Do you know to make sense of mutual fund factsheet: Part 1

In this series of posts, we are discussing terms that are commonly used in mutual funds. Many of you may have been familiar with these terms, but a better understanding of these terms will help you become a better investor. In our post, Did you know the basics of Mutual Fund investing, we discussed some basic terms and concepts of mutual fund investing. We demystified a wide variety (and often confusing) terms associated with mutual fund returns in our post, What are the different types of returns in mutual funds. In this post, we will discuss an important document published by Asset Management Companies (AMCs) on a monthly basis, factsheet. I know several people who have been investing in mutual funds for several years and yet have never seen a factsheet.

What is a Factsheet?

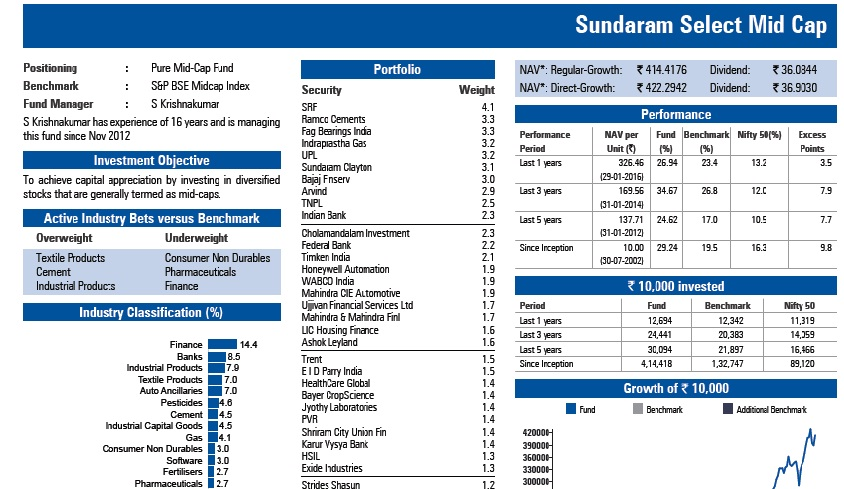

Factsheet is nothing but a monthly report published by all AMCs which has detailed information for each active scheme of the AMC. They are available online on the websites of the AMCs. Investors who prefer to read factsheets in print format should enquire with their financial advisors. A fact sheet usually begins with a commentary ondebt and equity markets and then has scheme wise information. Readers should note that, the information contained in the factsheet may also be found in summary form on various mutual fund research websites like moneycontrol.com, morningstar.in, valueresearchonline.com, Advisorkhoj.com etc. In this post, we will discuss how to effectively decode a factsheet. In this post, we will use a factsheet extract of a Sundaram Mutual Fund Scheme, Sundaram Select Midcap. We have chosen Sundaram factsheet, because Sundaram factsheets have very detailed information and we can explain these concepts to our readers, which will be relevant for all mutual fund schemes.

Source: Sundaram Mutual Fund January 2017 Factsheet. Only top part of the factsheet has been produced in this image

Let us now discuss different elements of the factsheet.

Scheme Related Information

Look at the top left section of the factsheet. It has some very useful scheme related information. The scheme is positioned as a pure midcap fund. This means that, the fund manager will be investing only in the midcap segment. This information is very useful as it tells you about the fund manager’s strategy. Many AMCs do not provide this information in their factsheet and the investor has to do more rigorous analysis to find out about the investment market cap strategy; the good news for investors is that, research websites (like moneycontrol.com, Morningstar.in, valueresearchonline.com, Advisorkhoj.com etc) do this analysis for you and categorize the scheme appropriately.

Every fund manager identifies the appropriate market benchmark for each scheme managed by him / her. Since mutual funds are market linked investments, performance is always measured on a relative basis. In the world of mutual funds, performance is measured against either benchmark or peers. Performance versus benchmark is the most straightforward measure of relative performance.

The factsheet will tell you who is managing the scheme, the fund manager. Some schemes have multiple fund managers. Most retail investors, who I have come across, have absolutely no idea of the fund managers of their mutual fund schemes. In fact, even many financial advisors do not know fund managers of different schemes recommended by them to their clients. You should know that, the fund manager is ultimately responsible for managing your money. The fees that you pay in all mutual fund investments include the cost of the fund manager and his/her support infrastructure (please refer to expense ratio discussed in our post, Did you know the basics of Mutual Fund investing). The fund manager is responsible for fund performance and, at the very minimum he / she should be able to beat the benchmark over a sufficiently long investment horizon; the fund manager’s performance has a direct impact on your returns. Therefore, you should try to know who the fund manager is and his / her track record. Investors should note that, fund managers often manage multiple schemes; you can find the different schemes managed by the fund manager(s), by flipping through the factsheet. You should try to see performance of different schemes managed by the fund manager, even if you have not invested in those schemes, to evaluate his / her track record. Sounds like a lot of work? Yes, it is a little bit of work, but if you want the best results, you have to put in work; is it not what we tell our children?

The investment objective is often a general statement telling us if the objective of the scheme is capital appreciation or income or both. It can also reveal some useful information on investment strategy. So fund houses (AMCs) have very sharply defined investment objectives, while others may not have it very sharply defined; nevertheless, it is useful to read it, because it can tell you about the market cap strategy, the stock picking universe and the investment style, e.g. growth, value, growth at a reasonable price (GARP) etc.

Sector Related Information

Generally, diversified equity funds (normally in Advisorkhoj, we refer to multi-cap or flexi-cap funds as diversified equity funds, but in this context, all non thematic funds are diversified funds), have no sector bias (sector agnostic). However, this is only theoretical; whether the fund manager follows a top-down or bottom-up approach to stock picking, the sector allocations of a scheme is most likely to be different from the benchmark. In a top-down approach, the fund manager is deliberately over-weight (invested more) or under-weight (invested less) to different sectors. In a bottom-up approach, where the fund manager stocks that can give high returns, irrespective of which sector they belong to, they are still likely to be over-weight / under-weight on different sectors. In the factsheet extract above, you can see which sectors the schemeis over-weight / under-weight in the section Active Industry Bets versus Benchmark. Investors should note that, not all AMCs provide this information in their factsheets (and that is why we chose Sundaram), but research sites like Morningstar.in and valueresearchonline.com provides this information for all schemes, based on their own research.

The section below Active Industry Bets versus Benchmark in the factsheet extract above (Industry Classification) shows the sector allocation in the scheme portfolio. Investors can use this information in a variety of ways. If the sector allocation is biased towards a few sectors, it is more risky, but the investor can also get higher returns. Pronouncedly biased sector allocation, if maintained over a period of time, can also signify the fund manager’s convictions towards certain sectors, depending on the business cycle stages of these sectors. Sectors can be classified into various broad types, cyclical sectors (e.g. Banks, automobiles, capital goods, cement, textile etc) defensive sectors (e.g. Pharmaceuticals, FMCG etc), rate sensitive sectors (e.g. Bank, NBFCs, real estate) etc. While cyclical sectors are seen as risky, it can give great returns in early and mid stages of bull market. At the peak of bull market or bear markets, defensive sectors tend to outperform. Regular readers of Advisorkhoj.com will recall that, we discuss sector allocation in terms of cyclical, defensive, rate sensitive etc, in our fund reviews; hopefully now you appreciate, why we do that.

Company Concentration

So far, we have dealt with the left hand side section of the factsheet extract; let us now focus our attention on the middle section. The middle section, Portfolio, gives you the stock holding details of the scheme portfolio. Our view in Advisorkhoj.com is that, investors should not focus on individual names (other than purely academic interest) but rather on company concentration. The reason is very simple; if you knew, which companies are the best bets in the future, from an investment standpoint, you would invest in stocks directly, rather than going through the mutual fund route. Company concentration, on the other hand, is extremely important in mutual fund investments because it tells you what percentage of your money (investment) is at risk, if something goes wrong with one (or more) company.

You will be able to calculate the company concentration by adding the stock allocation (weights) of the Top 5 or Top 10 companies. If the weight of the 10 largest stockholdings in the portfolio is within 50% of the portfolio value or thereabouts and the weight of the 5 largest stockholdings in the portfolio is within 30% of the portfolio value or thereabouts, the company concentration risk is seen to be acceptable. Readers should, however, note that, company concentration of some mutual fund schemes with focused portfolios, typically named in our (Indian) industry context as focused funds, can be very high. This is a deliberate strategy of the fund managers of these schemes and can give higher returns to investors, if the fund managers’ bets pay off in the long term. This kind of investment strategy is not unsound in a market like India, but investors should be aware of the risks associated with these investments. These funds should typically constitute a smallportion of the investors overall portfolio.

NAVs and Returns

The right side of the factsheet extract shows the NAVs of different scheme options and the returns of the scheme. We have discussed NAVs and different options in our post, Did you know the basics of Mutual Fund investing (I will urge readers, who have not read the post, to go through, so that, they can better understand NAVs and different options). We have also discussed about returns at length in our blog post, What are the different types of returns in mutual funds. Readers should note that, the returns mentioned in this factsheet and most other factsheets are trailing returns over different time-scales (we have discussed what trailing returns are in our post, What are the different types of returns in mutual funds). Growth of Rs 10,000 is one of the most popular representations of capital appreciation in mutual funds. Some investors may find it difficult to visualize how much money they could make from percentage annualized returns. Growth of Rs 10,000 is a more effective way of understanding, how much wealth the scheme created over different time-scales.

Conclusion

In this post, we discussed how to read factsheets more effectively, so that you have a better understanding of the schemes that, you have invested in or plan to invest in. The concepts discussed in this post will also be relevant for investors who prefer to use research websites to get information regarding mutual fund schemes, because most of the information available in factsheets is also there on different research websites. So far, we have discussed only the top half of the factsheet, which contained nearly 80% of the information related to the scheme. In our next post, we will discuss the bottom half of the factsheet, which also contains very valuable information. Please stay tuned.........

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY