What is Nifty 500 index and why you should invest in it?

Over the last three years, the assets under management (AUM) of index funds multiplied by 10 times (source: AMFI, as on 31st May 2024). The number of index fund folios multiplied 7 times from 11.8 lakhs to 83.6 lakhs, showing increasing preference for index funds. Investors normally associate index funds with well known benchmarks such as Nifty or Sensex. AUM of large cap (mainly Nifty and Sensex) index funds account for more than 70% of the AUM of equity index funds (source: Advisorkhoj research, as on 31st May 2024). The Nifty 50 index comprises of just 50 stocks, on the other hand, the Nifty 500 index comprising of 500 stocks provides exposure to a wider universe of sectors and stocks beyond the top 50 companies. In this article we will discuss the Nifty 500 index.

Nifty 500

Nifty 500 Index represents the Top 500 listed companies by full market capitalization. The combined market capitalization of Nifty 500 stocks is 93% of all companies listed in the National Stock Exchange (Source: AMFI, 31st December 2023). The weights of the constituents in the Nifty 500 index is based on the free float market capitalization methodology. The index is rebalanced semi-annually. Nifty 500 spans across all three market capitalization segments:-

- Large cap: Top 100 companies by market capitalization, covering 74.5% of total market capitalization.

- Midcap: 101st to 250th companies by market cap, covering 16.6% of total market capitalization.

- Small cap: 251st and smaller companies by market cap, covering 8.9% of total market capitalization.

Why invest in Nifty 500?

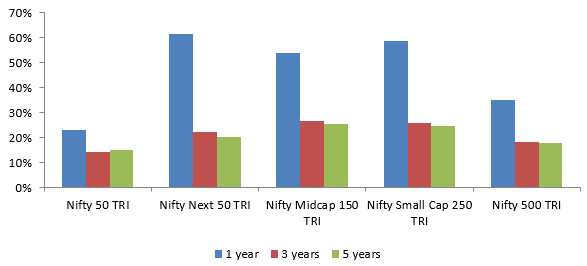

- Potential to outperform Nifty: According to the historical data, the broader market has the potential to outperform the Nifty 50 index (see the chart below).

Source: NSE, as on 31st May 2024. All indices are TRI. 3 and 5 year returns are in CAGR. Disclaimer: Past performance may or may not be sustained in the future

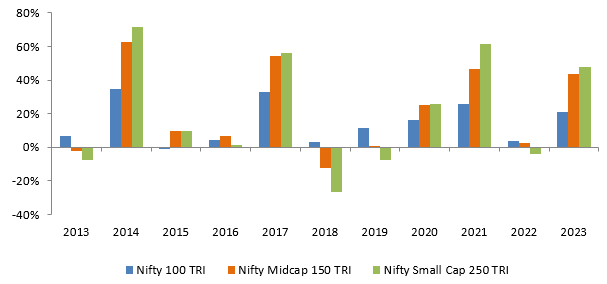

- Better diversification: Winners rotate across different market cap segments. Since Nifty 500 includes all three market cap segments, it will provide more diversification to your portfolio and potential to outperform across market cycles.

Source: NSE, as on 31st May 2024. All indices are TRI. 3 year returns are in CAGR. Disclaimer: Past performance may or may not be sustained in the future

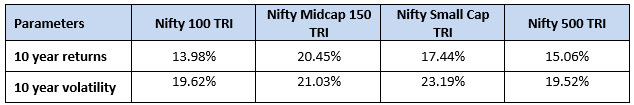

- Superior risk / return trade-off: Nifty 500 Total Returns Index has outperformed Nifty 100 TRI and at the same time, had less volatility. In other words, Nifty 500 has the potential of offering relatively superior risk return trade off compared to large caps, at the same time more stability compared to midcaps and small caps.

Source: NSE, as on 31st May 2024. All indices are TRI. 3 year returns are in CAGR. Disclaimer: Past performance may or may not be sustained in the future

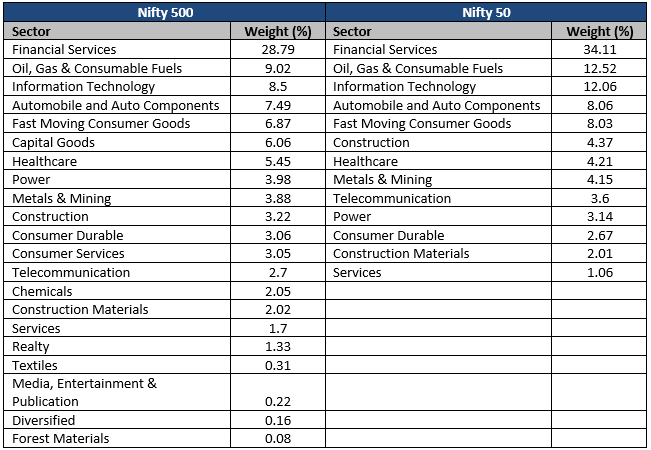

- Exposure to more sectors: Nifty 500 provides exposure to many more sectors compared to Nifty 50 index. You can not only benefit from more sector diversification, these sectors have strong market growth potential and are likely to play an important role in India Growth Story. These sectors can benefit from Government’s policy initiatives like Make in India, Production Linked Incentive Schemes (PLIs), infrastructure spending, shift from unorganized sectors to organized sectors etc.

Source: NSE, Index Factsheets, as on 31st May 2024.

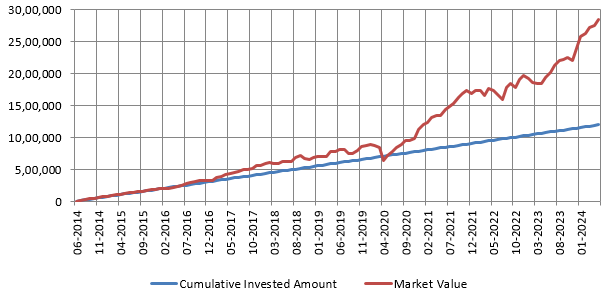

- Wealth creation potential through SIP: The chart below shows the growth of Rs 10,000 monthly SIP in Nifty 500 TRI over the last 10 years. The XIRR returns is 16.52%.

Source: NSE, Advisorkhoj Research, as on 31st May 2024.

Why invest in Nifty 500 Index?

Summary

According to IMF’s projections India, will be the fastest growing G-20 economy in 2025. IMF is forecasting India to become the third largest economy in the world after United States and China by 2027. With narrowing fiscal deficit and favourable interest regime (rate cuts) on the horizon, the outlook for Indian equities is positive. Nifty 500 covering 93% of the total market capitalization of the listed universe offers a far better representation of India equities compared to Nifty 50 or Sensex. Currently there are only 5 passive funds that track Nifty 500 index. We hope to see more index funds / ETFs tracking this index. Investors should consult with their financial advisors or mutual fund distributors if they want to know about passive mutual fund schemes tracking Nifty 500.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Axis Mutual Fund launched its first scheme in October 2009 Since then Axis Mutual fund has grown strongly. We attribute our success thus far to our 3 founding principles - Long term wealth creation, Outside in (Customer) view and Long term relationship. Come join our growing family of investors and give shape to your desires.

Quick Links

Other Links

Follow Axis MF

POST A QUERY