Investing for your children’s future: Part 2

In the first part of this series, Planning your child’s future: Part 1, we discussed that inflation in the education sector is amongst the highest in CPI basket. The aspirations that parents have for their children are also much higher than ever before and as a results we are spending many more times on our children compared to what our parents did. Children’s education and marriage expenses can easily add up to 10 years of the parent’s savings. If parents are not able to save a sufficient amount for your child, they may have to scale back on their lofty ambition (always a painful thing to do) or take an expensive loan or compromise on their own financial future (retirement). However, towards the end of the first part, we also said that it is possible to meet the aspirations you have for your children and without compromising on your other financial goals, if you remember 4 important mantras:-

- Early start to leverage the power of compounding

- The importance of fiscal discipline

- Understanding the difference between saving and investing

- The importance of risk management

In today’s post we will discuss each of these 4 mantras and see how they can help you achieve your financial goals.

Early start to leverage the power of compounding

We have discussed the virtue of starting financial planning early in your career in our post, For early starters power of compounding can be magical. What is power of compounding?

Suppose you save र 3,000 every month in a recurring deposit account earning interest at the rate 8% per annum. Assuming interest rate is constant, at the end of 20 years, the balance in your recurring deposit account will be nearly र 17.7 lakhs. How much did you actually invest? You invested र 36,000 every year and र 7.2 lakhs on a cumulative basis. Your total interest on र 7.2 lakhs investment was र 10.5 lakhs. How was your interest earned more than the investment itself? You earned interest not just on your investment but also on your interest. Earning Interest on interest is at the core of power of compounding. Power of compounding does not only works for fixed deposits or recurring deposits. It works for most types of investments; in fact, in equities the power of compounding is awesome, as we will discuss later.

However, investors should understand that money needs time to grow. If your money is the seed, time is sunlight, without which the plant will not grow. Power of compounding is simply the power of time. Therefore, in financial planning early start is very important.

To illustrate this, let us revisit the example we discussed in the first part. Akash and Seema want their children, Sameer (aged 5) and Rashi (aged 3) to get engineering degrees. We assumed that, cost of engineering education at today’s prices is र 20 lakhs. Applying a 10% inflation rate, the future cost of Sameer and Rashi’s engineeringe education will be र 69 lakhs and र 84 lakhs respectively. To meet Sameer’s engineering education expenses Akash and Seema will have to save र 24,800 per month in a recurring deposit account (at interest rate of 8%). For Rashi, they will have to save र 23,740 per month. You can already see the power of time. Even though Akash and Seema have to pay more for Rashi’s education compared to Sameer’s, they have to invest less every month for her. Why? Simply, because Rashi is younger and has more time to go to college.

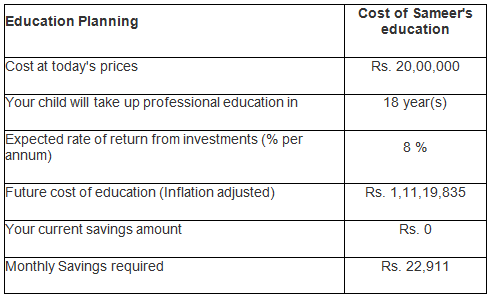

To further illustrate the importance of early start, let us assume that, Akash and Seema started saving for Sameer’s college education, just after he was born. How much they would have to save for him every month. We entered the details in Advisorkhoj Education Planner Calculator and got the following result.

Source: Advisorkhoj Education Planner

You can see that, Akash and Seema would have save र 1,900 less every month for Sameer’s education. The money saved can be invested in some other long term financial goals. Some readers may think र 1,900 is not such a big amount.

Let us illustrate the power of compounding over a long period one more time. Let us assume Akash and Seema are both 30 years old and they will retire at the age of 60. They invest the र 1,900 savings every month till Sameer goes to college in a diversified equity mutual fund through SIP and then simply wait and let their investment compound till retirement. Do you know how much retirement corpus they will accumulate through this “small saving”? They will accumulate a retirement nest egg of than more than र 1.33 crores simply through this “small saving”. Early start is essential in financial planning.

The importance of fiscal discipline

We have multiple goals and at different stages of life, different goals seem relatively more important to us. When you are in your early or mid twenties and recently married, you are not really concerned about the college of your future children. Buying a car may seem to the most important goal. If you are in your early thirties and do not own a house, buying a house may seem to be the all important goal. Retirement, which is twenty five or thirty years away, may not seem to be a very important goal. By the time you are forty, a substantial part of your income is probably going towards home loan EMI’s and there is only a few years left before your children go to college.

Early or mid forties, is also the time, when you first start to worry about retirement. All these worries in, what is probably, the busiest phase of your career. Life which seemed stress free in your younger days may seem a little stressful. Grappling with multiple priorities is challenging, but financial planning can help you meet these multiple challenges. Financial planning, in very simple terms, is defining your different short term, medium term and long term goals in financial terms, and making a plan to meet all the goals. The earlier in your life, you make a financial plan (preferably with the help of an experienced financial planner) and start working on it, the easier is your task in future years.

However, it is one thing to make a plan and another thing to stick to it. Look around your office and you are likely to see that some of your colleagues are financially more comfortable than others, even though their salaries might be the same. Fiscal indiscipline is the most common reason, why many of us are not able to meet our financial goals. Fiscal discipline does not mean saving more. It means saving the right amount for the right goal in the right investment.

Let us take an example. Suppose you are 40 years old with a 14 year old child. You are regularly saving and investing र 50,000 every month through SIPs in mutual fund schemes. It is great that you are saving, but ask yourself, why are you saving? You may be saving for your child’s college education, his or her marriage and your retirement.

Next ask yourself, are you saving the right amount? You can use several calculators developed by us, to get a sense of the right amount. For your child’s education planning, you can use our Education Planner; for your retirement planning, you can use our Retirement Planning Calculator. If the amount you are saving is not sufficient, then you have to think of ways, how to save more.

If the amount you are saving is sufficient, you should next ask yourself, how will you know you are on track with each of these goals? Remember each goal has different timelines. Your retirement is 20 years away, while your child’s college education is just 4 years away. It is important that, you have mechanism to track progress against goal on a regular basis. In order to do that, you should have separate investments for each goal. For example, if you are investing in 5 – 6 schemes, you can have 2 schemes earmarked for retirement planning, 1 or 2 schemes for your child’s college education and 1 or 2 schemes for your child’s marriage. You may be doing great in one goal, but falling short in another. You do not have to reshuffle your entire portfolio; just look at the schemes where you are falling short and make necessary changes. It is important that you review your savings and investments on a regular basis, to ensure that you are on track of all your goals.

Difference between saving and investment

The habit of saving is part of Indian culture. With spread of consumerism, however, average urban household savings rate in India is declining. Nevertheless, with an average household savings rate of more than 25%, we save much more than average households in most other countries. While most of us, hopefully, understand the importance of savings, many Indians do not know understand the importance of saving and investment. It is important for us to understand this difference, otherwise we will not be able to create wealth and fulfill our longer term aspirations for our children.

Let me explain with an example. When I was in school, my mother used to give me money for bus or auto-rickshaw fares. When I returned home, she would ask me to put the loose change in a piggy bank. When I had sufficient number of coins in the piggy bank, I would take it out and buy comic books. This is savings.

Let me now give an adult example. My grandfather was an ex-serviceman and worked in a Public Sector Company after he retired from the army. He bought a plot allocated to ex-servicemen by the Government at a highly subsidized price. It took him 6 – 7 years, but he built his house entirely out of his savings. How? He built the house, part by part, whenever he had surplus funds. He started with the boundary wall, then after a few months when he had some surplus funds he started excavation for his foundation; when he had some more money, he completed the foundation work so on so forth; my grandfather, literally built the house, one room at a time. This is an example of savings and how it can be put to use to fulfill one’s needs.

Let me now give you my example. I also bought a house, not through savings but through investments. When I started working, my wife and I would save a portion of my salary. We invested it through monthly SIPs in a couple of diversified equity mutual funds. After 6 years of investing, we had accumulated an amount large enough to make the down-payment for an apartment. This is an example of investment. Our down-payment for the apartment was several times more than the money which my grandfather spent in building his house, even on an inflation adjusted basis. Why were we able to spend much more than my grandfather? Our income was more than my grandfather’s and I saved more than my grandfather every month, but our higher savings explained only 30% of the difference in how much we spent and how much my grandfather spent. What was the balance 70% difference on account of? It was on account of returns.

Return is the most important aspect of investing. Since I was investing my savings, I was able to get returns on investment. Further, over a period of time, my investments made profits on accumulated profit (remember the power of compounding). My grandfather virtually did not get any return on his savings, because he was spending almost all his savings in building the house.

Investors should understand that there is very strong relationship between risk and return. My wife and I got great returns on our investment, because we took the risk of investing in equities. The more risk you take, the higher return you are likely to earn. We knew that, investing in equity mutual funds will expose us to market risks. But we were not worried about short term volatility, because we had 5 – 6 years investment horizon and we knew that, equity, as an asset class, gives the best returns among all other asset classes. The same principle applies when you are saving and investing for your children’s education.

Time horizon is an important factor in investing. Longer the time horizon, more risks you can take and vice versa. When investing for your children’s education or marriage, you should factor in their age and time to their goals, in your investment planning. When your children are very young, you can invest in equity funds and then gradually shift to lower risk asset types, like balanced funds as they approach their goals. When they are only a couple of years away from their goals, you should shift to low risk accrual based debt funds. Our post, How to select mutual funds based on your investment needs: Part 2, can give you some useful guidance, on how to select investment schemes for your children, based on their goal time-lines.

Importance of Risk Management

No matter how carefully we plan, we should always remember that, life is unpredictable. Your children, till they start their respective working careers, are dependent on you and any risk you face has a direct impact on their future. The biggest risk that our families face is mortality. An unfortunate death is not just emotionally devastating for our families, but can also bring extreme financial challenges due to loss of income. Life risk is not the only form of risk our families face. There are also health risks, unemployment risks, property risks etc. While all these risks present emotional challenges to families, there are serious financial challenges as well. Therefore, it is essential that you secure your family against these risks by buying suitable insurance policies.

Life insurance is absolutely vital, when it comes to securing the future of your children. An unfortunate death will result in loss of income and can prevent your children fulfilling their aspirations. A life insurance policy will cover your family from income loss, in the event of an untimely death. When buying a life insurance policy, you should ensure that, the cover or sum assured is not just sufficient to generate the current income need of your family, but also meet the future needs of your children, like college education and marriage. Term life insurance is the best form of life insurance and will leave you with more surpluses to invest towards your children’s future. In addition to life insurance, you should also ensure that your family has adequate health cover. If your employer provides you and your family health cover, through group health plans, you should evaluate if your employer’s plan is adequate for your family’s needs and buy additional Mediclaim policies if required. If you have a house, you should consider buying home insurance to protect you and your family from financial losses, arising out of damage to your property or other hazards. Some home insurance plans cover home loan EMIs in the event of an unexpected job loss.

Conclusion

Our children are the most important part of our lives and it is only natural that parents have high aspirations for their children. In order to ensure a great future for your children, you should start planning early in your careers, spend prudently, invest you savings wisely and most importantly protect them from risks. Kids grow up fast, so start planning and saving now.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Sundaram Asset Management Company is the investment manager to Sundaram Mutual Fund. Founded 1996, Sundaram Mutual is a fully owned subsidiary of one of India's oldest NBFCs - Sundaram Finance Limited.

Quick Links

- Interview - Mr. Dwijendra Srivastava - CIO - Fixed Income

- Interview - Mr. Sunil Subramaniam - CEO

- Sundaram Select Midcap Fund: Consistent outperformance makes it a big wealth creator

- Interview - Mr. Sunil Subramaniam - CEO

- Fund Manager Interview - Mr. Krishna Kumar - CIO - Equities

- Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

- Sundaram Equity Multiplier: Long term wealth creation potential

- Our Articles

- Our Website

- SIP one sheeter-Investor Education initiative

- Sundaram Asset Management Singapore

- Returns Calculator

- SEBI Investor Awareness Initiative

- Check your KYC Status

- KYC Forms & FAQs

- Recieve your PIN

- A note on NIGO

- FAQs on RGESS

- FAQs on Direct Plan

- Receive Updates

- Share your views

- Transmission Checklist

- Equity Application Form

- Fixed Income Application Form

- Transaction Slip

- Factsheet May - 2016

- MF Tax Reckoner 2015

Follow Sundaram MF

More About Sundaram MF

POST A QUERY