LIC MF Balanced Advantage Funds: A good investment option in volatile markets

What is dynamic asset allocation?

In this asset allocation strategy, asset allocation mix is adjusted depending on market conditions i.e. you will increase or decrease your allocations to equity and fixed income on an ongoing basis depending on market conditions. For example, if equity valuations areexpensive you will reduce your asset allocation in equity and increase your asset allocation in debt. If equity valuations are cheap then you will increase your asset allocation in equity and reduce your asset allocation in debt.

What are Balanced Advantage Funds?

Balanced Advantage Funds are a type of hybrid mutual funds which follow dynamic asset allocation strategy. The equity and fixed income allocations of the fund change dynamically based on the asset allocation model of the fund. The dynamic asset allocation models are usually back-tested to see how the model performed in different market conditions and across investment cycles. As per SEBI’s mandate Balanced Advantage Funds can invest from 0 to 100% in equity and from 0 to 100% in debt as per their asset allocation model.

Asset allocations in Balanced Advantage Funds

- Net or Active Equity: This is the un-hedged equity exposure of the fund. Net equity allocation is determined by a quantitative dynamic asset allocation model based on market conditions.

- Fixed Income: Fixed income allocation is determined by the asset allocation model but is usually capped at 35%, as 65% of portfolio allocation is invested in hedged equity/net equity exposure for equity taxation.

- Arbitrage: This is the fully hedged equity component which is not exposed to market risks but generates arbitrage (risk-free) profits based on price differences in cash and futures market or corporate actions. The arbitrage component reduces the net equity exposure and at the same time, helps to keep the gross equity exposure above 65%, which enables equity taxation.

Benefits of dynamic asset allocation

- Dynamic asset allocation has lower volatility and limited downside risks compared fixed asset allocation strategies with high equity allocations

- Advantage of systematic process driven approach versus discretionary decisions based on judgement calls or gut feelings

- Potential of getting superior risk adjusted returns by making asset allocation decisions based on market conditions.

In this article, we will discuss the dynamic asset allocation strategy of LIC MF Balanced Advantage Fund.

LIC MF BAF Dynamic Asset Allocation Model

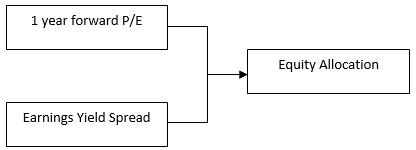

LIC MF Balanced Advantage Fund uses a two factor dynamic asset allocation model:-

- Forward P/E (80% weightage in the model): Forward P/E ratio is the current share price divided by the forecasted / estimated earnings per share (EPS) over next 12 months. To determine forward P/E, LIC MF focuses on the 12 months forward earnings of the companies.

- Earnings Yield Spread (20% weightage in the model): Earnings yield is the reciprocal of P/E ratio i.e. E/P. Earnings yield spread refers to difference between earnings yield and yield of 10 year G-Sec. If yield spread is high, it means valuation is attractive and if yield spread low, then it means that valuation is expensive.

How bands are determined from maximum / minimum equity allocation?

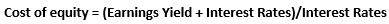

- P/E ratio: The model takes interest rates and earnings yield in account to make P/E bands. Yield gap is the difference between interest rate and earnings yield (Yield Gap = Earnings Yield – Interest Rate). At the lower end of the PE band, earnings yield = interest rate. The equity allocation will be highest at the lower end of the PE band. The upper end of the valuation band is derived from the cost of equity formula:-

In other words, this is the maximum valuation at which investors will be ready to buy i.e. the upper end of the valuation band. The equity allocation will be lowest at the upper end of the PE band. - Earnings Yield Spread: The model will increase equity allocation if yield spread is high and vice versa. The upper and lower bands for yield spread is from +4% to -4%.

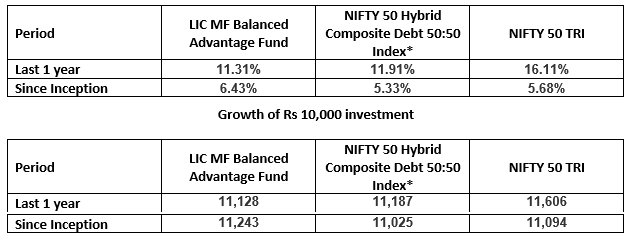

LIC MF Balanced Advantage Fund performance

Source: LICMF Factsheet, as on 29th September 2023

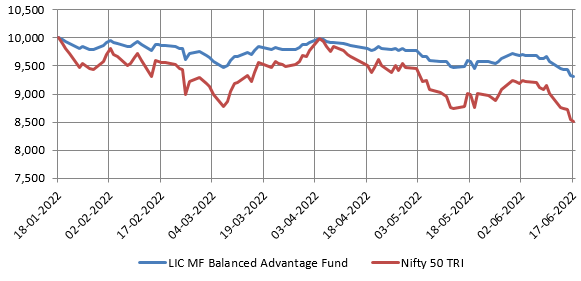

How the scheme performed in market correction?

The chart below shows the biggest drawdown on Rs 10,000 investment in LIC MF Balanced Advantage Fund since the scheme’s inception versus Nifty 50 TRI over the same period. This drawdown was mainly caused by Russia’s invasion of Ukraine and high inflation. You can see that the scheme was able to limit downside risks for investors.

Source: Advisorkhoj Research, from 18th January 2022 to 17th June 2022

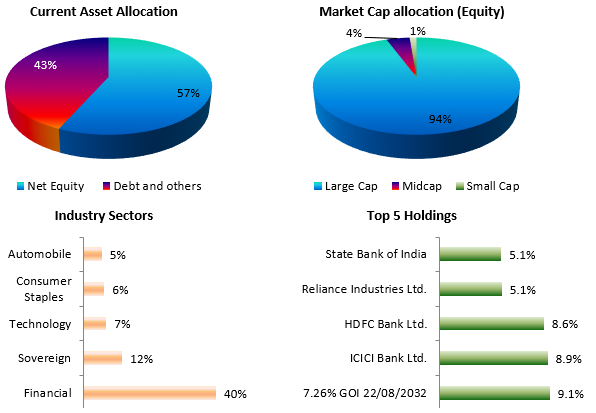

Current asset allocation and portfolio

Source: LIC MF Factsheet, Advisorkhoj Research, as on 29th September 2023

Why invest in LIC MF Balanced Advantage Fund?

- Diversification of portfolio

- Dynamic asset allocation

- Margin of Safety

- Protect downside by reducing the drawdown and participate in the upside by asset allocation

- Aims to generate near equity return with relatively lower volatility

- Equity tax benefit

Who should invest in LIC MF Balanced Advantage Fund?

- Investors looking for capital appreciation and income over long investment tenures

- Investors with moderately high risk appetites

- Investors with minimum 3 year investment tenures depending on your investment need.

- You can invest either in lump sum or SIP

- Suitable investment option for first time investors

Investors should consult with their financial advisors or mutual fund distributors if LIC MF Balanced Advantage is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- LIC MF Money Market Fund: Good investment option for parking your idle funds

- LIC MF Small Cap Fund: A promising small cap fund for long term investors

- LIC MF Dividend Yield Fund: A suitable diversified equity in current market dynamics

- LIC MF Value Fund: A good fund for volatile markets

- LIC MF Focused Fund: Potential of creating alphas over long investment horizons

LIC Mutual Fund was established on 20th April 1989 by LIC of India. Being an associate company of India's premier and most trusted brand, LIC Mutual Fund is one of the well known players in the asset management sphere. With a systematic investment discipline coupled with a high standard of financial ethics and corporate governance, LIC Mutual Fund is emerging as a preferred Investment Manager amongst the investor fraternity.

Investor Centre

Follow LIC MF

More About LIC MF

POST A QUERY