Approach to post retirement investment planning needs a rethink: Part 1

Over the past 2 years, many senior citizen relatives complained to me how managing regular monthly expenses was becoming challenging with cut in bank interest rates. On a deposit of Rs 50 lakhs, senior citizens have seen their monthly income shrink by Rs 8,000 to 12,000 over the last 2 years or so. I completely empathize with senior citizen’s plight of seeing their incomes shrink and expenses increase. The mental stress caused by the fear of running out of money will affect health of our seniors. This should be a matter of concern for the entire society. At the same time, senior citizens should be aware of changing economic realities and pro-actively take steps to improve their economic situation.

Interest rates in the future

Most senior citizens have the largest portion, if not the entire portion of their savings in bank fixed deposits and post office small savings schemes. In absence of pension, most senior citizens are dependent solely on interest income. Interest rates for senior citizens even a few years back was over 9%, which has now come down to 6.5 – 7%, a cut of around 2 – 3%. Some banks have increased interest rates last month and one more rate increase is possible in this financial year.

In the last 10 years, average FD interest rates for senior citizens were around 8%; Government (post office) small savings schemes usually paid slightly higher interest rates. Some investors may think that the current low interest rate situation is abnormal and the situation will normalize again to long term average. In my view, however, the low interest rate situation may be the new normal in the long term – interest rates may rise in the short term but it will fall again; the long term trajectory of interest rates, however, is likely be lower. Let me explain why.

Did you know about the relationship of interest rates and equity markets in the short term and long term

Inflation and interest rates

Inflation and interest rates are directly related. In very simple terms inflation is caused by excess money – more money you have, more you will spend. When interest rate is low, people borrow more money and spend it, causing prices of goods to increase - in economic jargon, inflation. When inflation increases, RBI will increase interest rate to suck up the excess money. On the other hand, when economic growth slows down, people have less money, they spend less and inflation goes down. In order to stimulate economic growth RBI will cut interest rate, so that people can borrow more.

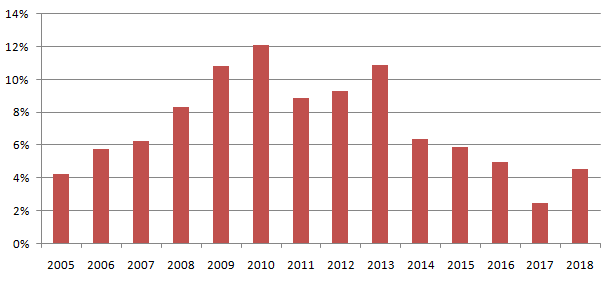

In India, average CPI inflation was very high from 2008 to 2015 (please see the chart below). The average CPI inflation from 2008 to 2015 was 9%. You can see that, inflation has been steadily declining from 2015 onwards. Inflation has crept up a bit this year, due to increasing crude oil prices, but it is still much lower than historical average.

Source: Inflation.eu

Interest rates were high from 2008 to 2015 because the inflation was also high. As inflation started falling, interest rates also started declining. The near term inflation target for the RBI is 4.7 to 5.1 and the medium target is 4% - this is significantly lower than pre-2016 historical (10 year) average. Therefore, lower inflation rates, in our view, will be the new normal in the medium to long term.

The economic growth and development of a country has an impact on inflation. Inflation rates in developed economies are much lower than India’s inflation rate. Average inflation rate in the US over the last 10 years was 1.2%. The average inflation rate in the UK over the last 10 years was 2 – 3%. Average inflation rate, even in China, from 2010 onwards was 2 - 3%. India has now become the sixth largest economy in the world. RBI’s inflation target therefore, seems quite reasonable, in line with global trends of large economies.

In the US, the interest rate paid by banks for 1 year term deposits is 1.25% - slightly higher the inflation rate. In China term deposit rates are around 3%, again in line with inflation. If our CPI medium term inflation rate is 4 – 4.5%, then we cannot expect to get 8% interest rate on bank FDs. That is why, I stated earlier that low interest rates might be the new normal and we may have no choice but to accept the new reality – interest rates may go down even below 6%.

Impact of other structural changes on interest rate actions

In the past, there was transmission lag between the RBI’s and the bank’s rate actions. Banks were quick to raise lending rates when RBI hiked rates, but were not quick to reduce lending rates when RBI cut rates. For the last 3 years, the RBI has been forcing banks to pass on rate actions to lenders more quickly. If banks reduce lending rates faster due to RBI rate cuts, they will also be forced to reduce deposit rates quicker than before.

Prime Minister’s Demonetization was a huge structural reform in our economy. A huge amount of money in the form of currency notes, which was outside the banking system, came within the system – banks saw a deluge of liquidity in the wake of demonetization, but unfortunately from senior citizen’s perspective, banks reduced interest rates after demonetization. The Government’s effort towards Digital India (cash-less economy) and Financial Inclusion, while great for our economy, will also have effect on interest rates – as more money,which was circulating outside the banking system, comes into the system, the lesser banks will pay in terms of interest rate to customers.

The Finance Minister made major changes to Government small savings schemes (e.g. Senior Citizens Savings Scheme, Post Office Monthly Income Scheme etc) a couple of years back. It was driven by the need to bring parity between bank FD interest and small savings scheme interest. The Government reduced small savings schemes interest rates. Interest rates of these schemes were benchmarked to relevant Government Bond yields and interest rate would be reset quarterly based on prevailing yields. As our economy matures, bond yields will fall, as evidenced in other matured economies. 10 year Government bond yields in the US fell by 3% in the last 18 years; even in India, bond yields fell by more than 3% during the same period. Bond yields in India is currently around 8%, much higher than the US or China – it is likely that, bond yields will fall in the medium to long term and therefore, interest rates of Government small savings schemes are also likely to be on a lower trajectory.

Read why should you get serious about retirement planning?

Rethink of post retirement investment planning

Senior citizens are concerned about their incomes due to lower interest rates, but the new reality might be even lower rates, for the reasons discussed above. However, senior citizens should not feel distressed about the future because there are investment options which can generate higher incomes for them. Senior citizens invest their retirement savings mostly in bank FDs and post office (Government) small savings schemes, primarily for two reasons – they are risk free and they give assured returns over the investment tenor.

However, senior citizens should also understand that risk free return is the lowest rate of return. Risk free return on a post tax basis will not provide you protection against inflation. Also in risk free investments, even if your capital is protected, your income is not because you have re-investment risk (investing at a lower interest rate) at the end of the investment tenor. Therefore, a rethink of post retirement investment planning is required. In the next part of this post, we will discuss how senior citizens can think about retirement planning in low interest rate scenarios. Please stay tuned.

In the meanwhile, we suggest you to read why smart asset allocation is necessary for retirement planning

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY