Mutual Funds Common Investing Mistakes To Avoid: Part 2

Yesterday in the first part this article we discussed few common Mutual Fund investing mistakes. In the concluding part today, we will discuss some more in order to help our readers take prudent investment decisions with regards to their Mutual Fund investments.

Do not undermine the risk of Equity Investing

If you read the standard disclaimer of Mutual Funds, it reads – Mutual Fund investments are subject to market risks, read all scheme related documents carefully. Risk in regards to Mutual Fund investments refers not only to getting less than the expected returns from these investments but also the probability of erosion in capital amount. But the point is how to know the risk and avoid it?

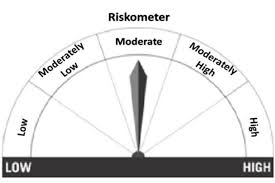

Please note that avoiding the risk completely is impossible given the nature of investments. However, one of the advantages of Mutual Fund investments is that the risk inherent to each fund is indicated with the Riskometer. Looking at the Riskometer, you know how much risk you are taking.

What is Riskometer?

Simple speaking, it tells you the schemes risk level. If you read the offer document of the scheme or go through the application form you will see the image of this Riskometer.

There are five levels in Riskometer – Low, Moderately low, Moderate, Moderately High and High – for different category of Mutual funds. Now, let us see what the meaning of these five levels is.

Low

– It denotes principal at low risk

Moderately low

– Principal at moderately low risk

Moderate

– Principal at moderately risk

Moderately high

– Principal at moderately high risk

High

– Principal at high risk

The above gives you a broad idea about the risk associated with each mutual fund scheme. However, one should not blindly follow the Riskometer before investing. The other factors that are to be considered while investing is your investment time horizon, risk taking appetite and the purpose of the investment. For example – A young investor with high risk profile may like to invest in thematic or sectoral funds for his long term financial goals, whereas the same investor, though young, may not like to invest in diversified equity funds for his medium term investments. Similarly an elderly person may invest in a hybrid balanced fund and completely avoid investing in diversified equity funds even though the Riskometer denotes ‘Moderately High’ for most of the schemes in these two categories.

Do know the taxation of Mutual Funds

While investing we first consider the probable returns that an investment can generate while ignoring the tax impact of the same. While it is important to know the returns but it makes more sense to know the ‘post tax return’. Post tax return is nothing but the total returns that you get after paying tax on the gains. The long term capital gains (more than one year) arising out of your equity Mutual Fund investments are totally tax free. The dividends received from Equity Mutual Funds are also tax free. Some of the key points to note with regards to mutual fund taxation is as follow –

- Try not to redeem Equity Mutual Funds before one year as gains will be taxed at 15%

- Tax on schemes other than Equity Oriented Funds, Like Debt Funds or Liquid Funds - Long Term Capital Gains (units held for more than 36 months) will be applicable @ 20% with indexation benefit.

- Tax on Schemes other than Equity Oriented Funds, Like Debt Funds or Liquid Funds, Short Term Capital Gains (units held for less than 36 months) is 30%.

- Dividend on the schemes other than Equity Oriented Funds, Like Debt or Liquid Funds, in the hand of the Investor are tax free. However, dividend distribution tax @ 25% is payable by the scheme.

While selecting Mutual Funds one should have a look at their taxation and try minimising or avoiding it. For example – if your risk profile suggests that apart from equity, you should also invest some part of your investments in debt fund, then instead of investing in separate schemes for equity and debts, you may consider investing in hybrid equity oriented funds. Hybrid equity mutual funds invests 65-70% in equities and rest in debts but the taxation applicable to these funds are that of equity, that is gains are tax free in case the investments are held for more a year. If you invest in debt separately you will have to pay capital gains tax at the rate of 20% after indexation.

Similarly, if you are investing in equity funds, you should check with your tax consultant if you need to save tax under Section 80C. If it is so, then instead of investing in an open ended equity fund you should consider investing in ELSS funds. ELSS or Equity Linked Savings Funds are nothing but diversified equity funds which are locked-in for three years but offer tax rebate under Section 80C upto a limit of र 150,000 per annum. The long term capital gains and dividends are completely tax free for ELSS Funds.

Do not wait for the right time to start investing

“Know the true value of time; snatch, seize, and enjoy every moment of it. No idleness, no laziness, no procrastination: never put off till tomorrow what you can do today” – A quote by Philip Stanhope.

The hardest part in investing is to get started. Most investors procrastinate and thus delay their investments. The delay is more if it is related to equity investing as the tendency is to wait for the right market conditions. The investors should note that by delaying they are actually loosing the opportunities that the different equity investments offer. By delaying, they also miss out the effect of power of compounding on their investments.

One of the best ways to start is to take the SIP route, if you are not sure about the markets. Not only this takes care of market volatility but also helps you invest in a disciplined manner and accumulate a substantial amount over a long period of time. The other benefit you get is ‘power of compounding’. With simple interest, you can only earn interest on the principal but in case of mutual fund equity investments you can earn interest on the principal and additionally on the interest due to power of compounding. Therefore, instead of waiting for the right time, start investing right away.

Do not equate low NAV with cheap NAV

This is one of the common and most talked about mistakes in mutual fund investing. Many investors feel that schemes having low NAV are cheap as they equate NAV of mutual funds with the market price of shares. The NAV of a mutual fund scheme is calculated by dividing the net value of the scheme’s total assets by the number of its outstanding units.

Let us understand this through an example – Investor Ramesh holds two mutual fund schemes with identical portfolios - A and B. Assume that the schemes have same amount of assets under management (AUM) of say Rs.100 crore each. Again assume that A has 2.00 crore units while B has 1.00 crore units. In this case, Scheme A’s NAV will be र 50 (i.e., र 100 crore/2.00 crore = 50) while scheme B’s NAV will be र 100 (i.e., र 100 crore / 1.00 crore = 100). Now, assuming that scheme A is cheaper than scheme B, it is totally wrong. In this case, the lower NAV of scheme A is because it has more number of units and not due to the scheme’s performance.

Therefore, NAV of a scheme should not be the criteria to compare or select mutual funds. There are other criteria of selecting or comparing mutual funds, like – Expense ratio, Fund Managers ability to deliver returns, past performance, rolling return of the scheme and the schemes ability to beat the benchmark etc. are some of them.

Do not give too much importance to short term performance

Investors pay too much attention to schemes which perform well in short time and there is a tendency to invest more and frequently in these schemes. The point to note here is that when you are investing in equity mutual funds you are actually investing in a basket of shares or stocks which has been selected by the fund manager based on the objective and nature of the scheme.

In a diversified equity mutual fund, the fund manager may invest in stocks of different sectors like, pharma, FMCG, banking, technology, construction etc. Whereas for a sectoral fund like technology, the fund manager will predominantly invest in technology or IT stocks. In this case the fund performance of technology sector will be better when the technology stocks outperform and suffer when the sector underperforms. Similarly, during the bull market period, mid and small cap funds may beat the returns of large cap or diversified equity funds but that does not mean that one should invest entire money in these funds.

To get a decent long term return from mutual funds one should always look at the long term performance of the schemes. A good long term performance of a scheme ensures that the scheme has gone through different market cycles and yet delivered decent returns.

Therefore instead of chasing short term returns, stay calm and remain invested in schemes with long term track record of consistent performance.

Conclusion

As mentioned yesterday, the two part series of the article was based on our real experience of interacting with investors. We tried explaining some common myths and mistakes such as, how to benefit by investing through SIPs and not to close them during volatile times, why one should not avoid asset allocation, why setting goal is the integral part of equity investing, how instead of chasing returns one should remain invested with schemes with long term track record of performance etc. to name a few. At Advisorkhoj, we think, that since equity oriented investing is for the long haul you must have a financial advisor who can be with you throughout the journey of your investing period. A good financial advisor not only stops you from committing mistakes, he guides you in your wealth creation journey while taking care of your investments.

RECOMMENDED READS

LATEST ARTICLES

- Investor Rights in Mutual Funds

- Responsibilities of Regulators and Key Constituents of the Mutual Fund Industry

- ABSL Balanced Advantage Fund: A proven all seasons fund for growth and stability

- ABSL SIP for Life: Plan to build and enjoy your wealth

- Aditya Birla Sun Life Flexi Cap Fund: Legendary track record of wealth creation

Follow Birla Sun Life MF

More About ABSL MF

POST A QUERY