Change of SBI Magnum Multicap Fund as SBI Flexicap Fund and what it means to investors

SBI Magnum Multicap Fund has been one of the top performing diversified equity funds. The scheme was launched in 2005 and has delivered north of 12% CAGR returns since inception. This scheme is one of the most popular schemes in the SBI Mutual Fund stable with Rs 10,425 Crores of assets under management (AUM) as on 31st January 2021.

We reviewed this fund sometime back and you can read the same a consistent performing Multi Cap Fund

In December 2020 SBI Mutual Fund announced that the name of the scheme will be changed to SBI Flexicap Fund along with change in fundamental attributes. In this blog post, we will explain why this change was made and what investors should expect.

Background

Vide its circular in 2017, the market regulator SEBI asked asset management companies to categorize their mutual fund schemes in specific categories. SEBI laid out clear guidelines with regards to categorizing mutual fund scheme e.g. large cap funds must invest at least 80% of their assets in large cap companies, midcap funds must invest at least 65% of their assets in large cap companies, large and midcap funds must invest at least 35% of their assets in large cap companies and 35% of their assets in midcap companies, multicap funds can invest across market cap segments. SEBI also laid out clear definitions with regards to which companies can be classified as large cap, midcap and small cap companies. We will discuss, what constitutes large cap, midcap and small cap later in this article.

One of the most popular types of diversified equity mutual funds in India, are the funds which invest across market capitalization segments i.e. large cap, midcap and small caps. Even before SEBI’s mutual fund classification guidelines came into force, these funds had a flexible approach towards market cap allocations in their scheme portfolios according to their fund manager’s outlook. These funds would increase / decrease their allocations to stocks different market cap segments depending on relative valuations as well bottom up analysis. In their 2017 circular, SEBI did not have any restrictions on market cap allocations of multicap funds. However in September 2020, SEBI mandated that multicap funds invest minimum 25% of their assets in each of large cap, midcap and small cap stocks.

We should clarify what large, mid and small cap stocks are. As per SEBI’s definitions the Top 100 companies by market capitalization are classified as large cap companies. 101st to 250th companies by market capitalization are classified as midcap companies. Companies who rank 251st or lower in terms of market capitalization are classified as small cap companies. Large cap stocks tend to be more stable / less volatile than midcap and small cap stocks. Small cap stocks are more volatile than midcap stocks.

Why did SEBI make this change?

This change caused a lot of concerns among investors who had investments in multicap schemes or were planning to invest in such schemes. SEBI clarified why it made this change in the mandate of multicap funds. The primary reason for this change as per SEBI was that a large number of multicap funds had a disproportionately high percentage of their assets in large cap stocks. SEBI made this change in mandate of multicap funds to make these schemes true to label. This would avoid confusion for new investors. Secondly, SEBI expected this change to promote a more balanced distribution of funds to all market cap segments. Thirdly, SEBI expected this change would encourage fund houses to use a more appropriate benchmark to disclose the fund performance.

Concerns of investors

The biggest concern for existing investors of multicap schemes was that, the new market cap mandate for multicap schemes will cause a significant change in the risk profiles of the schemes. As per SEBI’s new mandate, multicap funds will have minimum 50% allocation to midcaps and small caps. Also, these schemes will have minimum 25% exposure to small caps. Many investors were not comfortable with such high exposures to midcaps and small caps.

Another major concern for investors was that, as per the new mandate, multicap schemes will have to maintain their minimum asset allocations in more volatile stocks, irrespective of market conditions. In the past, diversified equity funds with multicap could have high allocations (more than 50%) to midcaps and small caps in favourable market conditions, but the fund managers had the flexibility to change their asset allocation depending on market conditions e.g. in volatile markets, fund managers could shed risks by shifting from small / midcaps to large caps. Investors were concerned that multicap fund managers would not have as much flexibility. Many AMCs shared the same concerns which investors had.

Flexicap Funds

In order to give more flexibility to the AMCs, SEBI had vide circular dated November 06, 2020 had introduced a new category under equity schemes i.e. “Flexicap Funds”, which as the name suggests has the flexibility to invest across market cap segments. There is no upper or lower limit with regards to market cap allocations of these schemes. The mandate of Flexicap funds is essentially the same Multicap funds prior to the September notification of SEBI with respect to market cap allocations. Accordingly, many fund houses have re-categorized their multicap schemes as flexicap schemes.

