Should you invest in midcap mutual funds now

The last one year has been a very difficult one for midcap stocks and funds. The BSE Midcap Index fell 14% from January 1, 2018 to January 1, 2019; on a year to date basis the index has fallen a further 8%. Such steep falls expectedly would have an unnerving effect on retail investors, especially inexperienced investors. Net inflows to mutual funds have slowed down and redemptions have increased. We hear from mutual fund distributors that investors are nervous about continuing volatility in the market and election results. At the same time, we are also getting queries from investors, whether the sharp decline in prices have made midcap funds attractive at this point of time. In this blog post, we will discuss whether you should hold on to your midcap fund investments and / or make fresh investments at these price levels.

Should you hold / redeem your midcap mutual funds?

If you invested in midcap mutual funds 1 to 2 years back then your scheme net asset values may have fallen more than 20% from their all time highs. We have stated a number of times in our blog that decline in NAVs result in only a notional loss, but you make an actual loss when you redeem at lower prices. If you redeem when markets are down, you will make your notional loss a permanent loss. The chart below shows the price of BSE Midcap Index from January 1, 2018 till date.

Source: Bombay Stock Exchange

Though the midcaps recovered somewhat from November 2018 to January, the recent correction has the BSE midcap index back to its 52 week low. If you want to exit now, you will be exiting at 52 week lows. Some investors may think situations is whether they are better off booking the loss and re-entering at lower levels assuming market goes down further; the question therefore, whether investors can gain by trying to time the market. Short term price movements are very difficult to guess and trying to time the market is always difficult, as the 2011 to 2014 BSE Midcap Index chart below will show. 2011 to 2013 was a slightly prolonged difficult period for midcaps. After the steep fall in 2011, midcaps recovered somewhat in 2012 but fell again in 2013. Investors, who want to time the market, always want a confirmation of bottom but in volatile market, when sentiments are weak it is extremely difficult to confirm the bottom.

Source: Bombay Stock Exchange

In the above chart, you can see that BSE Midcap Index fell from 8,000 levels in January 2011 to 5,100 levels in November 2011. Though there was a recovery in 2012, midcap again fell in 2013 to 5,200 levels. Now focus on the part of the chart circled in red. In the next 8 months from the point where the BSE Midcap Index made a 52 week low in 2013, the Midcap Index rose 66% to 8,700 levels. Such rallies which are quite common, in our experience with the midcap segment in India, make entries very difficult and investors end up buying at much higher levels. Midcap mutual funds have already corrected more than 20%; it is difficult to say whether they will correct more or will consolidate from here onwards. Buying low and selling high is the age old mantra of equity investing; if you sell now, you will be selling low. If you have a long investment horizon, then you should remain invested because market eventually always recover and make newer highs.

Do price levels really matter for long term investors?

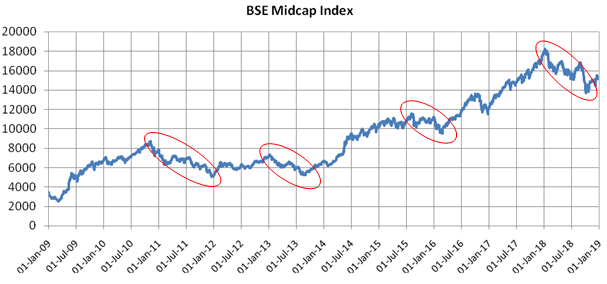

If you are a long term investor, whether you have investments in midcap funds or want to invest in these funds, we should examine whether entry price points really matter? The chart below shows the 10 year price chart of BSE Midcap Index.

Source: Bombay Stock Exchange

In the last 10 years, we had 4 major corrections in the BSE Midcap Index (see the portions of the chart circled in red):-

- More than 40% correction from end 2010 to end 2011

- More than 30% correction in 2013 (January to September)

- 17% correction in 2015 (August 2015 to February 2016)

- More than 25% correction in 2018

Despite 4 major corrections, in the last 10 years (from January 1, 2009 to January 1, 2019), the BSE Midcap Index gave 17% CAGR returns to investors. If you invested Rs 1 Lakh in BSE Midcap Index 10 years back, your money would have grown to Rs 4.8 Lakhs (nearly multiplied 5 times); these are outstanding returns by any standard. BSE 100 Index, the index of large cap stocks, on the other hand, gave 14% returns in the last 10 years. Over long investment tenors, midcaps outperform large caps and can generate considerable wealth for investors.

Do election results really matter for long term investors?

Many investors are understandably nervous about the impact of Lok Sabha election results on the market. Elections do have an impact on the stock market. When NDA lost the 2004 election, the BSE Midcap Index fell more than 20% in the next few months, but market recovered quickly and turned into a raging bull market for the next 3 years. On the flip side, when UPA was re-elected in 2009 the BSE Midcap Index rose 60% in the next 4 months, but fell 40% in 2011 (as discussed earlier). What conclusion can you draw from these 2 election results for long term investors? It is very difficult to draw any conclusion. We looked at the BSE Midcap Index price chart from April 2013 (the earliest point of time from which BSE Midcap Index data is available) to January 2019. During this period, we had 10 years of UPA rule and 6 years of NDA rule.

Source: Bombay Stock Exchange

In the last 16 years, irrespective of the political dispensation at the Centre, the BSE midcap index rose from 900 odd levels to 15,400 odd levels; CAGR of 20%. This shows of the intrinsic strength and growth potential of the Indian economy. Current political narrative on either side of the aisle and in media, notwithstanding, the long term wealth creation potential of Indian equity, especially in the midcap segment is substantial. Since economic liberalization was initiated in 1991, subsequent Governments irrespective of political colors did not roll back major reforms. If you are a long term investor, ignore the politics and invest for your long term goals.

Conclusion

- Given various risk factors, local and global, volatility can persist for some more time, but it is very difficult to predict market bottom. You should remain invested in midcap mutual funds over a long investment horizon.

- Despite intermittent volatilities midcaps give good returns in the long term. Therefore, if you have a long investment horizon you can invest in midcap mutual funds with good track records, irrespective of current price levels, for long term benefits.

- If you are worried about volatility, you can invest in midcap mutual funds through STP over the next 3 to 6 months to take advantage of Rupee Cost Averaging.

- Long term investors should ignore the potential impact of Lok Sabha election results and invest for their financial goals.

- The India growth story remains intact and economic reform measures undertaken by this Government will result in strengthening our economic growth in the long term. Midcap stocks and mutual funds are likely to benefit.

- You should consult with your financial advisors, if midcap mutual funds are suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- Importance of staying invested in the choppy market

- Two new promising smart beta funds: Nippon India Nifty 500 Low Volatility 50 and Nifty 500 Quality 50 Index Funds

- Going hybrid in the current environment

- Asset allocation is key to long term investing: Hybrid funds make a lot of sense in current market conditions

- Should you invest in momentum funds: Why momentum works in investing

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY