SBI Balanced Advantage Fund NFO

Investment cycles are inevitable in equity markets. Prices go up in bull markets, come down in bear markets and again go up; this cycle continues. You should sell equity (shift to other asset class) when market is high and buy equity (shift from other asset classes) when market is low. This idea is encapsulated in the age-old investment wisdom, “buy low and sell high”.

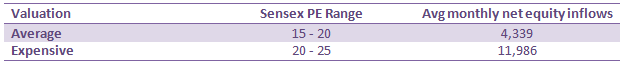

Though the idea is simple, it is very difficult to implement because in market rallies and crashes, emotions like greed and fear take over. The table below shows that investors end up buying when prices are high, and sell when prices are low. If you buy when valuations are high and miss out on buying when valuations are low, you may get sub-optimal returns.

Source: SBI MF, Period: March 2014 to March 2021

Timing the market is difficult

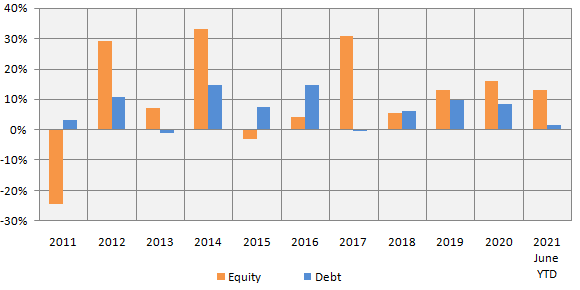

Timing the market i.e. predicting when / at level prices will peak or bottom is very difficult because short term prices are driven by sentiments. Even predicting which asset class (i.e. equity, debt etc) will outperform or underperform in the short term is difficult because winners keep rotating between asset classes (see the chart below). Therefore, a systematic valuation based approach is suitable for generating consistent returns across different market conditions.

Source: National Stock Exchange, Advisorkhoj Research, 1st Jan 2011 to 30th June 2020. Equity: Nifty 50 TRI; Debt: Nifty 10 year benchmark G-Sec Index. Disclaimer: Past performance may or may not be sustained in the future.

SBI Balanced Advantage Fund NFO

SBI Mutual Funds is launching a new fund offer (NFO) for a hybrid dynamic asset allocation fund, SBI Balanced Advantage Fund – The NFO opens on August 12 and closes on August 25, 2021.

SEBI does not have asset allocation (i.e. equity, debt etc) upper and lower limits for dynamic asset allocation funds or balanced advantage funds. In other words, equity allocation can range from 0 – 100% and debt allocation can range from 0 – 100% depending on market conditions and the dynamic asset allocation model of the scheme.

Asset allocation strategy of the scheme

- Net long Equity: This is the un-hedged equity exposure of the fund. Net equity allocation is determined the fund managers, using parameters such as Sentiment Indicator, Valuations & Earnings Drivers. The net long equity allocation of the scheme will be aimed at providing long term capital appreciation (wealth creation) for investors.

- Debt: Debt allocation will also determined by the fund managers using the above parameters and will be capped at 35% to ensure equity taxation. The debt allocation will provide stability in volatile markets.

- Arbitrage: This is the fully hedged equity component but generates arbitrage (risk-free) profits based on price differences in cash and futures market or corporate actions. The arbitrage component reduces the net long equity exposure and at the same time, helps to keep the gross equity exposure above 65%, which enables equity taxation.

How will the asset allocation of the scheme work?

- The broad allocation towards equitywill be determined by sentiment indicators and valuations

- Sentiment indicators: Breadth of the market, Retail participation, MF Flows, Primary market activities, etc.

- Valuations: Trailing PE, Shillers PE, Earnings Yield / Shillers Earnings Yield, Bond Yield Spread etc.

- Allocation band for equity will be decided on the basis of various macro inputs like fiscal/ monetary positions, real rates, monetary policy framework, variables of offshore markets, etc.

Where will the scheme invest?

The scheme will have quantitative framework the top down investment strategy in terms of the market cap allocation, investment style (growth / value / quality), sector preference etc.

How will the scheme select securities?

Stock selection will be based on fund manager conviction. The fund manager will use model portfolios based on thehighest conviction ideas of the SBI MF analyst team. The debt portion of the scheme portfolio will be of high credit quality / sovereign securities to maintain liquidity. The fund managers will actively manage duration to generate alpha across the yield curve.

Why invest in SBI Balanced Advantage Fund

- Diversification across asset classes to balance the risk and reward

- Dynamically managed Asset allocation basis the market outlook will remove emotional biases

- Uniqueness of the asset allocation range i.e., from 0 – 100% for both debt & equity will provide flexibility across different market conditions

- Expertise of SBI Mutual Fund investment team

Who should invest in SBI Balanced Advantage Fund

- Investors looking for long term wealth creation

- Investors looking for a dynamic solution for the right mix of debt and equity

- Investors who do not have high risk appetites. This scheme is suitable for investors with moderately high risk appetites.

- Investors with minimum 4 – 5 years of investment horizon

- Investors should consult with their financial advisors if SBI Balanced Advantage Fund is suitable for their investment needs.

Conclusion

Balanced Advantage Funds have given superior returns over traditional investment options and fixed income products – the category average returns have been 22.63%, 8.99%, 9.24% and 11.55% respective for 1,3,5 and 10 years period (source: Advisorkhoj trailing returns data as on August 10, 2021. Therefore, it is an ideal category to invest for investors with moderately high risk profile. Considering SBI Mutual Funds stellar fund management track record across asset classes, investors may consider investing in the NFO of SBI Balanced Advantage Fund. The NFO closes on August 25, 2021.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY