SBI Equity Hybrid Fund: A good hybrid fund for long term investments in uncertain times

The equity market is enjoying a fantastic bull market since the market recovered from the COVID-19 crash in March 2020. After breaching the previous all time high about 11 months back, Nifty 50 has risen 40% higher in the 11 months or so. The broader market (midcaps and small caps) also enjoyed a great bull run over the past 16 – 18 months. Since this is a classic bull market, momentum can take the market to higher levels in the coming months, but you should also be aware of the risk factors:-

- Delta variant COVID cases are increasing around the world causing concerns

- Soaring commodity prices are causing global inflation

- China’s regulatory crackdown on companies is cause of concern for investors

- Fears of taper tantrum when the US Federal Reserve starts tapering its bond buying programme

- High valuations, particularly in the midcap and small cap segments of the market

Investors should focus on asset allocation in uncertain times because asset allocation can balance risk / returns and provide stability to your portfolio in volatile markets.

SBI Equity Hybrid Fund

SBI Equity Hybrid Fund was launched in 1995 and has over Rs 45,748 crores of assets under management (AUM). The expense ratio of the scheme is 1.65%. The scheme has given 14.6% CAGR returns since inception (as on 16th September 2021). Dinesh Ahuja and R. Srinivasan have been managing this scheme from 2012.The continuity of the fund management team over a long period of time has provided stability and worked in favour of the scheme.

The scheme is an aggressive hybrid fund. As per SEBI’s mandate aggressive hybrid funds must invest at least 65% of their assets in equity and equity related securities. At the same these schemes must invest at least 20% of their in debt and money market instruments. In other words, the equity allocation of these schemes ranges from 65 – 80%, while the fixed income allocation range ranges from 20 – 35%. The fund managers have the flexibility to manage asset allocation within these ranges.

Performance of SBI Equity Hybrid Fund

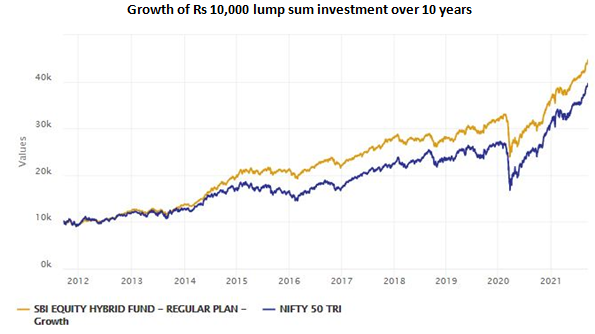

The chart below shows the growth of Rs 10,000 investment in SBI Equity Hybrid Fund versus Nifty 50 TRI over the last 10 years (ending 16th September 2021). You can see that the scheme had outperformed the Nifty. The long term performance of SBI Equity Hybrid Fund shows that asset allocation and regular rebalancing can produce superior risk adjusted returns even over long investment tenures. The 10 year CAGR of the scheme is around 16% (as on 16th September 2021).

Source: Advisorkhoj Research, as on 16th September 2021. Disclaimer: Past performance may or may not be sustained in the future

The chart below shows the growth of Rs 10,000 monthly Systematic Investment Plan (SIP) in SBI Equity Hybrid Fund versus Nifty 50 TRI over the last 10 years (ending 16th September 2021). You can see that the scheme had outperformed even the Nifty 50 TRI in terms of SIP returns. There is a misconception among some investors that SIPs are only suitable for equity funds. You can see SBI Equity Hybrid Fund gave good long term SIP returns. The 10 year SIP returns (XIRR) of the scheme was 16.18%.

Source: Advisorkhoj Research, as on 16th September 2021. Disclaimer: Past performance may or may not be sustained in the future

Limited Downside Risks

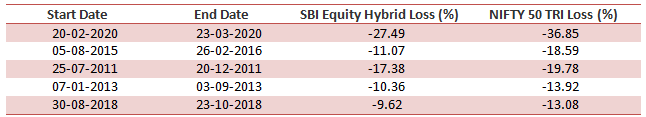

The table below shows the impact of the 5 largest drawdowns in the equity market over the last 10 years on SBI Equity Hybrid Fund and Nifty 50 TRI. You can see that drawdown on the hybrid scheme was much smaller than that on Nifty. The asset allocation of the scheme was able to limit the downside risks for investors in volatile market.

Source: Advisorkhoj Research, as on 16th September 2021. Disclaimer: Past performance may or may not be sustained in the future

Performance versus peers

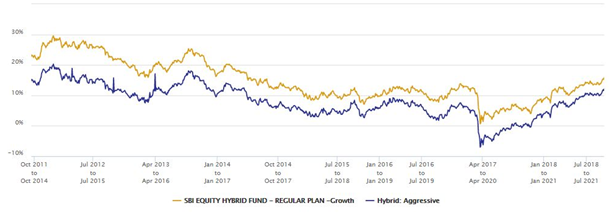

The chart below shows the three year rolling returns of SBI Equity Hybrid Fund versus the average 3 year rolling returns of the Aggressive Hybrid Funds category over the last 10 years. We have chosen a 3 year rolling return period because investors should have minimum 3 year investment horizon for Aggressive Hybrid Funds. You can see that the scheme consistently outperformed the category average across different market conditions.

Source: Advisorkhoj Research, as on 16th September 2021. Disclaimer: Past performance may or may not be sustained in the future

Current Asset Allocation

Equity allocation of the scheme was 72% (as on 31st August 2021), while the debt allocation was 20% (as on 31st August 2021). The scheme had around 6% in cash and cash equivalents. The equity portion of the scheme portfolio has a predominantly large cap bias; nearly 80% of the equity portfolio is in large caps while the balance is in midcaps. The duration strategy of the debt portion is in the short to medium duration range.

Why invest in SBI Equity Hybrid Fund?

- Equity as an asset class has the highest potential of wealth creation in the long term compared to other asset classes. The scheme invests 65 – 80% of its assets in equity.

- The debt portion of the scheme reduces downside risks and provides stability in volatile market conditions.

- If there is pullback in the equity market due to the risk factors mentioned earlier, the scheme should be able to limit volatility and at the same generate capital appreciation for investors in the long term.

- Those looking for regular income using the SWP route. You may like to read outstanding long term SWP returns even with annual increase in SWP

- SBI Equity Hybrid Fund has a strong long term track record.

Who should invest in SBI Equity Hybrid Funds?

- Investors who want capital appreciation in the long term

- Investors who do not want high volatility

- The scheme is also suitable for new investors who do not have the experience of volatile markets

- Investors should have moderately high to high risk appetites

- Investors should have minimum 3 to 5 year investment horizons for this scheme.

- The scheme is suitable both for lump sum and SIP investments. If investors have lump sum funds but are worried about volatility, then they can invest through 3 – 6 months Systematic Transfer Plan from SBI Liquid Fund.

Investors should consult with their financial advisors, if SBI Equity Hybrid Fund is suitable for their long term investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY