SBI Equity Hybrid Fund: One of the best performing aggressive hybrid funds

The stock market has been quite volatile this year. February and March saw the Nifty – 50 fall more than 1,000 points. The market then stabilized and recovered, though there were some choppy periods. Volatility has again returned in September; from its all-time high in August, Nifty has fallen around 450 points in the last 15 days or so. The main reason for the recent bout of volatility is the plunging Rupee. Amidst the escalating trade war between US and China, rising crude prices in the near term and the US Federal Reserve’s interest actions, the outlook of the Rupee is cloudy. We, in Advisorkhoj, expect the volatility to continue in the coming weeks and months.

Asset allocation offers beneficial attributes to investor’s portfolios in volatile stock markets by providing relative stability. As such, in these market conditions, investors should pay more attention to their asset allocation to reduce downside risks, while remaining invested in equity for the long term benefits.

Hybrid mutual funds are ideal investments for optimizing asset allocation. These funds invest both in equity and debt assets with the objective of long term capital appreciation, reducing near term risks and generating income. SEBI has defined several sub-categories of hybrid mutual funds e.g. aggressive hybrid funds, dynamic asset allocation funds, equity savings funds, multi asset allocation funds and conservative hybrid funds.

In this post, we will review SBI Equity Hybrid fund, one of the best performing aggressive hybrid funds in the last 5 years.

SBI Equity Hybrid Fund

Aggressive Hybrid Funds, as per SEBI’s guidelines, should have minimum active equity allocation of 65%. Maximum active equity allocation should be 80%. These funds were traditionally called Balanced Funds. However in the past, the definition of Balanced Funds was not tight and included schemes which employed different asset allocation strategies; SEBI’s guidelines have brought clarity and should simplify investment decision making. SBI Equity Hybrid Fund, previously known as SBI Magnum Balanced Fund, is an aggressive hybrid fund. The objective of this scheme is to provide investors long term capital appreciation along with the liquidity of an open-ended scheme by investing in a mix of debt and equity. The scheme will invest in a diversified portfolio of equities of high growth companies and balance the risk through investing the rest in fixed income securities.

We last reviewed this fund in July 2017 and the same can be read here

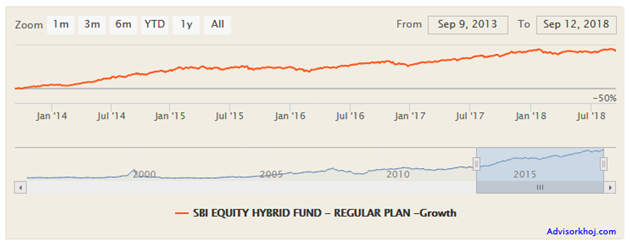

SBI Equity Hybrid Fund is one of the oldest hybrid mutual fund schemes in India. It was launched in 1995 and has Rs 28,104 Crores of Assets under Management (AUM). The expense ratio of the scheme is 2.39%. R. Srinivasan and Dinesh Ahuja are the fund managers of this scheme for the last 6 years. The chart below shows the NAV growth of the scheme over the last 5 years.

Source: Advisorkhoj Research

Consistent outperformance

Regular readers of our blog know that performance consistency is one of the most important attributes of mutual fund performance. SBI Equity Hybrid Funds is one of the most consistent performers in the Aggressive Hybrid Funds category. The scheme’s performance was in the two top quartiles in 4 years out of the last 5 years making this scheme one of the most consistent Aggressive Hybrid Funds in the last 5 years (please see our Top Most Consistent Aggressive Hybrid Funds tool). The fund is also among the Top 6 Aggressive Hybrid Funds based on last 5 year returns trailing returns (please see our Top Performing Mutual Funds (Trailing returns) - Hybrid: Aggressive tool).

The chart below shows the returns of SBI Equity Hybrid Fund versus the Aggressive Hybrid Funds category over various trailing periods (ending September 18, 2018). You can see that the scheme has beaten the category across all time-scales.

Source: Advisorkhoj Research

The chart below shows the annual returns of SBI Equity Hybrid Fund versus the category over the last 5 years. You can see that the scheme has beaten the category in most years.

Rolling Returns

Regular readers of Advisorkhoj blog know that rolling returns is the best measure of a mutual fund scheme’s consistency because it analyzes performance across different market conditions and is not influenced by the conditions prevailing currently. The chart below shows the 3 year rolling returns of the SBI Equity Hybrid Fund versus the Aggressive Hybrid Funds category over the last 5 years (largely coinciding with the fund manager’s tenors). Investors should note that we have chosen a 3 year rolling return period because investors should have a minimum 3 to 5 year investment horizon for Aggressive Hybrid Funds.

Source: Advisorkhoj Research

You can see that the scheme consistently beat the category in all market conditions. This is the hallmark of good fund management. Average 3 year rolling returns of the scheme over the last 5 years was 13.9%, while the median 3 year rolling returns of the scheme over the last 5 years was 12.8%. Maximum 3 year rolling return of the scheme over the last 5 years was 23.3%, while the minimum 3 year rolling return of the scheme over the last 5 years was 8.4%. The minimum 3 year rolling return of the scheme was higher than typical fixed income return. The chart below shows the returns consistency of SBI Equity Hybrid Fund.

Source: Advisorkhoj Research

Portfolio Construction

Currently, equity allocation is around 65% while the balance is invested in fixed income securities (debt) or held as cash / cash-equivalents. The equity investment style is “Growth”. From a market cap perspective, the equity fund manager currently has a large cap bias. On the debt side, the fund manager ensures high credit quality and limited interest rate sensitivity. The modified duration of the fixed income portfolio is 2.86 years. The yield to maturity (YTM) of the debt portfolio is 8.23%. The scheme portfolio is well diversified across stocks and sectors.

Source: Advisorkhoj Research

Lump Sum and SIP Returns

The chart below shows the growth of Rs 1 lakh lump sum investment in the scheme’s growth option over the last 5 years. Your investment in the scheme would have grown more than 2.3 times in value over the last 5 years.

Source: Advisorkhoj Research

The chart below shows the returns of Rs 5,000 monthly SIP in the scheme’s growth option over the last 5 years. With a cumulative investment of Rs 3 Lakhs, you could have accumulated a corpus of Rs 4.2 Lakhs.

Source: Advisorkhoj Research

Dividend Pay-out Track Record

SBI Equity Hybrid Fund has a strong dividend pay-out track record. The scheme has been paying regular quarterly dividends for 5 years now. Annual dividend yield of 8.5 to 9% is also quite good. Investors should note that mutual fund dividends are paid from accumulated profits of the scheme; dividends are not assured either in terms of rate or timing. The table below shows the dividend track record of the scheme.

Conclusion

SBI Equity Hybrid Fund has a strong performance track record of more than 20 years. There are many examples of past star performers, who were unable to hold on to their pre-eminent positions. SBI Equity Hybrid Fund, on the other hand, has not only been able to sustain its outperformance, but strengthen it further in the last 5 years. This scheme is suitable for investors who want long term capital appreciation, while limiting downside risks in the short term.

Investors should have a long investment horizon for this fund. You can invest in this fund both in lump sum and SIP. If you are worried about near term volatility and have funds to invest in lump sum, you can park your funds in the liquid or ultra-short term debt funds of SBI Mutual Fund and invest systematically in SBI Equity Hybrid Fund through STP over the next 6 to 12 months. Investors should consult with their financial advisors if SBI Equity Hybrid Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Balanced Advantage Fund: One of the top performing consistent balanced advantage funds

- SBI Magnum Midcap Fund: 22X times growth since inception

- SBI Multicap Fund: Strong performance recovery

- SBI Multi Asset Allocation Fund: Power of Multi Asset Allocation in Volatile Markets

- SBI Multi Asset Allocation Fund: Power of multi asset allocation in volatile market

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY