Axis Multicap Fund: Strong risk adjusted returns track record

Market situation

The market has been volatile for the last two months. From 26,200 levels (record high) the Nifty 50 fell below the psychologically important 24,000 level. The Nifty bounced back from 23,500 levels and seemed to be consolidating in a relatively narrow range. However, volatility spiked up after the US Federal Reserve FOMC meeting in December, where the Fed indicated fewer rate cuts (2 instead of the 4 expected) in 2025. The Nifty 50 has again slipped below the 24,000 level. There are several headwinds for the Indian equities namely uncertainty about rate cuts, strong US Dollar, cut in FY 2025 GDP growth forecast by the RBI, concerns about corporate earnings outlook and FII selling.

Why this may be a good time to invest in multicap funds for the long term?

From the long term perspective, India is in a macro sweet spot due to moderating inflation, narrowing fiscal deficit, strong forex reserves, healthy corporate balance sheets, as well as structural factors like rising per capita income, favourable demographics and growing consumption. India can also benefit from the changing global supply chain dynamics e.g. China + 1 strategy and emerge as a global manufacturing hub. A multicap strategy could be suitable to capture the long term growth opportunities in the Indian equities. The market volatility has brought down Nifty Trailing Twelve Month (TTM) PE ratio from 24X (in September) to just above 22X (as on 19th December 2024, source NSE). Long term investors can use this correction to tactically add equity (across all market cap segments) to their asset allocation through multicap funds. In this article, we will review one of the best performing multicap fund in the last 1 year, Axis Multicap Fund.

Axis Multicap Fund – Outperformed its benchmark

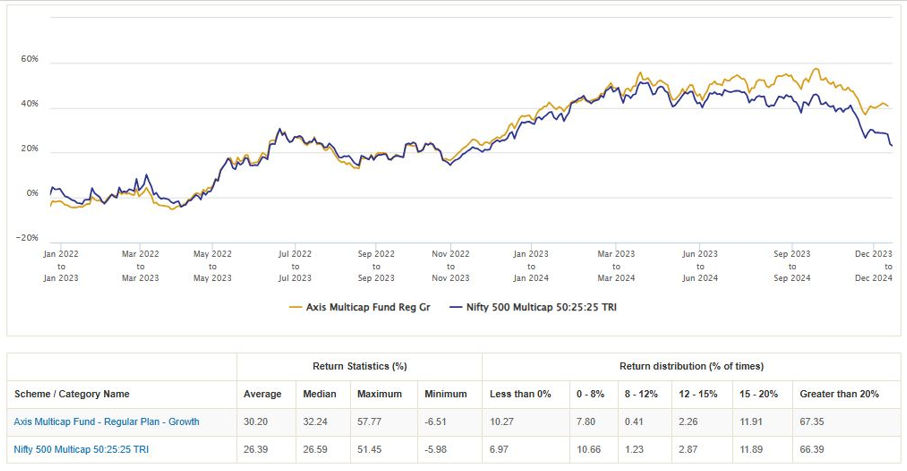

The fund was launched in December 2021 and has more than Rs 6,800 crores of assets under management (as on 30th November 2024). The chart below shows 1 year rolling returns of the fund versus its benchmark index since the inception of the scheme. You can see that after an initial period of underperformance, the fund has consistently outperformed its benchmark across different market conditions.

Source: Advisorkhoj Rolling Returns, as on 19th December 2024

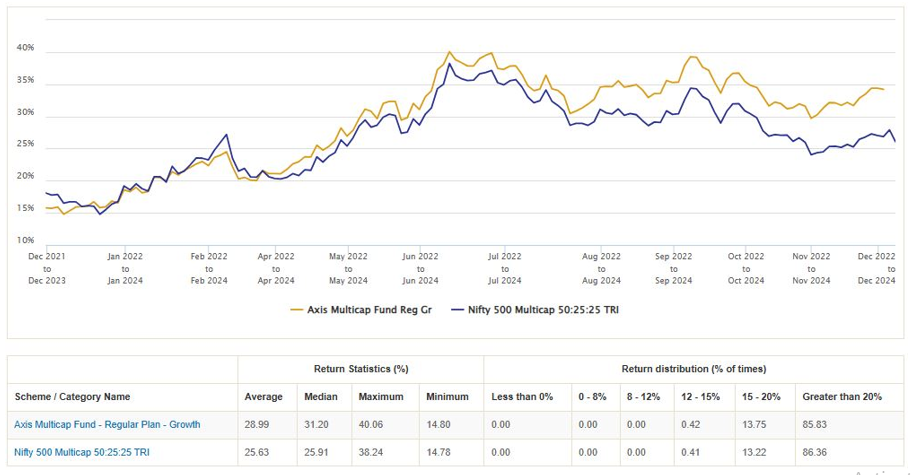

Let us now compare the 2 year rolling returns of the fund versus its benchmark index since the inception of the scheme. You can see performance consistency and outperformance improved significantly over longer investment tenures.

Source: Advisorkhoj Rolling Returns, as on 19th December 2024

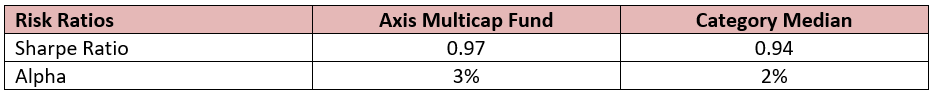

Superior risk adjusted returns relative to peers

Sharpe Ratio is a measure of risk adjusted returns of mutual fund schemes. We looked at the Sharpe Ratios of all the multicap funds, with sufficiently long performance track record. You can see that Axis Multicap Fund (marked in red) had higher Sharpe Ratios relative to most of its peers. The fund also outperformed its peers in terms of alphas generated.

Source: Advisorkhoj Research, as on 30th November 2024

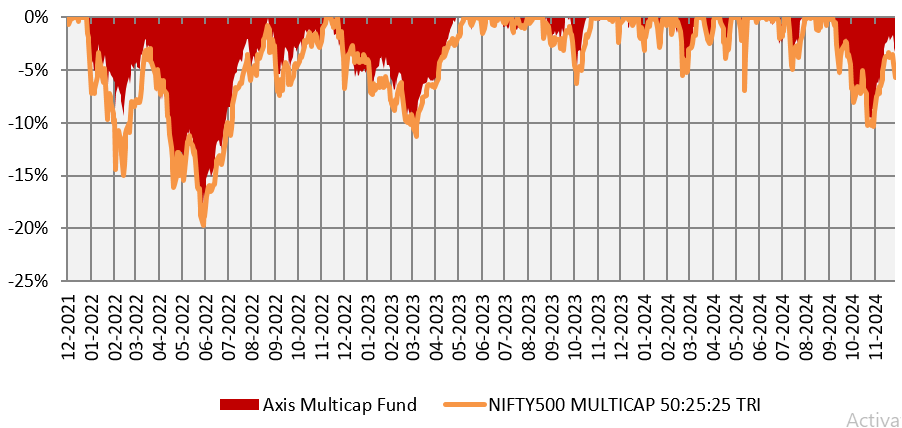

Lower downside relative to benchmark index – lesser drawdowns

The chart below shows the drawdowns of the scheme versus the benchmark index. You can see that despite outperforming the benchmark the fund experienced lower drawdowns compared to the benchmark index.

Source: Advisorkhoj Research, as on 19th December 2024

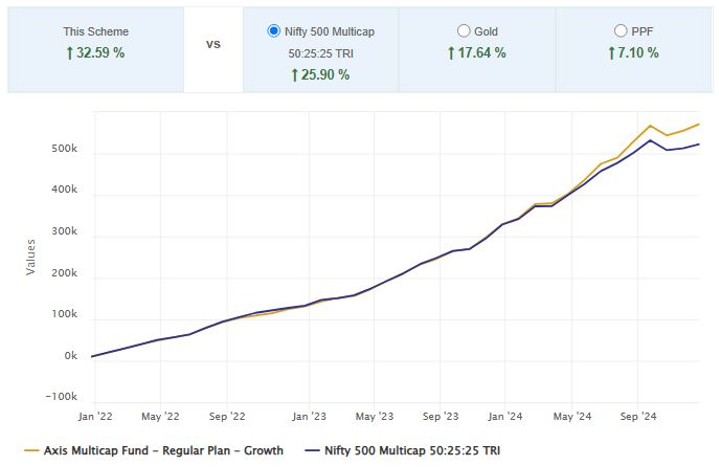

Wealth creation through SIP

The chart below shows the growth of Rs 10,000 monthly SIP in Axis Multicap Fund versus the benchmark index. You can see that with an investment of Rs 3.5 lakhs you could have accumulated a corpus of more than Rs 5.7 lakhs in Axis Multicap Fund (as on 19th December 2024).

Source: Advisorkhoj Research, as on 19th December 2024

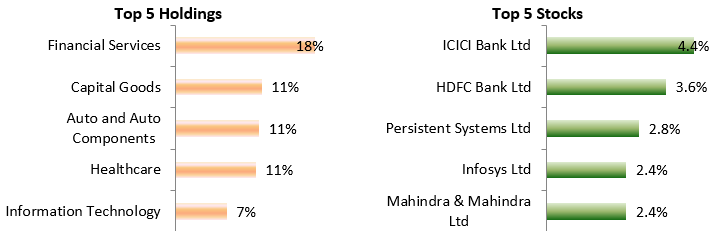

Current portfolio positioning

As per SEBI, multicap funds must have 25% minimum allocation to each of the three market cap segments, large cap, midcap and small cap. Axis Multicap Fund currently has 41% allocation to large cap, 26% allocation to midcap and 25% allocation to small cap stocks.

Source: Axis MF, as on 30th November 2024

Who should invest in Axis Multicap Fund?

- Investors with long term investment horizon i.e. 5 years or more

- Investors with a high-risk appetite who can tolerate the short term volatility associated with equity investments

- They are suitable for investors who want to invest from their monthly savings through SIP for their long term financial goals

- You can also invest in lump sum if you have long investment horizon

- If you have lump sum funds but are worried about volatility, then you can invest your lump sum funds in Axis Liquid Fund and transfer systematically to Axis Multicap Fund through 3 – 6 month STP

Investors should consult their financial advisor or mutual fund distributor if Axis Multicap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Axis Mutual Fund launched its first scheme in October 2009 Since then Axis Mutual fund has grown strongly. We attribute our success thus far to our 3 founding principles - Long term wealth creation, Outside in (Customer) view and Long term relationship. Come join our growing family of investors and give shape to your desires.

Quick Links

Other Links

Follow Axis MF

POST A QUERY