What personal finance lessons can we learn from COVID 19 pandemic

The COVID-19 pandemic has been the greatest crisis faced by the world, including India, in many generations. Everyone has been affected by the pandemic in some form or other. Many people have lost their loved ones or seen them suffer through sickness. Others may have suffered from financial difficulties caused by the pandemic. At the very least, all of us saw major disruptions in our usual day to day lives. However, there are many important lessons that we learnt from the events of this period as far personal finance is concerned.

We did an article on similar lines and you may like to read it – How to be prepared for uncertain times

Have an emergency fund

One of the fall-outs of any big financial crisis is to deal with sudden risks e.g. job loss, loss of income in business, unexpected large expenses, etc. Even if these risks do not materialize, the prospect of having to face these risks is a frightening one for most middle income households. The very purpose of an emergency fund is to enable you to face these risks without having to liquidate your long term assets. Financial planners recommend that you should have an emergency fund that can meet 6 to 12 months of your regular monthly expenses, should you face a sudden exigency. Debt mutual fund schemes like overnight funds, liquid funds and ultra-short duration funds are suitable instruments for parking your emergency funds.

Invest in financial assets

Physical assets like land, real estate, gold jewellery, etc. still hold a lot of allure for average Indian households. Though the proportion of physical assets in average household savings have come down over the last 10 years (source: RBI), many Indian households have a large percentage of their net worth still invested in physical assets. Physical assets can be very difficult to liquidate during a major crisis and can often lead to distress sale in extreme situations. Further, sale of physical assets often require physical interactions and a lot of time to complete. Financial assets, on the other hand, are much more liquid. Most financial transactions can be carried out online. The COVID-19 crisis has shown that financial assets are much more useful in extreme situations.

Do not panic

Volatility can be very stressful emotionally. No one likes to see investments made with their hard earned money go down. Volatility can be extreme as we saw during the first wave of COVID-19 pandemic and before that during the Global Financial Crisis of 2008. But if you panic and sell, you will make a permanent loss. Being patient is of utmost importance during a crisis.

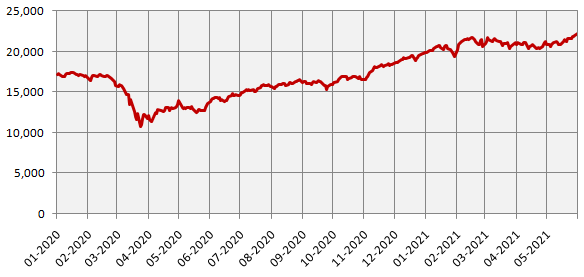

The chart below shows the movement of Nifty 50 TRI from 1st January 2020 to 31st May 2021. The market (Nifty 50 TRI) crashed by 38% from its peak (maximum drawdown), but recovered back to previous peak in 7 – 8 months. Over the last 18 months (ending 31st May 2021), Nifty 50 TRI gave 19% CAGR returns. This shows that patience is your greatest virtue in extreme market conditions.

Source: National Stock Exchange, Advisorkhoj Research (Period: 01.01.2020 to 31.05.2021). Disclaimer: Past performance may or may not be sustained in the future

You may also like to read what should you do when the stock markets are at high level

Asset allocation is your best friend in uncertain conditions

There is low or even negative correlation between performances of different asset classes in different market conditions. Diversifying across different asset classes limit downside risk and provides stability to your portfolio across investment cycles.

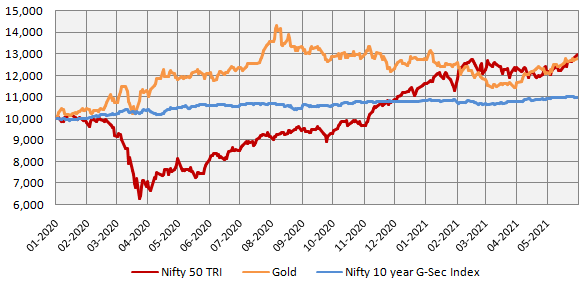

The chart below shows growth of Rs 10,000 investment in Nifty 50 TRI (representing equity), Nifty 10 year benchmark G-Sec index (representing debt) and Gold. You can see in the chart below that, gold is counter-cyclical to equity, while debt gave steady returns despite high equity volatility. Your asset allocation should depend on your risk appetite and financial goals. You should consult with your financial advisor to know what asset allocation will be best suited for your requirements.

Suggested reading – How to choose the right mutual funds according to your need

Source: National Stock Exchange, Advisorkhoj Research (Period: 01.01.2020 to 31.05.2021). Disclaimer: Past performance may or may not be sustained in the future

Did you know what are 5 important factors to look in debt mutual funds?

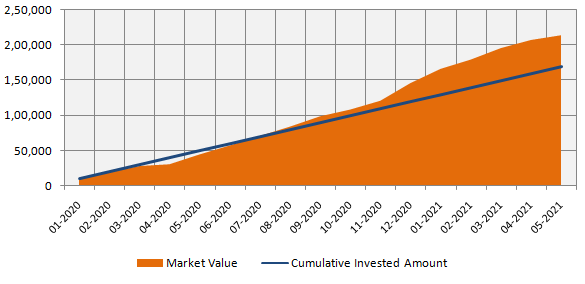

Remain disciplined with your SIPs

As the market goes down, there may be an impulse among some investors to stop investing. The chart below shows the growth in value of Rs 10,000 monthly SIP in Nifty 50 TRI from 1st January 2020 to 31st May 2021. You can see that, if you stopped your SIP and redeemed in March / April 2020 when the market was very volatile, you may have suffered a loss. However, if you continued your SIP, you would have got good returns. With cumulative investment of Rs 170,000 you could have accumulated a corpus of Rs 229,000 in the last 18 months. Volatile markets provide an opportunity to lower your average cost of purchase through Rupee Cost Averaging. You should remain disciplined in your SIPs irrespective of market conditions.

Source: National Stock Exchange, Advisorkhoj Research (Period: 01.01.2020 to 31.05.2021). Disclaimer: Past performance may or may not be sustained in the future

Conclusion

COVID-19 has been one of the worst crises that we have seen in our lifetimes. This is not going to be the last crisis that we will ever face. But lessons learnt from this crisis will help us be better prepared to face future crises and emerge stronger from it. The lessons learnt from this crisis are certainly not new, since we have discussed these in our blog several times over the last few years, but a crisis of the magnitude of COVID-19 tells us, how important these basic lessons are. You can also discuss with your financial advisor how to be better prepared for the future.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY