5 reasons you should invest in tax savings mutual fund: Axis ELSS Tax Saver Fund

As we are approaching the final quarter of the current financial year, tax planning will be one of the most important priorities for many tax payers. Section 80C of Income Tax Act 1961, allows investors to claim deductions from their taxable incomes by investing in certain eligible schemes. 80C investments can be either non-market linked or market linked. Non market linked 80C investments like Public Provident Funds (PPF), National Savings Certificates (NSC), tax saver term deposits etc are risk free investments. Market linked investments like Equity Linked Savings Schemes (ELSS) and Unit Linked Insurance Plans (ULIPs) are subject to market risks.

In this article, we will discuss 5 reasons, why you should invest in Equity Linked Savings Schemes or tax saving mutual fund.

- Reduce your tax obligations for the current financial year: The most obvious reason for making 80C investments is tax savings. You can claim up to Rs 150,000 deduction from your gross taxable income by investing an equivalent amount in Equity Linked Savings Schemes (ELSS) or other eligible 80C schemes; you can save up to Rs 46,800 in taxes (for investors in the highest tax bracket) every year. If you save Rs 46,800 in taxes every year and reinvest your tax savings over 30 years of working life, you can accumulate Rs 1.13 crores (assuming 12% return on investment).

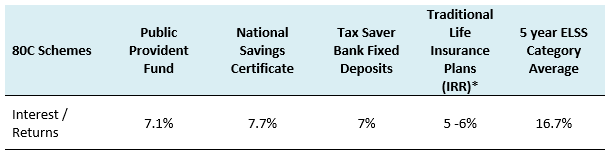

Suggested reading Plan your tax savings to get maximum benefits - Create wealth over long investment tenures: ELSS mutual funds are usually the best performing 80C investments for wealth creation in the long term. These schemes are essentially diversified equity mutual funds with a lock-in period of 3 years. While ELSS investments are subject to market risks, historical data shows that equity is the best performing asset class in the long term. Nifty 50, which is the index of 50 largest stocks by market capitalization, has given 14.5% CAGR total returns in the last 5 years, much higher than other asset classes like fixed income and gold (source: Advisorkhoj Research, as on 30th December 2023). Further ELSS mutual funds are managed by professional fund managers who are mandated to beating market returns. The table below shows the interest paid by different 80C investment schemes and historical returns of ELSS category.

Source: Indiapost, Bankbazaar and Advisorkhoj Research; *Average IRR of life insurance endowment policies (20 year terms), as on 30th December 2023

You may also like to read why ELSS works not just for tax saving but also wealth creation - Maximum Liquidity: ELSS offers the maximum liquidity among all 80C investment options. PPF has a tenor of 15 years with very limited liquidity in the interim. Minimum investment tenure of all non-ELSS 80C schemes is 5 years. ELSS mutual funds have a lock-in period of only 3 years. Your money is not locked up for a long periods of time in ELSS and you have the option of redeeming your investment partially or fully after the lock-in period. When investing in ELSS through the SIP route, investors should remember that each SIP installment will be locked in for 3 years and should plan accordingly.

- Tax Advantage: Investment proceeds of some 80C investments like PPF are tax free, but interest paid by some 80C investments are taxed as per the income tax rate of the investor. Till the beginning FY 2019, ELSS capital gains / profits were tax free but a change in taxation was introduced in this year’s Union Budget. Capital gains of up to Rs 1 Lakh in a year in ELSS mutual funds will be tax exempt. Capital gains in excess of Rs 1 Lakh will be taxed at 10%. Incidence of tax in ELSS investments arises only at the time of redemption and not during the term of the investment. Even with the introduction of the capital gains tax, ELSS remains one of the most tax efficient 80C investment options.

- Convenience and Flexibility: ELSS offers investors the convenience of investing through SIP. In the SIP mode, you can invest fixed amounts every month (or any other frequency) for tax savings. SIP not only helps investors stay disciplined, it can also help them get higher returns through Rupee Cost Averaging. ELSS SIPs are offers a lot of flexibility. Unlike PPF or life insurance plans, there are no penalties, in the event of missed payments in ELSS SIPs. You can stop and restart your SIPs at any time. However, if you miss 3 consecutive SIP installments due to insufficient funds in your bank, your SIP will be canceled and you will have to make a fresh application to restart your SIP. Therefore, you should ensure that there is always sufficient balance in your bank account on SIP dates.

About Axis ELSS Tax Saver Fund

Axis ELSS Tax Saver Fund was launched in December 2009 and has an AUM of Rs 33,088 crores. The expense ratio of the fund is 1.54% (for the Regular plan). The fund has a lock-in period of 3 years. The lock-in period works to the investor’s advantage in the long term because the fund manager has less redemption pressures and therefore, is able to stick to his high conviction stocks. The turnover ratio of the fund is only 19%.

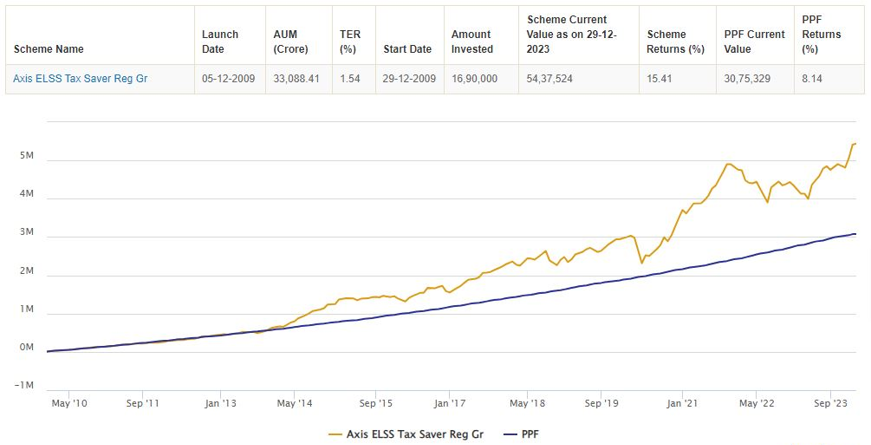

SIP Performance versus PPF

The chart below shows the wealth creation through Rs 10,000 monthly SIP in Axis ELSS Tax Saver Fund versus Public Provident Fund. The wealth creation potential of ELSS versus other 80C investment options is clearly evident in this chart.

Source: Advisorkhoj Research, as on 30th December 2023

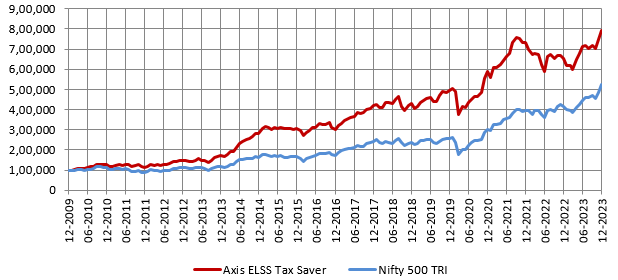

Performance versus benchmark

The chart below shows the growth of Rs 10,000 lump sum investment in the fund versus its benchmark index Nifty 500 TRI. You can see that the fund outperformed the benchmark since inception.

Source: Advisorkhoj Research, as on 30th December 2023

Stock selection

Current portfolio positioning

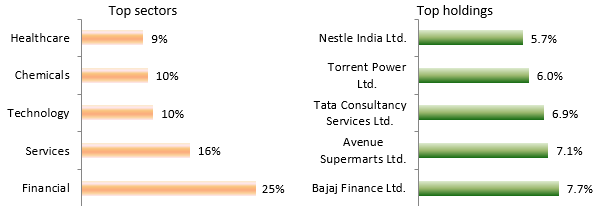

Axis ELSS Tax Saver Fund maintains large cap allocations at around 50-100% and midcaps up to 50%. Currently the fund has around 72% allocation to large cap and around 25% allocation to midcap.

Source: Advisorkhoj Research, as on 30th November 2023

Conclusion

In this post, we discussed why ELSS is one of the best tax saving investments. It not only helps you save taxes, but also create wealth over a sufficiently long investment for investors with high risk appetite. ELSS is also the most liquid and one of the most tax efficient investment options under Section 80C. Finally, ELSS offers more convenience and flexibility than other 80C investment options.

Axis ELSS Tax Saver Fund has been for many years one of the most popular tax saving mutual funds. The fund has underperformed in the recent past, but the alpha creation track record of the fund managers gives us confidence that the fund can be a good tax saving option for investors with high-risk appetite and long investment horizons. Investors should consult with their financial advisors or mutual fund distributor if Axis ELSS Tax Saver Fund are suitable for their tax saving purposes.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Axis Mutual Fund launched its first scheme in October 2009 Since then Axis Mutual fund has grown strongly. We attribute our success thus far to our 3 founding principles - Long term wealth creation, Outside in (Customer) view and Long term relationship. Come join our growing family of investors and give shape to your desires.

Quick Links

Other Links

Follow Axis MF

POST A QUERY