Should you invest in Axis India Manufacturing Fund NFO

Axis Mutual Fund is launching a New Funds Offer, Axis India Manufacturing Fund. Axis India Manufacturing Fund is an open ended thematic equity mutual fund scheme. The fund will invest in companies from industry sectors that are part of India’s manufacturing theme. The NFO will open for subscription on 1st December 2023 and will close on 15th December 2023. In this article, we will review this NFO.

Importance of manufacturing in economic development

Since the dawn of industrial revolution from late 1700s / early 1800s, growth of manufacturing industries has played a key role in the economic prosperity of nations. Manufacturing is one of the leading drivers of employment growth and reduces income inequality in a country. According to McKinsey (2020), manufacturing plays an important role in the global competitiveness of an economy.

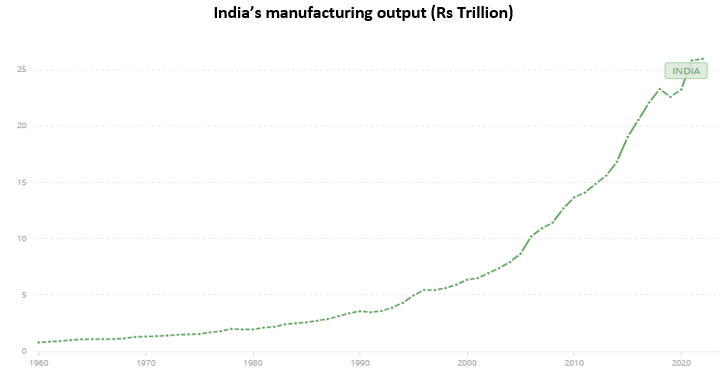

Growth of manufacturing sectors in India

India has made great strides in manufacturing since our economy was liberalized in 1991. From 1961 to 1991, our manufacturing output grew from Rs 0.85 Trillion to Rs 3.5 Trillion (3X growth); from 1991 to 2022 our manufacturing output grew from Rs 3.5 Trillion to Rs 26 Trillion (nearly 8X growth).

Source: World Bank

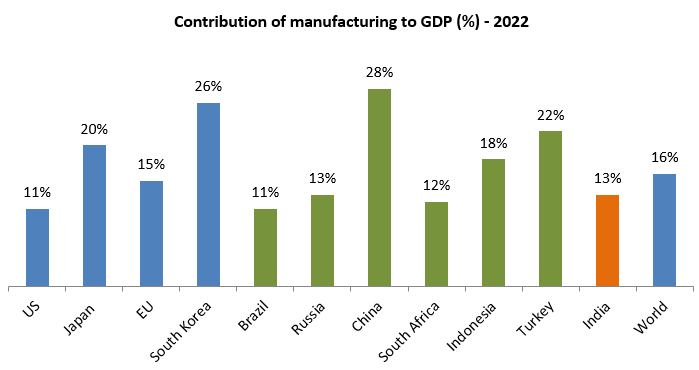

Growth potential of manufacturing in India’s journey to $5 Trillion GDP

There is a huge growth potential for manufacturing industries in India, if we compare the contribution of manufacturing to our GDP with developed and emerging economies. Manufacturing will play a key role in Government’s roadmap of making India a $5 Trillion economy. As per RBI’s forecast, India will be $5 Trillion economy and third largest in the world by 2027. Accordingly, we are likely to see significant growth in India’s manufacturing industries over the next 5 – 6 years.

Source: World Bank

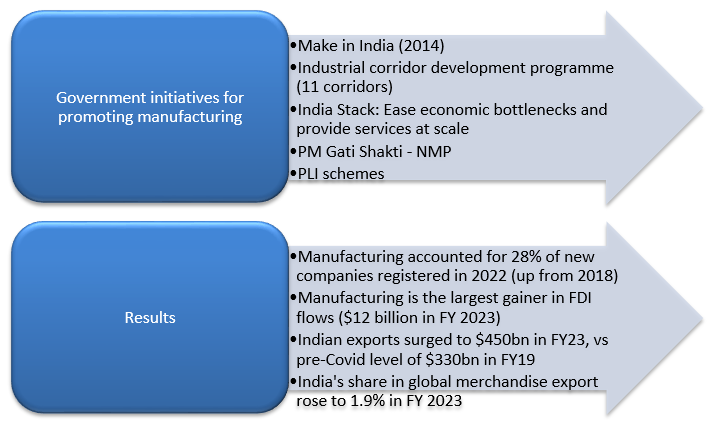

Government policies have started yielding results

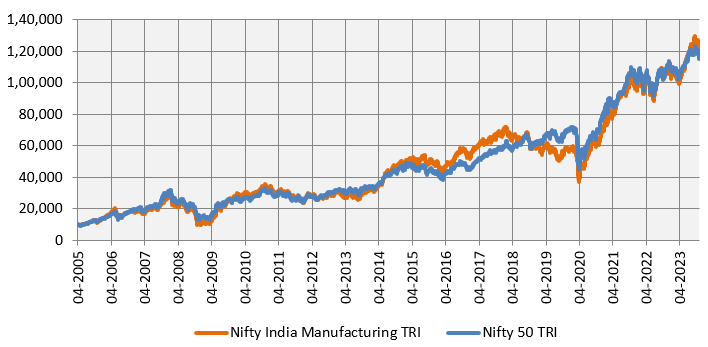

Manufacturing as an investment theme has outperformed the market

The chart below shows the growth of Rs 10,000 investment in Nifty India Manufacturing TRI versus Nifty 50 TRI, since the inception of the Manufacturing Index. Manufacturing as a theme has outperformed the market.

Source: National Stock Exchange, as on 31st October 2023. Disclaimer: The chart above is purely for investor education purposes and should not be construed as investment recommendation. Past performance may or may not be sustained in the future.

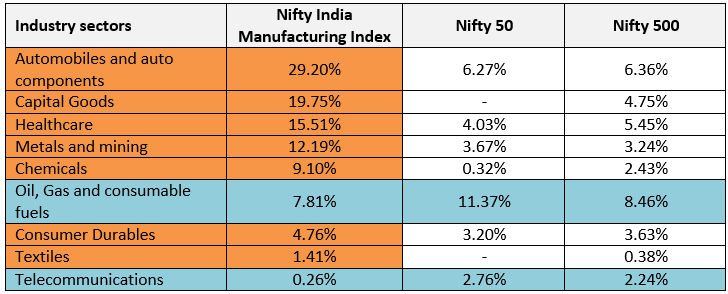

Why invest in Axis India Manufacturing Fund versus diversified fund?

Industry sectors in the manufacturing theme (Nifty India Manufacturing Index) are underrepresented in the broad market indices e.g. Nifty 50, Nifty 500 etc. These sectors are likely to play an integral role in the India Growth Story. A dedicated allocation to high growth stories in the manufacturing space could be taken via a dedicated thematic fund like Axis India Manufacturing Fund.

Source: National Stock Exchange, as on 31st October 2023. Disclaimer: The chart above is purely for investor education purposes and should not be construed as investment recommendation

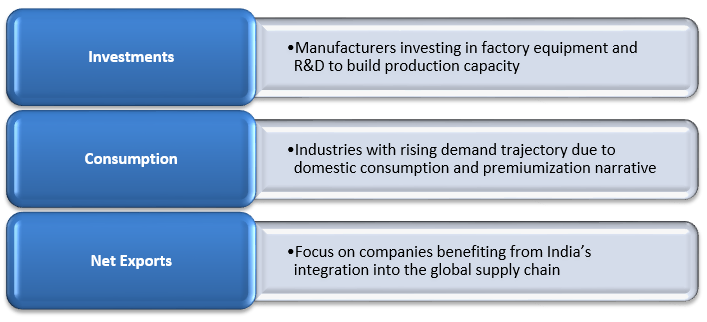

Axis India Manufacturing Fund – Investment Strategy

Why invest in Axis India Manufacturing Fund?

- India is the largest aspirational population in the world.

- Rising per capita income will lead to higher discretionary spending and increasing premiumisation

- Large middle class, demands internationally competitive goods

- Unlike other manufacturing centres e.g. China, Indian economy is heavily dependent on consumption

- India’s domestic demand also makes Indian manufacturing less cyclical to global economic vagaries

- Multi-polar world, global supply chain shifts e.g. China + 1 and India’s growing geopolitical clout has the potential to make India a global manufacturing hub

- Domestic demand and exports makes manufacturing in India viable

- Manufacturing as an investment theme has outperformed the broad market

- A dedicated allocation to manufacturing thematic fund can create alpha in your portfolio

- Axis MF as an asset management company has a strong long term track record of performance across many equity sub-categories

Who should invest in Axis India Manufacturing Fund?

- Investors willing to have Tactical Allocation to overall equity portfolio

- Investors looking for capital appreciation over long investment tenures from manufacturing theme

- Investors who have very high risk appetites

- Investors with minimum 5 year investment tenures

- You can invest either in lump sum and SIP depending on your investment needs.

Investors should consult with their financial advisors or mutual fund distributors if Axis India Manufacturing Fund is suitable for their investment needs

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Axis Mutual Fund launched its first scheme in October 2009 Since then Axis Mutual fund has grown strongly. We attribute our success thus far to our 3 founding principles - Long term wealth creation, Outside in (Customer) view and Long term relationship. Come join our growing family of investors and give shape to your desires.

Quick Links

Other Links

Follow Axis MF

POST A QUERY