Axis US Treasury Dynamic Bond ETF FoF: Unique opportunity in this interest rate scenario

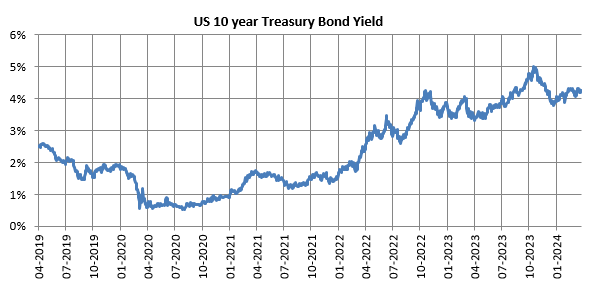

High interest rate regime

We have been in a global high interest regime for a fairly long period of time. The Reserve Bank of India began hiking repo rates in April 2022 when the rate was 4% and has held the repo rate at 6.5% for the last 1 year. The US Federal Reserve began hiking interest rates (Fed Funds Rate) in March 2022 from 0.25 – 0.5% level to 5.25 – 5.5% level by June 2023. Though the Fed did not hike interest rates since June, its continuing hawkish stance led to bond yields rising with the 10 year US Treasury Bond crossing 5% level in October 2023, a 16 year high.

Shift in Fed stance

In the December 2023 FOMC meeting the US Fed announced an end to rate hikes (prior to December, the Fed had kept the door open for future rate hikes). The Fed also indicated it will cut interest rates multiple times in 2023. The shift in Fed stance from hawkish to dovish led to bond yields coming off their highs. The 10 year bond yield has come down from 5% levels to around 4.2% as on 26th March 2024 (see the chart below). The current interest rate / yield scenario has created a unique investment opportunity to benefit from falling bond yields. The opportunity is indeed unique because even at current levels, the 10 year bond yield is still at 15 year high.

How can you benefit from this interest rate scenario? Axis MF launched the Axis US Treasury Dynamic Bond ETF FoF in December 2023, which invests in US Treasury ETFs across different maturities.

Source: Investing.com, as on 26th March 2024

What is the outlook on US bond yields?

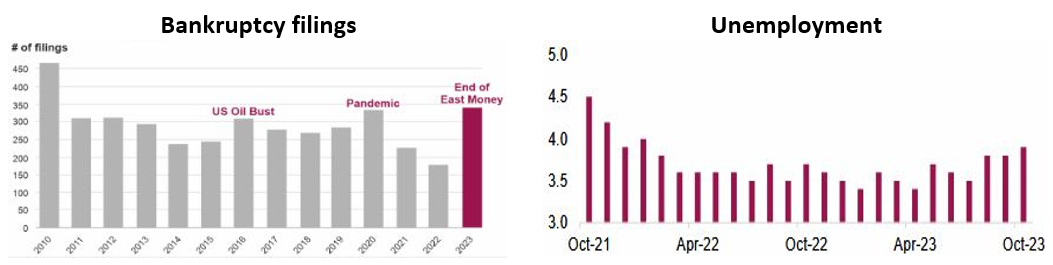

- Macros indicate that the US economy is slowing down. Bankruptcy filings and unemployment are slowly rising

Source: AXIS MF, Goldman Sachs, Data as of 15th November 2023.

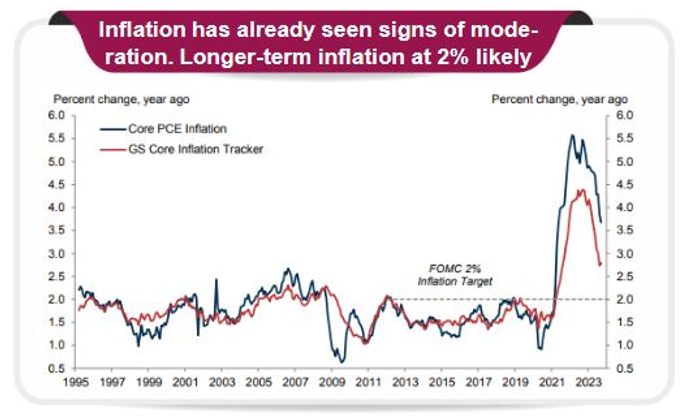

- Inflation is cooling down. The timing of rate cuts and number of rate cuts in 2024 hinges on inflation trajectory, but experts believe that the Fed will start to cut rates before Fed’s inflation target of 2% is reached.

Source: AXIS MF, Goldman Sachs, Data as of 15th November 2023.

- The fund manager expects US G-Sec curve is likely to normalize to 3% levels over the medium term. This implies 100 – 120 bps of capital appreciation opportunity in the medium term.

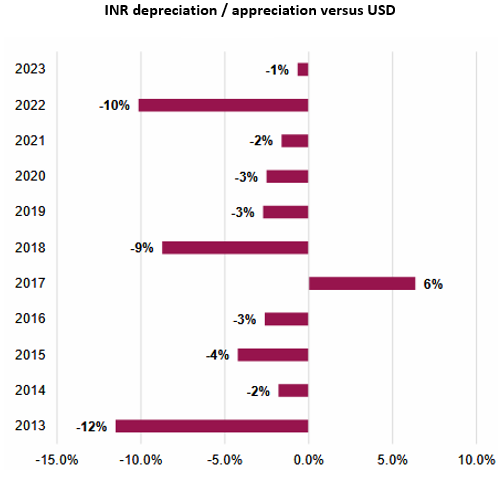

Benefit from INR depreciation – Passive Generator

A secondary, though not insignificant, benefit of international investing is that you can benefit from Rupee (INR) deprecation. Over the last 10 years, the INR has depreciated by around 3% per annum against the USD (see the chart below).

Source: AXIS MF, Bloomberg, Data as of 15th November 2023.

About Axis US Treasury Dynamic Bond ETF FoF

- An actively managed portfolio of ETFs capturing specific segments of the US treasury yield curve

- Portfolio duration will be managed dynamically based on macro assessments with an endeavour to blend capital appreciation and ‘carry’ opportunities

- The fund of fund may add additional ETFs as needed to fine-tune the overall investment direction of the fund depending on market conditions

- Maturity cap of the fund – up to 15 Years

Source: AXIS MF, as on 31st October 2023.

Why dynamic bond (allocation) strategy is warranted across interest rate cycles?

- Divergence in performances of different debt asset types is observed during market conditions (interest rate environments)

- Actively managed strategies pivot allocations with the intention to maximize the risk-return profile for investors

- Axis US Treasury Dynamic Bond ETF Fund of Fund endeavours to allocate across strategies depending on the prevailing market environment. Current market conditions warrant allocation to duration assets

Summing up – Why invest in Axis US Treasury Dynamic Bond ETF FoF

- US Treasury bond yields are at still at decadal highs. With rate cuts in the horizon, there is significant capital appreciation potential in the benefit.

- Active duration management to maximize benefits from risk / return trade-offs for investors

- You can benefit from INR depreciation

- The fund of fund structure enables you invest in international securities without the restrictions of RBI’s Liberalised Remittance Scheme (LRS).

Please note that the scheme is temporarily closing for subscription from 1st April 2024.

Investors should consult their financial advisors or mutual fund distributors if Axis US Treasury Dynamic Bond ETF FoF is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Axis Mutual Fund launched its first scheme in October 2009 Since then Axis Mutual fund has grown strongly. We attribute our success thus far to our 3 founding principles - Long term wealth creation, Outside in (Customer) view and Long term relationship. Come join our growing family of investors and give shape to your desires.

Quick Links

Other Links

Follow Axis MF

POST A QUERY