Axis Midcap Fund: Track record of wealth creation

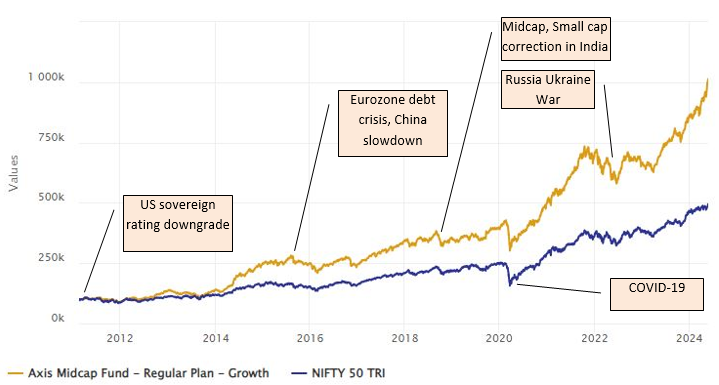

Axis Midcap Fund has been over the years, one of the most popular midcap schemes especially with retail investors. As on 30th April 2024, Axis Midcap Fund is among the top 5 midcap funds in terms of assets under management (AUM). The fund has recently reached the important landmark of its Net Asset Value (NAV) crossing Rs 100. If you had invested Rs 100,000 in the scheme at its inception, your investment would have multiplied to more than Rs 10 lakhs by 24th May 2024 (Source: Advisorkhoj Research). The stock market has had to face at least 5 major corrections since the launch of the scheme. The long term wealth creation track record of Axis Midcap Fund despite these corrections is testimony of India Growth Story and the alpha creation skills of the fund manager.

Source: Advisorkhoj Research, as on 24th May 2024. Disclaimer: Past Performance may or may not be sustained in the future

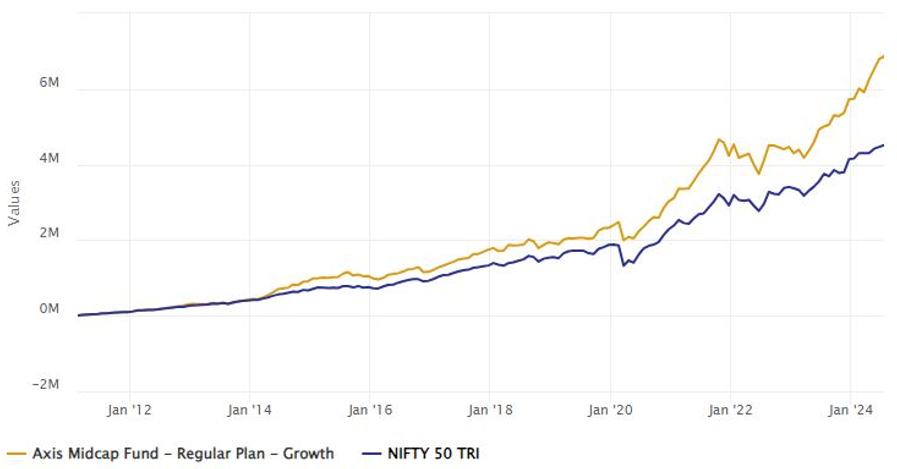

Wealth creation through SIP

The chart below shows the returns of Rs 10,000 monthly SIP in the scheme since inception. With a cumulative investment amount of Rs 16 lakhs through monthly SIPs you could have accumulated a corpus of nearly Rs 69 lakhs by 24th May 2024. The annualized SIP returns (XIRR) since inception of the scheme is 20.13%.

Source: Advisorkhoj Research, as on 24th May 2024. Disclaimer: Past Performance may or may not be sustained in the future

Rolling Returns

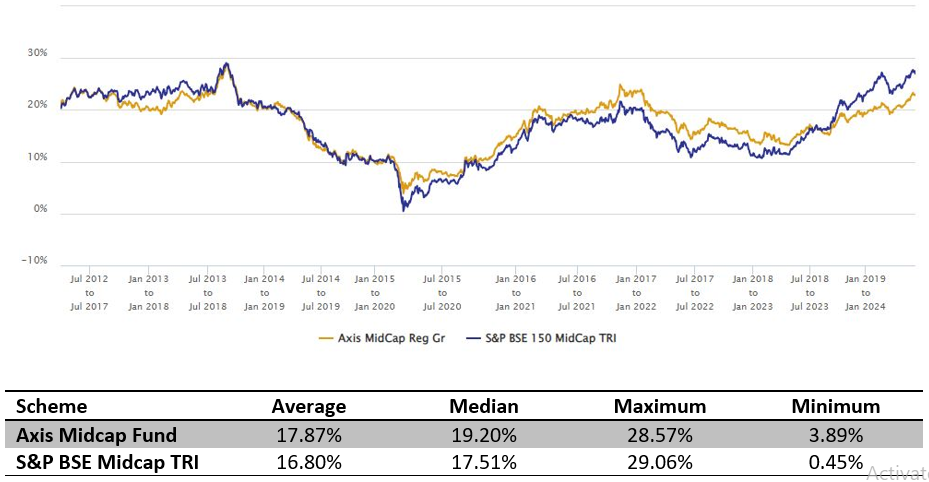

The chart below shows the 5 year rolling returns of Axis Midcap Fund versus its benchmark index, S&P BSE Midcap TRI, since the scheme’s inception. We are showing 5 year rolling returns because in our view, investors should have minimum 5 year investment horizon while investing in equity funds. Even though quality midcaps have the potential to outperform large caps in the long term, they are more volatile than large caps in the short term. Therefore, investors should always have long investment horizons for midcap funds. You can see in the chart below that over the 5 year investment tenures since inception, across different market conditions Axis Midcap Fund was able to consistently outperform the benchmark and deliver higher average rolling returns.

Source: Advisorkhoj Rolling Returns, as on 30th April 2024. Disclaimer: Past Performance may or may not be sustained in the future

The chart below shows the percentage of instances of 5 year rolling returns of Axis Midcap Fund over certain return levels. Over 5 year investment tenures in the past, Axis Midcap Fund has never given negative returns. Extrapolating historical rolling returns, the wealth creation potential of the fund is very attractive since it has delivered more than 12% CAGR returns over 5 year tenures in 85% instances and more than 15% CAGR returns in 53% of instances since inception.

Source: Advisorkhoj Research. Disclaimer: Past Performance may or may not be sustained in the future

Lower downside risk

The table below shows the biggest market corrections since the inception of Axis Midcap Fund. You can see that in almost big corrections Axis Midcap Fund had lesser drawdowns compared to the Midcap Index.

Source: Advisorkhoj Research. Disclaimer: Past Performance may or may not be sustained in the future

Market Capture Ratios - Superior risk adjusted returns

Market capture ratios are good indicators of risk / return trade-offs of a mutual fund scheme relative to the market benchmark index. Market capture ratio is a measure of the performance of a mutual fund scheme relative to its benchmark index in rising and falling markets. Up Market Capture Ratio tells us how much percentage of the market’s upside was captured by the fund when the market was rising, while Down Market Capture Ratio tells us how much percentage of the market’s downside was arrested by the fund when the market was falling. We looked at the market capture ratios of Axis Midcap Fund over the last 10 years.

The Up Market Capture Ratio of Axis Midcap Fund over last 10 years was 80% which implies that if the benchmark index went up by 1% in a month, then the fund’s NAV went up by 0.80%. The Down Market Capture Ratio of the fund was 75% which implies that if the benchmark index went down by 1% in a month, then the fund’s NAV went down by 0.75%. Historical market capture ratios data of mutual fund schemes and their long term returns provides evidence that a fund which is able to limit downside risks more in corrections and at the same captures a large part of the market’s upside in bull markets are able to generate superior returns across multiple investment cycles covering both bull market and bear market. The market capture ratios of Axis Midcap Fund are a clear indication of the potential of the fund to give superior risk adjusted returns of the fund.

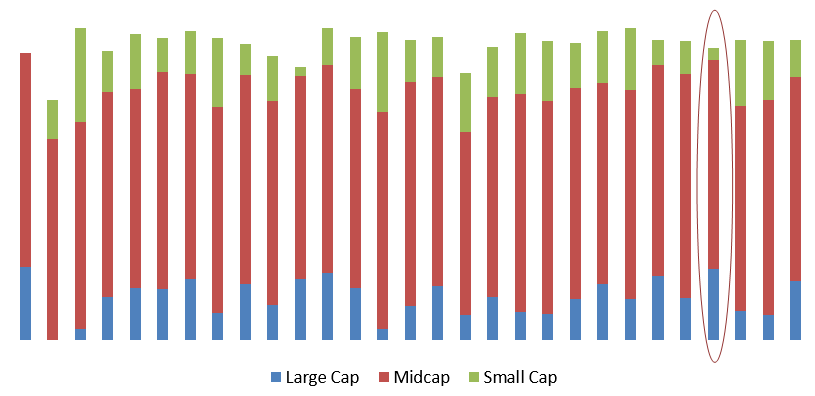

Higher large cap and lower small cap allocations compared to peers

As per SEBI’s mandate midcap funds need to invest at least 65% of their assets in companies ranked 101st to 250th (midcap companies) in terms of market capitalization. SEBI’s mandate leaves considerable room (up to 35%) for fund managers to invest in any market cap segment (large, mid or small) or in cash / cash equivalent as per their investment strategy and outlook. In the chart below we have shown the market cap allocations of all midcap funds with minimum Rs 500 crores AUM (as on 30th April 2024). You can see that the as an investment strategy Axis Midcap Fund (circled in red) has significantly higher large cap allocation and lower small cap allocation compared to its peers. Higher small cap / lower large cap allocations can boost the returns of a fund in bull markets but it also increases the risk, which will have the opposite effect in bear markets.

Source: Advisorkhoj Research. Disclaimer: Past Performance may or may not be sustained in the future

Investment strategy

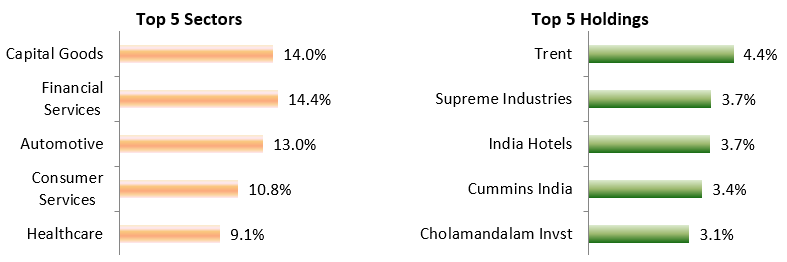

The fund manager of this scheme, Shreyash Devalkar, looks for innovative and entrepreneurial companies with experienced management. These companies can be market leaders in emerging industries or higher growth companies in established businesses. The fund manager looks for companies with economic moats. His preference is for high quality and growth stocks.

Source: Axis MF (As on 30th April 2024)

Conclusion

Axis Midcap Fund has a strong performance track record of 13 years. Though the scheme has underperformed in recent years relative to its peers, the fund follows a robust risk management strategy and not just chases returns. As we have said several times in our blog, recent performance of a fund can be misleading. We should see how a fund has performed over several market cycles. This scheme is suitable for your long term financial goals like children’s education, retirement planning and wealth creation. Though we usually recommend SIPs as the preferred way of investing in midcap funds, you can also take advantage of corrections to invest in lump sum on dips. Alternatively, a simpler approach can be to invest in this fund through a 3 – 6 month STP. You should have moderately high risk appetite for this scheme. You should consult with your financial advisor if Axis Midcap Fund is suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Axis Mutual Fund launched its first scheme in October 2009 Since then Axis Mutual fund has grown strongly. We attribute our success thus far to our 3 founding principles - Long term wealth creation, Outside in (Customer) view and Long term relationship. Come join our growing family of investors and give shape to your desires.

Quick Links

Other Links

Follow Axis MF

POST A QUERY