SBI Savings Fund: Good debt fund for short term investments

SBI Savings Fund is a money market mutual fund scheme which invests in money market instruments like commercial papers (CPs), certificates of deposits (CDs) etc. As per SEBI’s mutual fund classification directive, money market funds must invest in money market instruments having maturity up to 1 year. The very short duration profile of money market instruments make money market funds much less sensitive to interest rate risk compared to longer duration funds. Money market funds are suitable investment options for parking your money for up to a year. Money market funds yield higher returns than extremely short duration funds like overnight funds, liquid funds etc, at the same time their risk is considerably lower compared to short duration, medium duration and long duration debt funds. SBI Savings Fund is a good investment choice for investors looking to park their idle funds for 3 to 12 months. In order to avail tax benefits, investors with low risk appetites can also opt to remain invested in the scheme for longer periods.

Suggested reading: What are short term investment options as bank rates are lowest point in many years

A consistent performer

We have stated a number of times in our blog that, performance consistency across different market conditions is the hallmark of well managed funds. Rolling returns is one of the best measures of performance consistency.

In Advisorkhoj, we have developed a tool which identifies performance based on average rolling returns over the last five years (covering different market or interest rate conditions) and outperformance consistency (how many times the scheme beat the category average on a rolling return basis). Using our proprietary ranking algorithm, we identify the most consistent performers in different fund categories – please see our tool, Top Consistent Mutual Fund Performers. You can see that SBI Savings Fund is among the Top 10 most consistent funds in the money market category.

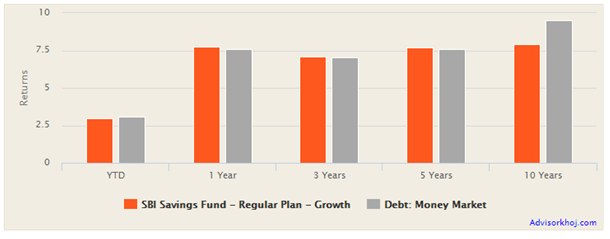

The annualized returns of SBI Savings Fund over different trailing time periods support our assertion of performance consistency of the scheme. The chart below shows the trailing returns of SBI Savings Fund versus Money Market Fund category average over different time-scales. The scheme beat the category average over different time-scales. On a 2019 year to date basis, the scheme is matching category average.

Source: Advisorkhoj Research

The annual returns of SBI Savings Fund over the last 5 years, also demonstrates why this fund is a consistent performer – please see the chart below. SBI Savings Fund beat the money market fund category average in 4 out of the last 5 years.

Source: Advisorkhoj Research

Rolling Returns

The chart below shows the 1 year rolling returns of SBI Savings Fund over the last 5 years. 1 year rolling return of the scheme never fell below 6%, while the maximum 1 year rolling return was 8.7%. The average and median 1 year rolling returns were both around 7.5%.

Source: Advisorkhoj Rolling Returns Calculator

Scheme Portfolio Characteristics

The scheme portfolio comprises of commercial papers (issued primarily by NBFCs) and certificates of deposits (issued by banks). The modified duration of the underlying portfolio of SBI Savings Fund is 0.39 years, which indicate low interest rate sensitivity. Further, the modified duration of the scheme portfolio is less than the average modified duration of the money market funds category which leads us to believe that this scheme has lower interest rate risk compared to many other schemes in the money market fund category. The yield to maturity (YTM) of the scheme portfolio is around 7.5%.

Credit Risk

Over the past few months, credit risk is a major concern in the entire debt mutual fund space. A series of high profile credit defaults and downgrades have impacted returns of specific debt schemes across categories. The credit quality of SBI Savings Fund portfolio is very high (95% in A1+ rated papers and balance in cash equivalents). As such, credit risk in this debt scheme appears to be very low. However, since there is a growing liquidity crisis in the NBFC sector, investors need to monitor credit risk carefully to see whether it is worsening. We think that the liquidity issues in the NBFC sector is a temporary problem and things will improve in the near term, hopefully with Government and RBI intervention. One very positive feature of the scheme portfolio is that concentration risk is quite low – the maximum exposure to a particular instrument is 6% (which is in a bank). Exposure to individual CPs of NBFCs is much lower.

About SBI Savings Fund

The scheme was launched in July 2004 and has nearly Rs 8,500 Crores of assets under management (AUM). The expense ratio of the scheme is 0.82%. The scheme has 0.1% exit load for redemption within 3 days; there is no exit load for redemptions made after 3 days from the date of investment. Apart from Growth Option, SBI Savings Fund also offers Daily, Weekly and Monthly Dividend Options for subscription. R. Arun is the fund manager of the scheme.

Conclusion

SBI Savings Fund has completed nearly 15 years since launch. Over the last 5 years, the scheme performance has been fairly consistent. The scheme has given good returns over last 1, 3 and 5 years. The risk profile of the scheme is also moderately low. As such, SBI Savings Fund is good short term investment option not only for sub 1 year tenures but also for longer tenures. Conservative investors can choose to remain invested for longer tenors to avail of tax benefits. Long term capital gains in debt funds held for more than 3 years are taxed at 20% after allowing for indexation benefits. Investors should consult with their financial advisors if SBI Savings Fund is suitable for their investment needs.

Suggested reading: Demystifying Debt Mutual Funds

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY