Why you should use SIP Top up facility

Mutual fund systematic investment plan (SIP) is a very popular investment vehicle among retail investors in India. As per AMFI data (February 2021), there are nearly 3.63 crore SIP accounts in India. Nearly 1.25 crore new accounts were added till February 2021 in FY 2020-21 (source: AMFI). Till February year to date (FY 2020-21), total SIP contribution was Rs 86,898 crores. Besides the plain vanilla SIP, fund houses offer investors the facility of SIP Top-up, whereby you can use increase your SIP instalments at regular intervals. In this blog post, we will discuss about SIP top-up and why you should opt for it.

What is SIP Top-up?

SIP Top-up or SIP Step-up is a SIP facility using which you can increase your SIP instalments at regular intervals e.g. half yearly, annual etc. You can specify the SIP increment either in Rupees or in percentage terms. Let us assume that you have a monthly SIP of Rs 10,000 in a mutual fund scheme. If you opt for Rs 1,000 SIP top-up on an annual basis, your monthly SIP instalments will be Rs 11,000 after one year and Rs 12,000 in the following year. If you opt for 10% SIP top-up on an annual basis, your monthly SIP instalments will be Rs 11,000 after one year and Rs 12,100 in the following year.

You can use this SIP TOP UP CALCULATOR to plan your Mutual Fund SIP investment.

Increase savings with increase in income

Our salary usually increases over time. There is the annual inflation based salary increment. Further, you can also get performance based salary hikes. Also, as you progress through your career and take on increasing responsibilities, you get role based increments (promotion linked). As our income increases, it is natural for expenses to increase with change in lifestyle. As your salary increases, you may aspire to upgrade your car, move to a bigger house and make other changes to your lifestyle commensurate with your income. These changes usually entail more expenses. Along with lifestyle changes, aspirations may also change. Unless you increase your savings with income, you may fall short of your own aspirations with respect to different life-stage goals.

Increase your investments with income

We have stated many times in our blog that savings are not enough to achieve your financial goals. You must invest your savings in the right assets so that you can get sufficient returns for your financial goals. Financial advisors always recommend linking investments with financial goals. Mutual fund SIPs are great investment options for your long term financial goals. You may have a specific financial goal in mind when you start a SIP in a mutual fund scheme, but over time, as your income increases, your aspiration may become much bigger.

For example, you may be investing through SIP for your young child’s higher education e.g. medical college, engineering college, MBA etc. However, after some years, as you progress through your career, you may aspire to send your child to a foreign university. Cost of higher education in a foreign university e.g. an US university can be 4 to 5 times higher than the cost in an Indian university. If you do not increase your SIP investments over time, you will fall short of your changed aspirations.

Suggested reading: How can you maximize your Mutual Fund SIP Returns

Similarly, if you are investing through SIPs with a particular retirement goal in mind, over the next 20 – 30 years, with changes in your lifestyle you may need a much larger retirement corpus than what you had initially planned. Naturally your savings should also keep pace with your increase in income, so that you can maintain your lifestyle even after retirement. SIP top-up is a prudent approach to achieve your long term financial goals.

Benefit of SIP Top-up

Our regular blog readers are aware of the wealth creation potential of SIP over long investment horizons. The wealth creation potential of SIP Top-up is bigger – due to the enhanced power of compounding in SIP Top-up.

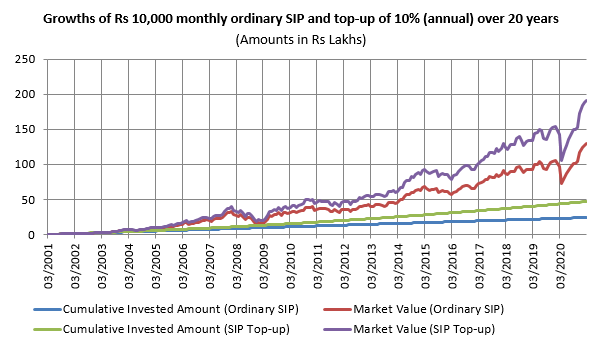

The chart below shows the growth of Rs 10,000 monthly ordinary SIP (no top-up) and one with top-up of 10% in Nifty 50 TRI over the last 20 years (ending 26th February 2021). You can see that SIP top-up was able to create much more wealth.

Source: National Stock Exchange (01.03.2001 to 26.02.2021), Advisorkhoj Research. Disclaimer: Past performance may or may not be sustained in the future.

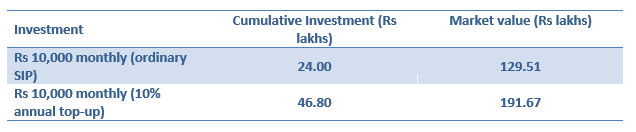

For the benefit of readers, we have summarized the results of the above analysis in the table below

Source: National Stock Exchange (01.03.2001 to 26.02.2021), Advisorkhoj Research. Disclaimer: Past performance may or may not be sustained in the future.

You were able to get additional wealth of Rs 60 lakhs, with additional investment of Rs 22.8 lakhs (spread over 20 years) i.e. extra profit / return of Rs 37.2 lakhs.

Things to keep in mind for SIP Top-up

We saw that there are considerable benefits in SIP Top-ups. You must keep the following in mind when opting for SIP top-up:-

- Just like plain vanilla SIPs, SIP top-ups call for disciplined investing. You should ensure that there is sufficient balance in your bank accounts for your monthly SIP auto debits.

- Once you setup a SIP Top-up, you cannot go back to an ordinary SIP. You will have to cancel the SIP and start a new one. Therefore, you should opt for a reasonable top-up amount or percentage, which you think you can sustain over long investment tenure.

- You can specify the upper limit to cap the top-up either in terms of the amount or the month and year. Topping-up the SIP will stop when the defined cap is reached. The SIP will however continue for the tenure for which the investor has signed up for with the instalment at the capped level.

- Some financial advisors may recommend changing your SIP to SIP Top-up in highly volatile markets to average your costs. We do not think this is the right approach. Just like plain vanilla SIPs, SIP Top-ups should be linked to your financial goals. You can invest in lump sum or short term STPs to take advantage of deep corrections.

Summary

In conclusion, we will summarize the benefits of SIP Top-up:-

- It automatically increases your savings with increase in your income

- Helps you achieve bigger financial goals

- It can fast track your goals e.g. plan for early retirement

- Additional wealth creation

- SIP top-ups are especially beneficial for young investors, who may start with a small SIP instalment and grow it over their working careers.

SIP top-up is good investment option to achieve your long term financial goals. You should consult with your financial advisor to learn more about SIP top-ups and how it can benefit you.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY