No end to volatility in sight: What should we do: Part 1

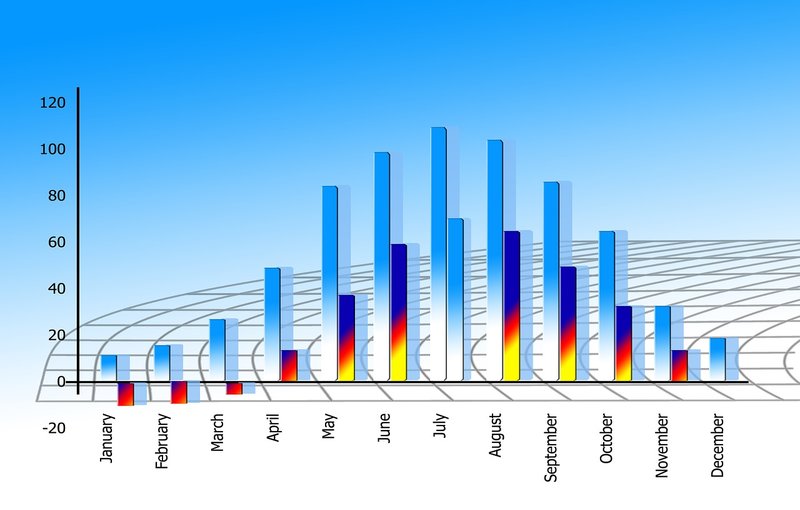

If you have invested in equities and are feeling stressed with the market right now, you are not alone. Experienced investors would have seen this kind of volatility before in 2008 and 2011, but new investors with little or no exposure to equity market must be feeling very nervous. The chart below shows the daily price chart of Nifty over the past one year.

Source: www.nseindia.com

In our blogs and in other investment related article / blogs on other websites, virtues of patience and discipline are preached almost every other day, but a chart like the one shown above and its impact on your net asset values is likely to test your patience severely. As a market observer and investor over many years, I have seen worse bear markets before and I am happy to see much better resilience shown by Indian retail investors in this market compared to what I saw in bear markets of 2008 and 2011. Having said, there is no denying that these are stressful times indeed. If you watch business channels during market hours your stress level is likely to go up and if you hear some of the experts speak you are likely to get extremely confused as well. In my opinion a retail investor should not pay too much importance to technical levels which these experts give you and then subject it to a number of caveats. Did you not hear that 8350 was a strong support for the Nifty, which was quickly revised downwards to 8100, then 7850, then 7600 and now 7500? Well even the 7,500 level on Nifty was breached couple of days back. One thing I have realized is that, when the market sentiment is bearish then technical levels are quite meaningless. I saw the same thing in 2008. One technical analyst once told me, that levels are meant to be breached. I asked, if that is the case, how is it useful for the average investors?

The other thing, that I find not very helpful is, how experts characterize this market. I heard one of them characterizing it as a bull market correction. By the way, the same expert is no longer calling this a bull market correction, after the market fell by another 5 – 6% from when he made that statement. Now to the other extreme; another market expert, very well known in market circles for his bearish views, said, that the market this year (2016) looks a lot like 2008. As a student of statistics, I learnt in school that, as per the laws of statistics say that you need have a sufficient sample size to make a confident forecast. I have to say that the gentleman saying that 2016 looks like 2008, is gifted with amazing foresight, if he can make such a prognosis in less than 15 days into the New Year. By the way, the same gentleman forecasted a difficult 2014 for Indian equities and advised investors to take money off equities in November 2013. The market rose over 35% in 2014 and you would have been much better off, if you had not listened to his advice. Yet another expert characterized the correction that we are seeing now as, a deep correction over several quarters in an otherwise secular bull market. I sincerely hope that this gentleman is right, but from an actionable viewpoint, I do not understand how his characterization is useful, except for the fact that, I should remain invested. But, what if I want to invest more? Should I invest now or wait for the market bottom? When will I get the market bottom? One of my acquaintances, a short term trader, told me that, over the last one year, he has been doing exactly the opposite of what a leading technical expert usually recommends and he has been making money. I do not know if that is right or wrong, but one thing that I do know, based on my experience, is that, the market is far too complex for an individual to call it correctly, at least in the short term, no matter how much expertise he has. Readers should note that, even the legendary investor, Warren Buffet lost a lot of money in 2015. Berkshire Hathaway, Warren Buffet’s investment holding company, was down 12% in 2015. So what should investors do in such market conditions?

