Axis Quant Fund: Strong performance in current market conditions

Axis Quant Fund has recently completed 3 years since launch. Unlike traditional fund managers who rely on a combination of quantitative and qualitative analysis to select stocks for their scheme portfolios, quant funds employ systematic, algorithmic rule-based approaches to build their portfolios. Though the fund is relatively new, its performance in the last 2 years or so has caught our attention.

Strong returns since inception

Axis Quant Fund has given 18.3% CAGR returns since inception (as on 12th July 2024) outperforming the leading broad market index, Nifty 50 TRI. One of the primary tests of an actively managed equity mutual fund scheme’s performance is whether it is able to the leading market index.

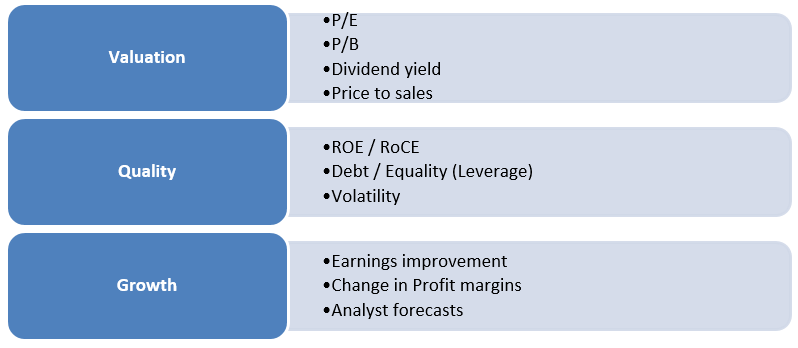

How does the quantitative model works?

The fund uses Q-GARP, blend of quality and growth at a reasonable price (GARP) to select stocks and build the portfolio. Blend of styles makes Axis Quant Fund, an all weather fund.

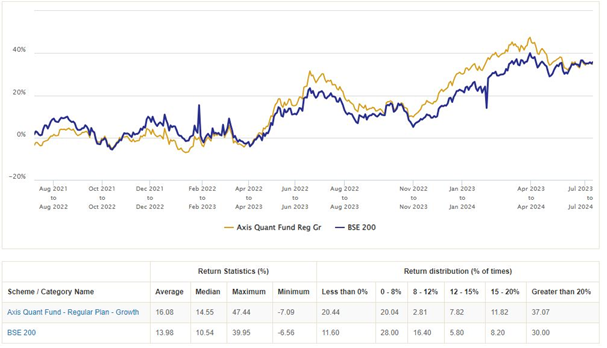

Outperformed the benchmark index

Rolling returns is the most unbiased measure of a fund’s performance because it evaluates the fund’s performance across benchmark across all market conditions. We looked at 1 year rolling returns of Axis Quant Fund since its inception versus its benchmark index. You can see that after the initial period of underperformance, the fund was able to consistently beat the benchmark index across different market conditions, rising market, falling market, flat / range-bound market. You can see that the average and median rolling returns of the fund was higher the benchmark during this period. The percentage instances of 15%+ CAGR returns were also significantly higher than the benchmark.

Source: Advisorkhoj Rolling Returns, as on 30th June 2024

Superior risk / return trade-off

Up Market Capture Ratio and Down Market Capture ratio can give us a sense of risk / return trade-off of an investment. We looked at the market capture ratios Axis Quant Fund over the last 1 year. For the benefit of new investors and mutual fund distributors who may not be familiar with the concept of market capture ratios, Up Market Capture Ratio tells us how much percentage of the market’s upside was captured by the fund, while Down Market Capture Ratio tells us how much percentage of the market’s downside was arrested by the fund.

The Up Market Capture Ratio of Axis Quant Fund over last 1 year was 96% which implies that if the benchmark index went up by 1% in a month, then the fund’s Net Asset Value (NAV) went up by 0.96%; in other words, the fund was able to capture almost the entire market upside. The Down Market Capture Ratio of the fund was only 85% which implies that if the benchmark index went down by 1% in a month, then the fund’s NAV went down by only 0.85%; in other words, the fund was able to limit the downside risk of investors in falling markets. An up market capture ratio, which is higher than the down market capture ratios e.g. market capture ratios of Axis Quant Fund is clear indication of the potential of the fund to give superior risk adjusted returns of the fund and a validation of the investment strategy of the fund.

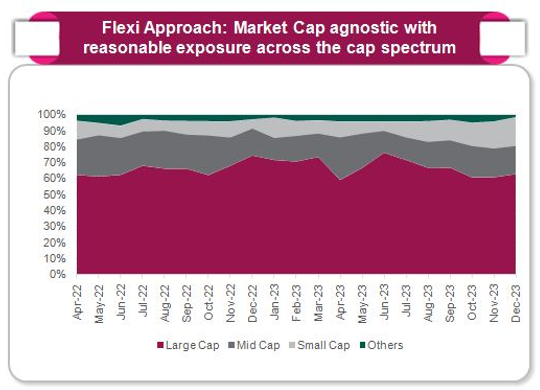

Flexicap approach

The fund is market cap agnostic and aims to maintain reasonable exposure to all market cap segments. This ensures diversification and performance consistency across market cycles.

Source: Axis MF, April 2022 to December 2023

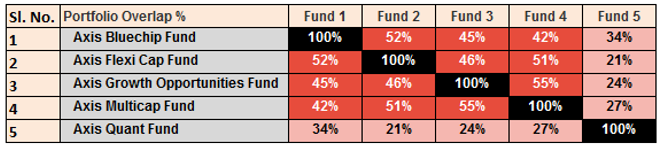

Low overlap with other Axis MF diversified equity funds

Axis Quant Fund has relatively low overlap with other Axis MF diversified equity funds (see the table below). You can build your core equity portfolio with Axis Quant and other diversified funds from Axis MF as per your risk appetite.

Source: Advisorkhoj Research, as on 30th June 2024

Current Market Context

The market is trading at record highs after the formation of the new Government at the centre. With expectations of political stability and policy continuity the momentum in the market is strong, not just with respect to the headline indices but also the broader market. However, sustained bull markets and record highs inevitably, raise concerns about valuations which can make investors jittery about investing. In phases of market exuberance, Q-GARP investment strategy with its focus on quality, growth and valuation can be a judicious investment approach. Axis Quant Fund follows a quantitative investment approach, without biases that are common in trending markets. The rolling returns and market capture ratios of the fund, strengthens our conviction in the long term potential of the fund.

Summarizing - Why invest in Axis Quant Fund?

- The strategy will appeal to investors looking to diversify their existing portfolio of funds through a rules based and data driven approach to investing.

- A unique proposition of a fundamentally driven quantitative approach.

- Very little human bias in portfolio management.

- A systems driven approach to portfolio management can produce more consistent investment outcomes for investors over long investment horizons

- Diversified portfolio across sectors and market capitalisation

Who may consider the Axis Quant fund?

- Investors are seeking capital appreciation or wealth creation over long investment horizons.

- You should have a high-risk appetite for this fund.

- You should have minimum 5-year investment tenure for this fund.

- You can invest in this fund in a lump sum or Systematic Investment Plan (SIP) based on your investment needs and financial situation.

- Also investors who prefer actively managed funds may consider this fund as an addition to their core equity portfolio.

Investors should consult with their financial advisors or mutual fund distributors if Axis Quant Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Axis Mutual Fund launched its first scheme in October 2009 Since then Axis Mutual fund has grown strongly. We attribute our success thus far to our 3 founding principles - Long term wealth creation, Outside in (Customer) view and Long term relationship. Come join our growing family of investors and give shape to your desires.

Quick Links

Other Links

Follow Axis MF

POST A QUERY