Axis Nifty 500 Momentum 50 Index Fund: Navigate market tides with high momentum stocks

Axis Mutual Fund has launched a new fund offer (NFO), Axis Nifty 500 Momentum 50 Index Fund. This is a factor based passive fund which will track Nifty500 Momentum 50 Index which comprises of 50 high momentum stocks selected from the large, mid and small cap stocks from the composition of Nifty 500 Index. The NFO has opened for subscription on 24th January 2025 and will close on 7th February 2025. In this article we will review Axis Nifty 500 Momentum 50 Index Fund NFO.

What are factor indices?

Factor indices are constructed based on quantitative, rule-based investment strategies based on specific characteristics that have historically driven a portfolio's returns and risk. Factor indices select stocks from the constituents of a certain benchmark index like Nifty 50, Nifty 100, Nifty 500, etc based on different factors like Momentum, Low Volatility, Quality, Value etc. Factor investing combines aspects of Active and Passive investing, looking to combine the best of both worlds.

What is momentum?

Momentum, in the context of equity markets, refers to the tendency of stock price trends to persist. Recent winners in stock markets will continue to remain winners in the near term, and similarly losers will remain losers. Momentum factor investing refers to taking advantage of this market behaviour to generate better returns than markets. It is essentially based on owning securities that have shown favourable price trends. Instead of the conventional, “buy low, sell high” approach, momentum strategy is essentially, “buying high and sell higher”.

How momentum investing works?

- Momentum works on behavioural biases of humans. As investor behaviour often deviates from perfect rationality, these market inefficiencies present opportunities for momentum strategies to capitalize on trends arising from these anomalies.

- The momentum takes into consideration the relative performance of stocks over recent history say - past 6 months and 12 months.

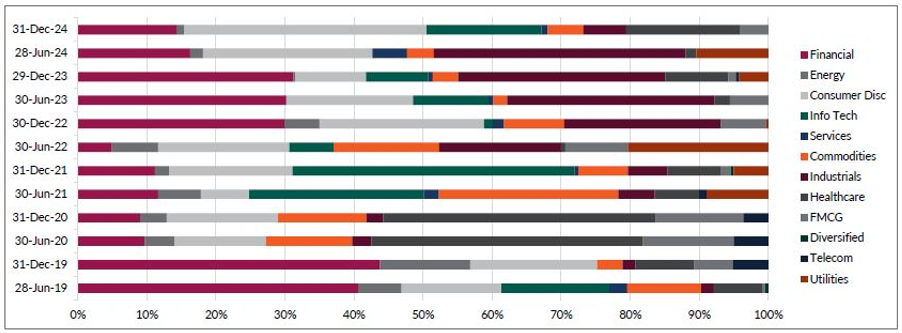

- Momentum strategy evolves with market trends by changing the style, sectors and stocks in the portfolio.

Momentum Investing adapts to market trends

- Momentum investing adapts dynamically to emerging sectoral trends. The chart below shows the historical sector weight movements in Nifty 500 Momentum 50 Index.

Source: National Stock Exchange, Data 28-Jun-2019 to 31-Dec-2024

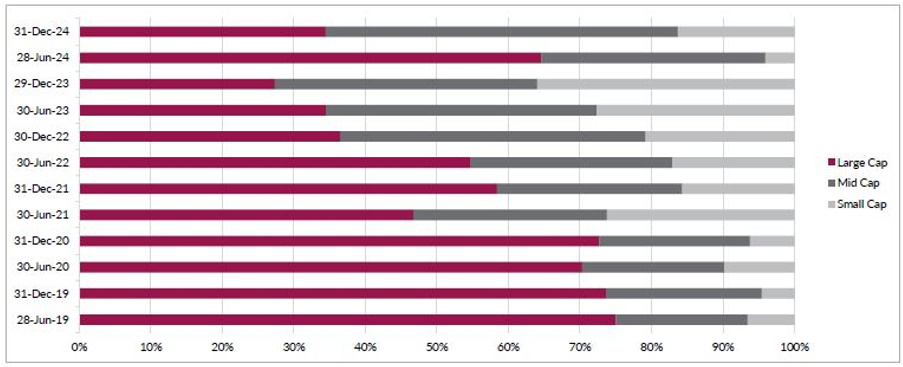

- Momentum investing adapts dynamically to market capitalization segment trends. The chart below shows the historical market capitalization weight movements in Nifty 500 Momentum 50 Index.

Source: National Stock Exchange, Data 28-Jun-2019 to 31-Dec-2024

How is Nifty 500 Momentum 50 Index constructed?

Top 50 companies with highest Momentum score based on 6 & 12-month price return adjusted for volatility. Index constituents have tilt-based weights (Free Float Market Cap x Normalized Momentum score). Momentum score is calculated using stock’s price returns in recent period (i.e. 6 months and 12 months) and 12-month standard deviation. The index is rebalanced semi-annually in June and December.

Momentum investing has outperformed broad market

The chart below shows the growth of Rs 10,000 investment in Nifty 500 Momentum 50 TRI versus the broad market index, Nifty 500 TRI since the inception of the momentum index. You can see significant outperformance by the Nifty 500 Momentum 50 TRI.

