Axis Momentum Fund: Invest in winners

Axis Mutual Fund has launched a new fund offer (NFO), Axis Momentum Fund. The fund will follow a momentum approach using price trends and model based approach for risk management. The NFO has opened for subscription on 22nd November and will close on 6th December. In this article we will review this NFO.

What is momentum?

Momentum, in the context of equity markets, refers to the tendency of stock price trends to persist. Recent winners in stock markets tend to continue to remain winners in the near term, and similarly losers tend to remain losers. Momentum factor investing refers to taking advantage of this market behaviour to generate better returns than markets. It is essentially based on owning securities that have shown favourable price trends. Instead of the conventional, “buy low, sell high” approach, momentum strategy is essentially, “buy high and sell higher”.

How momentum investing works?

- Investors usually over-react or under-react to important information.

- Investors react properly to news that confirms to their belief and under-react to news that does not conform to their beliefs.

- Momentum strategy evolves with market trends by changing the style, sectors and stocks in the portfolio.

Momentum investing has outperformed the broad market

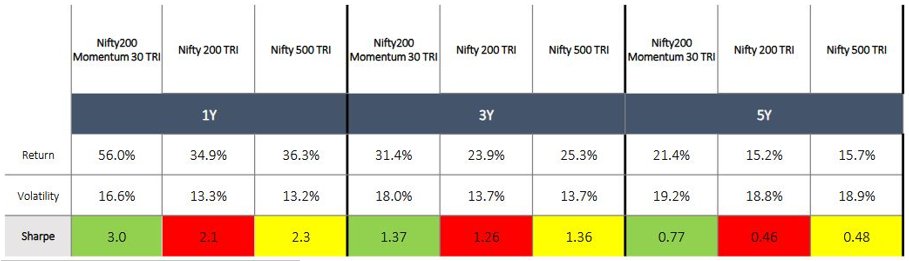

Momentum investing outperformed the broad market indices like Nifty 200 TRI and Nifty 500 TRI over long investment tenures. Though momentum strategy carries with it higher levels of volatility on a relative basis, it can generate superior risk adjusted returns (Sharpe Ratio) compared to broad market indices over long investment horizon.

Source: Axis MF, as on 31st October 2024

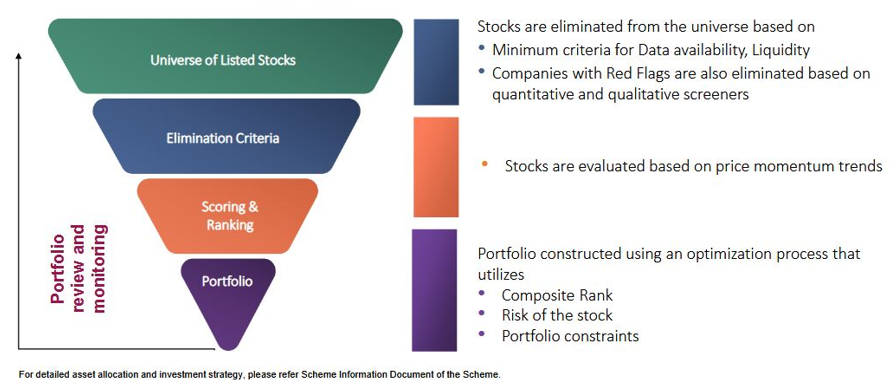

Portfolio construction of Axis Momentum Fund

How has Axis Momentum Fund model performed versus broad market?

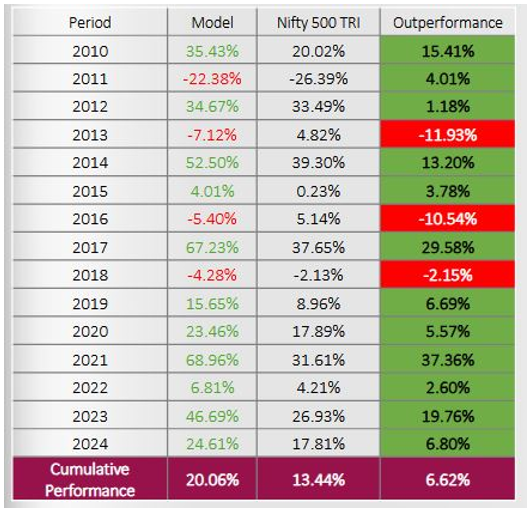

The model has outperformed Nifty 500 TRI 12 times in the last 15 years (see the table below).

Source: Axis MF, as on 31st October 2024

Performance across different market conditions

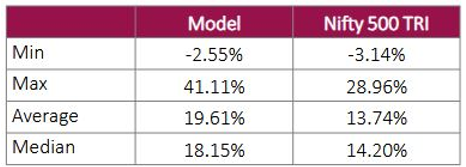

The chart below shows the 3 year rolling returns of the model versus Nifty 500 TRI from January 2013. In the past 11 years, the model has outperformed the benchmark on 76.8% instances. The average rolling return of the model was 19.61%, while that of Nifty 500 TRI was 13.74%. On a 3-year rolling return, the model has delivered 96% times positive return.

Source: Axis MF, as on 31st October 2024

Efficient risk management

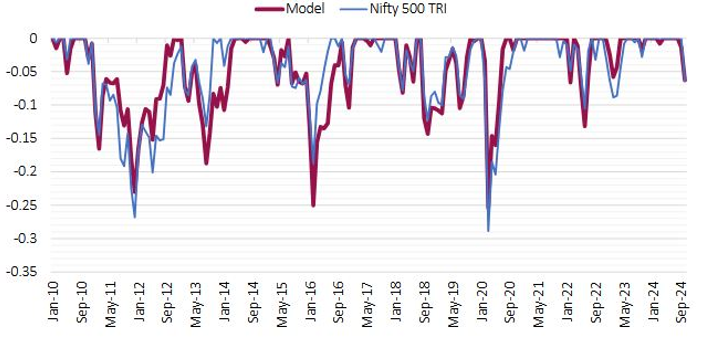

The model has efficient risk management built into it. Despite slightly lower momentum score, a stock with a lower risk score may have higher portfolio exposure than stock with higher risk score and slightly higher momentum score. The model experienced smaller maximum drawdown compared to the benchmark, Nifty 500 TRI (see the chart below). Model’s maximum drawdown was -25%, whereas the benchmark’s maximum drawdown was -29%.

Source: Axis MF, as on 31st October 2024

Why invest in Axis Momentum Fund?

- The fund can unlock the potential for higher returns

- The fund can benefit from agile re-adjustments and rebalancing to capture new opportunities

- Controls exposure to sector/stock concentration, market cap skewness and liquidity risk

- The fund can add richer diversification to your investment portfolio by complementing other strategies

- The investment strategy of the fund ensures that the portfolio remains responsive to market changes,potentially leading to better performance and risk management

Who should invest in Axis Momentum Fund?

- Investors with a high-risk appetite

- Investors having a long-term investment horizon (minimum 5 years)

- Investors seeking to add aggressive strategy to their portfolio

Investors should consult their financial advisors or mutual fund distributors if Axis Momentum Fund is suitable for your investments.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Axis Mutual Fund launched its first scheme in October 2009 Since then Axis Mutual fund has grown strongly. We attribute our success thus far to our 3 founding principles - Long term wealth creation, Outside in (Customer) view and Long term relationship. Come join our growing family of investors and give shape to your desires.

Quick Links

Other Links

Follow Axis MF

POST A QUERY