Should you invest in conservative hybrid funds?

What are conservative hybrid funds?

Conservative hybrid funds are hybrid mutual fund schemes which invest primarily in debt and money market instruments and also in equity and equity related securities. As per SEBI’s mandate, conservative hybrid funds must invest 75 – 90% of their assets in debt and money market instruments. They also invest 10 – 25% of their assets in equity and equity related securities. The funds are suitable for conservative investors, hence the name conservative hybrid funds. These funds can also be suitable for new investors who do not have the experience of equity markets.

Why conservative hybrid funds are suitable for first time investors?

Simple asset allocation maths will demonstrate why conservative hybrid funds are suitable for firsttime investors. Let us assume that a conservative hybrid fund has 80% allocation to debt and 20% allocation to equity. Let us assume the debt as an asset class gives 6 to 7% annualized return. So in a year, the debt portion of the fund will contribute 4.8 - 5.6% (80% multiplied by 6 to 7%) to the fund’s returns. Let us now assume that in the same year, equity market fell by 20% (a 20% correction is technically known as a bear market). In that year, the equity portion of the fund will have -4% (20% multiplied by -20%). So the point to point return of the hypothetical conservative hybrid fund will be 0.8 – 1.6%, despite the large correction in equities. You can see that conservative hybrid funds can limit downside risk of investors in bear markets.

Equity portion can provide a kicker to the returns

Continuing with the above example of a hypothetical conservative hybrid fund, let us see how much return, can the fund generate in a bull market. Let us assume debt continues to give 6 – 7% return. So the debt portion of the fund will contribute 4.8 - 5.6% to the fund’s returns. Let us now assume that equity gave 20% return in a bull market year. So the equity portion of the portion will generate (20% multiplied by 20%) i.e. 4% returns. So the conservative hybrid fund will generate 8.8 – 9.6% returns; the equity portion provided a 4% kicker to the fund’s returns. Unlike traditional fixed income products which often fail to beat inflation on a post tax basis, over long investment horizons, conservative hybrid funds can generate inflation adjusted returns for investors.

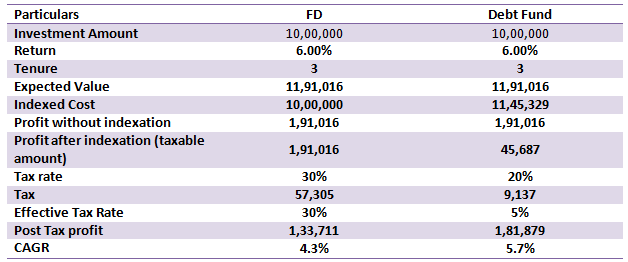

Conservative hybrid funds are more tax efficient than traditional fixed income schemes

Interest paid by traditional fixed income schemes like Bank Fixed Deposits, Government Small Savings Schemes etc, are usually added to the investor’s income and taxed as per the income tax rate of the investor. Over 3 years plus investment horizon, capital gains in conservative hybrid funds are taxed at 20% after allowing for indexation benefits. The table below demonstrates how conservative hybrid funds are much more tax efficient than traditional fixed income schemes like Bank FDs for investors in the higher tax brackets. In this example, we have assumed that Cost Inflation Index (CII) in the year of purchase was 289 and CII in the year of redemption is 331.

Disclaimer: The above illustration is purely for investor education purposes. You should discuss the tax consequences of your investment with your tax advisor.

About SBI Conservative Hybrid Fund

SBI Conservative Hybrid Fund formerly known as SBI Debt Hybrid Fund is one of the best performing conservative hybrid funds in the last 3 years (please see top performing conservative hybrid funds in the last 3 years ->Mutual Fund Trailing Returns - Hybrid: Conservative). The scheme was launched in April 2001 and has Rs 6,843 crores of Assets under Management (AUM) as on 30th November 2022. The expense ratio of the scheme is 1.1%. Saurabh Pant, Mohit Jain and Mansi Sajeja are the fund managers of this scheme.

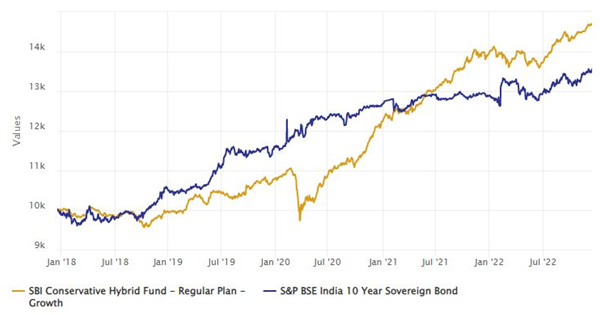

The chart below shows the growth of Rs 10,000 investment in SBI Conservative Hybrid Fund over the last 5 years. You can see that the fund was able to beat debt as an asset class over the last 5 years.

Source: Advisorkhoj Research

Suitable for long term investment through SIP

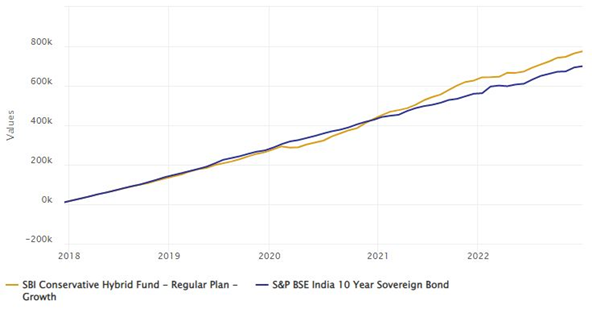

The chart below shows the growth of Rs 10,000 monthly SIP in SBI Conservative Hybrid Fund over the last 5 years. The scheme generated over 10% SIP XIRR over the last 5 years.

Source: Advisorkhoj Research

Is this a good time to invest in SBI Conservative Hybrid Fund?

Equity markets have rebounded strongly from June lows. While inflation seems to be cooling, the market was surprised by hawkish comments made by the Fed in the December meeting. There are near term risks particularly with concerns about slowdown / recession in the US economy and valuations of Indian equities. While the market has largely remained range bound, bouts of volatility or short term correction cannot be ruled in the coming months or quarters. Conservative hybrid funds can be good long term investment options for first time investors who do not have high risk appetite.

Why invest in SBI Conservative Hybrid Fund?

- Potential to generate inflation adjusted post tax returns over long investment horizon

- Limited downside risks in volatile markets

- Suitable for conservative and new investors

- Tax advantage over traditional fixed income investments

- Strong performance track record – one of the top performing conservative hybrid funds

Who should invest in SBI Conservative Hybrid Fund?

- Investors seeking capital appreciation and income

- You should have long investment tenures; minimum 3 to 5 years

- You should have moderate risk appetite for this scheme

- You can invest either in lump sum or through SIPs

Investors should consult with their mutual fund distributors or financial advisors if SBI Conservative Hybrid Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY