What does Brexit mean for Indian Investors in the medium term: Opportunities

In our earlier post, What does Brexit mean for Indian Investors in the medium term: Part 1, we discussed the broad implications of Brexit for the Indian economy and capital markets. We discussed that, volatility in global financial markets notwithstanding, the risks arising out of Brexit to Indian equities, except specific sectors and companies, are limited in the medium term.

In fact, as far as India is concerned, the monsoon, GST Bill and the Q1 earnings season might play a more important role in giving our markets direction over the next few months. However, as discussed in our previous post, in the short term, over the next few weeks and months, global risk sentiments will also impact Indian equity market and currency. In this post, we will discuss opportunities in medium to long term, which the current market scenario provides for Indian equity investors; opportunities for investors who have, at least, a 2 to 3 years investment horizon.

Let us first discuss the concerns in our equity market, which predate Brexit and which we believe to play a more important role than Brexit. The four major concerns for some time have been weak global economic conditions impacting exports, weak rural consumption demand due to poor monsoon, credit supply constraints due to the non performing asset situation in the banking system and weak corporate earnings.

India is better placed now than where it was 12 months back

Let us look at each of the factors and discuss how they will impact the market in the future. We will begin with exports. Exports have declined year on year for two consecutive years, due to weak global demand. Though exports contribute around 20% to India’s GDP, the contribution percentage is far less than China and some other Asian economies. We are largely a domestic consumption driven economy and hence, even though exports declined, India’s GDP grew at a healthy rate over the last 2 years.

We had terrible monsoon for the last 2 years with drought like situation in many parts of the country. This led to high food inflation and low rural consumption demand. Over the past few months, we have stated in our blog a number of times that, the 2016 monsoon is likely to be good (thanks to the La Nina meteorological effect). Monsoon has been good so far and the MET department has forecasted surplus rainfall. This will have a benign effect on our rural economy and inflation. In addition to good monsoon, substantially increased rural sector allocations in this year’s Budget, is expected to have a favourable effect in revival of rural consumption demand.

Non-performing assets (NPA) have been a major concern in our banking system for a number of quarters. There are a variety of factors, which are outside the scope of this discussion, that have led to this situation. Mutual fund managers, who we have interviewed, have told us that, complete recognition of losses and provisioning is still work in progress. The Government has taken steps, like capital infusion in the public sector banks, constitution of the Bank Board Bureau and consolidation of PSU banks. The RBI also has taken a number of steps, including issuing provisioning guidelines, tweaking SDR norms and committing to provide liquidity support when required. The market, it is believed, has taken cognizance of the fact that, the NPA pain in Bank’s balance sheets will continue for the next few months, and hopefully would have discounted the impact in the share prices.

Corporate earnings have been a concern for a number of quarters, but FY 2016 Q4 corporate earnings showed definite signs of improvement, after a fairly long lean spell. As per an analysis of earnings of 309 companies in BSE 500 done by Mint, one of the leading online financial publications, year on year sales and profit growth was highest in the last 6 quarters. The next set of quarterly earnings is due in the next few weeks. Let us see if companies are able to continue on the upward trend, but if we are looking for signs of recovery, they are there in the Q4 results.

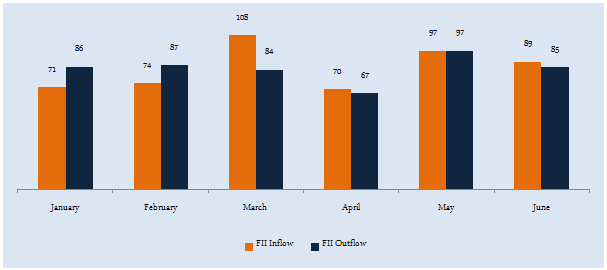

Therefore, while the risk to Indian equities arising out of Brexit is limited, the effect of good monsoon, revival in corporate earnings and low interest rates (on the back of moderating inflation) will have a positive effect on Indian market in the medium term, positioning it strongly among the emerging market basket, as far as foreign investment flows are concerned. The chart below shows the FII flows to Indian equity market over the last 6 months.

Source: Moneycontrol

You can see that, FIIs were net buyers in India for the last 4 months. While we certainly hope that, this trend will continue in the coming months as well, we should, as discussed in our previous post, note that the Brexit is a very recent event and given its magnitude, there is the possibility of global risk aversion, the current resilience of global equity markets notwithstanding. However, even if volatility in global financial markets spikes up in the near term future, once we get over the initial period, India should be an attractive investment destination for FIIs.

Potential benefits to Indian equities from Brexit

In our previous post, we had noted that risks arising out of Brexit to Indian market are quite limited. In fact, we believe that, Brexit can even be beneficial to Indian equities in medium to long term in a number of ways. We will now discuss some of the potential benefits.

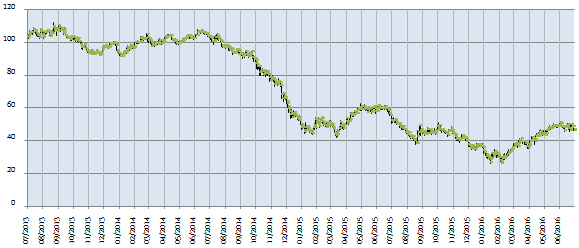

India is the fourth largest importer of crude oil in the world, after the EU, USA and China. Crude oil is more than 30% of our import bill. Crude oil prices have been on declining trend from the middle of 2014. In February, crude price slipped below $30 a barrel, but rebounded from those levels to around $50 a barrel (please see chart below).

Source: Investing.com

Falling crude prices have been beneficial for India, as far as our fiscal deficit and inflation are concerned. In fact, there were inflation related concerns with crude’s rally in the last 4 months. Global economic uncertainty in the wake of Brexit will put downward pressure on crude again. After Brexit, crude prices fell from $50 a barrel (on June 23) to $47 a barrel (on July 6). Lower crude prices, along with good monsoon, will help in moderating our CPI inflation and enable the RBI to lower repo rates, which in turn will have a positive effect on Indian equities.

The other knock on effect of Brexit will be on the US Federal Funds Rate hike. Over the past 6 months, the US Federal Reserve has made its intent very clear that, it will increase interest rates moderately this year. However, the Fed has also taken cognizance of the global economic uncertainty and has stated the interest rate actions will be calibrated carefully so as not to cause instability in financial markets. The Fed did not increase rates in its June announcement and many market experts believe that, the Fed will postpone the interest rate hike to later in the year. We would not like to speculate when the Fed will increase interest rates, but it suffices to say that, the Fed will not do anything to destabilize the financial market at a time of uncertainty related to Brexit. Delay in Fed rate hike will have a positive effect on short term risk sentiments, particularly with respect to funds flow to emerging markets like India. Further, delay in Fed rate hike can encourage the RBI to reduce repo rates in the coming quarters, subject to other factors remaining favourable. This again will have a positive effect on Indian equity.

As discussed briefly in previous post, Indo British relationship can get a boost in the aftermath of Brexit. Free from EU regulations, UK can negotiate bilateral trade deals with India, which are beneficial for both the countries. With the UK leaving EU, changes in immigration laws in the UK are now inevitable and India, along with other Commonwealth States may emerge as source of talented labour for the UK. This will again be beneficial for both the countries.

The reform agenda of the Government with respect to liberalizing Foreign Direct Investment and other reforms in the pipeline have been well received by foreign investors. If the Goods and Services Tax (GST) Bill gets passed in the monsoon session of the Parliament, it will be a strong booster to market sentiments. India may stand to benefit as global equity investors look to rebalance country weights in their emerging market portfolios, in the wake of Brexit, India with its strong economic fundamentals, lower reliance on exports may get higher portfolio weights relative to countries which are more adversely impacted by economic slowdown in EU and UK.

How can investors benefit from the opportunities in the equity market?

For retail investors, mutual funds are the best investment avenues for participating in equity markets because the investors can benefit from the expertise of professional fund managers to spot the best investment opportunities in the market. While uncertainty in global equity markets may persist for some time, in the backdrop of good monsoon, lower interest rates and capex cycle revival prospects in India, mutual funds which invest in cyclical themes, particularly in themes which more favourably impacted by Government reforms will be good medium to long term investment opportunities for investors.

Midcap funds have outperformed large cap funds in the last one year. However, large cap funds made a strong comeback in the last 3 months or so. Midcap funds are suitable for investors who have a long investment horizon and high risk appetite. While midcap funds usually tend to outperform large cap funds in the long term, large cap funds are less volatile. Surprisingly we saw that, in the last one year, large cap funds were more affected by adverse global risk sentiments, because FIIs invest primarily in large cap stocks in India. Diversified equity multicap or flexicap funds invest in companies across market cap segments and as such, these funds are also excellent long term investment choices for investors. In the current environment of potential volatility in global financial markets and prospects of cyclical economic recovery in India, investors can allocate their investments to a portfolio of large cap, midcap and diversified equity funds to benefit from varying market. Investors should consult with their financial advisors, the appropriate allocations that will be suitable for their investment needs.

Across all three fund categories, there are number of good funds that can do well in the medium to long term in the backdrop of the current challenges and opportunities. Irrespective of market conditions, investors should always select mutual funds whose managers have a strong track record of creating alphas for the investors. We will do brief reviews of three equity funds (all from SBI Mutual Fund stable), one from each category and discuss how well they are positioned to do well in current market conditions. Let us start with a large cap fund, SBI Bluechip Fund.

SBI Bluechip Fund

SBI Bluechip Fund is one of the best performing large cap equity mutual funds in India. In the last 1 year, while the BSE – 100 index was down about 1%, this fund gave 5.75% returns. In the last three years, the fund has given more than 23% compounded annual returns, which is quite outstanding. The fund has created strong alphas for its investors. The fund is overweight on cyclical sectors like, banking and finance (23% of the portfolio), cement and construction (12%), petroleum products (9%), automobiles (9%) etc. These sectors are likely to benefit from lower interest rates, domestic demand recovery and economic reforms.

SBI Magnum Multicap Fund

SBI Magnum Multicap Fund has been the best performing diversified equity (multicap or flexicap) fund in the last one year. In the last 1 year, this fund has given 9.5% returns, while the BSE – 500 was almost flat. In the last 3 years, the fund gave 26.5% trailing annualized returns. This fund also has a strong track record of alpha creation. Like the large cap fund, this fund also has a bias for cyclical sectors like banking and finance (20%), automobiles (8%), construction (5%), power (4%). However, the fund has substantial allocations to defensive sectors like technology (11%), FMCG (8%) and pharmaceuticals (4%). The defensive portion of the portfolio will provide stability in high volatility conditions. The cyclical sectors are likely to benefit from lower interest rates, domestic demand recovery and economic reforms, while FMCG is likely to see growth in volumes with good monsoon.

SBI Magnum Midcap Fund

SBI Magnum Midcap Fund is one of the best midcap equity mutual funds. We recently reviewed this fund in our article, Outstanding SIP returns by SBI Magnum Midcap Fund in the last 10 years. In the last one year, this fund gave 10.6% returns. In the last three years, the fund gave nearly 39% trailing annualized returns. Like the previous two funds, this fund also has strong track record of alpha creation. As discussed earlier, the last one year has shown us that, midcap funds are relatively more immune to volatility in global equity markets. The Fund Manager has a bias for cyclical sectors like banking and finance, capital goods, cement and construction etc. These sectors, as discussed earlier are likely to benefit from lower interest, capex recovery and Government reforms.

STP can be used if volatility increases

Contrary to fears, global equity markets have shown good resilience post Brexit. Our market has been quite strong in the last few days, making a year to date high. But in this environment of global uncertainty, if we see volatility spiking up, Systematic Transfer Plan (STP) from liquid fund to equity funds can be a smart investment strategy. Investors should discuss with their financial advisors and form a suitable strategy.

Conclusion

Readers should note that, while we discussed three mutual fund schemes from SBI Mutual Fund stable, these are simply some examples of good schemes for investment in the current environment. There are a number of good schemes from other AMCs that are also suitable for investment, which we review from time to time.

Whenever we have an event of the magnitude of Brexit, we hear a lot of conflicting opinions. Over the coming days, weeks and months, you should expect to hear extreme views, ranging from extremely bullish to extremely bearish. In this series of posts, we discussed risks and opportunities related to Brexit for India, so that you develop a rational understanding of how this event will impact you as a mutual fund investor in India. Whatever be the market circumstances, it is always prudent to be focused on your own financial goals, asset allocation and have a disciplined approach to investing.

Disclaimer:

Any information contained in this article is only for informational purpose and does not constitute advice or offer to sell/purchase units of the schemes of SBI Mutual Fund. Information and content developed in this article has been provided by Advisorkhoj.com and is to be read from an investment awareness and education perspective only. SBI Mutual Fund’s participation in this article is as an advertiser only and the views / content expressed herein do not constitute the opinions of SBI Mutual Fund or recommendation of any course of action to be followed by the reader

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY