum Capital Withdrawal Plan) paid by ELSS during a financial year will be added to your income and taxed according to your income tax slab rate.

Wealth creation potential – PPF versus ELSS

One of the main reasons of PPF being one of the most popular tax savings option for investors is the assurance of capital safety. Though equity is a volatile asset class, historical data shows that equity, as an asset class, has the highest wealth creation potential in the long term.

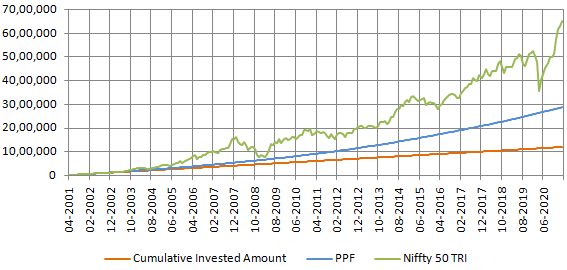

The chart below shows the growth of Rs 5,000 SIP in PPF and Nifty 50 TRI (proxy for equity as asset class / ELSS) over the last 20 years ending 31st March 2021. You can see that with Rs 5,000 monthly deposit in PPF you could have accumulated a corpus of around Rs 29 lakhs in last 20 years (15 years maturity plus 5 years extension with contributions). Your cumulative investment would have been Rs 12 lakhs. With the same cumulative investment through monthly SIP of Rs 5,000 you could have accumulated a corpus of nearly Rs 65 lakhs.

The difference amount is huge Rs 36 Lakhs!

Source: Advisorkhoj Research (1st April 2001 to 31st March 2021). Disclaimer: Past performance may or may not be sustained in the future.

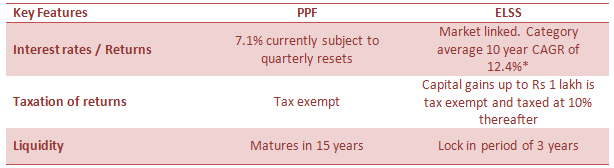

Summary PPF versus ELSS

Source: Advisorkhoj Research (as on 7th April 2021). Disclaimer: Past performance may or may not be sustained in the future

PPF interest rate cut and roll-back

PPF interest rates were recently in the news when Government announced on March 31st that PPF interest rates would be cut by 80 bps (0.8%) for the next quarter. The next day, the Government issued a clarification rolling back the interest rate cut and reinstating the previous quarter’s interest rates. Government’s decision to cut PPF interest rates and subsequent roll-back has generated a lot of discussion in the media. We will not go into the possible reasons for rolling back the rate cut (investors can make their own guesses), but we will advise our readers not to be over-optimistic about the Government’s roll back decision. We, in Advisorkhoj, think that reduction in PPF interest rate is inevitable, whether it happens in the next quarter or later.

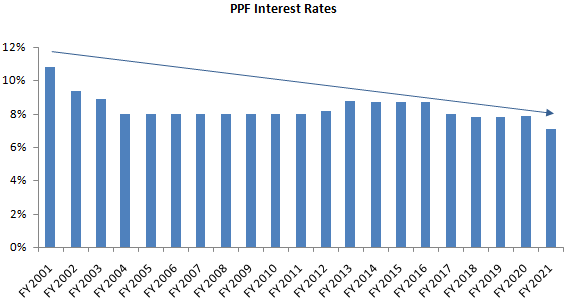

PPF interest rates have seen a secular decline over the last 20 years (see the chart below). There are several reasons for this decline in interest rates, but the fundamental reason is that, as our economy grows in size, interest rates in general will decline. PPF interest rates cannot be delinked from the prevailing interest rates in the economy, so fall in PPF interest rates is natural. PPF interest rates have always been higher than the bank deposit interest rates but this has caused problems in our monetary system. If PPF interest rates are significantly higher than bank term deposit rates, then it will cause problems for RBI’s monetary policy transmission in the financial system. The RBI has been pushing for cutting small savings interest rates for quite some time and we think that PPF interest rates will be cut sooner than later.

Source: Advisorkhoj Research (1st April 2000 to 31st March 2021). PPF interest rates are averages for each financial year.

SBI Long Term Equity Fund

SBI Long Term Equity Fund, formerly known as SBI Magnum Taxgain scheme, is an Equity Linked Savings Scheme (ELSS). Investments in SBI Long Term Equity Fund will qualify for deduction from taxable income for income tax calculation purposes under Section 80C.

The scheme was launched in 1993 and has Rs 9,184.73Crores of assets under management (AUM) as on 28th February 2021. The expense ratio of the scheme is 1.94%. Dinesh Balachandran is the fund manger of this scheme.

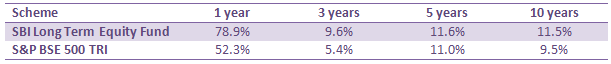

The table below shows the trailing returns of SBI Long Term Equity Fund versus its benchmark index over various investment periods ending 31st March 2021.

Source: Advisorkhoj Research

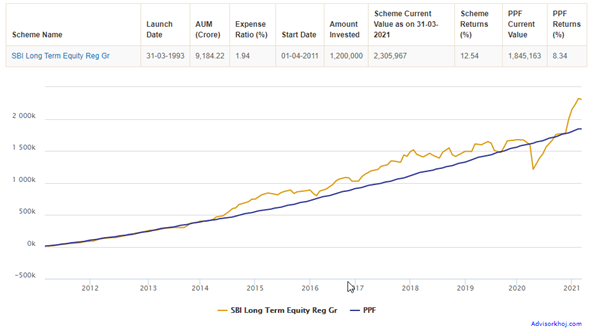

The table shows the SIP returns of Rs 10,000 monthly SIP in SBI Long Term Equity Fund versus PPF over the last 10 years ending 31st March 2021. You can see that the scheme has been a wealth creator for investors – The fund gave 12.54% annualized return (XIRR) compared to PPF which gave only 8.34% annualized return!

Who can invest in SBI Long Term Equity Fund?

- Investors who are looking to create wealth for their long term financial goals

- Investors with high risk appetites

- Investors who can remain invested for at least 3 years. Though the lock-in period of the scheme is 3 years, we recommend a minimum 5 year investment horizon for equity oriented funds

- Investors should consult with their financial advisor if SBI Long Term Equity Fund is suitable for their tax planning requirements

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY