Should you invest in Banking Sector mutual funds

Top performing banking sector mutual funds have given more than 30 - 40% returns in the last one year. When funds give such high returns, both existing and new investors are wary if the returns will be subdued in the future. Many of the top performing banking sector funds gave negative returns in the last 3 months. It is natural for investors to feel concerned about these funds. In this blog post, we will discuss the reasons behind the terrific performance of banking sector funds in the last one year, their relative underperformance in the last 3 months and the outlook for this sector.

Outperformance in the last one year

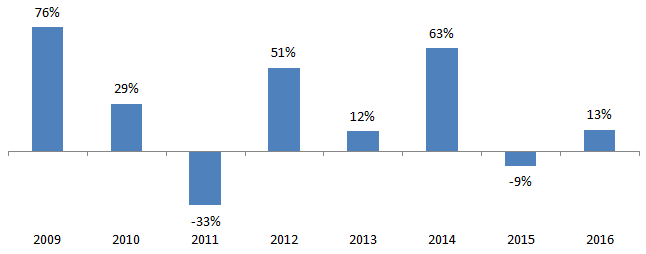

The banking sector was among the worst hit in 2015 for reasons that we will discuss later in this post. In a sentiment driven market like India, we often see that, rallies take prices to levels where valuations are stretched.At the same time, in bear markets, we see prices beaten down too much. When risk sentiments and liquidity improves in the market, the most beaten down stocks often rally the most because investors see value in these stocks. Investors should keep this market behaviour in mind, when investing in banking stocks and funds. The chart below showing the annual returns of the banking sector funds over the last 7 years reflects this market behaviour.

Source: Morningstar

Timing can make a big difference in banking sector funds

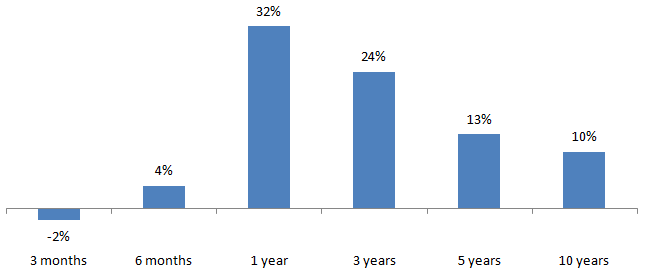

You can see the extreme swings in return in the chart above and as an investor you should be prepared for such swings, if you are investing in cyclical sector funds. The chart below shows the annualized trailing of banking sector funds over several time-scales, both short term and long term.

Source: Advisorkhoj Mutual Fund Category Monitor

The two charts above tells us one important thing about banking (and other cyclical sector) funds. In these funds, timing entry and exit can make a huge difference to the investor’s returns, in the short to medium term. Let me clarify that, entry and exit timing make a difference in all equity fund returns, but in banking sector funds the difference can be much bigger.

Relative underperformance in the last 3 months

The banking sector funds have given negative returns in the last 3 months. Let us understand the two most important reasons for the underperformance.

Demonetization Effect:

The performance of the banking and financial sector is influenced by the overall market risk sentiment more than any other sectors. The Prime Minister announced withdrawal of old Rs 500 and Rs 1,000 notes from the monetary system on November 8, 2016. Demonetization affected risk sentiments in the market unfavourably. Investors should not confuse between public sentiment and market sentiment. Opinion polls have shown that public reaction to demonetization has been overwhelmingly positive.However, the market was concerned about the impact of the Government’s move on demand in the short term because a large percentage of transactions in our country take place in cash.The Economic Survey released a couple of days back suggests that our GDP growth in FY 2016-17 will be 6.5%, lower by 1.1% points than the GDP growth in FY 2015 – 16. Lower demand due to demonetization affected a number of sectors and affected market sentiment. Banking and Financial Services is one the largest sectors in our economy and is closely linked with a number of other sectors. The overall sluggishness in the economy in the wake of demonetization has naturally affected the banking sector.Lingering NPA issue:

The banking sector, especially public sector banks, was badly hit by non performing assets (NPAs). While the Government and the Reserve Bank of India has taken a number of steps to address the NPA problem and it has somewhat stabilized, but the FY 2017 third quarter results of some banks showing increasesin NPAs tell us that problem is certainly not over. The recovery of bad loans by the banks has also been not as fast as anticipated. The problem with the NPA situation is that, unless the underlying economic situation of the debtors (borrowers) improve, the situation is not likely to improve. Subdued economic activity, exacerbated by demonetization in the short term, has affected the economy and therefore, not helped the NPA situation.

Valuations

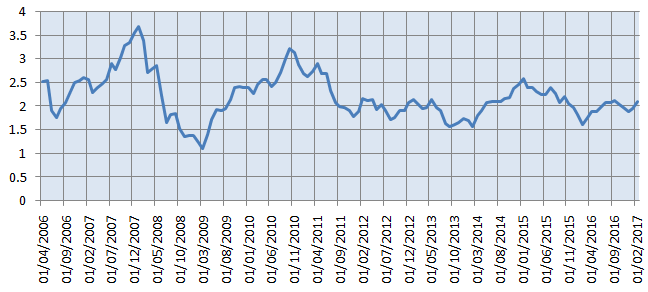

Some people are concerned with the valuation of bank stocks, given the strong rally over the past 9 months. However, if we look at the current valuation of banking sector relative to its historical valuation then valuations do not look stretched over a longer investment horizon. The chart below shows the historical Price to Book Ratio of S&P BSE Bankex over the last 10 years.

Source: Bombay Stock Exchange

The current P/B ratio of the Bankex is around 2.1. You can see that, there is room for considerable valuation upside for banking sector.

Future Outlook

What we have discussed in the previous section are short term impact of demonetization and the slightly longer term lingering NPA problem. However, we need to have a longer term outlook with respect to this sector. While demonetization has been negative to the banking sector from the investor’s perspective, the longer term effects of the Government’s move are being viewed favourably by economists. Firstly, it is expected that, demonetization might bring more people (erstwhile tax evaders) and money within the taxation system, resulting in higher tax revenues for the Government. More tax revenues will result in more public spending, resulting in higher employment and demand. Higher economic growth will spur demand for bank credit and therefore, revenues and profits.

Secondly, demonetization has resulted in banks being awash with funds, as people deposited money held as cash in banks. The cash deposited with banks after demonetization has provided banks with more funds to lend and resulted in reduction in interest rates. Banks have reduced their FD rates by 25 bps and cut lending rates by around 1%. Reduction in lending rates will increase demand for loans and consequently, improve the revenues and profits of banks. Sceptics say that, it is only a matter of time before the money is taken out again once the restrictions on withdrawal go away, but it is difficult to predict what will happen when a structural change of this magnitude is implemented.

Thirdly, the 2017 Budget has many positives for the banking sector. Containing fiscal deficit at 3.2% of the GDP is certainly great news for this sector. Provisions announced for the housing sector and a big push in infrastructure spending are also good news for banking sector. Increased spending in these two sectors will help the financials of the companies in these sectors and alleviate the stressed asset situation of the banks.

The Finance Minister has identified the banking sector as one of his most important priority areas for the Government. Though the Government has taken a number of steps to address the issues facing this sector, private sector spending is crucial for earnings growth in this sector. Though private sector spending, especially in capex, has remained subdued for some time now, we are seeing recovery in corporate earnings over the past few quarters. Hopefully, we will also see increase in private sector spending in the coming years.

Conclusion

2016 was a great year for banking sector funds. While investors should not expect a repeat of 2016 performance in 2017, in the slightly longer term, for reasons discussed in this post, the outlook of this sector is good and it may outperform the broader market. Investors should discuss with their financial advisors if banking sector funds are suitable for their investment portfolios.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY