Why Axis Nifty 500 Index Fund can be a suitable long-term investment in current market?

Axis MF has launched a New Fund Offer called the Axis Nifty 500 Index Fund. The NFO opened for subscription on 26th June 2024 and will close on 09th July 2024. Index funds have become very popular with retail investors over the last few years. Index funds have gained popularity among retail investors in recent years, with total assets under management in index funds exceeding Rs 2.2 lakh crores (as of May 31, 2024, according to AMFI). Though there are more than 120 index funds tracking various equity indices, there are very few index funds which track the Nifty 500. The Nifty 500 is a true broad market index, covering 93% of the total market capitalization of all the companies listed on the NSE. Axis Nifty 500 Index provides investors with a broad and comprehensive exposure to Indian equities.

About Nifty 500 Index

Nifty 500 is the index top 500 companies by market capitalization listed on the National Stock Exchange. It covers all three market capitalization segments: -

- Large Cap: Top 100 companies by market cap. These companies are established conglomerates with large balance sheets and market share leadership. They provide stability and are usually pay dividends to shareholders / investors

- Mid Cap: 101st to 250th companies by market cap. These companies have growing businesses, with potential of growing their product range and geographical expansion. Today’s midcaps can be large caps in the future.

- Small Cap: 251st and smaller companies by market cap. These are usually young companies with high growth potential. Companies in this stage are usually scaling up their business, which can result in significantly higher revenue and earnings growth over long investment horizons compared to large cap and midcap stocks.

Why invest in index funds?

Index funds are passive schemes which simply track a market benchmark index. They invest in a portfolio of securities that replicate the benchmark index. The weight of each security in the fund is the same as weight of security in the index. Index funds do not aim to beat the index. Their aim is to minimize tracking errors i.e. difference between fund and index returns.

- Low cost compared to actively managed funds. Low cost can be a significant advantage in the long term relative to actively managed funds, if the active funds are unable to create alphas

- No unsystematic risks. Actively managed funds have overweight or underweight on certain stocks or sectors to beat the benchmark index. This results in unsystematic risk. Since index funds simply track the index, there are no unsystematic risks in index funds.

- No fund manager bias. In index funds, unlike active funds, there is no active selections of stocks. This makes index funds relatively free of human biases or judgement.

- Suitable for both experienced and new investors

Why invest in Axis Nifty 500 Index Fund?

- India currently is in a very favourable macroeconomic position. The International Monetary Fund (IMF) predicts India’s GDP to grow by 6.8% in FY 2025, positioning it as the fastest-growing G-20 economy. Additionally, the IMF forecasts that India will become the third-largest economy by 2028.

- Interest rates have peaked and the market is expecting US Federal Reserve to cut interest rates in the next few months. Fed rate cuts will be positive for global risk sentiments and for equities as an asset class.

- India’s fiscal deficit is estimated to be 5.8% in FY 2023-24, with a projected reduction to 5.1% in FY 2024-25. The government aims to achieve the long-term target of a 4.5% fiscal deficit as a percentage of GDP by FY 2025-26. Narrowing fiscal deficit and cooling inflation will lead to favourable interest rate scenario in India.

- Healthy corporate earnings growth, lower financial leverage (debt to equity ratios), political stability / policy continuity and long term impact of Government’s reforms can set the stage for secular long term growth for Indian equities. Nifty 500 with companies across market cap segments is well positioned to benefit from the long term India growth story.

- Valuations are expensive in certain pockets of the market but reasonable in some segments. A broad market exposure will mitigate risks of high valuations.

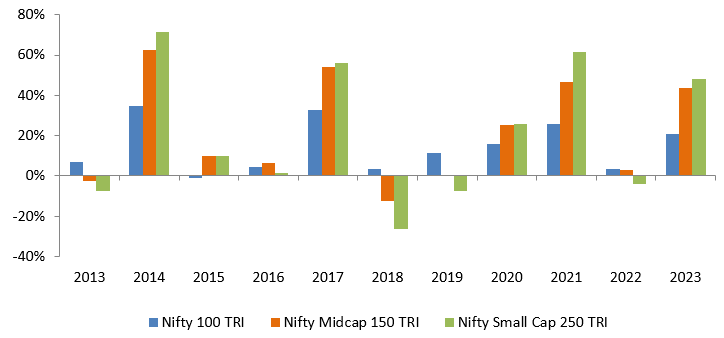

- Winners rotate across market cap segments. The Nifty 500 Index covers all segments, providing stability to your investment portfolio.

Source: NSE, as on 31st December 2023. Disclaimer: Past performance may or may not be sustained in the future

- Nifty 500 Index provides much wider industry coverage compared to popular indices like Nifty and Sensex. It covers 21 industry sectors, out which only 13 sectors are represented in Nifty 50.

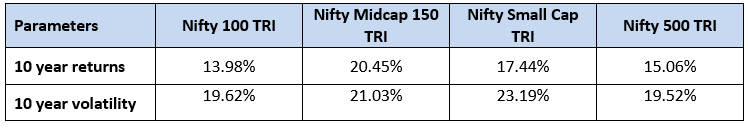

- Nifty 500 Total Returns Index has outperformed Nifty 100 TRI and at the same time, had less volatility. In other words, Nifty 500 has the potential of offering relatively superior risk return trade off compared to large caps, at the same time more stability compared to midcaps and small caps.

Source: NSE, as on 31st May 2024. All indices are TRI. 3-year returns are in CAGR. Disclaimer: Past performance may or may not be sustained in the future

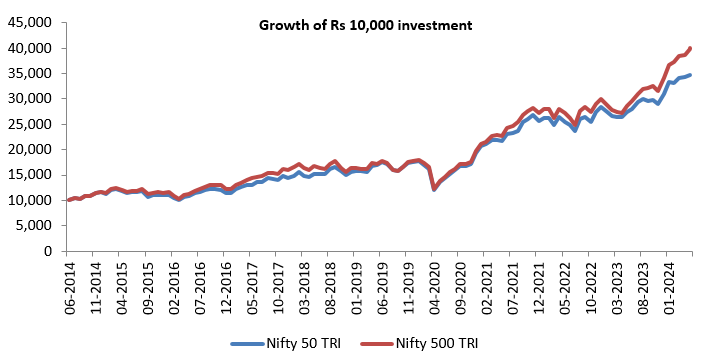

- Nifty 500 has outperformed Nifty 50 in terms of long-term wealth creation (see the chart below). This is not surprising because Nifty 500 includes midcap and small cap stocks, which historically have outperformed large caps over investment horizons

Source: NSE, Advisorkhoj Research, as on 31st May 2024. Disclaimer: Past performance may or may not be sustained in the future

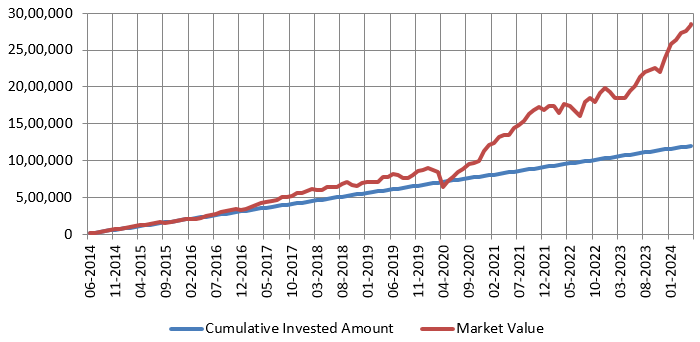

- You can invest in Axis Nifty 500 Index Funds systematically from your regular savings through SIP. The chart below shows the growth of Rs 10,000 monthly SIP in Nifty 500 Index over the last 10 years (as on 31st May 2024)

Source: NSE, Advisorkhoj Research, as on 31st May 2024. Disclaimer: Past performance may or may not be sustained in the future

Who should invest in Axis Nifty 500 Index Fund?

- Investors looking for capital appreciation over long investment horizon

- Investors with high risk appetites

- Investors with minimum 3 – 5 years investment tenures

- This fund is suitable for both first time and seasoned investors

- You can invest in this fund either in lump sum or SIP depending on your investment needs and financial situation

Investors should consult their financial advisors or mutual fund distributors if Axis Nifty 500 Index Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Axis Mutual Fund launched its first scheme in October 2009 Since then Axis Mutual fund has grown strongly. We attribute our success thus far to our 3 founding principles - Long term wealth creation, Outside in (Customer) view and Long term relationship. Come join our growing family of investors and give shape to your desires.

Quick Links

Other Links

Follow Axis MF

POST A QUERY