Interest Rates and Equity Markets Relationship: Short term and Long term

Earlier this week we saw major correction in equity markets around the world, including India. This sell off in equity markets was caused by a several comments made by US Federal Reserve officials over the last few weeks, hinting at a rise in the interest rates (Fed Funds Rate) this year. Policy inaction by the European Central Bank and confusion ahead of the Bank of Japan monetary policy meeting next week has raised further fears in equity markets.

Though we saw a rally on Monday in US stocks my sense is that, still nervousness will prevail in the market, till the Fed policy meeting next week. Over the past year or so, we had a number of events which caused jitters in equity markets globally, namely the Greece Debt Crisis, Brexit, China economic slowdown and Yuan devaluation, but I have mentioned that the biggest risk to equity markets globally will be caused by news flow from the US. While rise in US interest rates will definitely have an impact on the equity prices in the short term, for long term equity investors, rise in US interest rates is not necessarily a bad thing (we will explain why, later in the post).

In this post, we will discuss the relationship between interest rates and equity markets. We will discuss why markets are happy when interest rates are cut and why they are nervous when interest rates are expected to rise. For the benefit of long term equity investors, we will also examine the long term relationship between interest rates and equity market returns in the Indian context

Relationship between interest rates and equity returns in the short term

Readers, who are not very familiar with capital markets, may wonder, what has interest rates got to do with equity markets. Some of you may have observed that the markets react positively when the RBI announces a rate cut and reacts negatively when interest rates are increased. What explains such behaviour?

Let us try to understand the relationship between interest rate and equity prices in very simple terms. Interest is essentially the cost paid by the borrower for using the money of the lender for a specified period of time. Now ask yourself, why would you borrow money? You borrow money to spend on something; if you do not have to spend, there is no need to borrow. Therefore, when people borrow less, they also spend less. You should understand that, spending by you is income for others.

For example, if you take a loan from a bank and buy a car or house, the car manufacturer or the builder get income from the sales made to you. Low or high interest rates provide incentive or disincentive to borrow. For example, you want to buy a house for which you will have to take a loan. If interest rates are low, you will take a loan to purchase the house and the builder will get revenues. However, if interest rates are high, unless you are in a desperate need, you will not be inclined to take a loan and will wait till interest rates come down; the builder will not be able to sell the house and will lose revenues.

Therefore, low interest rates will result in more sales for the car manufacturer or the real estate company (house builder), while high interest rates will result in less sales for them. When sales increase, profits and share prices of the manufacturers increases; when sales decline, profits and share prices of the manufacturers falls.

What applies to you as an individual also applies to companies. When interest rates are low, companies will borrow more to expand their capacities, which in turn can lead to higher sales. On the other hand, when interest rates are high, the company will refrain from borrowing and spending on capex. If a company is operating at low capacity utilization, it can increase sales by simply improving its capacity utilization. But if the capacity utilization is high, the company will not be able to increase its sales, unless they add more capacity. To add more capacity, companies need more money, but if interest rates are high, then they will be hesitant in borrowing money and as a result, will give up on higher revenues and earnings. Interest rates will have an effect not just on the manufacturer but across the supply chain. If the manufacturer is producing more, it will buy more from its suppliers; if it is producing less, it will buy less from its suppliers. Interest rates also affect the distributors or dealers of the manufacturers. That is why markets react positive to news of interest rate cuts and negatively to news of interest rate increases.

Interest rates changes also affect behaviour of investors. Rise in interest rate causes a flight to safety, because safer fixed income investments, like Bank Fixed Deposits, Government bonds etc become more attractive investment options relative to equity. Fears of interest rate increase also cause the yield curve to flatten out (we have discussed the yield curve and the implications of its various shapes in our post, Make Debt Funds your friend: Basics of fixed income investing Yield Curve).

Interest rates and bond prices have an inverse relationship; rising interest rates causes bond prices to decline and long duration bonds are the worst affected. Therefore, if there are fears that interest rates will rise, long duration bond investors will sell. As discussed in our post, Make Debt Funds your friend: Basics of fixed income investing Yield Curve, flattening yield curve increases uncertainty and with increase in uncertainty, equity investors will demand higher risk premiums (if you are taking more risks, you will want more returns). While with higher interest rates and higher risk premiums, the investor demands higher returns, the earnings or cash-flow projections of companies do not change; it can actually worsen for companies in rate sensitive sectors. The mismatch in risk premium and the fair value of the company (in terms of cash flows), will lower investors demand for stocks and will, therefore, affect stock prices.

We have tried to explain, why stock prices are affected when interest rates go up or down. However, at this point of time, I would like to stress that, the behaviour that we have tried to explain is strictly short term behaviour. As far as long term share price behaviour in relation to interest rates is concerned, investors should try to analyze, the cause of change in interest rates.

Central banks around the world (including RBI) have two main concerns with respect to interest rates; the effect of interest rates on inflation and the effect on GDP growth. Both these effects are inter-connected and therefore, the central banks have to maintain a careful balance between the two. We had discussed earlier that, lower interest rates stimulate demand for goods. However, it is also important to remember that, higher demand leads to higher prices. Inflation affects the poorest sections of the economy the most. Central banks (including our RBI) have the responsibility of protecting the weaker sections of the economy from price rise, and they do it by adjusting interest rates (the Repo Rate in case of India, the Fed Funds rate in the US).

It is very important for investors to understand that, higher demand in the economy is not caused by interest rates alone; there are other important factors at play. While interest rates certainly have a role in stimulating GDP growth, GDP growth is caused by higher per capita income, increased capital productivity and ease of doing business. Higher GDP growth will inevitably result in higher inflation, for which the central bank (RBI) will have to increase interest rates, but history has shown that, GDP growth can be restrained somewhat, but not reversed, by higher interest rates.

The 90s was one of the best periods of the US economy. There is no doubt the US boom in the 90s was triggered, in no small measure, by the Fed rate cut in 1991, but the economy continued to boom despite Fed rate hikes in the mid and the late nineties. The 90s boom in the US came to an end in 2001, because the business cycle of the 90s ended, not because of high interest rates.

Similarly, if you look at the Indian economy, the early and mid 2000s, right up to 2008, was characterized by high GDP growth. If you look at interest rates in our economy, interest rates were rising from 2003 to 2008, but this was also the period, when we had high GDP growth. High interest rates in the long term signify high growth, which is beneficial for equity investors.

Relationship between interest rates and equity returns in the long term

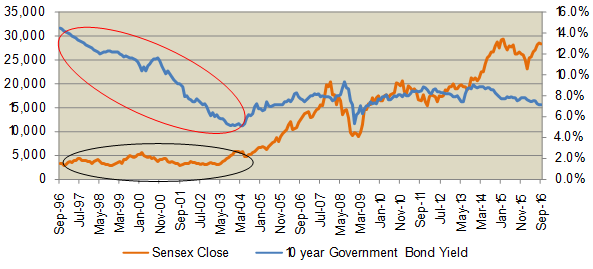

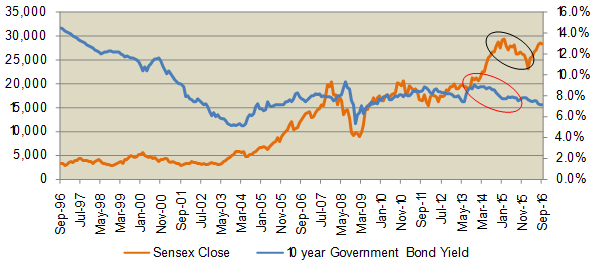

Let us examine the relationship between interest rates and equity returns in the long term by analyzing interest rates and equity returns data over the last 20 years. For the purposes of this analysis, we have taken the 10 year Government Bond yield as the proxy for interest rates; the 10 year G-Sec yield approximates to the prevailing risk free rate (also the bank FD rates) in our economy. We have used the BSE - Sensex as proxy for equity investments in our analysis. We have looked at 10 year bond yields and Sensex values over the last 20 years, so that we could examine their relationship in different market cycles (bull or bear markets) and interest rate scenarios (rising interest rate or falling interest rate regimes). The chart below shows the 10 year Government bond yield and Sensex values over the last 20 years.

Source: Bombay Stock Exchange and Reserve Bank of India

The orange line shows the monthly Sensex closing value corresponding to the vertical axis on the left side of the chart, while the blue line shows the 10 year Government Bond yield corresponding to the vertical axis on the right side of the chart. Please focus your attention, on the red and black ovals on the chart. From the 1996 to April 2004, the 10 year yield declined by more than 9% (shown in the red circle), but the Sensex, over this period, was relatively flattish. From September 1996 to April 2004, Sensex gave a compounded annual growth rate (CAGR) of only around 7%, lower than what an investor could have got from fixed income investment over the same period. This shows that, over a long timeframe, falling interest rates do not imply high equity returns. Let us now look at the period between 2004 to early 2008.

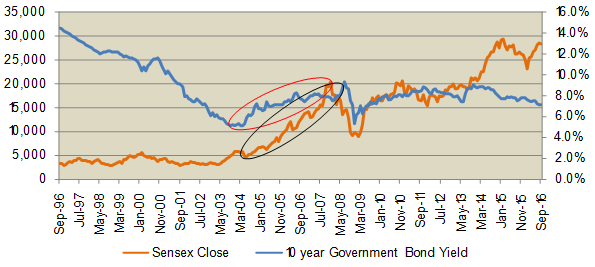

Source: Bombay Stock Exchange and Reserve Bank of India

Please focus your attention on the red and the black ovals on the chart. You can see that, from 2004 to early 2008, interest rates (10 year yields) were rising, but the Sensex was also rising during that period. During this period bond yields rose by 5%, while the Sensex rose by almost 260% (a staggering 40% CAGR over approximately 4 years), giving fantastic returns to equity investors. Whoever said that equities do not give good returns in rising interest rate regime! At the peak of the financial crisis in 2008, central banks around the world, including RBI, had to take desperate measures, to prevent the 2008 financial crisis from becoming worse.

A lot of fiscal and monetary economic theories are derived from the lessons learnt during the Great Depression of the 1930s in the United States. The Great Depression, many monetary economists argue, was caused by the US Fed doing nothing. The lesson learnt, stood us in good stead in the worst financial crisis after the Great Depression, the financial crisis of 2008, when central banks around the world (including India) pro-actively reduced interest rates and injected liquidity in the banking system.

You can see in the chart above the interest rates were cut and the bear market bottomed out in 2009. This is a great example, where pro-active monetary by central banks and fiscal policies by Governments around the world, prevented a much worse financial crisis from affecting us. Let us now look at the post 2008 period.

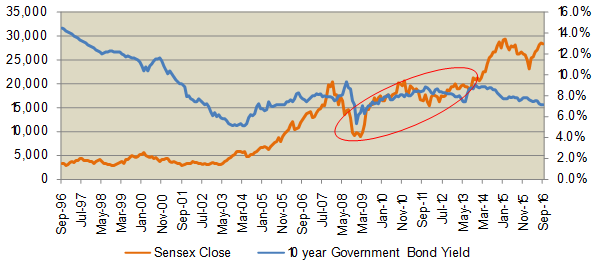

Source: Bombay Stock Exchange and Reserve Bank of India

Please focus your attention on the red oval in the chart above. You can see that the interest rates (10 year bond yields) rose by nearly 3.5% from early 2009 to mid 2014. During this time, the Sensex rose by 127% (18% CAGR), giving fantastic returns to equity investors.

From mid 2014 the market has rallied further but in 2015, even though RBI reduced repo rates a number of times, it did not stop the downward slide of the market. Please see the red and black ovals in the chart below.

Source: Bombay Stock Exchange and Reserve Bank of India

Conclusion

The market has since March 2016 recovered considerably. Going back to the beginning of this post, there are valid concerns about interest rates globally, particularly in the US. But it will, as discussed in this post, only have a short term impact on equities, by reducing liquidity available for equities. Since the financial crisis of 2008, central banks in the US and other major economies, have kept interest rates very low. From a longer term perspective, however, increase in interest rates in the US will be a sign that, the US economy is strengthening and does not need the monetary stimulus. A strong US economy is a source of demand from emerging economies like India and is also a source of capital for investments in economies like ours. If interest rates rise in the US due to lower unemployment and higher inflation, the short term impact notwithstanding, it is not bad news for long term equity investors; on the contrary it is good news.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY