How SWP from Balanced Mutual Funds can be useful to get regular return

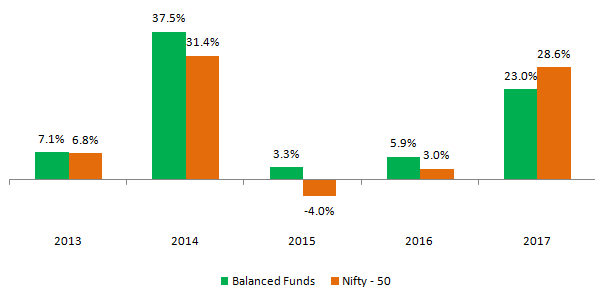

Balanced Mutual funds have 65 – 75% exposure to equities and 25 – 35% to debt. The debt component of balanced mutual funds makes these funds considerably less volatile than equity mutual funds. At the same time, the equity component enables balanced mutual funds to beat inflation and give good returns over a sufficiently long time horizon. Balanced mutual funds are tax friendly investment options - long term capital gains (for an investment holding period of more than 12 months) in balanced mutual funds are tax free. Dividends paid by balanced mutual funds are also tax free. The chart below shows average annual returns from balanced mutual fund category versus the Nifty index over the last 5 years.

Source: Advisorkhoj Research

You can see that, balanced mutual funds as a category was able to beat Nifty in most years. You can see that, balanced mutual funds gave positive returns even in 2015, when the market gave negative returns. Please note that the green bars represent balanced fund category average returns; top performing balanced mutual funds gave much superior returns. As such, balanced mutual funds are ideal investment option for investors with moderate risk capacities looking for stability.

Over the past several years top performing balanced mutual funds had an excellent dividend pay-out track record. The chart below shows the dividend payout track record of Reliance Regular Savings Fund – Balanced Option for the last 9 (we have selected the scheme for purely illustrative purposes; some of the other top performing balanced funds also have been paying regular monthly dividends over the last year or so).

Source: Advisorkhoj Research

The dividend yield of this scheme over the last 3 years was quite good.

Let us now understand how dividends are paid by mutual funds. Investors should remember that mutual fund dividends are not assured. SEBI regulations require mutual funds to pay dividends from the distributable surplus of a scheme. The distributable surplus of a scheme is calculated using the Net Asset Value (NAV), face value, Dividend Equalization Reserve and Unit Premium Reserve.

Let us understand this with the help of an example. Suppose the NAV of mutual fund scheme, whose face value is Rs 10, goes up to 15. What is the increase in NAV represent? This represents the increase in the price of the securities in the scheme portfolio. But the mutual fund cannot use the entire Rs 5 gain to pay dividends to investors. In March 2010, the market regulator, SEBI asked mutual funds to pay dividends only from realized gains. Gains are realized when mutual funds sell securities. Suppose the scheme books Rs 3 as profits (by selling securities). This goes to the Dividend Equalization Reserve account. Dividends can be paid out of this account. The unrealized gains (Rs 2 in this example) go to the Unit Premium Reserve account. Therefore, dividend payout arises only when profits are booked.

Investors should note that, the fund may not pay the entire realized gains (Rs 3 in this example) booked to the Dividend Equalization Reserve as dividends to investors. It may save some for a rainy day – at times, when the fund is not able to book profits, the fund may dip into the Dividend Equalization Reserve to pay dividends to investors from profits booked but not distributed.

You may have seen that, older balanced mutual funds were able to pay dividends to investors even in bear market years because they had sufficient distributable balances in their Dividend Equalization Reserve. However, investors should not take historical monthly dividend track record as an assurance of regular monthly dividend payments in the future, because if a fund runs out of balance in Dividend Equalization Reserve and there are no profit booking opportunities due to market conditions, then the fund will not be able to pay dividends to investors. In summary, historical track record notwithstanding, mutual fund dividends are not assured and investors should not solely rely on dividends for their regular monthly income needs.

Fortunately mutual funds offer a smart solution to investors to meet their regular monthly income needs through SWP or Systematic Withdrawal Plan.

Systematic Withdrawal Plan

In a Systematic Withdrawal Plans (SWP) you can regularly withdraw a fixed amount of money from your investment in a mutual fund scheme. The amount to be withdrawn and the frequency of withdrawal are fixed by the investor. So you can have a monthly, quarterly or annual frequency for any fixed amount that you wish to receive. SWP from a Balanced Mutual Fund is an ideal investment option for investors to get regular fixed monthly income from their investment and at the same time see their investment grow in value over sufficiently long investment tenures.

Investors should note that, SWP generates fixed cash-flows for investors by redeeming a certain number of units at prevailing NAVs. While unit balance goes down every month, the unredeemed units continue to accrue returns for the investor over the SWP tenure. If the withdrawal rate per annum is lower the average long term annualized returns of the fund, then investor can get both regular income as well as capital appreciation.

Let us illustrate this with the help of an example. Suppose you can invest Rs 50 lakhs from which you need an income of Rs 40,000 per month. You can invest Rs 50 lakhs in lump sum in growth option of a balanced mutual fund.

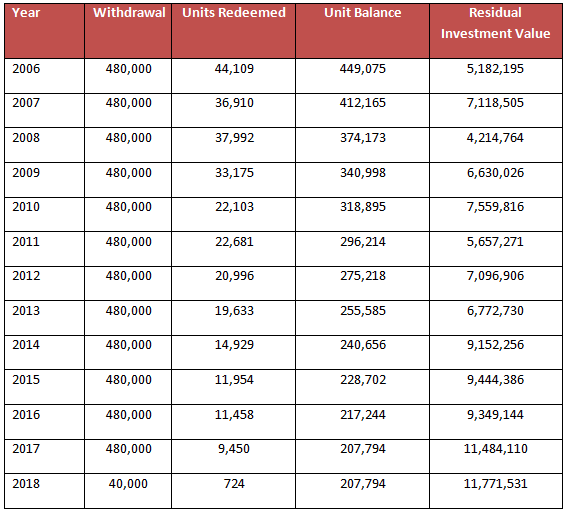

To illustrate this we have given the example of Reliance Regular Savings Fund – Balanced Option. We chose a period of Jan 1, 2006 to Jan 18, 2018 (today) to observe the SWP results. We chose a long period for SWP because income planning is usually done for a long period. Further, over a long historical period, we can observe how the SWP performed in different market conditions (multiple bull and bear market cycles). Please note that for the sake of simplicity we have ignored the effect of exit load and short term capital gains tax.

Source: Advisorkhoj Research

You can see that, despite drawing Rs 40,000 every month – Total Rs 480,000 in a year - (around 9.6% of invested amount per annum) to meet income needs, the investment in Reliance Regular savings Fund – Balanced Option grew from Rs 50 lakhs to Rs 1.18 Crores in 12 years.

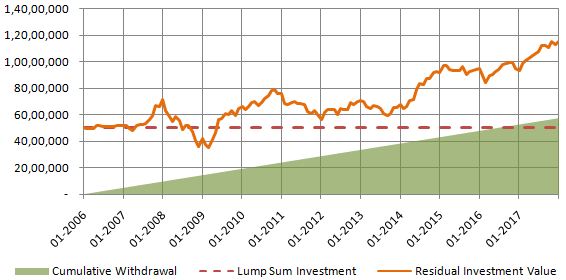

The results of SWP are best over a long investment horizon and moderate rates of withdrawal. In the chart below you can see that, the residual investment value dipped below the investment amount in 2008, but the investment recovered and continued to grow despite withdrawals. In fact, over the 12 year period the cumulative withdrawals exceeded the one time (lump sum) investment amount (please see the chart below). Despite withdrawing more than what you invested, you were still able to grow your investment 2.4 times in value.

Source: Advisorkhoj Research

Why are Balanced Mutual Funds suited for SWPs?

During market corrections (bear markets) mutual fund investments decline in value since the net asset values (NAVs) fall. The fall in NAVs is a double whammy in SWP because lower the NAV, higher the number of units which need to be redeemed to meet your SWP cash-flows. SWP through a long bear market can cause substantial unit depletion if the fund is volatile. In balanced funds downside risks are limited by asset allocation. While in bear market, balanced mutual fund’s NAVs may decline, it will not be as sharp as equity mutual funds; as a result, unit depletion in SWP through a bear market will be lower. The investment will therefore, be able to recover faster in value when the correction ends and bull market commences.

Conclusion

In this blog we have seen how SWP from a balanced mutual fund is a smart option to generate both regular monthly income and capital appreciation over long investment tenure. Though in the SWP example, of this post we have ignored the impact of exit load and short term capital gains tax on the SWP, investors should be mindful of the impact of exit load and tax when setting up their SWPs; the SWP withdrawals should begin after the exit load and short term capital gains tax period. If you need regular income from your mutual fund investment, you can consult with your financial advisor, if SWP from a balanced mutual fund is appropriate option for you.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- Two new promising smart beta funds: Nippon India Nifty 500 Low Volatility 50 and Nifty 500 Quality 50 Index Funds

- Going hybrid in the current environment

- Asset allocation is key to long term investing: Hybrid funds make a lot of sense in current market conditions

- Should you invest in momentum funds: Why momentum works in investing

- Nippon India Active Momentum Fund: Invest in winners

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY