Do you know what is the Mutual fund taxation for FY 2020-21

Several important tax changes were announced in Union Budget of 2020. Taxation is an important consideration in financial planning from various tax savings options to tax consequences of your investments. Investors should note that several important changes were announced in the Budget which may have an impact on your income tax.

In this blog post, we will discuss only about mutual fund taxation for FY 2020-21, including the impact of the changes announced in the 2020 Budget. You should consult with your tax consultant or chartered accountant to know about the other tax changes, including the new tax regime.

Readers who are also interested to know what was the taxation of mutual fund in the last FY (2019-20) may read this link.

Types of mutual funds for tax purposes

We have discussed about different types of mutual funds in our blog, but for purposes of taxation there are two types of funds:-

- Equity Funds: From a tax perspective, a fund in which at least 65% of the portfolio is allocated to domestic (Indian) equities is an equity fund. Please note that as far as mutual fund taxation is concerned, derivatives whose underlying assets are stocks (or stock indices) are also considered to be equity. Apart from funds which are categorized as equity funds as per SEBI’s classification, certain types of hybrid funds where average gross equity allocation is more than 65%, like aggressive hybrid funds, arbitrage funds, equity savings funds etc are also treated as equity funds from a tax perspective. ETFs and index funds are also taxed as equity funds, since the underlying asset class (at least 65%) is Indian equities. If you are unsure about the tax treatment of a mutual fund scheme in your portfolio, you should consult your financial advisor.

- Non-Equity Funds: Non-Equity funds from a tax standpoint are mutual fund schemes which have less than 65% allocation to equity in their portfolio. Non-equity funds include schemes which are classified as debt funds as per SEBI’s definitions and certain types of hybrid funds where equity allocation is less than 65%, like conservative hybrid funds. Investors should note that mutual fund schemes which invest primarily in international equities are taxed as non-equity funds, even though the underlying asset class is equity. Investors also note that Fund of funds, whether the underlying funds are equity funds or not, are treated as non-equity funds. Gold ETFs, Gold fund of funds are also treated as non-equity funds. Again, if you are unsure about the tax treatment of a mutual fund scheme in your portfolio, you should consult your financial advisor.

Incidence of taxation in mutual funds

New mutual fund investors should know that incidence of taxation in mutual funds arise only for the following outcomes:-

- Capital Gains: Capital gain is the appreciation in the value (redemption value – purchase value) of the units of a mutual fund that are redeemed. Investors should know that capital gains are taxed only at the time of redemption or sale. In other words, capital gains tax is levied only on realized gains. If your mutual fund units have appreciated in value and you are still holding them, then there is no taxation on the unrealized gains.

- Dividends: Dividends are profits made by a mutual fund scheme which is paid to unit-holders at intervals determined by the Asset Management Companies. Dividends may be paid yearly, quarterly, monthly etc. All dividends are taxed. If a scheme does not pay dividends and you do not make any redemption, then there will be no tax on scheme. An important change has been made in dividend taxation in 2020 Union Budget, which we will discuss later in this post.

Capital gains taxation

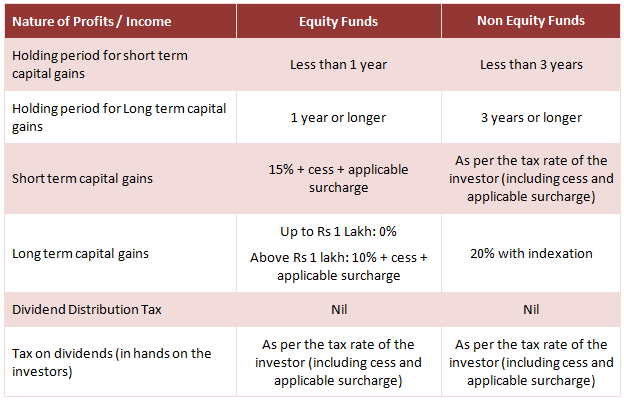

- For equity funds: If you sell units of equity funds before completion of 1 year from date of investment, then it is treated as short term capital gains from a tax standpoint. Short term capital gains in equity funds are taxed at the rate of 15% plus 4% cess and applicable surcharge (if any). If you sell units of equity funds after completion of 1 year from date of investment, then it is treated as long term capital gain. Long term capital gains of up to Rs 1 Lakh are tax exempt in a financial year. Long Term Capital gains in excess of Rs 1 Lakh are taxed at 10% plus cess and applicable surcharge (if any).

- For non equity funds: If you sell units of non equity funds before completion of 3 years from date of investment, then it is treated as short term capital gains from a tax stand point. Short term capital gains in non equity funds are added to the income of the investor in his / her Income Tax Returns and taxed as per applicable tax rate (including cess and applicable surcharge) of the investor. If you sell units of non equity funds after completion of 3 years from date of investment, then it is treated as long term capital gains from a tax standpoint. Long term capital gains of non-equity funds are taxed at 20% with indexation. To calculate capital gains with indexation, you should index your purchase cost by multiplying the purchase cost with the ratio of the cost of inflation index of the year of sale and cost of inflation index of the year of purchase, and then subtract the indexed purchase cost from sales value.

Dividends taxation

There have been several changes to taxation of dividends paid by mutual funds over the past two years. We will not go into the history of tax changes in mutual fund dividends in this post, but suffices to say that prior to the current financial year dividends were tax free in the hands of the investors. However, prior to this financial year, the AMC had to pay dividend distribution tax (DDT) before paying dividends to investors. The DDT was obviously deducted from the dividends and what investors received was net of DDT.

One of the most important tax changes in the 2020 Union Budget was the abolition of Dividend Distribution Tax, which experts saw as a regressive tax. Going forward, AMCs will not deduct DDT from mutual fund dividends. So dividends in the hands of the investors are likely to increase in absence of DDT. However, dividends now will be taxed at the hands of the investors. Dividends paid by mutual funds (whether equity funds or non-equity funds) will now be added to the income of the investor in his / her Income Tax Returns and taxed as per applicable tax rate (including cess and applicable surcharge) of the investor.

You may like to read which is a better option – Dividends of SWP?

What are the implications of the dividend tax change?

We had discussed the implications of dividends tax change in our post, Implications of 2020 Budget: Growth versus Dividend Option of mutual funds (we urge investors to go through this post, if you have not already read it before). However, for benefit of new investors on our website, we will recap in brief, the implications of dividends tax change for equity and non equity funds.

Prior to the current fiscal, the DDT for equity oriented funds was 11.65%. So if your income tax slab rate is less than 10%, then this change will be beneficial for you. For income in higher tax brackets, this change will result in more taxes.The DDT for non equity funds (debt funds and debt oriented hybrid funds) prior to this fiscal was 29.12%. The change in dividend taxation will be beneficial for all investors whose income tax slab is less than 30%. However, for investors in the 30% tax bracket, this change will result in more tax outgo.

Summary of capital gains and dividends taxation (FY 2020-21)

Tax Savings u/s 80C

Investors can claim deductions of up to Rs 1.5 lakhs from their gross taxable incomes by investing in eligible schemes under Section 80C of Income Tax Act of 1961. Mutual fund Equity Linked Savings Schemes are eligible for Section 80C tax benefits. Investments of up to Rs 1.5 lakhs in Equity Linked Savings Schemes (ELSS) will qualify for deduction from your taxable income for income tax calculation.

However, as per Union Budget 2020, 80C tax benefit will be available only for investors who opt to remain in the old income tax regime. If you opt for thenew tax regime, you willnot be eligible to claim deductions under Section 80C. You should consult with your tax consultant or chartered accountant to know more about the old and new tax regimes to plan your taxes accordingly.

Conclusion

In this post, we have discussed the effect of taxes on your mutual fund investments. When filing Income Tax Returns (ITR), you should carefully go through all the mutual fund redemptions made during financial year and calculate the capital gains. You also need to disclose all the dividends received by you in your Income Tax Returns. You can get your capital gains and dividends statements online from mutual fund registrars (RTAs). You can also ask your financial advisor to provide you with one. You should mention your capital gains and dividends in your income tax returns and pay taxes accordingly. If you are in any doubt you should consult with your tax consultant.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY