SBI Arbitrage Opportunities Fund: A smart choice for short term investment needs

With increased investor awareness in India, investors have increasingly investing their savings in mutual funds instead of traditional investment schemes like FDs, Post Office Small Savings, Gold, property etc. For making short term investments, where safety and liquidity are very important considerations, liquid funds and ultra-short duration funds were considered to be the best choices for investors. However, the credit risk related event over the past year or so, has certainly caused concerns about debt mutual funds among many investors. Even so called safe funds like liquid funds and ultra-short duration funds have been impacted by credit risk.

Fortunately, mutual funds offer investors another low risk and yet tax efficient option for their short term investment needs which is not affected by credit risk - Arbitrage funds.

How Arbitrage Funds work?

These funds aim to make risk-free profit by exploiting price difference of the same underlying asset in different market segments. The most common form of arbitrage, known as cash and carry arbitrage, is between the cash and the F&O market. For the same stock or index, there is usually price difference between the cash and futures market. The price difference is due to several factors, interest rates (futures contracts are leveraged positions), dividends (buyers of futures do not receive dividends), time to expiry and most importantly liquidity (demand and supply situation in the market). Even though there may be price difference between cash and futures market for the same stock, on expiry of the futures contract the cash and futures price converges. The arbitrageur aims to lock in risk-free profits by taking opposite (long / buy and short / sell) positions in cash and futures market – profits are locked in because price will converge on the F&O expiry date and the arbitrageur will simply square off both the long and short positions.

Let us understand with the help of an example –

Suppose the price of the share of a company today in the spot or cash market is Rs 100 and the price of the August futures contract of the company in the F&O market is Rs 110. If you buy 1000 shares of the company in the cash market and sell 1000 futures, you will lock in a gross profit of Rs 10,000 today itself. On expiry of the August futures contract on 29/08/2019, the spot and futures price will converge. The expiry price is irrelevant. You will still make a net profit before other expenses.

Let us understand how? Suppose the expiry price is Rs 120. You will make a profit of Rs 20 per share on the shares that you bought or took delivery in the cash market. On the other hand, you will make a loss of Rs 10 per share in your futures. The net profit for you, before other expenses, will be Rs 10 per share or Rs 10,000 on 1,000 shares. What if, the price of the share falls to Rs 90 on expiry date? You will make a loss of loss of Rs 10 per share you bought in cash market but you will make a profit of Rs 20 per future. Your net profit per share will again be Rs 10 or Rs 10,000 on 1,000 shares.

SBI Arbitrage Opportunities Fund

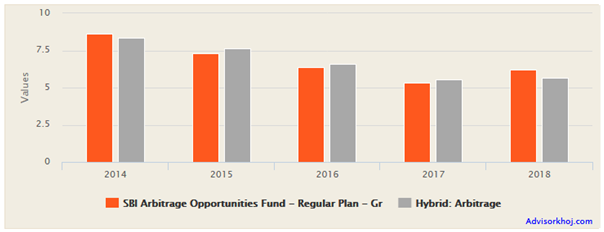

SBI Arbitrage Opportunities Fund was launched in 2006 and has around Rs 2,874 Crores of Assets under Management (AUM). The expense ratio of this fund is 0.88%. The chart below shows the annual returns of the fund over the last 5 years.

Source: Advisorkhoj Research

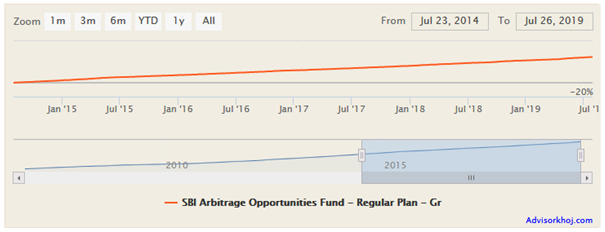

You can see that the annual returns of this fund over the last 5 years ranged from 5.3% to 8.6%. These funds are much less volatile than equity funds and even many debt fund categories. The chart below shows the NAV movement of SBI Arbitrage Opportunities Fund over the past years. You can see that the NAV movement is almost linear, which implies very low volatility.

Source: Advisorkhoj Research

Rolling Returns of SBI Arbitrage Opportunities Fund

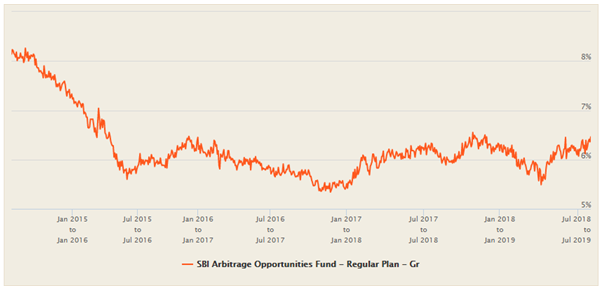

The chart below shows the 1 year rolling returns of SBI Arbitrage Opportunities Fund over the last 5 years.

Source: Advisorkhoj Rolling Returns Calculator

You can see that the 1 year rolling returns of this fund ranged from 5.3% to 8.3% for most of the last 5 year period, but have been rising for the last 12 months. The average 1 year rolling returns of this fund over the last 5 year period was 6.2%, while the median return in 6.1%. They are considerably higher than savings bank interest rate. The maximum one year return of this fund over the last 5 years was 8.3%, while the minimum 1 year rolling return over the same period was around 5.3%. Even the lowest return was higher than the savings bank interest rate.

Taxation of this fund

Arbitrage funds are comparable for liquid funds from a risk perspective. Liquid funds or any other debt fund returns are taxed as per the tax rate of the investor for investments held for less than 3 years.

Arbitrage funds are taxed like equity funds. Short term capital gains(investments held for less than 12 months) are taxed at 15%.Long term capital gains (investments held for more than 12 months) up to Rs 1 lakh is tax exempt. Long term capital gains in excess of Rs 1 lakh in a financial year are taxed at 10%. Furthermore, the dividends paid by liquid funds, though tax free in the hands of investors, are taxed at around 28.8%. Whereas dividends paid by arbitrage funds are taxed at just 10%.

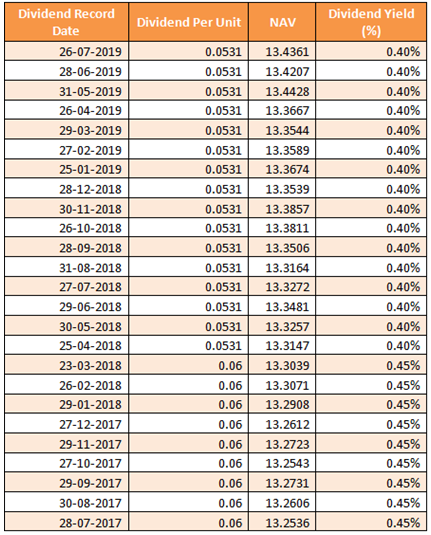

Dividend track record of SBI Arbitrage Opportunities Fund

The table below shows the dividend payout track record of SBI Arbitrage Opportunities Fund.

Arbitrage versus liquid funds in the current environment

Liquid funds like other debt funds are subject to credit risks. In the current environment, there are concerns about credit risk. While this certainly does not imply that all liquid funds will be impacted by credit risk, but investors need to check the credit quality of the underlying papers of liquid funds.

Arbitrage funds are safer from a risk standpoint because arbitrage works on the principle of market neutral or risk free profits strategy. Even if credit rating of a company deteriorates, arbitrage funds will not be affected because their position in any stock is always hedged. Further, in the current interest environment (lower interest rates) arbitrage funds have the potential of giving higher returns than liquid funds.

Conclusion

In this blog post, we discussed how arbitrage funds work and the tax advantages they enjoy. Investors should understand that arbitrage opportunities are subject to market conditions. Considering all the factors, given the low volatility of SBI Arbitrage Opportunities Fund and potential higher returns compared to liquid funds, it can be considered for short term investments. Investors should discuss with their financial advisors if SBI Arbitrage Opportunities are suitable for their short term investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY