Why you must avoid these 5 cardinal mistakes in volatile stock market

The stock market has been quite volatile this year. In the last 2 months or so, Nifty has declined by around 10%. Such big declines in the past may have triggered off panic selling by retail investors but mutual fund SIP inflows have continued to remain robust, with record inflows in the month of September 2018. Volatility in stock markets around the world, particularly emerging markets has been caused mainly by rising interest rates in the US. The commentary from the last US Federal Reserve monetary policy meeting indicates that the Fed does not intend to slow down their interest rate hike program. This will have implications on the Rupee and therefore, stock market volatility can be expected to continue for some more time.

Source: National Stock Exchange

Though retail investors have shown good resilience and discipline so far, if volatility persists and market declines by another 10% or more, investors may start having doubts about their investment strategy. I have followed the stock market for the last 20 years and have seen multiple bear markets. I have seen investors making some common mistakes in market crashes. Many investors had to pay heavily for these mistakes in the long term. In this blog post, we will discuss some mistakes which you must avoid in volatile market.

You must read: Interest rates and equity market relationship: Short term and long term

Do not sell in panic

A market high may be a good time to sell, but retail investors rarely sell when market is high. They usually sell when the market has fallen 15 – 20%. This is the worst time to sell. You should understand that, as long as you remain invested rise or fall in the asset values (stocks or mutual funds) results only in book profit or loss. You make an actual profit or loss, only when you sell. If a stock or mutual fund in your investment portfolio has fallen 20% in value, it is only a temporary or notional loss. If you remain invested in the stock or fund, it is quite likely that it will eventually recover and you may be able to make a good profit in the long term. But if you sell, the notional loss will become apermanent loss for you.

If you think that a particular stock or fund in your portfolio has underperformed, then you should try to understand why it has underperformed. You should always evaluate the performance of a stock or fund relative to the market. If your mutual fund NAV has fallen 10%, while the market has fallen 15%, then even though you might feel disappointed seeing your investment declining in value, your investment has actually done well on a relative basis.

However, a big market crash gives you an opportunity to understand your risk appetite better. Take the example of midcap stocks and funds. This year the Nifty Midcap 100 index fell by nearly 22%. However, from December 31, 2013 to December 31, 2017, Nifty Midcap 100 grew at a CAGR of 27%; your investment in midcap would have multiplied nearly 3 times during this period. You should know that Risk and return are directly related. Different segments of the market have different risk profiles. If you think you do not have the appetite for volatility associated to certain market segments, you can align your investment strategy to segments which are less volatile.

Avoid Value Traps

Investors can be tempted to do bottom fishing (buying stocks which have fallen a lot) in market crashes. My experience of bear markets, including investing mistakes which I made personally, tells me that bottom fishing can be like catching a falling knife. During deep market corrections, you will often come across blogs / articles which have fallen 40 - 50%. Unless you have sufficient expertise in fundamental analysis, which includes understanding the business of a company, the financial situation and analyzing its future prospects, you should avoid bottom fishing.

The price of a stock can be low, simply because earnings growth potential is low. If you simply invest on the basis ofprice or valuation, you run the risk of getting caught in a value trap. Value trap means that you can get trapped in a stock, whose price seemed very attractive when you invested, but it continues to remain low for a long period of time. If you have money to invest in a bear market, it is advisable to invest in mutual funds with good track record. Mutual funds are managed by experienced fund managers who have expertise of identifying good value or growth opportunities. Mutual funds also offer the benefits of diversification, which will ensure that your hard earned money is not stuck with one or two underperforming stocks.

Avoid margin trading and futures

Even in bear markets there will be a few stocks which does well on an intraday basis or continue to rise for a few days. Your stockbroker may tempt you to take large exposures in these stocks on margin. If the share price rises, you can make a sufficiently large intraday profit. Even if the stock price falls and you make a loss, the broker can offer you margin funding, so that you can carry over your position for a few days in the hope that the price will recover. You should not fall for this temptation because margin funding has a cost which you will have to incur. In a bear market, stocks can fall 10 – 15% in a day. You should understand that, in margin trading you usually take a bigger exposure than what your risk capacity allows. But if you make a loss, you will have pay for the loss of your total exposure – this makes it very risky, unless you are an expert trader.

The same applies for futures trading. You may have heard stories about how investors made millions by selling futures in bear markets and be tempted to take short positions (sell futures) but it is very risky. Futures are marked to market daily; if the marked to market margin balance falls below the margin requirement, if the market moves in the opposite direction, you will get a margin call from your broker and will have to make up for the margin shortfall, which can often result in a big loss for you. Stock markets are unpredictable and the market is never one way (one way rise or fall). In bear markets there may be pullback rallies which can cause a big marked to market loss and funds outflow, if you took short position in futures.

Would you like to read – Should you invest in equity mutual funds or directly in stocks

Avoid sector concentration

In falling markets, some industry sectors fall more than other sectors. Sectors where prices have fallen more, may seem attractive buys but you should avoid the temptation. For example, sectors like non banking financial companies (NBFCs), real estate, automobiles etc. may fall more than other sectors, when interest rate rises. Similarly oil market companies may underperform when crude price rises. But under performance does not necessarily make a sector unattractive over other sectors; you have to understand the fundamentals of the business and growth prospects, otherwise you may to live with underperformance for a long time.

Defensive sectors tend to outperform in bear markets. You may also be tempted to buy stocks or funds in these sectors. They may continue to outperform in certain market conditions, but when the market recovers the cyclical sectors, which perform poorly in bear markets, are likely to outperform. Diversification is extremely important if you want to get the best returns from your investment in the long term. Mutual funds diversify their investments across multiple sectors and change sector allocations from time to time so that you can get good returns over a long investment horizon, across different market conditions.

Did you know what are the most important parameters in selecting mutual funds

Do not stop your SIPs in falling markets

Systematic Investment Plans (SIPs) have become quite popular among retail investors because their benefits over a long investment horizon are enormous. In falling markets, you may see your investment value decline despite making fresh investments through the SIP mode. You may ask yourself, why you are investing your savings every month only to see them decline in value; you may be tempted to stop your SIP and wait till the market recovers.

Stopping your SIP in a falling market is a big mistake because it defeats the purpose of SIP. SIPs enable investors to take advantage of volatility by investing a fixed amount every month (or any other frequency) at different price levels. This is known as Rupee Cost Averaging. When the market falls, through SIP, you will be buying Mutual Fund units at lower and lower cost till the market recovers; this will lower your average cost of acquisition of units and over a long investment tenor can significantly enhance your returns.

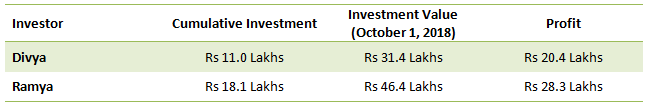

Let us understand this better with the help of an example. Let us assume that Ms Divya and Ms Ramya both started a SIPs of Rs 10,000 in Nifty 15 years back on October 1, 2018. Ms Divya stopped her SIP whenever the Nifty fell 20% or more and waited for market to recover to its previous high to resume her SIP. Ms Ramya simply continued with her SIP irrespective of market levels. Let us see the results of both, as on October 1, 2018.

To Calculate SIP returns of any Benchmark including SENSEX and NIFTY you can use this tool

Even though Divya put in much more effort than Ramya, tracking the market and executing transactions based on market levels, she made Rs 8 Lakhs less profit than Ramya. Even if Divya, invested her savings during the period she stopped her SIP in bank recurring deposits, she would have got much lesser returns than Ramya, who simply stayed disciplined in her investments. How did Ramya get much better returns? She got better returns through Rupee Cost Averaging. Market recovery is not always V-shaped;it can be U-shaped, it can make double bottoms and other patterns. By remaining invested in falling markets through SIP you can take advantage of low prices, which can considerably enhance your returns in the long term. Therefore, you should stick to your financial plan and not stop your SIP in down markets.

You must know which is a better investment option? Lump sum or SIPs

Conclusion

Warren Buffet said that, investing success is as much about Emotional Intelligence as IQ. Though we read blogs about why market corrections are the best time to invest, there is no denying that high volatility causes stress in investors. This is where financial advisors have an important role to play, in terms of handholding investors through difficult times. When the going gets tough (and we may see tougher times ahead), the tough gets going. If you remain disciplined in your investments and stick to your financial plan, you will achieve success in your financial goals.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY