SIP in debt mutual funds: Does it Make Sense? Look at Returns

We have stated a number of times in our blog that Systematic Investment Plan (SIP) is ideal mode of investment for your long term financial goals. Though SIP is very popular among retail investor in India, there is a misconception that SIP is type of investment. Whether you invest through SIP or lump sum, the risks characteristics of your investment will depend on the underlying asset class e.g. equity fund, debt fund, hybrid fund etc. SIP is simply a way of investing in the scheme of your choice. In this blog post, we will discuss how SIPs in debt mutual funds can also be part of your financial plans.

SIP returns depend on asset class

Most investors in India associate SIP with equity mutual funds only. You should have moderately high to high risk appetites for investing in equity mutual funds whether you are investing in lump sum or SIP. Till the recent correction many investors had the misconception that SIPs had low risk and rarely give negative returns. If you look at SIP returns across equity fund categories e.g. large cap, multi-cap, midcap, small cap etc., most schemes have given negative returns over the last 1, 3 and even 5 years.

As mentioned earlier irrespective of investment mode, lump sum or SIP, the risk of your investment will depend on the underlying asset class.

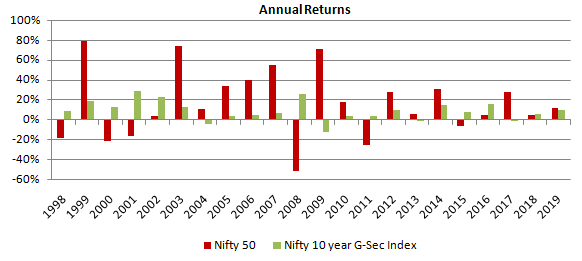

If you do not have sufficiently high risk appetites, then you should invest in debt mutual funds which have much lower risks compared to equity or equity oriented funds. The chart below shows the annual returns of Nifty 50 versus Nifty 10 year G-Sec Index over the last 20 years or so.

Source: National Stock Exchange

SIP in debt mutual funds

Many investors think that only lump sum investments are suitable for debt mutual funds. You can also invest through SIP in all open ended debt mutual fundschemes. You should invest through SIP in debt mutual funds if:-

- You want to invest from your regular savings in a disciplined manner for long term financial objectives. By investing from your regular savings, you can start early and give more time for investments to grow.

- You have long investment tenures and want to benefit from the power of compounding. Compounding is interest earned on interest. Compounding leads to wealth creation over long investment horizons.

- You want to benefit from volatility through Rupee Cost Averaging. Debt funds are market linked instruments and their prices may fluctuate depending on the price sensitivity of their underlying assets to interest rate changes and other factors. Through SIP, you buy units at different price points and average your cost of purchase.

SIP in debt mutual funds can also create wealth

Wealth creation potential of equity funds is known to regular Advisorkhoj readers. Debt mutual funds can also create wealth for investors in the long term. Debt funds invest in debt and money market instruments like commercial papers, certificates of deposits, non-convertible debentures, Treasury Bills, Government Securities etc.

The yields of many debt and money market instruments are higher than bank FD interest rates of similar maturities. Yields of AAA rated corporate bonds can be 150 – 200 bps higher than FD interest rates.

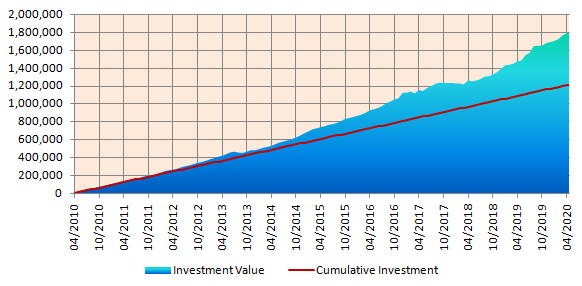

The chart below shows the returns of Rs 10,000 monthly SIP in BSE India 10 year Sovereign Bond Index over the last 10 years. Please note that the underlying asset of this index is the 10 year G-Sec which has no credit risk (sovereign guarantee by Government of India) but high sensitivity to interest rate changes. With a cumulative investment of Rs 12 lakhs, you could have accumulated a corpus of Rs 18 lakhs over the last 10 years. The annualized SIP return over the last 10 year was 7.7%.

Source: Asia Index (BSE and S&P DJI Venture), Advisorkhoj Research

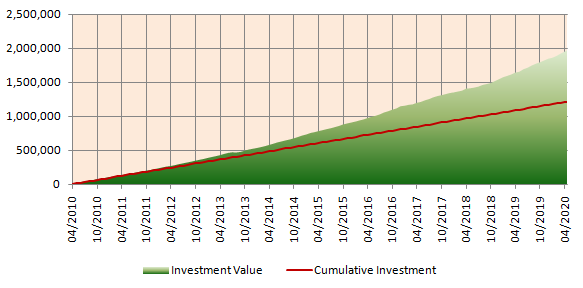

Let us now see the results of SIP in another debt asset type, corporate bonds. Corporate bonds are subject to credit risks but give higher yields than risk free assets. The chart below shows the returns of Rs 10,000 monthly SIP in BSE India Corporate Bond Index over the last 10 years.

With a cumulative investment of Rs 12 lakhs, you could have accumulated a corpus of nearly Rs 18 lakhs over the last 10 years. The annualized SIP return over the last 10 year was 9.5%.

Source: Asia Index (BSE and S&P DJI Venture), Advisorkhoj Research

How do the two SIPs compare with bankrecurring deposits?

Bank recurring deposits are nothing but systematic investment plans in bank fixed deposits, earning interest at the rate applicable to fixed deposits. Bank recurring deposits over the last 10 years, gave 7.3% average annualized returns (please see our tool Mutual Fund Benchmark Returns - Recurring Deposit).

SIP returns of 10 year Sovereign Bond Index and Corporate Bond Index were able to beat the bank recurring deposit returns.

Two good debt funds in the current economic environment

The spread of the COVID-19 pandemic across the world has prompted Government to impose strict lockdowns to prevent / slowdown the transmission of the disease among the larger population. The lockdown will cause a severe slowdown in many industry sectors. The IMF is projecting a severe recession for the global economy in 2020. In a severe economic downturn, credit risk becomes an important factor since several companies may face challenges servicing their debt obligations. Investors should be aware of credit risks when making investment decisions.

Two debt schemes from SBI MF stable, SBI Corporate Bond Fund and SBI Banking & PSU Fund have low credits risk and good performance track records. As such, these two funds can be good investment options in this economic situation.

SBI Corporate Debt Fund

As per SEBI’s mandate corporate bond funds must invest at least 80% of their total assets in highest rated instruments. SBI Corporate Bond Fund has 82% of its assets in AAA (highest credit rating) rated instruments, 15% in Government Securities (no credit risk) and 3% in cash / cash equivalents (no credit risk). Accordingly, the credit quality of the scheme is very high.

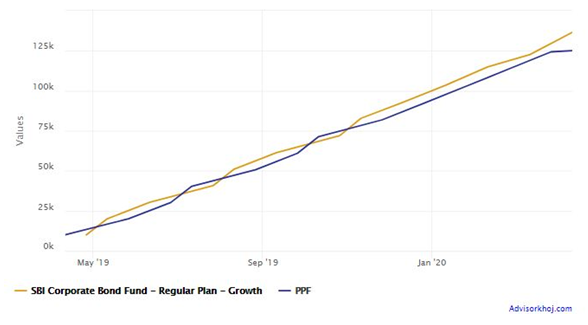

The yield to maturity (YTM) of the scheme portfolio is 6.65%. The chart below shows the returns of Rs 10,000 monthly SIP in SBI Corporate Bond Fund versus PPF over the last 1 year. We are showing the returns of the scheme versus PPF because PPF offers the highest interest rate among most Government Small Savings Schemes and higher interest rate than Bank FDs. You can see that SBI Corporate Bond Fund outperformed PPF in SIP returns. The fund gave return of over 10.02% XIRR

Source: Advisorkhoj Research

SBI Banking and PSU Fund

As per SEBI’s mandate Banking & PSU funds must invest at least 80% of their total assets in debt instruments issued by banks (PSU and private), public sector undertakings and public sector financial institutions. The credit quality of these instruments is generally high because public sector undertakings enjoy quasi sovereign status (low credit risks) and banks being regulated by the RBI are also seen as low risk even though there might be one-off credit related events e.g. Yes Bank.

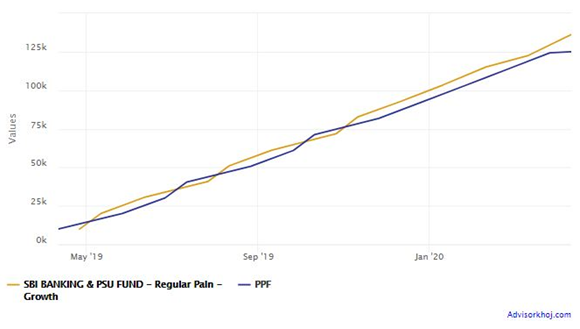

SBI Banking and PSU Fund has 74% of its assets in AAA / A1+ (highest credit rating) rated instruments, 9% in AA (second highest credit rating) and rest (17%) in Government Securities and cash equivalents (no credit risk). As such, the credit quality of this scheme is also very high. The yield to maturity of the scheme portfolio is 6.6%. The chart below shows the returns of Rs 10,000 monthly SIP in SBI Corporate Bond Fund versus PPF over the last 1 year. You can see that even this SBI MF debt scheme outperformed PPF in SIP returns. The fund gave return of over 9.50% XIRR

Tax advantage of fixed income funds

The concept of SIP in fixed income funds may be new to many investors, but recurring deposits in bank is essentially SIP in fixed income. Fixed income funds are much more tax efficient over 3 years plus investment tenures over recurring deposits.

Interest paid by bank recurring deposits is fully taxable as per the income tax rate of the investor. Capital gains made in fixed income funds held for more than 3 years are taxed at 20% after allowing for indexation benefits. Indexation benefits can reduce the tax obligations of investors in higher tax brackets substantially. Further, RD interest is taxable during the tenure of the investment but debt funds are taxed on capital gains only on redemptions. However, dividends paid by debt funds will be added to your income and taxed according to your income tax rate.

Source: Advisorkhoj Research

Summary

In this blog post, we have discussed how SIP in debt mutual fund can be good investment for investors of moderately conservative to moderate risk appetites. Like SIPs in equity mutual funds, you need to have long investment tenures and a disciplined approach. Different fixed income funds have different risk / return profiles. In this article, we have reviewed two debt mutual fund schemes from the SBI MF stable that may be suitable in the current economic environment. You should consult with your financial advisor which debt fund is most suitable for you to invest through SIPs.

Suggested reading: Make salary day your mutual fund SIP investment day

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY