Diversified Equity Mutual Funds: Performance and Risk in the Last 10 Years

The issue of diversification is a constant worry that gnaws at an investor. Am I diversified enough? This is a question that a lot of investors ask themselves and the ones around them. The various equity mutual funds, all come with their own set of features and nuances. Large cap funds are preferred by investors who like to play safe, since large cap companies grow at a slow pace due to their sheer size. Mid and small cap funds are preferred by investors with high risk taking appetite or those who have a long investment horizon. The factor that always puts an investor into confusion is what is the extent and ratio in which investments are to be done in the various caps. What if you did not have to constantly worry about diversification? That is exactly what diversified equity funds are for.

Diversified Equity Mutual Funds: An Overview

The funds that invest across various market caps are known as diversified equity funds. Such diversification ensures that the negative performance of one of the market caps or sectors does not affect the overall performance of the fund. In this article, we have analyzed large & mid Cap funds and multi cap funds which are also known as diversified equity funds based on valueresearch fund categories. Flexi cap funds are also known as diversified equity funds. Let us see how Diversified Equity Funds has fared over the last ten years and the risk associated with it.

Diversified Equity Funds Vs Other Equity Categories

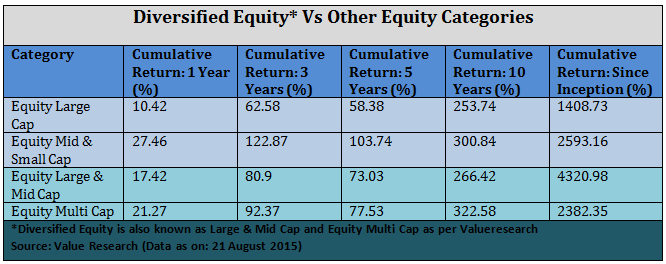

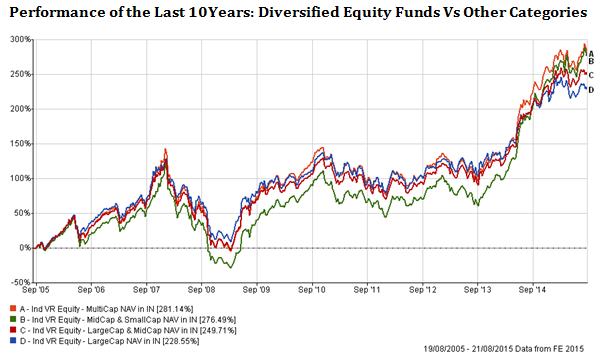

The performance of every fund is always measured by gauging the performance of its peer groups and the categories. Hence, to understand the performance of Diversified Equity funds we have taken the cumulative returns since inception of large cap and mid and small cap categories and compared that to equity large and mid cap and equity Multi Cap funds. Equity Multi cap funds have been the leading cumulative performers for the last ten years across all caps consisting market capitalization. They have a cumulative return of 322.58%. In the long run an investor who invests in Multi cap funds will have accumulated returns much more than other volatile categories such as mid and small cap funds.

In the table below it is clearly visible that large cap funds due to their stable nature and limited growth avenues have generated the least cumulative return in the last ten years and since inception. It is suitable for investors who wish to invest in equities and minimize the risk that is usually associated with it.

Mid and small cap funds maybe volatile in nature but they are not far behind the diversified funds as far as cumulative returns are concerned. These caps have generated the second highest cumulative return of 2593.16%, since inception. However, it must be noted that the highest return of 4320.98% generated by large and mid cap funds have a wide difference of with that of the mid and small cap cumulative returns. The third highest generation of return since inception is equity Multi cap funds with a cumulative return of 2382.35%. It is also the highest cumulative return generator of 322.58% in the last ten years. Hence, overall multi cap funds and large and mid cap funds are a better option for investment because of its consistent returns over the years.

Through this we can see that diversified equity funds could be an ideal choice for an investor because it has all the ingredients that investors usually seek from an investment category i.e. moderate risk and high returns. Other categories either have low return and low risk like the large cap funds. Mid and small cap funds, even though they generate high returns, suffer from high volatility making them unstable in nature, while diversified equity funds are the return generators with moderate risk.

Diversified Equity versus Market Benchmarks

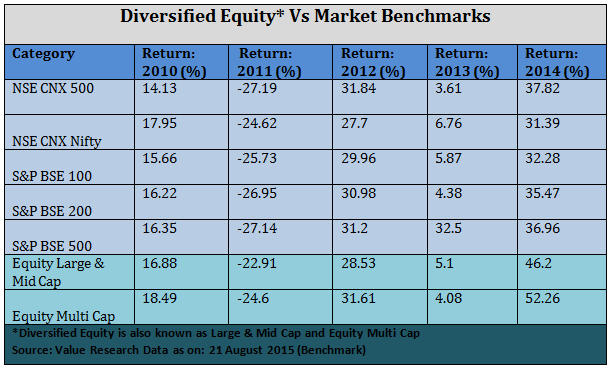

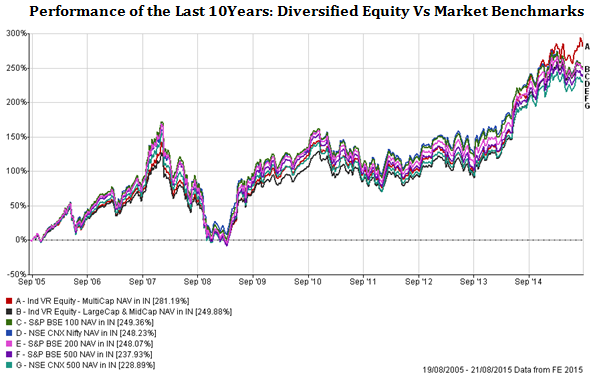

Another parameter of measuring the performance of an investment category is to measure its performance against the market Benchmarks. The market benchmarks which have been selected here are NSE CNX 500, NSE CNX Nifty, S&P BSE 100, S&P BSE 200 and S&P BSE 500. These benchmarks have been selected after taking the leading funds into consideration and the benchmarks that have been used to compare those funds.

In the table above the cumulative returns of Large and Mid cap and Large Multicap category has been compared with five market benchmarks. The numbers clearly reflect that the annual returns of diversified equity funds in the last 5 years are above the market benchmarks. In the annual performance graph showcasing the performance of the benchmarks and Diversified funds the points ‘A’ and ‘B’ which reflect the Multicap and Large and Midcap categories respectively have been generating the highest returns compared to all the other points such as ‘C’, ‘D’, ‘E’, ‘F’ and ‘G’ which reflect the various market benchmarks. In the last ten years Multicap and Large and Midcap have generated a return of 281.19% and 249.88% respectively as compared to 228.89% by NSE CNX 500 and 249.36 by S&P BSE 100.

Conclusion

Diversified equity mutual funds have historically performed well outperforming both - the other equity categories and the market benchmarks. This makes Diversified equity funds an ideal choice for investors. It is both suitable for investors who do not wish to take risk or are risk oriented. The fundamental need to take risk is arises from the need to generate high returns as compensation for the risk. With moderate risk in diversified equity funds, investors can generate returns which are at par with highly volatile fund categories such as mid and small cap funds. Therefore, it caters to the needs of investors who are averse to high risk or have an appetite for high risk. Hence, fear not if you think your portfolio is not diversified enough or your investments are not generating stellar returns. Diversified funds may have been that investment option that your portfolio needs. Consult your mutual fund advisor and figure out if diversified equity funds are suitable for you.

RECOMMENDED READS

- SWP from Debt Mutual Funds give the most tax efficient income over fixed deposits

- Combination of Home Loan EMI and Mutual Fund SIP can save you lot of money

- Systematic Withdrawal Plans from Debt Mutual Funds give the most tax efficient income

- How to select the right debt mutual funds for your portfolio: Part 1

- How to select the right debt mutual funds for your portfolio: Part 3

LATEST ARTICLES

- Different types of diversified equity mutual funds: Schemes from Principal MF stable

- Principal Equity Savings Fund: For investors who look for regular income and capital appreciation

- Regular Withdrawal Plan: A smart and convenient way of getting regular income

- Mutual Fund ELSS schemes: best way to save tax and create wealth

- What are Balanced Mutual Funds

We understand what you're working for

We are committed towards helping individuals, businesses & institutional clients achieve financial security & success.

Quick Links

Product Brochures

More About Principal MF

POST A QUERY