AXIS Multicap Fund: Off to a great start

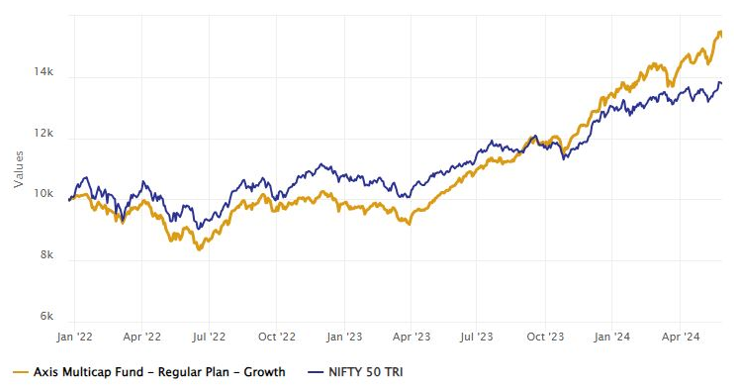

The Axis Multi Cap Fund was launched in December 2021 and has given 19%+ CAGR returns since inception (as on 28th May 2024). Multicap Funds are equity funds with a diversified portfolio holding stocks across market capitalization. In its circular dated 11th September 2020, SEBI had mandated that Multi Cap Funds should hold at least 25% of their assets in the stocks of each of the three market caps — Large Cap, Small Cap and Mid cap. A lumpsum of Rs 1 lakh invested at the inception of the fund would have grown to nearly Rs 1.53 lakhs as on 28th May 2024 creating alphas for investors. The Fund is managed by Mr. Nitin Arora, Mr. Shreyas Dewalkar, Mr. Hitesh Das, and Mr. Sachin Jain.

Source: Advisorkhoj Research

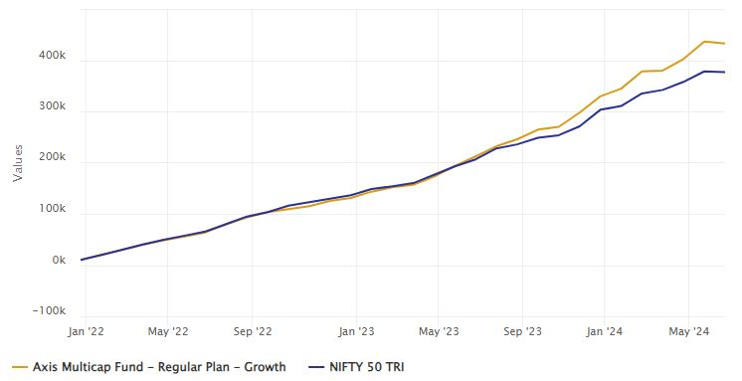

SIP Returns

A monthly SIP of Rs 10,000/- started at inception of the Axis Multi Cap Fund (Regular Growth) would have grown to Rs 4.32 lakhs with a cumulative investment of Rs 2.9 lakhs only (see the chart below). The SIP XIRR returns since inception of the fund is 32.63%.

Source: Advisorkhoj Research as on 28th May 2025

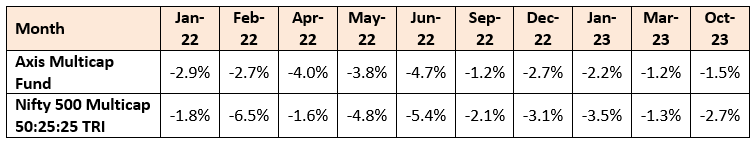

Restricted downside risks in down market

In the table below we are showing the returns of Axis Multicap Fund versus its benchmark index, Nifty 500 Multicap 50:25:25 TRI in the down market months (months in which the market fell).

Source: Advisorkhoj Research

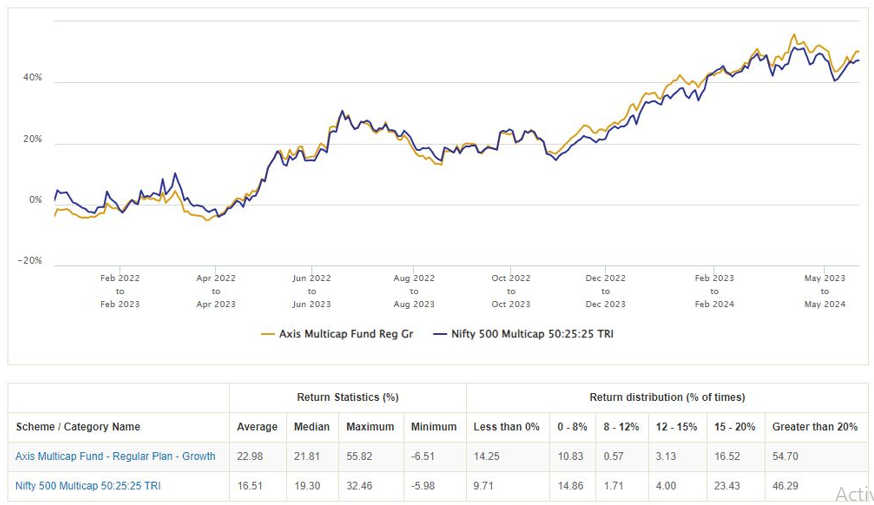

Strong performance consistency

The chart below shows the 1 year rolling returns of Axis Multicap Fund versus its benchmark index, Nifty 500 Multicap 50:25:25 TRI, since the scheme’s inception. You can see in the chart below that Axis Multicap Fund was able to consistently outperform the benchmark and deliver higher average rolling returns compared to the benchmark index across different market conditions.

Source: Advisorkhoj Rolling Returns

Market Capture Ratios - Superior risk adjusted returns in last 1 year

Market capture ratios are good indicators of risk / return trade-offs of a mutual fund scheme relative to the market benchmark index. Market capture ratio is a measure of the performance of a mutual fund scheme relative to its benchmark index in rising and falling markets. Up Market Capture Ratio tells us how much percentage of the market’s upside was captured by the fund when the market was rising, while Down Market Capture Ratio tells us how much percentage of the market’s downside was arrested by the fund when the market was falling. We looked at the market capture ratios of Axis Multicap Fund over the last 1 year.

The Up Market Capture Ratio of Axis Multicap Fund over last 1 years was 96% which implies that if the benchmark index went up by 1% in a month, then the fund’s NAV went up by 0.96% (capturing the almost entire market upside). The Down Market Capture Ratio of the fund was 41% which implies that if the benchmark index went down by 1% in a month, then the fund’s NAV went down by only 0.41%.

Historical market capture ratios data of mutual fund schemes and their long term returns provides evidence that a fund which is able to limit downside risks more in corrections and at the same captures a large part of the market’s upside in bull markets are able to generate superior returns across multiple investment cycles covering both bull market and bear market. The market capture ratios of Axis Multicap Fund are a clear indication of the potential of the fund to give superior risk adjusted returns of the fund.

Investment Strategy of the Axis Multicap Fund

The scheme invests in equity and equity related securities across market capitalization using a bottom-up stock selection process, focusing on appreciation potential of individual stocks from a fundamental perspective. The objective of the scheme is to invest in equity and related securities with a view to earn long term capital appreciation. The fund managers invest in a mix of companies having the mature growth of large cap, the stable growth of low debt companies & Mid & small cap high growth niche businesses to approach markets using a Multicap strategy.

The Axis Multi Cap fund utilizes larger, more diversified portfolios to deliver alpha. The Fund diversified their portfolios from concentrated holdings to a broader number in the last one year, which has led to a wider exposure across sectors. The fund will aspire to capture potential opportunities throughout the lifecycle of the company’s progression from small cap all the way to large cap. Through this approach the fund will aim to achieve a quality focused long-term portfolio with an improved risk reward profile and controlling fund volatility typically faced during fund rebalancing.

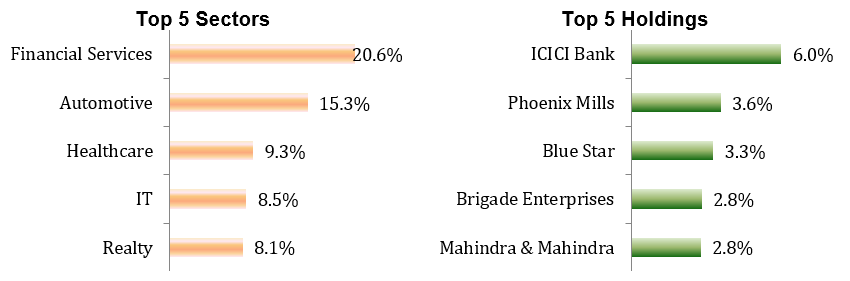

Current Portfolio Positioning

Source: Axis MF Factsheet as on 30th April 2024

Why invest in Multi Cap funds?

- Diversification: Since Multi Cap Funds hold stocks from all the market capitalization, it helps the investors in getting an exposure to the different sizes of companies and reap the growth potential from each segment.

- Winners rotate across market cap segments: A diversified portfolio of Large, Mid and Small cap stocks may reduce downside risks and give you superior returns in the long-term investment horizon.

- Winners rotate across sectors: Like market cap segments, winners also keep rotating across industry sectors. Some sectors may outperform in some quarters or years, and others may outperform in other quarters or years. Multi Cap funds diversify across industry sectors and can change sector allocations based on a top down or bottoms up approach depending on the strategy of the fund manager.

Who should invest in the Axis Multi Cap Fund?

- Investors looking for capital appreciation over long-term investment horizon

- Investors who are looking for a one-stop solution with disciplined exposure to Large Caps, Mid-Caps and Small Caps as a part of their asset allocation

- Investors with high to very high-risk appetites

- Investors with minimum 5 years investment tenures

Investors should consult with their mutual fund distributors or financial advisors if Axis Multi Cap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Axis Mutual Fund launched its first scheme in October 2009 Since then Axis Mutual fund has grown strongly. We attribute our success thus far to our 3 founding principles - Long term wealth creation, Outside in (Customer) view and Long term relationship. Come join our growing family of investors and give shape to your desires.

Quick Links

Other Links

Follow Axis MF

POST A QUERY