Source: National Stock Exchange, Data 31-Mar-2005 to 31-Dec-2024

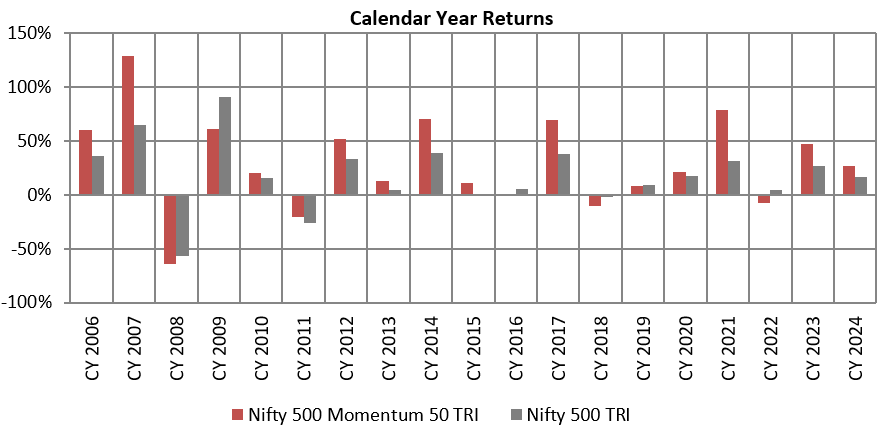

The chart below shows the calendar year returns of Nifty 500 Momentum 50 TRI versus the broad market index, Nifty 500 TRI since the inception of the momentum index. You can see that the momentum index outperformed the broad market index in 13 out of 19 calendar years.

Source: National Stock Exchange, Data 31-Dec-2005 to 31-Dec-2024

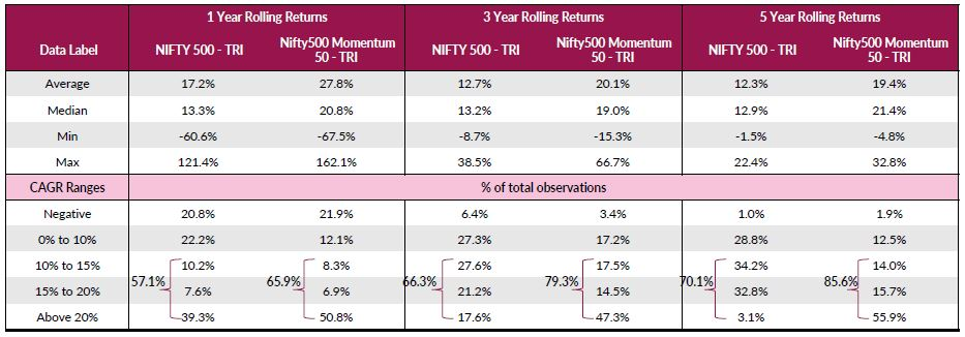

The table below shows the rolling returns of Nifty 500 Momentum 50 TRI versus the broad market index, Nifty 500 TRI for 1 year, 3 year and 5 year investment tenures since the inception of the momentum index. You can see that the average and median rolling returns of the momentum index across different investment tenures were higher than that of the Nifty 500 TRI. Even though the momentum index is more volatile, the instances (number of observations) of 10%+ CAGR returns over different investment tenures is significantly higher for Nifty 500 Momentum 50 TRI compared to Nifty 500 TRI.

Source: National Stock Exchange, Data 31-Mar-2005 to 31-Dec-2024

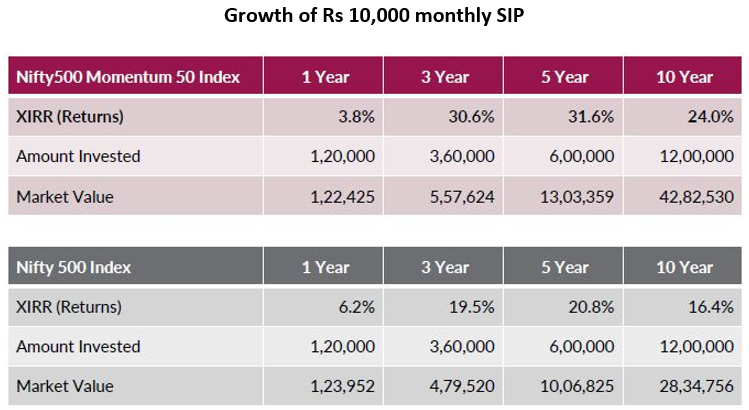

Higher SIP returns

One of the advantages of index funds is that, like other mutual fund schemes, you can invest in index funds from your regular savings through Systematic Investment Plans (SIP) and potentially create wealth over long investment horizons. Since the Nifty500 Momentum 50 Index is relatively more volatile, you can benefit from Rupee Cost Averaging by investing through SIP. You can see in the tables below that Nifty 500Momentum 50 TRI was able to create more wealth than the broad market index, Nifty 500 TRI over long investment tenures. The Nifty 500 Momentum 50 TRI noted the XIRR of 24.0% over last 10 years.

Source: National Stock Exchange, As on 31-Dec-2024. First date of the month has been assumed to the SIP instalment date

Who should invest in Axis Nifty 500 Momentum 50 Index Fund?

- Investors with a high-risk appetite

- Investors having a long-term investment horizon (minimum 5 years)

- Investors seeking to add aggressive strategy to their portfolio

Investors should consult their financial advisors or mutual fund distributors if Axis Nifty 500 Momentum 50 Index Fund is suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Axis Mutual Fund launched its first scheme in October 2009 Since then Axis Mutual fund has grown strongly. We attribute our success thus far to our 3 founding principles - Long term wealth creation, Outside in (Customer) view and Long term relationship. Come join our growing family of investors and give shape to your desires.

Quick Links

Other Links

Follow Axis MF

POST A QUERY