SBI Flexicap Fund

SBI Magnum Multicap Fund was re-categorized as SBI Flexicap Fund. The fund follows a bottom-up approach to stock picking and selects companies across industry sectors. Anup Upadhyay is the fund manager of this scheme. This scheme will have flexibility to invest across market cap segments i.e. large cap, midcap and small cap without any restriction. The current market cap wise asset allocation of the scheme is as follows (as 31st January, 2021):-

- Large Cap: 68%

- Midcap: 19%

- Small cap: 10%

Source: SBI Mutual Fund (as on 31st January 2021)

What changes for investors?

Essentially nothing has changed for investors – only the name has changed. As explained earlier, the schemes which have been re-categorized as flexicap have the same investment characteristics as multicap schemes prior to SEBI’s change in mandate for multicap schemes. Investors can expect the basic investment strategy to function in the same way as it was before this change was made.

Performance of SBI Flexicap Fund

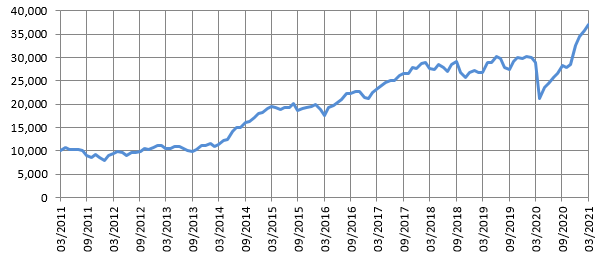

The chart below shows the growth of Rs 10,000 in SBI Flexicap Fund over the last 10 years. Your investment would have multiplied more than 3.7 times in the last 10 years. The CAGR return over last 10 years is over 14% (as on 28th February 2021).

Source: Advisorkhoj Research

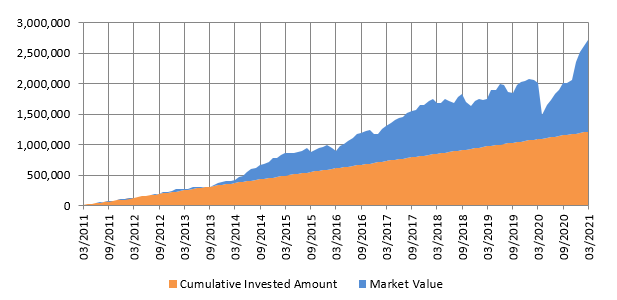

The chart below shows the growth of Rs 10,000 monthly SIP in SBI Flexicap Fund over the last 10 years. With a cumulative investment of Rs 12 lakhs, you could have accumulated a corpus of over Rs 27 lakhs (as on 28th February 2021). The annualized SIP return (XIRR) over the last 10 years was 16.2%. The SIP performance of the scheme is not only a testimony of wealth creation potential of SIP but also of the strong performance track record of the scheme as a wealth creator.

Source: Advisorkhoj Research

Conclusion – Advisorkhoj Take

- Though SEBI’s change in mandate for multicap funds introduced in September 2020 raised concerns among investors for very valid reasons, we think that it is a good move keeping the interest of all investors, both new and experienced in mind. This change will bring about more clarity in decision making for investors who want to invest across market cap segments.

- In light of investors and AMC’s concerns, SEBI introduced a new category called Flexicap funds. Though this category “Flexicap” is new, many diversified equity funds have followed a flexicap strategy for many years and the top performing funds following flexicap strategy have created wealth for investors. As such, funds following this flexicap approach have been very popular with investors for many years.

- SBI Magnum Multicap Fund has been re-categorized as SBI Flexicap Fund. As such, there is no change in the long term investment strategy of the fund.

- SBI Flexicap Fund has a proven long term track of strong performance across different market conditions. SBI Mutual Fund, as an AMC, has a strong track record of performance across several product categories.

- Existing investors of SBI Flexicap (erstwhile SBI Magnum Multicap Fund) can remain invested in this fund with a long term investment horizon. New investors with high risk appetites can also invest in this fund for their long term financial goals.

- You can invest in this scheme either in lump sum or SIP, depending on your financial situation. In our view, you should have minimum 5 year investment tenure for this fund.

- Investors should consult with their financial advisors if SBI Flexicap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY