Different types of diversified equity mutual funds: Schemes from Principal MF stable

Diversified equity mutual funds are equity mutual fund schemes which invest across different industry sectors and market capitalization segments. Prior to 2018, there was no consistent framework for categorization of mutual fund schemes. Most equity mutual funds, with the exception of sector funds, were classified as diversified equity funds. It was difficult for the average retail investor to understand the investment characteristics of individual schemes. Many investors and financial advisors rely on third party research portals including advisorkhoj.com to know what category a mutual fund scheme belongs and make investment decisions. However, in absence of a common framework, each research portal used their own methodology to categorize schemes.

In October 2017, SEBI issued a circular where it defined categories and investment characteristics of the different schemes within each category to bring about uniformity in the characteristics of similar schemes launched by different fund houses. Furthermore, SEBI allowed fund houses to have only one scheme per category, making exceptions for only a few categories like index funds, fund of funds, thematic funds etc. By mid 2018, all fund houses re-categorized their mutual fund schemes, rationalizing and merging schemes where required to comply with SEBI’s requirements. In our view this was a much needed reform and a great development from an investor standpoint because it ensures that an investor is able to evaluate different options available before making an informed decision to invest in a scheme according to his / her own investment needs.

While SEBI’s initiative has brought about a lot of clarity, it is also important that investors should educate themselves about different mutual fund categories and the underlying investing concepts therein, so that they can make the best decisions according to their investment needs and risk appetite. Through our blog, we also have been trying to bring about awareness of different mutual fund categories. An important aspect of SEBI’s mutual fund category definitions was clearly defining different market capitalization segments – large cap, midcap and small cap. We have discussed this multiple times in our blog.

Apart from large cap, midcap and small cap equity funds, there are many equity mutual fund schemes which invest across different market cap segments and in that sense, they are truly diversified funds. However, there are sub-categories into which these diversified or multi cap oriented funds can be classified depending on their investment characteristics.

In this blog post, we will discuss some of these sub-categories along with examples of schemes from Principal Mutual Fund product suite. Some of these Principal MF schemes are strong performers in their respective sub-categories. These sub-categories are:-

- Multi Cap

- Large and Midcap

- Focused

- Dividend Yield

Multi Cap - Principal Multi Cap Growth Fund

According to SEBI’s guidelines, multi cap funds can invest across large cap, midcap or small cap stocks. There are market cap segment wise limits in multi cap funds, i.e. the fund managers enjoy total flexibility in investing across different market segments. However, since these funds can have large percentage of their portfolio invested in midcap and small cap stocks, these funds tend to be more volatile than large cap funds. One of the benefits of investing in these funds is their inherent advantage in outperforming the market across market cycles is their multi cap flexibility. Unconstrained by regulatory mandates and limits, multi cap fund managers can be more nimble in reacting to market risks and opportunities.

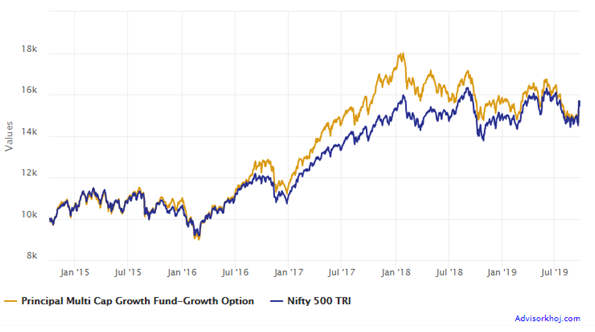

Principal Multi Cap Growth Fund invests in companies across market cap segments. The scheme has a 19 year track record and has given nearly 15% CAGR returns since inception. Over the last year or so, the scheme has maintained a large cap bias. As of end of August 2019, the scheme has 74% of its assets invested in large cap, around 12% in midcap and 10% in small cap. The chart below shows the growth of Rs 10,000 lump sum investment in Principal Multi Cap Growth Fund versus its benchmark index Nifty 500 TRI over the last 5 years (giving 1.5 times returns). You can see that the fund clearly outperformed its benchmark and created wealth for investors (giving 1.5 times returns).

Source: Advisorkhoj Research

Multi cap funds are suitable for investors with moderately high to high risk appetite looking for capital appreciation over a long investment horizon. You can also invest in this scheme through systematic investment plan (SIP) for your long term financial goals. We suggest that you read this fund review – two consistent Principal Mutual Fund Schemes for long term wealth creation

Large and Midcap – Principal Emerging Bluechip

As per SEBI’s mandate large and midcap funds must invest at least 35% of its assets in large cap stocks and 35% in midcap stocks. Though there is a minimum 35% limit each for both large and midcap stocks, fund managers have sufficient flexibility to position their portfolio for creating sufficiently large alphas and long term capital appreciation for investors. Minimum 35% allocation to midcaps makes this fund more volatile than large cap funds, but the mandatory large cap allocation limits downside risk in extremely volatile conditions.

Principal Emerging Bluechip invests in both large and midcap stocks. Currently (August end) nearly half of the scheme’s assets are invested in large cap, giving this a large cap bias. The scheme has invested 35% of its assets in midcap stocks in compliance with SEBI’s mandate for such funds (large and midcap). The balance is primarily invested in small cap. This is one of the best performing schemes in its category. With an 11 year track record, this scheme has given 24% CAGR returns since inception. The chart below shows the growth of Rs 10,000 lump sum investment in Principal Multi Cap Growth Fund versus its benchmark index, Nifty Large Midcap 250 TRI over the last 5 years. You can see that the fund outperformed its benchmark by a big margin and created substantial wealth (1.8 times) for investors.

Source: Advisorkhoj Research

Large and midcap funds are suitable for investors with moderately high to high risk appetite looking to create wealth over long investment horizon.In our view SIP is the ideal mode of investment for these schemes, but you can also tactically take advantage of deep corrections to invest in lump sum to increase your asset allocation to equities. If you have lump sum funds available and are not sure about the right time to invest, you can invest your funds in Principal Cash Management Fund (liquid fund) and then invest from your liquid fund to Principal Emerging Bluechip Fund through Systematic Transfer Plan (STP) over 3 – 6 months. Read more about this fund in this review

Focused Fund – Principal Focused Multi Cap Fund

As per SEBI’s circular, focused funds can invest in a maximum of 30 stocks. The fund house also needs to mention in its Scheme Information Document (SID) where the scheme intends to focus e.g. large cap, multi cap, midcap, small cap etc. Though these schemes diversify across market cap segments, concentration risks are higher in these schemes since they invest only in a limited number of stocks and hence are exposed to more stock specific risks. From a diversification standpoint however, research shows that 25 to 30 stocks can provide adequate diversification, albeit with higher concentration risk.

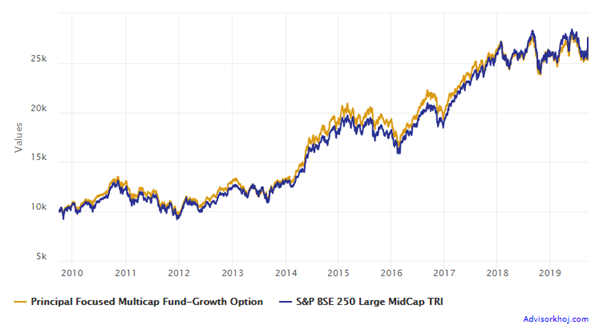

Principal Focused Multi Cap Fund invests in up to 30 high conviction stocks across different industry sectors. As the name suggests, the fund has a multi cap focus but over the last year or so, the scheme has a large cap bias. We have observed this bias across different diversified equity schemes of Principal MF and it has helped different Principal MF equity schemes limit downside risks because large cap has outperformed midcap during the past 12 to 18 months. The scheme has a 14 year history and has given 14.5% CAGR returns since inception. The chart below shows the growth of Rs 10,000 lump sum investment in Principal Focused Multi Cap Fund versus its benchmark index, S&P BSE Large Midcap 250 TRI over the last 10 years. You can see that the fund outperformed its benchmark by a big margin and created substantial wealth (nearly 2.7 times) for investors.

Source: Advisorkhoj Research

Focused Funds are suitable for investors with moderately high to high risk appetite with long investment horizons.Investors should understand that focused funds can underperform for longer periods of time compared to other diversified equity funds but since fund managers invest in high conviction stocks and stick to it, irrespective of short term performance these funds can create substantial alphas for investors in the long term. You can tactically allocate a small portion of your portfolio to these funds, but patience is the key if you want best results from focused funds.

Read this fund review: Good risk adjusted performance

Dividend Yield Funds – Principal Dividend Yield Fund

These funds predominantly invest in high dividend yield stocks. Dividend yield is defined as the company’s annual dividend as a percentage of its current share price. Principal Dividend Yield Fund invests predominantly in a well-diversified portfolio of companies that have a relatively high dividend yield. High dividend yield stocks usually have lower downside risks in volatile markets because dividends paid out by the company offset the share price depreciation in market corrections.

Principal Dividend Yield Fund invests across different market cap segments. Like other diversified equity schemes discussed in this post, Principal Dividend Yield Fund has also a large cap bias currently with more than 70% of its assets invested in large cap stocks. 16% of its assets are invested in small cap stocks while 10% is in midcap. The higher proportion of the scheme portfolio in small cap may be a result of the much sharper price correction in this segment leading to attractive dividend yields and hence investment opportunities. The scheme has a 6 year track record and has given more 11% CAGR returns since inception. The chart below shows the growth of Rs 10,000 lump sum investment in Principal Focused Multi Cap Fund versus its benchmark index, Nifty Dividend Opportunities 50 TRI over the last 5 years. You can see that the fund outperformed its benchmark by a big margin and created wealth (over 1.5 times) for investors.

Source: Advisorkhoj Research

Dividend Yield Funds are suitable for investors with moderately high risk appetite who want limited downside risks in bear markets. You need to have a long investment horizon for these funds. Many experienced investors like high dividend yield stocks and these stocks as generating superior risk adjusted returns. While dividend yield funds may not form your core mutual fund portfolio, we see these funds as excellent additions to your core portfolio. In our view, SIP is the best mode of investment over long investment tenures, but if you have lump sum funds available, then you can invest in Principal Dividend Yield Fund through 3 – 6 months STP from Principal Cash Management Fund (liquid fund).

Summary

In this blog post, we discussed about different types of diversified equity funds, each with their own investment characteristics. You should try to understand the nuances of these investment characteristics and invest according to your own preferences or needs. As mentioned several times in our blog, historical returns should not be the sole criterion in fund selection. You should clearly understand the risk return characteristics before investing. Principal Mutual Fund schemes are all strong performers; some have performed more strongly than others on a relative basis versus their benchmark. You should consult with your financial advisor, if these scheme categories and the schemes discussed in this blog are suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- SWP from Debt Mutual Funds give the most tax efficient income over fixed deposits

- Combination of Home Loan EMI and Mutual Fund SIP can save you lot of money

- Systematic Withdrawal Plans from Debt Mutual Funds give the most tax efficient income

- How to select the right debt mutual funds for your portfolio: Part 1

- How to select the right debt mutual funds for your portfolio: Part 3

LATEST ARTICLES

- Principal Equity Savings Fund: For investors who look for regular income and capital appreciation

- Regular Withdrawal Plan: A smart and convenient way of getting regular income

- Mutual Fund ELSS schemes: best way to save tax and create wealth

- What are Balanced Mutual Funds

- How to select the right debt mutual funds for your portfolio: Part 3

We understand what you're working for

We are committed towards helping individuals, businesses & institutional clients achieve financial security & success.

Quick Links

Product Brochures

More About Principal MF

POST A QUERY