Axis Consumption Fund: Invest in India's consumption wave

Axis Mutual Fund has launched a New Fund Offer (NFO), an actively managed fund based on the consumption theme, Axis Consumption Fund. India is largely a domestic consumption driven economy and as per Economic Survey 2023-24, India’s private final consumption expenditure (at constant 2011-12 prices) is around 56% of the GDP. According to S&P Global, India’s nominal GDP will grow to $7.3 Trillion by 2030, almost double of our current nominal GDP. Domestic consumption is expected to play a pivotal role in India’s economic growth, making it an attractive theme for long term investors. While investors often associate consumption theme with Fast Moving Consumer Goods (FMCG), it actually encompasses a broader range of sectors that benefit from consumption. Axis Consumption Fund will open for subscription on 23rd August and will close on 6th September 2024.

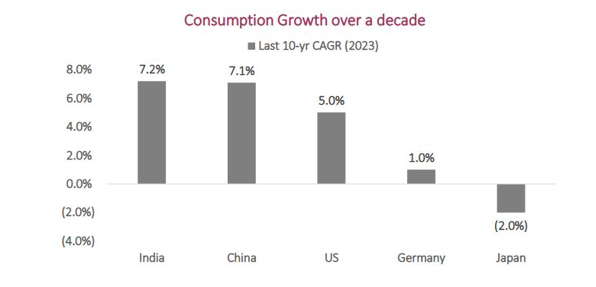

Drivers of consumption growth rate in India

- India is the fifth largest consumer market. We are also the fastest growing consumer market. India's household consumption nearly doubled in the past decade at an CAGR of 7.2%, higher than China, the US and Germany

Source: Axis MF, as on June 2024

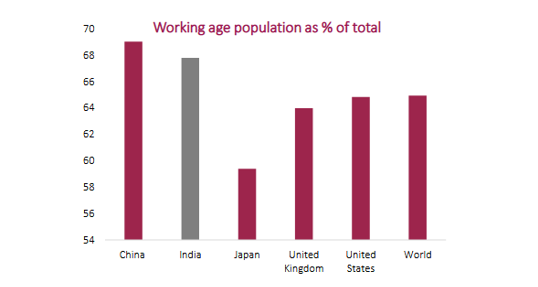

- One of the drivers of high PCE growth rate is the demographic dividends of our population. More than 65% of the population is in the working age group (see the chart below). As per E&Y, share of India’s working age population to total population will reach its highest level at 68.9% by 2030.

Source: Axis MF, as on June 2024

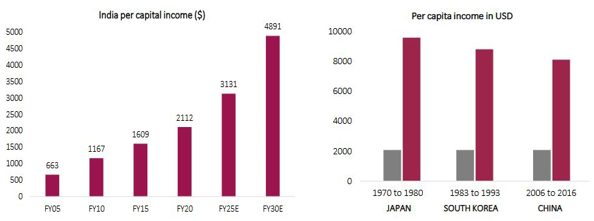

- Rising income on a per capita basis is another driver of PCE growth rate. India’s per capita GDP grew from sub $1,000 levels in the mid 2000s to around $2,730 in FY 2023-24 (source: IMF). Per capita income of up to $2,000 is an inflection point because income up to $2,000 mostly spent on basic needs; as it keeps growing above $2,000 discretionary spending rises. After crossing the inflection, per capita income can rise at faster rate based on historical per capita income growth of emerging economies like Japan, South Korea and China.

Source: Axis MF

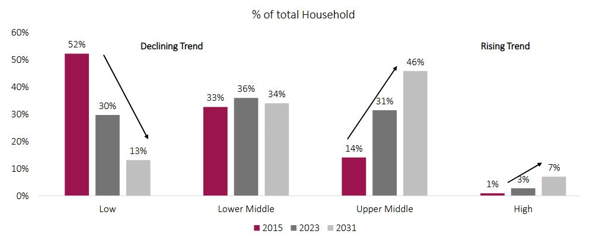

- The percentage of the population in the low income bracket is decreasing, while the percentage of population in the upper middle and high income brackets are increasing. With an increase in affluent household in India, the consumption of non-essential and luxury items is expected to pick up significantly

Source: Axis MF, June 2024.

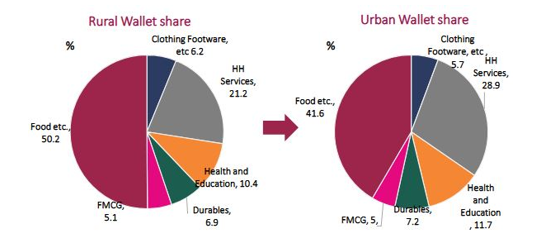

- Growing urbanization of India is also a major driver of consumption growth. Percentage of people living in urban areas has grown from 31.6% in 2012 to 36% in 2022. Since urban incomes are significantly higher than rural incomes, urban spending is also much higher. Spends on travel, durable goods, household consumables and consumer services could increase, with increasing urbanization.

Source: Axis MF, June 2024

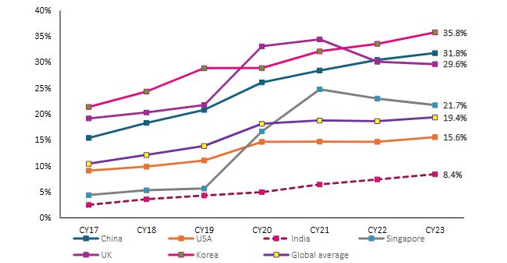

- Digital penetration and growth of e-commerce can be a major driver of consumption spending. India’s e-commerce penetration at 8.3% is low relative to the global average of 19.4% (see the chart below). Increasing digital access taking advantage of low cost data can drive e-commerce growth in India. Indian E-Commerce market is expected to reach US$133 B by 2025

Source: Axis MF, June 2024

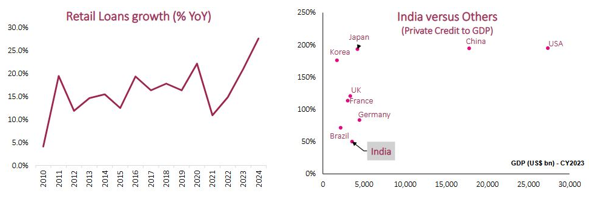

- Retail loan growth continues to be strong; credit card spends remain robust. However, India still has a long way to grow compared to developed markets as far private credit growth is concerned.

Source: Axis MF, June 2024

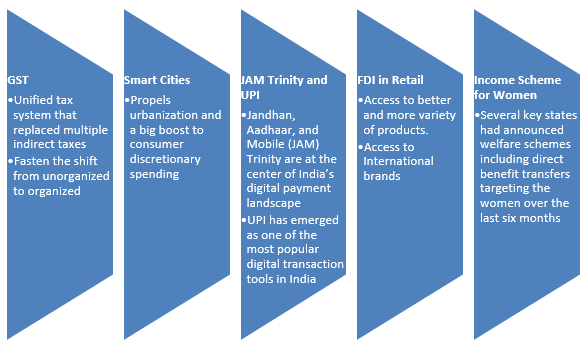

Government’s reforms will boost consumption

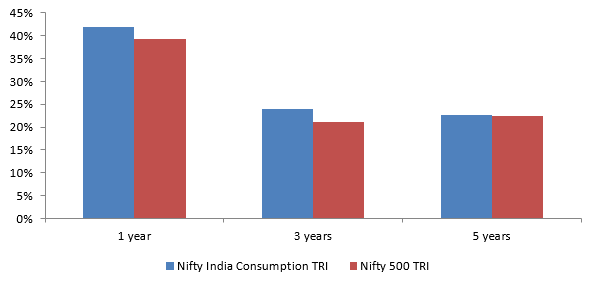

Consumption as an investment theme has outperformed the market

Nifty India Consumption TRI has outperformed the broad market index Nifty 500 TRI despite significantly higher weights to sectors e.g. FMCG (34% of the consumption index) which underperformed relative to the broad market index.

Source: National Stock Exchange, as on 31.07.2024

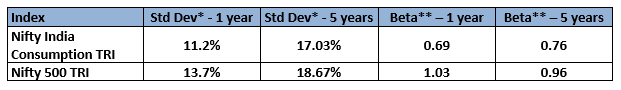

Lower volatility compared to the broad market index

Source: National Stock Exchange, as on 31.07.2024. *Standard Deviation **Beta to Nifty 50

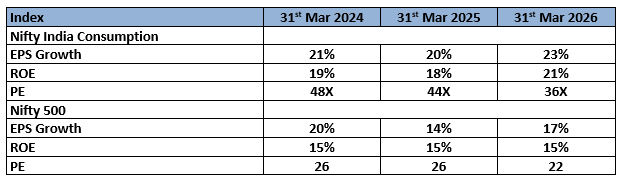

Stronger fundamentals compared to the broad market index

Valuation of the consumption index is high compared to Nifty 500, but Earnings growth and ROE prospects for the Consumption index are stronger

Source: Source: Axis MF, June 2024

Salient Features of Axis Consumption Fund

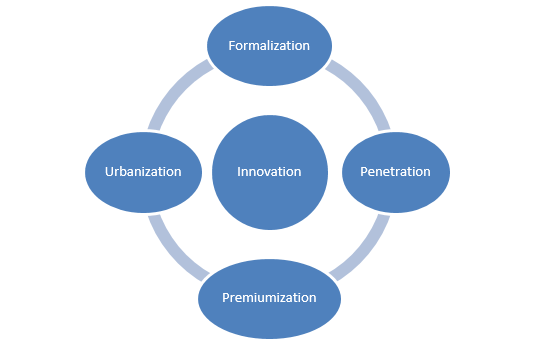

Investment approach

Capture emerging trend in Consumer Story

Why invest in Axis Consumption Fund?

- Consumption is a broad theme, with sector representation beyond FMCG – like Consumer discretionary, Retailing, Auto, Realty

- It is a sector that has demonstrated long term return potential and at the same time has witnessed lower drawdowns during down cycle. This makes it an important diversifier in an investor’s portfolio

- The government's emphasis on significant capital expenditure is leading to a chain reaction: more jobs, higher per capitaincome & a consequent increase in consumer demand;coupled with our demographic strength & changing consumer face could result in a significant consumption boom.

Who should invest in Axis Consumption Fund?

- Investors looking for capital appreciation over long investment tenures from India’s consumption growth theme

- Investors with high to very high risk appetites

- Investors with minimum 5 year investment tenures

- You can invest either in lump sum and SIP depending on your investment needs.

Investors should consult their financial advisors or mutual fund distributors if Axis Consumption Fund is suitable for their investment needs

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Axis Mutual Fund launched its first scheme in October 2009 Since then Axis Mutual fund has grown strongly. We attribute our success thus far to our 3 founding principles - Long term wealth creation, Outside in (Customer) view and Long term relationship. Come join our growing family of investors and give shape to your desires.

Quick Links

Other Links

Follow Axis MF

POST A QUERY