Be under no illusion:

If your financial advisor or stock broker is saying that the market will start recovering in the next few weeks, be under no such illusion. The market is a reflection of local and global macro-economic conditions, as well as local and global market sentiments. As discussed earlier, you should not give undue importance to what experts think about the market. If they get it wrong, which they very often do, they either go off air or have a perfectly good explanation of why things did not pan out as they expected. Be under no illusions as to the nature of the market. Is this a bear market? We can argue endlessly on this topic, but a bear market by definition is usually a 20% fall from the highs of the market. We are only a couple of bad sessions away from the threshold of, what by definition is a bear market. You should also not give too much importance to what global investment banks are saying. Many of them have been saying that they are bullish on India within the emerging economy basket. That might be true, but we cannot use their views as an indicator of how foreign institutional investors (FIIs) will behave. At the end of the day, if FIIs have been net sellers in our market for the past 6 months or more, their view of our market is bearish, end of story. As an investor, you should instead focus on the basics. The price of a share is simply a function of demand and supply of the shares. The price of the share will go up, if and only if, the demand of the share of the company goes. It is as simple as that. The demand and supply of shares of a company will depend on two factors, the earnings per share (EPS) delivered by the company, the earnings growth outlook of the company and the overall sentiment in the market, with respect to the market overall and the specific company / sector. If both the sentiments and the EPS do not improve, the share prices will not go up. So as a retail investor, what should you do? The results season is upon us. Pay attention to the EPS growth, but pay more attention to what the companies are saying with respect to future outlook of revenues. You should also pay attention to the macro factors in the economy. Index of industrial production (IIP) and inflation, especially Consumer Price Inflation (CPI) are important factors. News on both the fronts has not been good in the last couple of months. But what is the outlook on the future? Pay attention to what the economists have to say, instead of what the brokers have to say. You will get a better sense. The Reserve Bank of India policy wordings and the press conference of the RBI governor are usually very useful. The global factors afflicting equity markets worldwide will not go away very easily, because the issues are extremely complex. The Chinese economy will not recover next week, irrespective of what your broker says. If you have been following crude prices, they are headed downwards. Unless we see a recovery in consumption demand or a severe geo-political event, crude prices will continue to head downwards. The global economy is currently weak, including the largest economy in the world. Though the unemployment situation in the US is improving, prompting the Federal Reserve to raise interest rates, the demand situation is still weak. China and the US are the largest oil importers. US oil production and import are both falling. Economic problems in Europe are well known. As per Goldman Sachs, a leading investment bank, crude prices can go down to as low as $20 a barrel, which is 30% lower than the current price. The impact on stock market of such a fall will be quite significant. So let us be under no illusion.Let us be rational:

The other extreme is the doomsday scenario which the bears are painting. Let us be rational. The fundamental driver of share prices is valuation. If you think the market is going to see a crash like 2008, let me refer you to an observation made by one of the leading domestic fund managers of India. He pointed out that the overall valuation of the market currently is different from an early 2008 like scenario. The valuation of the market, as measured by the market cap to GDP ratio, is much lower than what it was in 2008. Therefore, a 2008 like scenario being played out again is unlikely, given the market fundamentals. The market deviates from fundamentals from time to time, but markets do not veer very widely off the fundamentals. As a reader, you should be asking, when is this volatility going to end? It is a valid question to which, unfortunately, the market does not have any answer. A bear market, if we can call this market a bear market in first place, increasingly looks like it though, ends when the worst happens. In 2008, the worst situation in the US was triggered by the failure of Lehman Brothers and a number of other investment banks. Merrill Lynch was taken over by Bank of America and Smith Barney was taken over by Morgan Stanley. Overall there was a liquidity crisis in the US Banking industry and the US Federal Reserve initiated several steps to counter the crisis through the Troubled Asset Relief Program and the long Quantitative Easing Program. From an economic perspective, India actually, was far more resilient in the global financial crisis of 2008, even though our stock markets suffered tremendously that year. The economic resilience of India during the crisis was the reason, why FIIs returned to India in 2009, even though they pulled outर1,200 crores from Indian stock markets in 2008. From the lowest point of 2008, around 8,500 on the Sensex, the Indian stock market recovered to over 30,000 by March 2015, a compounded annual growth rate of 22%, which is higher than any other asset class, could have possibly given. Let us not forget that. So coming back to the question, when will the volatility end? Given past experience, it usually ends when the night is darkest and the recovery is usually triggered by some Government action, whether locally or globally. Criticisms notwithstanding, the Chinese Government has taken on an activist role in resolving the economic issues in that country. China is going through a transition from an export led economy to consumption led economy. It will take some time and some pain, the repercussions of which will be felt in the global stock markets. Later this year, the United States will go through a historic presidential election after 8 years of Barak Obama presidency. Historically, US stock markets have rebounded in the first year or the second year of a new President. It is a useful piece of history, in this age of increasing globally inter-connected market. So you should continue to follow the markets and global events closely. As the situation goes from bad to worse, it is usually a sign that the bear market is about the end.Is India an emerging market:

A Morgan Stanley banker, in an interview to CNBC, suggested that India is in the process of de-coupling itself from the emerging markets investment basket. Whether this hypothesis is true or not, is itself a subject of debate and only time will tell, but if it is true, there are both positives and negatives for India. On one hand, while India may be relatively more immune in future to any negative perception with respect to emerging markets, on the flip side, it is also quite possible India may be left behind, when “risk on” returns to the market. Whether India is part of emerging market basket or not, there are increasing signs that as our economy grows, we will no longer be treated in the same league as other emerging economies in the future. In the slightly longer term, it is likely that, foreign investment flows to India will depend more on the performance of the Indian economy and companies, and less of global risk perceptions related to emerging markets. So the question is do we have faith in India Growth Story? Though our GDP growth rate has been revised downwards to 7.5%, it is still much higher than the average global economy. The Narendra Modi Government is committed to reforms agenda and economic growth in India. Do we have reasons to be a little disappointed with the Government? I think yes. Perhaps the Government could have managed the politics better on the floor of the Parliament and got important legislative reforms like GST passed. Blaming the opposition parties is not very helpful as far as we investors are concerned. Is it not the responsibility of the leader of the Rajya Sabha to do whatever it takes, to get the necessary bills passed? Ignore the politics and think from the perspective of shareholders and investors. If my business does not do well, I will not be doing either myself or my shareholders any favour, even if I come up with 100 excellent reasons why my business did not do well. The NDA government may have very valid reasons of why the bills could not get passed, but as investors in equity market we lost. Having said, the good of this country is not the sole responsibility of the Central Government, it is also the responsibility of the Opposition parties as well. Anyway, while disappointing on legislative front, the Government took several administrative steps to ease the process of doing business in India and some more is expected even before the Budget. The World Bank has predicted that India will be the fastest growing economy in 2017. We should not lose sight of this important fact. However, the Government plays a crucial role in this. The Budget is just a couple of months away. In the next round of state elections the BJP is anyway not expected to do spectacularly well, except perhaps Assam. Therefore, one can expect the Government to put forward a bold budget without compulsions of electoral politics. A great budget will go a long way towards boosting market sentiments. Let us hope for the best.

Conclusion (to be continued in the next part)

In market conditions like these, knowledge is your best friend. It helps you filter signal from the noise and helps you stay calm which is very important. Your other good friends in such conditions are your rational intelligence and discipline. More on that in our next part.

RECOMMENDED READS

- SWP from Debt Mutual Funds give the most tax efficient income over fixed deposits

- Combination of Home Loan EMI and Mutual Fund SIP can save you lot of money

- Systematic Withdrawal Plans from Debt Mutual Funds give the most tax efficient income

- How to select the right debt mutual funds for your portfolio: Part 1

- How to select the right debt mutual funds for your portfolio: Part 3

LATEST ARTICLES

- Different types of diversified equity mutual funds: Schemes from Principal MF stable

- Principal Equity Savings Fund: For investors who look for regular income and capital appreciation

- Regular Withdrawal Plan: A smart and convenient way of getting regular income

- Mutual Fund ELSS schemes: best way to save tax and create wealth

- What are Balanced Mutual Funds

We understand what you're working for

We are committed towards helping individuals, businesses & institutional clients achieve financial security & success.

Quick Links

Product Brochures

More About Principal MF

POST A QUERY