How do you know if you have good funds in your mutual funds portfolio: part 2

In the first part of the article in this series How do you know if you have good funds in your mutual funds portfolio: part 1, we have discussed how trailing returns are important but not the only significant factor in determining a fund’s performance for the long term potential. We have also discussed how the Mutual Fund Quartile Rankings and Mutual Fund Rolling Returns are two very important factors to analyze fund selection or its performance.

In this concluding part of the article, we will discuss Key Risk / Return Measures like standard deviation of returns, Sharpe Ratio, Beta and Alpha and how the Capital Asset Pricing Model works?

Mutual Fund Key Risk / Return Measures

You should look at key risks and risk adjusted returns metrics, when evaluating the performance of mutual fund schemes. You want the fund manager of your mutual fund scheme to take the right amount of risk, in line with your investment horizon and risk tolerance. A mutual fund scheme can deliver extraordinary returns in bull markets by taking extra risks. On the other hand, the same mutual fund scheme can make big losses in a bear market. At the same time, you do not want the fund manager of your mutual fund scheme to take too little risks. Lower risks can limit your losses in a bear market, but may not be able to achieve your wealth creation objectives in the long term. So, how will you understand, how much risk your fund manager is taking?

A popular measure of risk is standard deviation of returns. Standard deviation defines a range within which you can expect your returns to be, based on a certain confidence level. However, if the market itself is very volatile the standard deviation of a fund will be high and if the market is less volatile the standard deviation of a fund will be less. Therefore, in addition to absolute value of standard deviation, it is important to compare the standard deviation of a fund, relative to the standard deviation of its category. You can check the standard deviation of fund relative to its category by looking at scheme level details using our Mutual Fund Selector Tool. Once you select a mutual fund scheme, you can see its key risk and risk adjusted measures by scrolling down to the Key Performance and Risk Statistics table in the scheme details page. Standard deviation is difficult for the average retail investor to comprehend as a standalone metric. Therefore, you should always compare standard deviation in relation to the category. Just because the standard deviation of a fund is higher than its category, it does not mean that, it is not a good fund. It simply means that, the fund is taking more risks.

The incremental risks would be totally justified if they are commensurate with incremental returns. Investors should be more concerned about the risk adjusted returns of the fund. Sharpe Ratio is a measure of the risk adjusted returns of a fund. Sharpe ratio is defined as the ratio of excess return (i.e. difference of return of the fund and risk free return from Government securities) and annualized standard deviation of returns. Higher the Sharpe Ratio of a fund better is the risk adjusted returns from the fund. You will find the Sharpe Ratio of the fund relative to its category in the Key Performance and Risk Statistics table in the scheme details page.

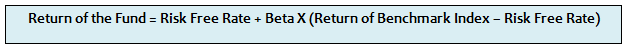

Two other important fund metrics, that investors should take note of, are Beta and Alpha. Let us discuss Beta first. Beta is a metric which helps us understand the risk taken by a stock or fund relative to the market. Beta of a fund is defined as the excess returns of the fund over the risk free rate relative to the excess returns of the benchmark index over the risk free rate. Let us understand this with the help of an example. Let us assume you can get 8% interest from your fixed deposit. This is the risk free rate because you do not take any risk when investing in Fixed Deposits. Let us further assume that you have invested in a fund whose benchmark index is BSE-100 and the beta is 2. If BSE-100 rises by 15%, how much return can you expect from your fund? The answer lies in a theory called Capital Asset Pricing Model, in finance parlance, popularly known as CAPM (pronounced as Cap-M). As per CAPM:-

In the above example:-

Expected Return of the Fund = 8% + 2 X (15% - 8%) = 22%

What if BSE-100 falls by 10%? As per CAPM:-

Expected Return of the Fund = 8% + 2 X (-10% - 8%) = -28%

We can see that, beta is a double edged sword. Higher the beta, higher is the potential returns in bull market, but we also risk higher losses during bear markets. You will find the Beta of the fund relative to its category in the Key Performance and Risk Statistics table in the scheme details page.

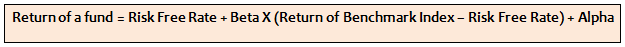

Let us now understand Alpha, which in our opinion, is the single most important metric of an equity mutual fund scheme. Alpha, in the simplest terms, is the value generated by the fund manager, relative to risk taken by him or her. Alpha, in mathematical terms, is the excess returns generated by the fund manager, compared to what he or she would have expected to get after factoring in the risk taken by him or her.

Compare this formula with the formula in the box shaded light blue. You will realize that alpha is the value added by the fund manager, for the same amount of risk. Let us understand this concept by revisiting the example discussed earlier. Let us assume you can get 8% interest from your fixed deposit, which is the risk free rate. Let us further assume that you have invested in a fund whose benchmark index is BSE-100 and beta is 2. If BSE-100 rises by 15%, how much return can you expect from your fund? As per Capital Asset Pricing Model (discussed earlier) you can expect a return of 22% from your fund. Let us assume you get a return of 25%. How did you get 3% extra returns? It was a result of the value created by your fund manager. The 3% is the alpha of the fund. What if BSE-100 falls by 10%? As per CAPM your expected return would be -28%, but if your fund manager is able to generate a 3% alpha, your actual return would be -25%. From a conceptual standpoint, alpha is the excess return generated by your fund manager versus what is predicted by CAPM. The top performing funds that have sustained their outperformance over a sufficiently long period of time are undoubtedly funds with high alphas. If a fund manager has generated high alpha, it is quite likely that he or she will generate high alpha in the future as well. High alpha speaks to the fund manager’s ability of stock selection and portfolio construction. You will find the Beta of the fund relative to its category in the Key Performance and Risk Statistics table in the scheme details page.

Conclusion

In this blog post of two series, we have discussed the different parameters, that you need to look at, in determining, whether a scheme in your mutual fund portfolio is good or not. As discussed in this post, you will find all the necessary information, related to each of these different parameters in our Mutual Fund Research Section on advisorkhoj.com. We encourage you to visit our research section and hopefully, you will benefit from the available analytics. We started with cricket in this and let us end with cricket again. One of my friends, another ardent cricket fan like me, always used to say that, to him Virender Sehwag was the best batsmen. My friend was a fan of the slam bang approach of Sehwag. My point is that, for many people analytics do not matter, if they are happy with what they are getting. My friend was happy with the entertainment which Sehwag provided, despite the suspect footwork (sometimes) of Sehwag. I, on the other hand, was more of a purist in terms of technique, and therefore was always a Sachin Tendulkar fan. From a mutual fund perspective, if you are happy with the returns you are getting from your mutual fund portfolio, you will be tempted to think, why fix something that is not broken? I would like to remind you of Sehwag, who despite his massively entertaining batting style and phenomenal statistics in different forms of cricket, had his career truncated much before his fans would have liked it.

https://www.sbimf.com/SBI_Fund_Guru/assetProfiler2.aspx

Disclaimer:

Any information contained in this article is only for informational purpose and does not constitute advice or offer to sell/purchase units of the schemes of SBI Mutual Fund. Information and content developed in this article has been provided by Advisorkhoj.com and is to be read from an investment awareness and education perspective only. SBI Mutual Fund’s participation in this article is as an advertiser only and the views / content expressed herein do not constitute the opinions of SBI Mutual Fund or recommendation of any course of action to be followed by the reader

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY