How Thematic funds can capture India Growth Story

What are thematic funds?

Thematic funds are equity mutual fund schemes which invest in some ideas or strategy. These schemes try to identify specific macro-trends in the economy and invest in sectors which can benefit from these macro-trends. Examples of investment themes are manufacturing, consumption, healthcare etc. Unlike a sectoral fund, which invests in a specific industry sector, thematic funds invest in multiple sectors. As such thematic funds are much more diversified than sector funds.

Role of thematic funds in portfolio

Investment experts recommend that your core equity portfolio should be made up of diversified equity mutual funds. To supplement your core portfolio, you can have a satellite portfolio which can comprise of thematic funds, since some investment themes have the potential to grow faster and outperform the broad market over sufficiently long investment horizons. In this article, we will discuss two themes which will be central to the India Growth Story – Consumption and Manufacturing. These two themes are closely interrelated because domestic consumption is the one most important demand drivers of manufacturing.

Private consumption expenditure growth in India

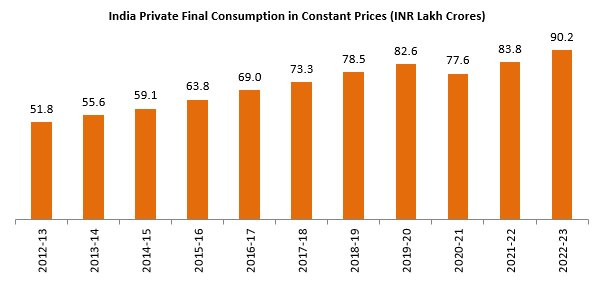

In the last 10 years, India’s private consumption expenditure grew at a compounded annual growth rate (CAGR) of 5.7% (see the chart below), which is higher than the long term historical average. It is noteworthy that India has been able to maintain a high growth rate of consumption expenditure for the last 10 years despite crossing the $ 1 Trillion GDP mark more than 15 years back.

Source: Private Consumption Expenditure at Constant Prices (2011-12 series), Economic Survey (2023), Ministry of Finance, Government of India. Disclaimer: The chart above is for investor education purpose only and should not be used for any other purpose.

Drivers of consumption growth

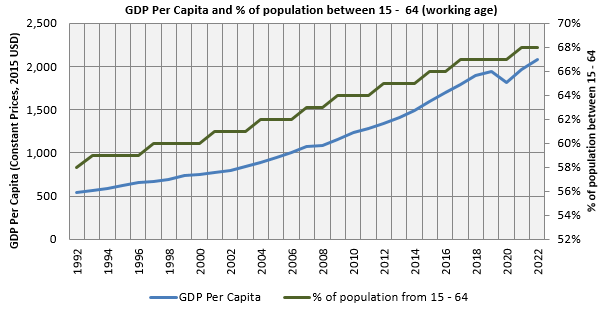

As per National Family Health Survey 2021, 88% of the population is below the age of 60 and more than 65% of the population is in the working age group (see the chart below). Favourable demography is driving economic growth. India’s per capita GDP at constant prices (2015 USD) grew from sub $1,000 levels in the mid 90s to nearly a $2,400 (in 2022-23) (see the chart below). Per capita income of up to $2,000 is mostly spent on basic needs; as it keeps growing above $2,000 discretionary spending rises.

Source: World Bank (1992 – 2022). Disclaimer: The chart above is for investor education purpose only and should not be used for any other purpose.

Apart for demographics and per capita income, growing urbanization, shift to nuclear families, digital penetrations etc are also key factors that will drive consumption growth in India.

Consumption as an investment theme has outperformed the broad market

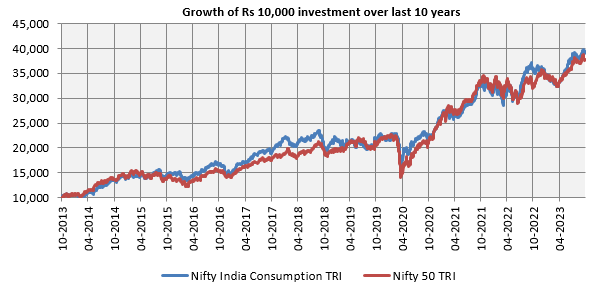

The chart below shows the growth of Rs 10,000 investment in Nifty India Consumption TRI versus the Nifty 50 TRI over the last 10 years. In the last 10 years Nifty India Consumption TRI generated 13.6% CAGR returns, 50 bps higher CAGR returns than Nifty 50 TRI. You can that the consumption index had experienced smaller drawdown compared to Nifty.

Source: National Stock Exchange, as on 31.10.2023. Disclaimer: Past performance may or may not be sustained in the future

Importance of manufacturing in economic development

Since the dawn of industrial revolution from late 1700s / early 1800s, growth of manufacturing industries has played a key role in the economic prosperity of nations. Manufacturing is one of the leading drivers of employment growth and reduces income inequality in a country. According to McKinsey (2020), manufacturing plays an important role in the global competitiveness of an economy.

Growth of manufacturing sectors in India

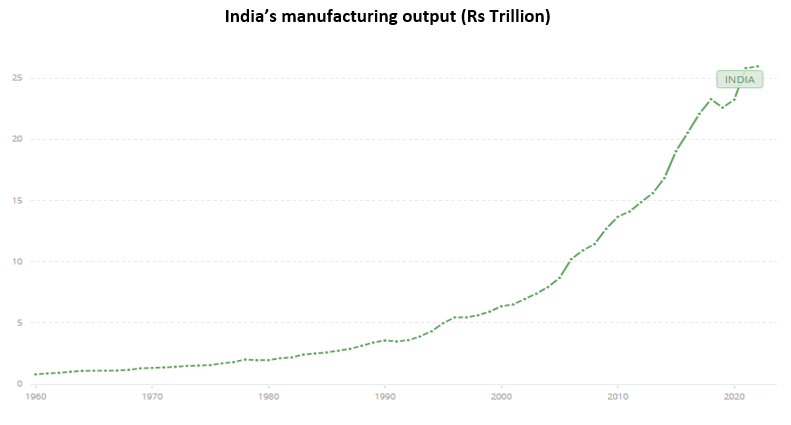

India has made great strides in manufacturing since our economy was liberalized in 1991. From 1961 to 1991, our manufacturing output grew from Rs 0.85 Trillion to Rs 3.5 Trillion (3X growth); from 1991 to 2022 our manufacturing output grew from Rs 3.5 Trillion to Rs 26 Trillion (nearly 8X growth).

Source: World Bank

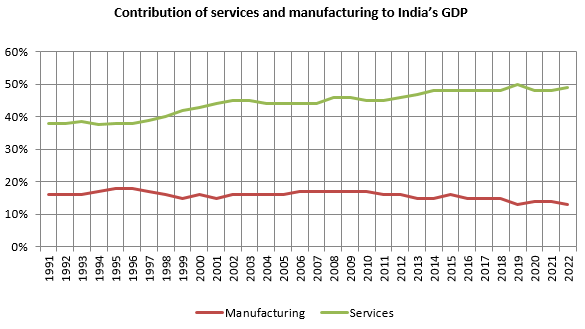

Services sector growth outpaced manufacturing sectors

Though we made huge strides in boosting manufacturing output, growth of the services sectors outpaced manufacturing (see the chart below). Service sector leads manufacturing in terms of employment (31% of India’s workforce versus 25%) and GDP growth.

Source: World Bank

Government’s push for manufacturing

The Government has made manufacturing a key priority for economic development of India. From the Make in India initiative in 2014 to Atmanirbhar Bharat (2020), the Government’s focus has been to transform India into a global manufacturing hub.

- Make in India (2014): To turn India into centre for manufacturing, design and innovation

- Industrial corridor development programme (11 corridors): To improve the connectivity and logistics

- India Stack: Leveraging technology to ease economic bottlenecks and provide services at scale

- PM Gati Shakti - NMP: Multi-modal infrastructure platform. Monetization plan aimed at creating a circular financing model

- PLI schemes: Various schemes for 14 sectors to enhance manufacturing capabilities and exports

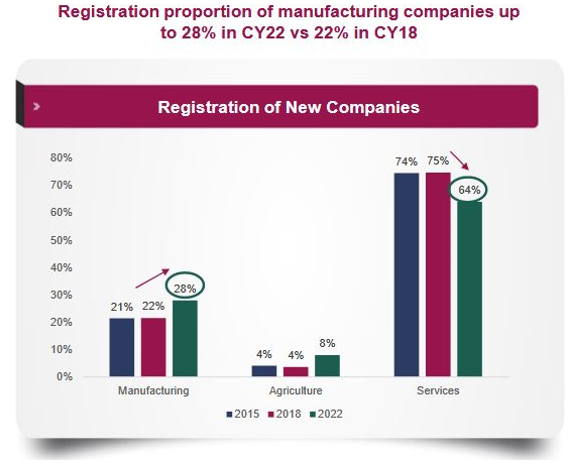

The Result – Growth in manufacturing companies

- Growth in registration of manufacturing companies compared to other sectors

Source: Axis MF

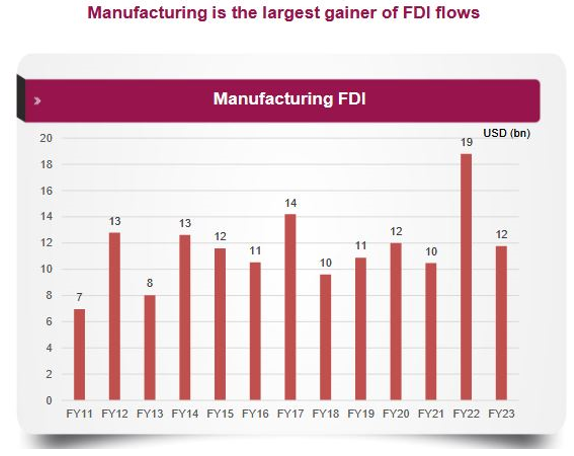

- FDI flows into manufacturing sectors

Source: Axis MF

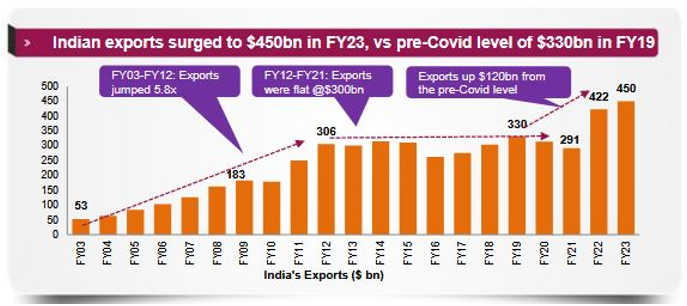

- Surge in exports

Source: Axis MF

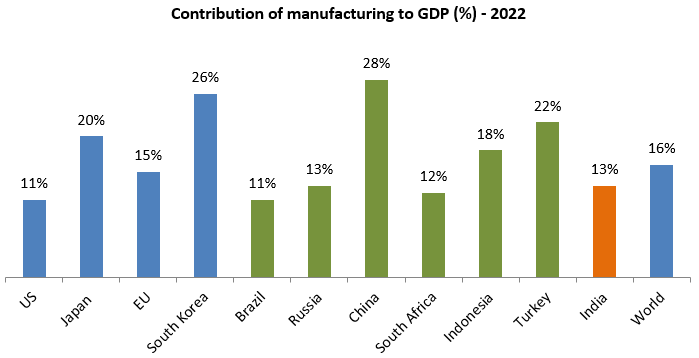

Long way to go

Despite the tailwinds and There is a huge growth potential for manufacturing industries in India, if we compare the contribution of manufacturing to our GDP with developed and emerging economies.

Source: World Bank

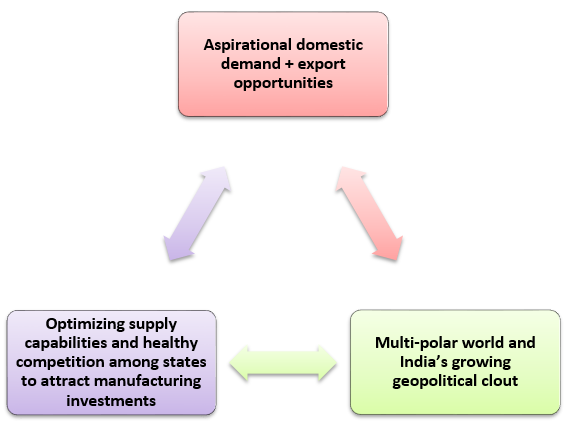

Demand drivers for Indian manufactured goods

- India is the largest aspirational population in the world.

- Rising per capita income will lead to higher discretionary spending and increasing premiumisation

- Large middle class, demands internationally competitive goods

- Unlike other manufacturing centres e.g. China, Indian economy is heavily dependent on consumption

- India’s domestic demand also makes Indian manufacturing less cyclical to global economic vagaries

- Multi-polar world, global supply chain shifts e.g. China + 1 and India’s growing geopolitical clout has the potential to make India a global manufacturing hub

- Domestic demand and exports makes manufacturing in India viable

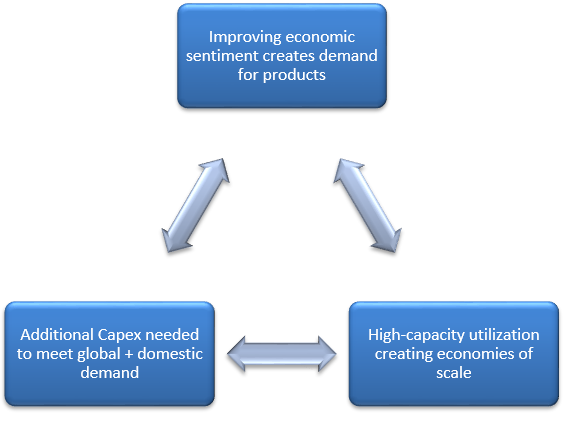

Virtuous Investment Cycle

3 – Pronged Opportunity for India’s manufacturing

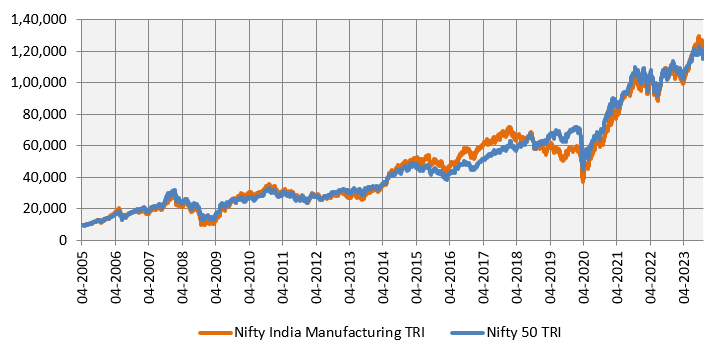

Manufacturing as an investment theme has outperformed the market

The chart below shows the growth of Rs 10,000 investment in Nifty India Manufacturing TRI versus Nifty 50 TRI, since the inception of the Manufacturing Index. Manufacturing as a theme has outperformed the market.

Source: National Stock Exchange, as on 31st October 2023. Disclaimer: The chart above is purely for investor education purposes and should not be construed as investment recommendation. Past performance may or may not be sustained in the future.

Who should invest in thematic mutual funds?

- Investors willing to have Tactical Allocation to overall equity portfolio.

- Investors looking for capital appreciation over long investment tenures from manufacturing theme.

- Investors who can take high to very high risk.

- Investors who have minimum 5 years of investment horizon.

- Investors who can invest either in lumpsum and SIP depending on thier investment needs.

Investors should consult with their financial advisors or mutual fund distributors if thematic funds are suitable for their investment needs

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Axis Mutual Fund launched its first scheme in October 2009 Since then Axis Mutual fund has grown strongly. We attribute our success thus far to our 3 founding principles - Long term wealth creation, Outside in (Customer) view and Long term relationship. Come join our growing family of investors and give shape to your desires.

Quick Links

Other Links

Follow Axis MF

POST A QUERY