What should be the percentage of midcaps in your equity portfolio: Part 1

If you ask a financial advisor what should be the percentage of midcap stocks or mutual funds in equity portfolio, you will get a variety of answers. Some will suggest that, midcap stocks or funds should not exceed 20% of your investment portfolio. Others will suggest that, young investors should start with, as much as 50%, in midcap stocks and funds and then gradually reduce as their risk tolerance declines. One financial advisor told me once that, the best investment option for retail investors is monthly SIP in midcap mutual funds because of the triple virtues of SIP, higher volatility of midcap funds which makes SIPs even more effective for these funds and the superior long term return potential of midcap funds. A stock broker told me that, most of the multi-bagger stocks were from the small and midcap segment. Another stock broker told me that, retail investors should buy only large cap stocks and they should invest in midcap through mutual funds, because the multi-bagger midcap stocks are extremely difficult for retail investors to spot. So, which of the above statements are correct? While, all the above statements are correct but if you are a retail investor, none of the above statements are practically helpful, because none of these statements tell you what to do. The most important word in the previous statement is you. So what should you do? Please note that, the points mentioned in this blog post reflect my personal opinion on this matter.

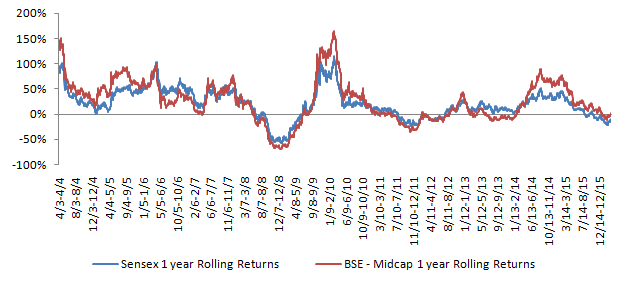

Let us first discuss should you even invest in small and midcap stocks or funds. If you are an expert stock-picker and have made a lot of money by picking multi-bagger midcap stocks, then the rest of the article is not for you. This article is meant for the rest of us, who do not have the necessary stock-picking expertise. One of the fundamental theories of investment is the relationship between risk and return. Higher is the risk; higher are the returns. Small and midcap stocks and funds are more risky than large cap stocks funds. Therefore, when you are investing in small and midcap stocks and funds, you should expect to get higher returns. However, at the same time, you should be prepared for volatility in the short term. The question is how much additional return you may get by investing in small and midcap stocks or funds vis a vis large cap stocks and funds. We will examine this question by statistically examining the relationship between the returns of large cap stocks and those of midcap stocks. The most popular index of the largest market cap stocks in India is the Sensex. We will use the Sensex returns as the proxy for large cap stock returns. For midcap stock returns, we will use the BSE – Midcap Index. We looked at daily 1 year rolling returns of the Sensex and BSE – Midcap index over the last 13 years. Why 13 years? This is because, on the BSE website, the BSE - Midcap index data is not available for before April 1 2003. The chart below shows the 1 year rolling returns of the Sensex versus the BSE – Midcap index over from April 1, 2003 to April 1, 2016.

Source:BSE

You can see that BSE – Midcap Index outperformed the Sensex in certain periods and vice versa. From a visual examination, we can see that the BSE – Midcap Index has outperformed Sensex most of the times. In the last 13 years, BSE – Midcap Index grew at a CAGR of 21% while the Sensex grew at a CAGR of 17.5%, but for various intermediate periods in the last 13 years, the relative performance between the two varied. While past data is interesting, investors are more interested in knowing about future performance. To get a sense of future performance, we have to take recourse to predictive analysis. Predictive analysis is stochastic in nature, which means that there is always an element of uncertainty with respect to predictive analysis. One of the most simplest and popular predictive models is Bi-variate Regression. In a Bi-Variate Regression, we model the relationship between two variables, Sensex returns and BSE-Midcap Index returns in our case, and try to forecast the value of one variable (BSE-Midcap Index returns) based on the forecast of the other variable (Sensex returns).

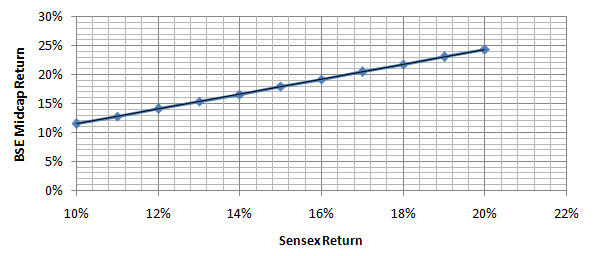

In this predictive modelling we ran a regression analysis of daily Sensex 1 year rolling returns and BSE-Midcap 1 year rolling returns over the past 13 years. Since we looked at daily 1 year rolling returns of both these indices, the sample size was fairly large (nearly 3,000 data points) which gave us confidence about the model. Further, the last 13 year period covered multiple bull and bear market periods. So hopefully, there will be no market timing related bias in this analysis. In a regression analysis, basically what we do is, try to predict the value of one variable, known as the dependent variable (BSE-Midcap Index in our case), based on the values of another variable, known as the independent variable (Sensex in our case). In mathematical terms, regression model is the best fit line, when the values of the dependent variable is plotted on the Y axis, based on the values of the independent variable on the X-axis. Please not the phrase, best fit line, which implies that the relationship is the best fit but not exact. It is important to remember this. Based on the regression modelling of BSE-Midcap Index 1 year rolling returns versus Sensex 1 year rolling returns over the last 5 years, we came up with the following relationship between BSE-Midcap Index and the Sensex.

BSE Mid-cap Index Annualized Returns = -0.0125 + 1.28 X Sensex Annualized Returns

What does this mean? To understand this let us plot BSE Mid-cap Index returns for different scenarios of Sensex returns in a graph (please see below).

We can see in the chart above that, if Sensex return is 10%, the BSE Midcap Index return will be 12%. If the Sensex return is 12%, the BSE Midcap Index return will be 14%. If the Sensex return is 15%, the BSE Midcap Index return will be 18%. If the Sensex return is 17%, the BSE Midcap Index return will be 20%. If the Sensex return is 20%, the BSE Midcap Index return will be 24%. You can plug in any Sensex return in the regression model and see what the BSE Midcap Index forecasted return will be.

How good is this model? We had said earlier that, a regression model can never be 100% accurate. After all, we are trying to predict the future based on past data and therefore, we can never be sure. However, there is a very important parameter in regression modelling known as R-squared. The parameter R-squared tells us how good our model is. R-squared, in statistical terms, is the percentage variation of the dependent variable was explained by the regression model. R-squared varies from 0 to 100%. If R-squared is low then, the actual value of the dependent variable (BSE Midcap Index Returns in our case) does not conform to the model. If R-squared is 95%, then 95% of the actual values of the dependent variable conform to our model. So higher the R-squared the better our model is. In our regression analysis, of 1 year rolling returns of BSE-Midcap Index versus Sensex over last 13 years, the R-squared is 82%, which is a good fit and gives us confidence in our model.

Coming back to the relationship between Sensex and BSE-Midcap Index, we have seen that, based on our regression model, BSE – Midcap Index may outperform Sensex by 2 – 4%, when Sensex gives 10 – 20% returns. An outperformance of 2 to 4% over a long investment horizon, can amount to significant different in your investment corpus. But the question is, are you happy with a 2 – 4% outperformance, given the fact that, you will have to take higher risks, when investing in a midcap stock. So to see, if the risk return trade-off makes sense, we have to compare the risks of investing in midcap stocks versus large cap stocks. Assuming, you have a three year investment horizon the standard deviation of 1 year rolling returns of Sensex from 2003 to 2016 is 29%, while that of BSE-Midcap Index is 40%. So by investing in midcap you are taking 11% higher risk. In other words, you get 2 to 4% incremental returns by taking 11% higher risk. The question which you should ask yourself is that, is the extra risk worth it? The answer will vary from individual to individual, but given the risk return trade-off, you should certainly expect more for the additional amount of risk.

Are we saying that, you should not invest in small or midcap equities? No, we are not saying that. We are only saying that, if you are randomly selecting stocks from the Sensex and the BSE-Midcap Index for investment, it is better if you stick to the Sensex only. The Sensex is made up of the 30 largest market cap publicly traded companies in India, whereas the BSE-Midcap index is made up of a large number of companies, some of which may be multi-baggers but there is also the possibility that you can pick up a rank underperformer. While there are examples of midcap stocks which gave 50 – 60% CAGR in the last few years, there are also examples of midcap stocks which fell 70 – 80% and have not recovered. It is not easy to spot the big wealth creating midcap stocks. By investing large sums of money in midcap stocks based on your broker or friend’s tip, you can get burnt very easily. Investing in small and midcap stocks requires professional expertise and lots of experience.

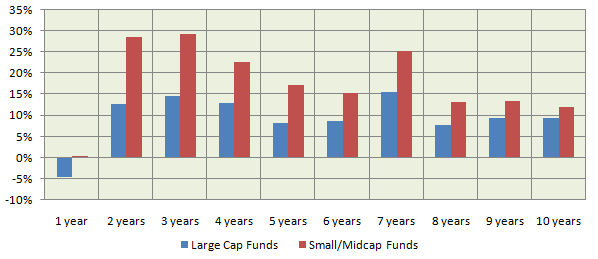

Good mutual fund managers have the right kind of expertise and experience. They can select the right small and midcap stocks, which have high potential, both from a value and growth perspectives. Historical data tells us that, top performing small and midcap fund managers have been able to beat their benchmark by a bigger margin than what the large cap fund managers have been able to do. It does not mean that, small and midcap fund managers are more talented than large cap fund managers (in many cases, the same fund manager managed both midcap and large cap funds with different results); it simply means that, the small and midcap segments offer more opportunities to generate alpha compared to the large cap segment. Small and midcap stocks, especially in India, are under-researched and in many instances, often under-value. A visionary fund manager can spot these value and growth opportunities, to create wealth for investors. Historical analysis shows that, small and midcap mutual funds as a category have outperformed large cap funds by significant margin. Please see the chart below and note that small/midcap funds have beaten large cap funds by a significant margin, in terms of trailing annualized returns across all time-scales.

Source:Morningstar

Conclusion

In this blog post, we have discussed that, for the average retail investor, investing directly in midcap stocks is not attractive from a risk reward perspective, relative to investing in large cap stocks. However, investing in small and midcap mutual funds is a different ball game altogether. Investors can get much better risk return trade-off by investing in small and midcap mutual funds and create substantial wealth. We will discuss more about investing in small and midcap mutual funds in the second part of this post. Stay tuned for more.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY