Axis Multicap Fund: Track record of alpha creation

What are multicap funds?

SEBI mandates Multi Cap Funds to invest 25% of their assets in each market cap segment viz. large, mid and small cap. The remaining 25% (after allocating 25% each to Large, Mid and Small Cap) can be allocated to any market cap segment or asset class at the discretion of the fund manager.

Benefits of multicap strategy

- Capture best ideas regardless of size (market capitalization)

- Opportunity to capture budding companies

- Capture the lifecycleof the company (journey from early stage to mature business)

- Disciplined allocations with a minimum of 25%

- Aim for relativelystable returns by blending large cap allocation with mid/small

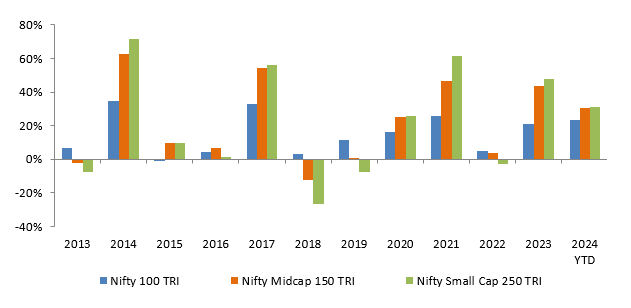

Winners rotate across market cap segments

Source: National Stock Exchange, Advisorkhoj Research, as on 30th September 2024

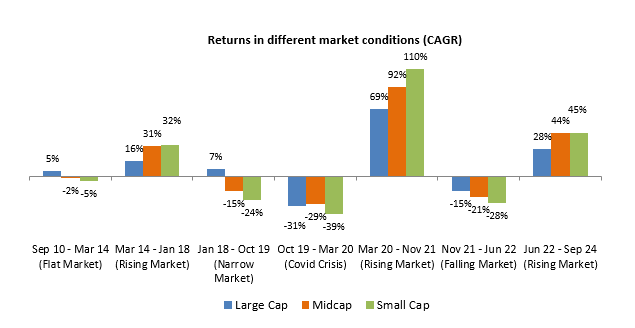

Different market caps work differently in different phases

Large caps tend to outperform in falling and narrow market (market breadth is narrow). On the other hand, midcap and small caps tend to outperform in large caps when broader market rallies. A multicap strategy i.e. allocation to all three market cap segments can therefore help in managing risks and providing relatively stable returns.

Source: National Stock Exchange, Advisorkhoj Research, as on 30th September 2024

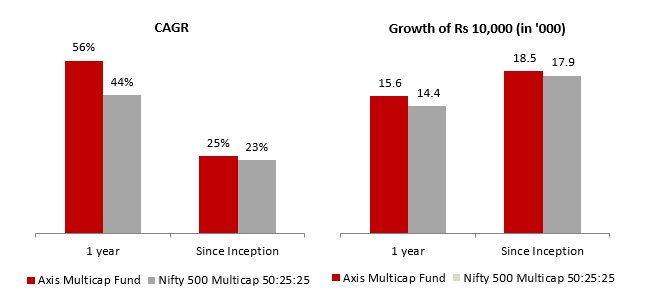

About Axis Multicap Fund

Axis Multicap Fund was launched in December 2021 and has given 24.7% CAGR returns (Regular Plan, Growth option) since inception (as on 30th September 2024). The fund has beaten its benchmark in the last 1 year and since inception.

Source: Advisorkhoj Research, Benchmark returns are total returns, as on 30th September 2024

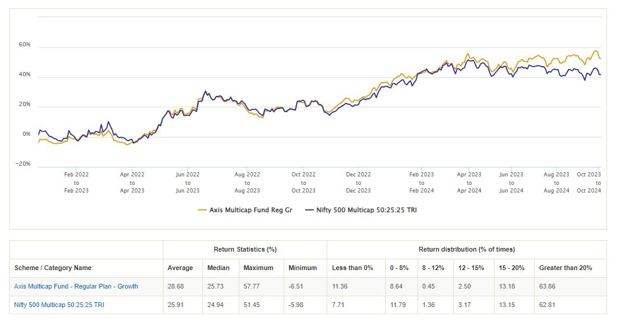

Rolling Returns

The chart below shows the 1 year rolling returns of Axis Multicap Fund versus its benchmark index Nifty 500 Multicap 50:25:25 TRI since the inception of the scheme. You can see that the fund was able to outperform the benchmark quite consistently. The average and median 1 year rolling returns of the fund was higher than that of the benchmark. The fund gave more than 12%+ CAGR returns in nearly 80% of the instances.

Source: Advisorkhoj Research, as on 30th September 2024

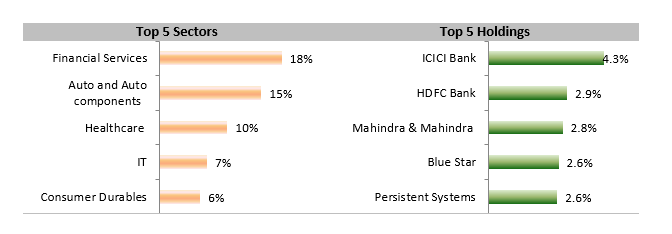

Current portfolio positioning

The fund adapts to market changes with flexible rebalancing with an aim to optimize returns in a disciplined manner. As on 30th September 2024, the fund had 39% allocation to large cap, 24% allocation to midcap and 35% allocation to small cap.

Source: Axis MF Fund Factsheets, as on 30th September 2024

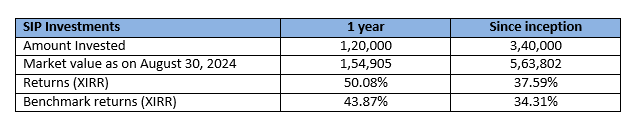

Wealth creation through SIP

Source: Advisorkhoj Research, as on 30th September 2024

Why invest in Axis Multicap Fund?

- The fund simplifies investing by combining all three market cap segments in a single fund

- Diversification across market caps and sectors for a balanced risk and reward potential

- The fund adjusts investments based on market conditions, reducing timing concerns

- The fund maintains a disciplined allocation of at least 25% in each of the three market caps

Who should invest in Axis Multicap Fund?

- Investors with long term investment horizon i.e. 5 years or more

- Investors with a high-risk appetite who can tolerate the short term volatility associated with equity investments

- They are suitable for investors who want to invest from their monthly savings through SIP for their long term financial goals

- You can also invest in lump sum if you have long investment horizon

- If you have lump sum funds but are worried about volatility, then you can invest your lump sum funds in Axis Liquid Fund and transfer systematically to Axis Multicap Fund through 3 – 6 month STP

Investors should consult their financial advisor or mutual fund distributor if Axis Multicap Fund is suitable for their investment needs

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Axis Mutual Fund launched its first scheme in October 2009 Since then Axis Mutual fund has grown strongly. We attribute our success thus far to our 3 founding principles - Long term wealth creation, Outside in (Customer) view and Long term relationship. Come join our growing family of investors and give shape to your desires.

Quick Links

Other Links

Follow Axis MF

POST A QUERY