Equity Savings Funds can be smart options in uncertain environment: Axis Equity Saver Fund

The last couple of months have been volatile for equity markets. Uncertainty about future interest rates and Israel / Hamas War is causing volatility. The Nifty corrected by more than 1,000 points, with buying support coming in at lower levels. In volatile market, reducing capital losses become a primary concern for investors. Asset allocation is of utmost importance, if you want to reduce downside risks to your portfolio. Asset allocation is spreading your investments over different asset classes e.g. equity, fixed income, gold to balance risk and returns. While you may want to reduce risk in your portfolio, you also want to get inflation adjusted returns over medium to long investment horizon. Equity savings funds can be good medium to long term investment options in these market conditions, for investors who do not have high risk appetite.

Asset allocation of Equity Savings Funds

- As per SEBI, minimum allocation to equity and arbitrage should be 65%. The fund manager may change allocations to equity and arbitrage based on market outlook, but the overall exposure to equity and arbitrage should be 65% to 90%.

- These schemes are also required to mention their minimum hedged (arbitrage) and un-hedged (equity) exposures in their Scheme Information Document (SID).

- If the outlook is unfavourable, then fund manager may increase allocation to arbitrage and reduce allocation to equity. If the outlook is favourable, then fund manager may increase allocation to equity and reduce allocation to arbitrage.

- As per SEBI, minimum allocation to debt and money market instruments should be 10%. The maximum exposure to debt and money market will not exceed 35%.

- On an average over a full investment cycle, average exposure to equity, arbitrage and debt can roughly be one third in each.

- Since equity savings funds have minimum 65% exposure to equity and arbitrage (which involve equity related securities), these schemes enjoy equity taxation.

How do equity savings funds work?

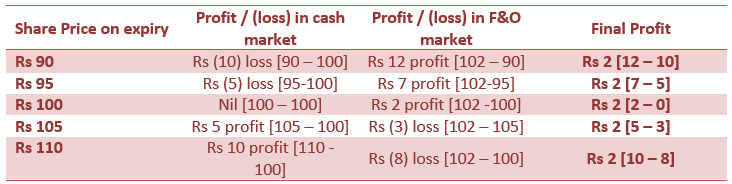

- Arbitrage: Arbitrage by definition is defined as risk free profit, by exploiting pricing mismatches in the equity market. Let us understand how arbitrage works. Let us assume that price of a stock in cash market at the beginning of a month is Rs 100 and its price in the futures (F&O) market is Rs 102. The fund manager can lock-in Rs 2 of risk-free profits by buying the stock in the cash market and selling futures in the F&O market. The profit is locked in because on expiry of the futures contract the cash price and the futures price will converge irrespective of whether price moves up or down. The table below shows various scenarios of share price changes and the final profit of the fund manager.

Note: Figures in the table are purely illustrative for investor education purposes. Please note that we have not considered transactions costs (e.g. STT, brokerage etc) in arbitrage trades. Transaction costs will have an impact on profits.

Arbitrage profits are usually higher in volatile markets.

- Debt and Money Market: In the fixed income / money market portion of equity savings funds, the fund managers usually employ accrual strategy to generate income and minimize interest rate risk. In accrual strategy, fund managers hold the debt and money market instruments in their portfolio till maturity and accrue the interest (coupons) paid by the debt or money market instruments. They usually invest in shorter duration instruments to minimize interest rate risks. However, some fund managers may take duration calls depending on their interest rate outlook.

- Equity: Equity savings funds take active (un-hedged) exposure within specified allocation ranges. Fund managers may increase or decrease active equity exposure depending on market conditions.

Axis Equity Saver Fund

Axis Equity Saver Fund was launched in August 2015 and Rs 882 crores of assets under management (AUM). The expense ratio of the fund is 2.29%. The fund has given 7.65% CAGR returns since inception. The chart below shows the growth of Rs 10,000 investment in Axis Equity Saver Fund over the last 5 years versus PPF.

Source: Advisorkhoj Research, as 9th November 2023

The table below shows the performance of AXIS Equity Saver Fund in deep market corrections over the last 10 years or so. You can see that the Net Asset Value (NAV) fall of the scheme was much less than the fall in Nifty 50 TRI. The scheme was also able to recover faster in most cases than Nifty 50 TRI.

Source: Advisorkhoj Research, as 9th November 2023

SIP Returns

The chart below shows the growth of Rs 10,000 monthly SIP in AXIS Equity Saver Fund over the last 5 years. The scheme gave an XIRR of 7.7% which is higher returns of traditional fixed income investments. AXIS Equity Saver Fund enjoys equity taxation and there will give more tax efficient returns compared to fixed income investments.

Source: Advisorkhoj Research, as 9th November 2023

Taxation Advantage

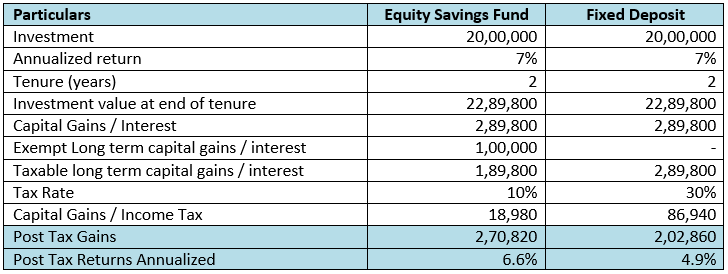

Equity Savings Funds are taxed as equity funds. Short term capital gains (holding period of less than 12 months) are taxed at 15% (plus applicable surcharge and cess). Long term capital gains (holding period of more than 12 months) of up to Rs 1 lakh are tax exempt and taxed at 10% (plus applicable surcharge and cess) thereafter. Dividends paid by Equity Savings funds are added to investor’s taxable income and taxed as per the income tax rate of the investor. The table below illustrates the tax advantage of Equity Savings funds versus traditional fixed income investment e.g. Fixed Deposits.

Note: Above example is purely illustrative. Please consult with your tax advisor to know the tax consequences of your investment.

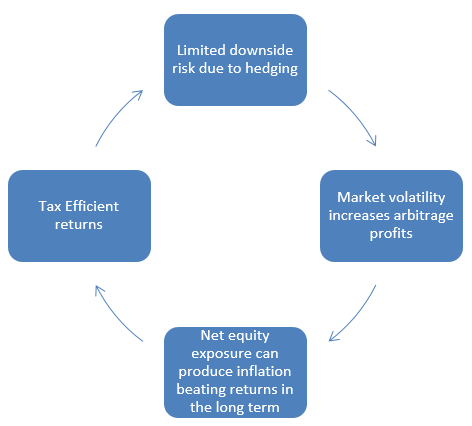

Why Axis Equity Saver Fund is a smart investment option?

Who should invest in Axis Equity Saver Fund?

- Investors who want to get higher returns than traditional fixed income investments without taking high risks.

- Investors with moderate to moderately high-risk appetites.

- Investors with at least 3 – 5 years investment horizon.

- Investors should read the scheme information document carefully to understand the asset allocation and risk profile of their schemes.

Investors should consult with their financial advisors or mutual fund distributor before investing.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Axis Mutual Fund launched its first scheme in October 2009 Since then Axis Mutual fund has grown strongly. We attribute our success thus far to our 3 founding principles - Long term wealth creation, Outside in (Customer) view and Long term relationship. Come join our growing family of investors and give shape to your desires.

Quick Links

Other Links

Follow Axis MF

POST A QUERY