Balanced Advantage Fund as a Category

Market Context

The market has been volatile for the past 4 months. INR depreciation, weaker than expected corporate earnings and concerns about trade policies of new US Administration have led to heavy Foreign Institutional Investor (FII) sell-off. Nifty 50 has corrected by more than 13% from its 52-week high. The market rebounded briefly after a favourable Union Budget which provided relief to the middle class through tax cut. However, the bear grip on the market has intensified in past few weeks due to concerns about the trade policies of the new Trump Administration.

Valuation scenario

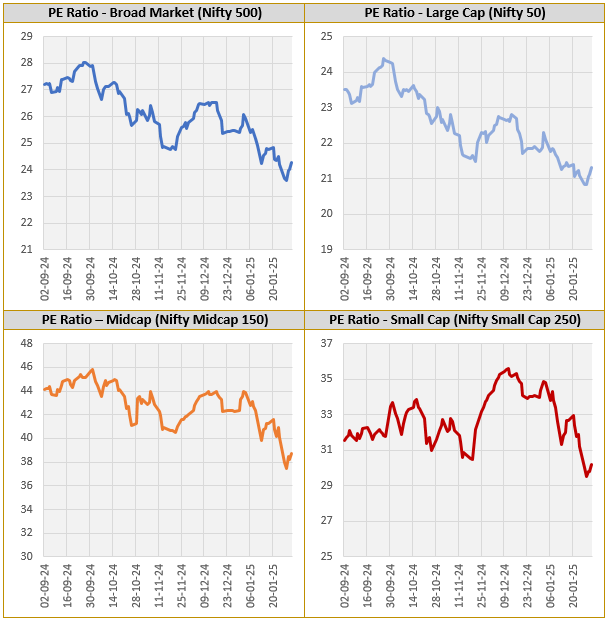

The sharp correction has brought down valuations across all the market cap segments. Large cap valuations seem reasonable. Though mid and small cap valuations have moderated, there are concerns whether current valuation levels are justified given earnings growth concerns.

Source: National Stock Exchange, as on 31st January 2025

In such a scenario, Balanced Advantage funds may offer this blend of relative stability and reasonable risk adjusted returns over sufficiently long investment horizons for the investors. In this article we shall understand all about Balanced Advantage funds and the pros and cons of investing in them.

What are Balanced Advantage funds?

Balanced Advantage funds or Dynamic Asset Allocation Funds are a type of hybrid funds. Hybrid funds invest across multiple asset classes e.g. equity, debt etc. Hybrid funds provide asset allocation leading to risk diversification benefits to your portfolio. Since different asset classes have different risk / return characteristics, asset allocation aims to balance risk and returns to achieve financial goals. SEBI has not mandated upper or lower asset allocation limits for dynamic asset allocation funds and fund managers have the complete flexibility to manoeuvre asset allocation in the range of 0 – 100% to arrive at an optimal allocation.

How do Balanced Advantage Funds work?

In Balanced Advantage funds, the asset allocation between equity and fixed income (debt) is managed dynamically depending on prevailing market conditions. When equity valuations are high, the fund manager shifts the asset allocation from equity to debt and equity valuations are low, asset allocation is shifted from debt to equity. This ensures that in the ensuing correction investors do not see a big fall in the investment value. When stock prices are very low, the fund manager shifts back to equity, so that investors are able to get maximum benefits from the recovery which follows. Balanced Advantage funds typically follow the "Buy low, Sell High" approach.

In order to enjoy equity taxation, Balanced Advantage funds usually cap their debt allocation to 35%. If the net equity exposure needs to fall below 65% as per the dynamic asset allocation model, these funds use hedging to reduce the net equity allocation, but keep the gross equity exposure above 65% to ensure equity taxation.

There are various asset allocation models within the BAF category. Some funds use technical indicators e.g. momentum indicators to tactically change asset allocation.

Asset Allocation of Balanced Advantage Funds

- Active (net) equity: Active equity allocation or equity allocation net of hedging is determined by the dynamic asset allocation model

- Fixed income: Fixed income or debt allocation is usually capped at 35% to avoid non-equity taxation.

- Arbitrage: This is the equity component of the fund that does not have exposure to market risks and is therefore fully hedged. The arbitrage component not only reduces risk (i.e. the net equity exposure) it also generates arbitrage (risk-free) profits based on price differences in cash and futures market or corporate actions. It also enables these schemes to enjoy equity taxation.

Dynamic Asset Allocation Models

- Counter-cyclical model - This model focuses on purchasing low and selling high. Counter-cyclical models boost equity allocation (reduce debt allocation) in declining markets (lower valuations) and decrease equity allocations in rising markets (higher valuations). Different fund managers utilize various valuation criteria for dynamic asset allocation, such as P/E, P/B, and so on. Most balanced advantage funds follow counter cyclical dynamic asset allocation model.

- Pro-cyclical model - This model aims to follow the trend. Funds that use pro-cyclical models raise their equity exposure in rising markets and decrease it in falling markets. Pro-cyclical models rely on market trend indicators (daily moving averages) as well as trend strength/health indicators (standard deviation, downside deviation, etc.). Some pro-cyclical models may incorporate additional aspects such as valuations, macroeconomic conditions, and so on.

- Core and tactical strategy – Some funds have their core asset allocation strategy based on counter-cyclical model i.e. increasing equity allocations when valuations are falling and vice versa. At the same time, these funds tactically change their asset allocation based on market trend. For example, when valuations are higher the fund may have higher equity allocations relative allocation suggested by purely valuation based dynamic asset allocation models

Why a combination of valuation and trend-based model can be suitable in Indian market conditions?

- Counter-cyclical models are easier to understand.

- Low equity allocations at market tops reduce volatility during corrections.

- Valuations alone do not determine stock price movements. Momentum can propel stock prices far higher despite lofty valuations. Previous bull markets have proved that momentum works in India.

How did Balanced Advantage Funds perform in different market conditions?

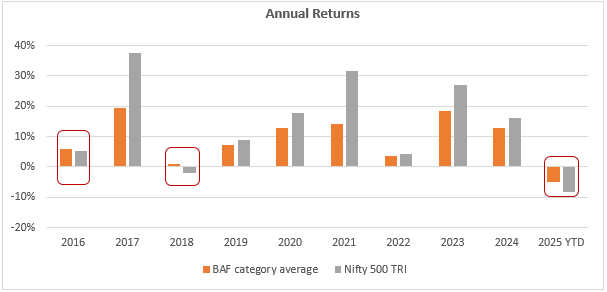

The chart below shows the calendar year returns of Balanced Advantage Funds category average versus Nifty 500 TRI over the last 10 years. You can see that Balanced Advantage Funds outperformed the broad market index (Nifty 500 TRI) in bearish conditions (reduced downside risks). At the same time in bullish conditions, balanced advantage funds were able to capture part of the market upside.

Source: Advisorkhoj Research, as on 25th February 2025

Why should you invest in Balance Advantage Funds?

- These funds are less volatile than aggressive hybrid funds due to smaller equity allocations during market peaks. As a result, during corrections, they may see lesser drawdowns.

- Balanced Advantage Funds are ideal for new investors who have not experienced market volatility, as they are less volatile than equity funds and aggressive hybrid funds.

- Since Balanced Advantage Funds usually adopt valuation based "buy low, sell high" investment strategy, they have the potential of generating risk-adjusted returns over long investment periods.

- Balanced Advantage Funds can benefit from equity taxation if their average gross equity exposure (hedged and unhedged) is 65% or higher. Investors should speak with their financial advisors regarding the tax treatment of their mutual fund schemes.

Who should invest in Balanced Advantage Funds?

- Investors seeking long-term capital appreciation and income opportunities

- Investors seeking lower downside risks in volatile markets

- Investors with moderately high-risk appetites

- Balanced Advantage Funds can be suitable for first time investors

- Investors with a minimum investment tenure of 3 to 5 years

Conclusion

Balanced Advantage Funds offer a systematic, quantitative approach to asset allocation, eliminating the need for human judgement. The models are back-tested in various market scenarios. You should understand the asset allocation model that a balanced advantage fund follows. You should also read the scheme information document (SID) to understand how dynamic asset allocation will function for your specific scheme. Consult a financial advisor or mutual fund distributor to understand the risk characteristics of a plan or your own individual risk profile. You should always make informed financial selections based on your risk tolerance and investment objectives.

Axis Mutual Fund launched its first scheme in October 2009 Since then Axis Mutual fund has grown strongly. We attribute our success thus far to our 3 founding principles - Long term wealth creation, Outside in (Customer) view and Long term relationship. Come join our growing family of investors and give shape to your desires.

Quick Links

Other Links

Follow Axis MF

POST A QUERY