How to plan for your retirement with mutual funds: Part 2

In the first part of this two part series, How to plan for your retirement: Part 1, we had discussed why retirement planning is important and how much you need to save / invest in order to meet your retirement goal. In this second and final part, we will discuss how mutual funds can help you meet your retirement goal. Before we get into the nitty gritties of the topic, let us understand different cycles of wealth creation; you need to create wealth to maintain your financial independence and lifestyle to enjoy a long and fulfilling retired life.

3 phases of wealth creation

- Accumulation phase: In this phase you accumulate a corpus by saving and investing. This phase covers a large part of your working career.

- Transition or preservation phase: By the time, you have entered this phase, you would have accumulated substantial phase. Now your main goal is to preserve the wealth or grow it further, without taking undue risks. This is the phase when you are approaching retirement or other important life-stage goals like children’s higher education, marriage etc.

- Distribution phase: This is the phase where you reap the benefits of the hard work that you have put in your working career. You are now dependent on the income from your investments. This is typically, the retired phase of your life.

Mutual funds provide solutions for all three phases of wealth creation. In this post, we will discuss how you can approach mutual funds from the point of an average salaried retail investor looking to save for his / her retirement.

SIP for the accumulation phase

Systematic Investment Plan (SIP) is a mutual fund investment facility where you can invest relatively small amounts at regular intervals (e.g. weekly, fortnightly, monthly etc). In monthly SIPs, for example, the SIP amount gets auto-debited from your savings bank account every month and gets invested in the mutual fund scheme of your choice. The AMC will allot you units of the mutual fund scheme based on the prevailing Net Asset Values (NAV). SIPs are ideal for the wealth accumulation phase for the following reason:-

- You can start investing from your regular savings, early in your working careers with relatively small amounts through SIPs. You can start SIPs with just Rs 500 or Rs 1,000.

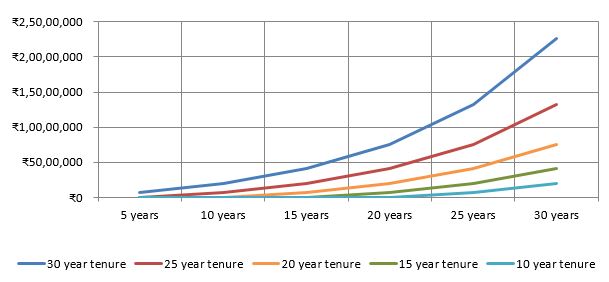

- By starting early, you give yourself long investment tenures, by which you can benefit from the power of compounding. Compounding is profit made on profits re-invested. In the chart below you can see the growth of Rs 10,000 monthly SIPs over different investment tenures e.g. 10 years, 15 years, 20 years, 25 years, 30 years etc. at 10% annualized return on investment (ROI). You can see that, wealth grows exponentially over long investment tenures.

- SIPs help you remain disciplined in your financial plan. SIPs make market timing irrelevant since you are investing at different price levels. Lack of discipline can lead investors to make emotional decisions (due to greed and fear) in both momentum driven and high volatile markets. This will harm your interests in the long term.

- By investing at a regular frequency, you can take advantage of market volatility by averaging the cost of the investment. Rupee Cost Averaging can lower the cost of acquisition of units in volatile or bear markets.

- Invest in the right asset class to reach your financial goals. Equity, as an asset class has the potential to give superior returns in the long term, based on historical data. The chart below shows the returns of Rs 10,000 monthly SIP in Nifty 50 TRI over the last 20 years. With a cumulative investment of Rs 24 lakhs over the last 20 years, you could have accumulated a corpus of nearly Rs 1.4 crores (as on 31st December 2021) for your long term goals e.g. retirement planning. As equity funds or aggressive hybrid funds may be suitable investment options for younger investors, investing for retirement planning.

Source: Advisorkhoj analysis. Assumptions: Rs 10,000 monthly SIP, 10% CAGR ROI. Disclaimer: The chart above is purely illustrative for investor education purposes only. The chart should not be taken as an indicator of future returns or as investment recommendation. Consult with your financial advisor before investing.

Source: National Stock Exchange, Advisorkhoj analysis. Period: 01.01.2002 to 31.12.2021. Disclaimer: Past performance may or may not be sustained in the future.

You may like to read: how can you maximise your Mutual Fund SIP returns?

Transition or preservation phase

As you approach your financial goals, you need to change your investment strategy because you cannot risk your financial goal to the vagaries of financial markets. Accordingly, you should change your asset allocation from higher risk profiles to lower risk profiles. Mutual funds offer a wide variety of solutions for investors of different risk appetites and investment goals.

There are different types of hybrid funds e.g. balanced advantage funds, equity savings funds, conservative hybrid funds etc and debt funds e.g. low duration funds, short duration funds, medium duration funds, corporate bond funds, banking and PSU funds which have different risk / return profiles. Select the appropriate fund, to switch your asset allocation based on your risk appetite and investment needs. At the same time, you should continue to have allocations to equity even after your retirement so that you can generate capital appreciation to fight inflation in the long term.

SWP in the distribution phase

This is your life stage, where you are dependent on the cash-flows generated from the corpus that you have accumulated. A large section of senior citizens in India are dependent on the interest from bank Fixed Deposits and Government Small Savings Schemes e.g. Senior Citizens Savings Schemes, Post Office Monthly Income Schemes etc. However, mutual funds offer solutions that have the potential of generating higher income (subject to market risks) and are also more tax efficient than traditional fixed income investment options.

Systematic Withdrawal Plans (SWP) is a mutual fund investment solution which gives fixed cash-flows at regular intervals. You can specify the amount, the intervals (e.g. monthly, quarterly, annual etc) and day of the month, quarter etc, when SWP takes place and the amount credited to your bank account. In order to generate the cash-flows for SWP, the asset management company will redeem units of the scheme from your folio. The number of units redeemed will depend on the SWP amount specified by you and the prevailing NAV. The number of units redeemed will depend on the SWP amount specified by you and the prevailing NAV.

The chart below shows results of SWP from an Rs 1 crore investment in portfolio of mutual fund schemes comprising of 50% equity funds and 50% debt funds over the last 10 years ending 31st December 2021. Let us assume you withdraw Rs 50,000 every month from this portfolio. You can see that, despite withdrawing Rs 60 lakhs over the last 10 years from this portfolio, your wealth would have grown to nearly Rs 2.2 crores over the last 10 years. This wealth creation will enable to withdraw more from your investments to meet inflation.

Source: National Stock Exchange, Advisorkhoj analysis. Period: 01.01.2012 to 31.12.2021. Assumption: Equity funds are represented by the index Nifty 50 TRI and debt funds are represented by the index Nifty 10 year benchmark G-Sec index. Disclaimer: Past performance may or may not be sustained in the future.

Suggested reading: Are you investing in the right hybrid mutual funds

SWP is more tax efficient

SWP is more tax efficient than traditional fixed income investments. Profits made in withdrawals made after 12 months from the date of investment in equity oriented funds will be subject to long term capital gains tax. Long term capital gains in equity oriented funds are tax free up to Rs 100,000 per year and taxed at 10% plus applicable surcharge and cess, thereafter. Profits made in withdrawals made after 36 months from the date of investment in non equity or debt oriented funds will be subject to long term capital gains tax. Long term capital gains in non equity or debt oriented funds are taxed at 20% plus applicable surcharge and cess after allowing for indexation benefits.

Things to note in SWP

You should have moderate withdrawal rates if you want to continue your SWP for a long period of time. If your annualized withdrawal rate is lesser than the average return on investment, you can get both regular cash-flows and capital gains from your SWP over sufficiently long investment tenures. You should be mindful of exit loads and short term capital gains when planning your SWP. You should consult with your financial advisor if required.

Conclusion

- Know how much you need to save and invest for your retirement.

- Start saving and investing, as early in your working career, as you possibly can.

- Remain disciplined in your investments. Do not make emotional decisions based on market movements.

- Focus on asset allocation to balance risk and return as you progress through different life-stages.

- Consider tax implications in making investment decisions.

Consult with your financial advisor, if you need help in planning your retirement.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY